For landlords and tenants in India, having a rent receipt template is key to keeping clear records of payments. This simple document serves as proof of rent paid, offering legal protection for both parties involved. Whether you are managing residential or commercial properties, a standardized template simplifies the process.

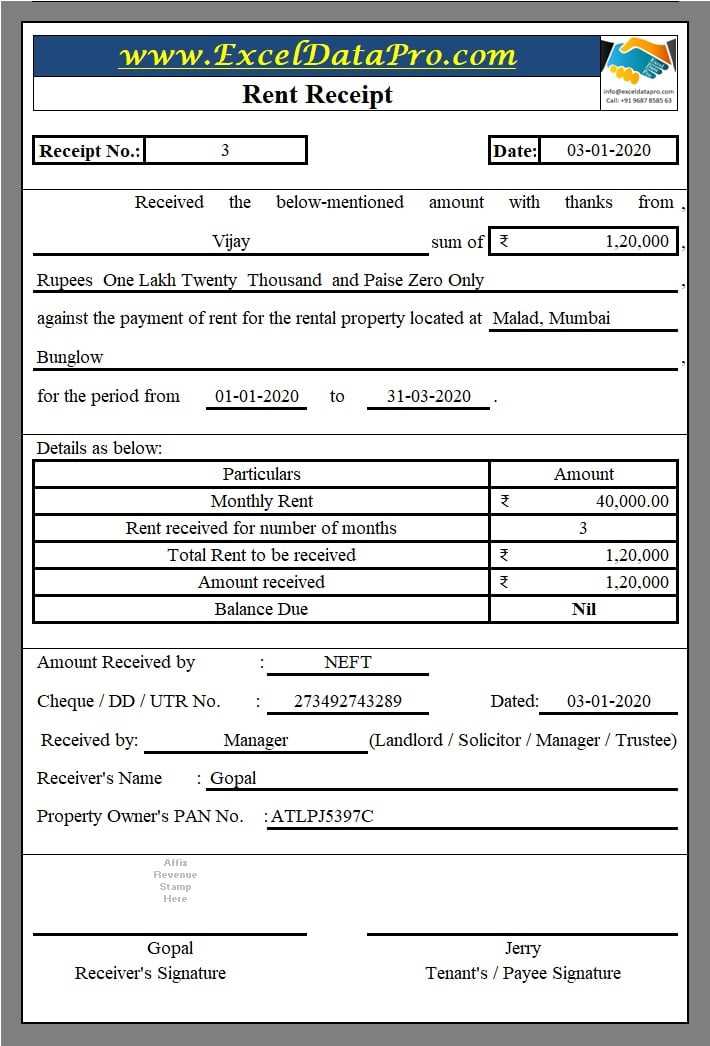

Download a reliable rent receipt template from reputable sources that comply with Indian tax and legal requirements. Make sure the template includes essential details such as the tenant’s name, rental period, payment amount, and both parties’ contact information. Clear and accurate documentation can help prevent future disputes and provide a reference for tax filing purposes.

Ensure the rent receipt is properly filled out and signed by both the landlord and the tenant. This serves as confirmation of the transaction and establishes mutual understanding. Using a pre-designed template can save time and ensure consistency across multiple transactions.

Here’s the corrected version with minimal repetition of words:

To create a rent receipt template suitable for download in India, ensure the following elements are included:

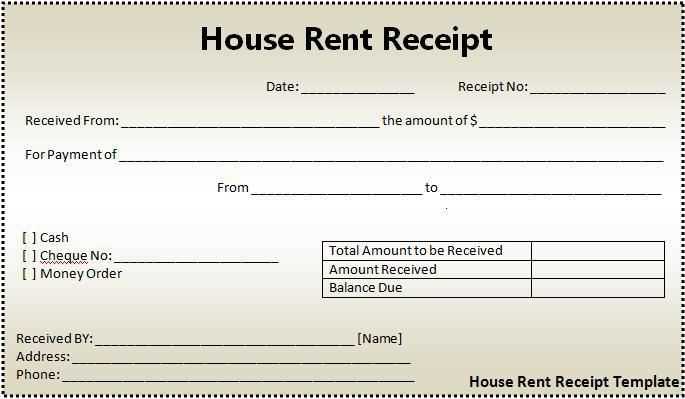

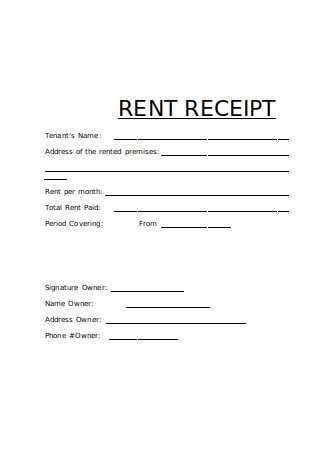

- Tenant’s Information: Full name, address, and contact details.

- Landlord’s Information: Name, address, and contact details.

- Property Details: Address of the rented property, including unit number if applicable.

- Rent Payment Details: Amount paid, payment date, and rental period covered.

- Payment Mode: Indicate whether the payment was made via cheque, bank transfer, or cash.

- Signature: Both tenant’s and landlord’s signatures to confirm the transaction.

Formatting Tips

- Use a simple, clear font like Arial or Times New Roman for readability.

- Ensure each section is clearly labeled with bold headings.

- Consider adding a footer with additional terms or references if required.

Make sure to update the template regularly to accommodate changes in payment details, especially if rent or payment terms change. A well-structured receipt template helps both parties maintain accurate records and avoid future disputes.

- Rent Receipt Template Download in India

For landlords and tenants in India, downloading a rent receipt template can save time and ensure accuracy. A rent receipt serves as proof of payment and is necessary for record-keeping or tax purposes. You can easily find downloadable templates that comply with Indian regulations.

Where to Find Rent Receipt Templates

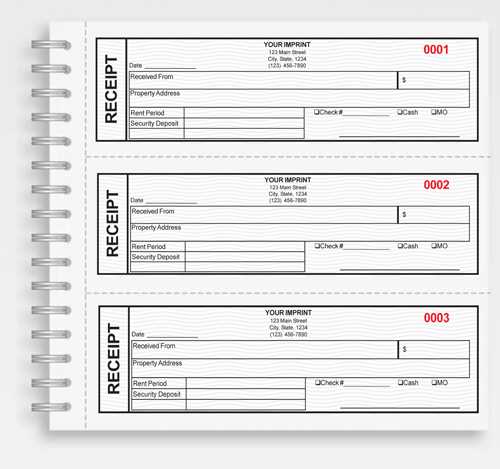

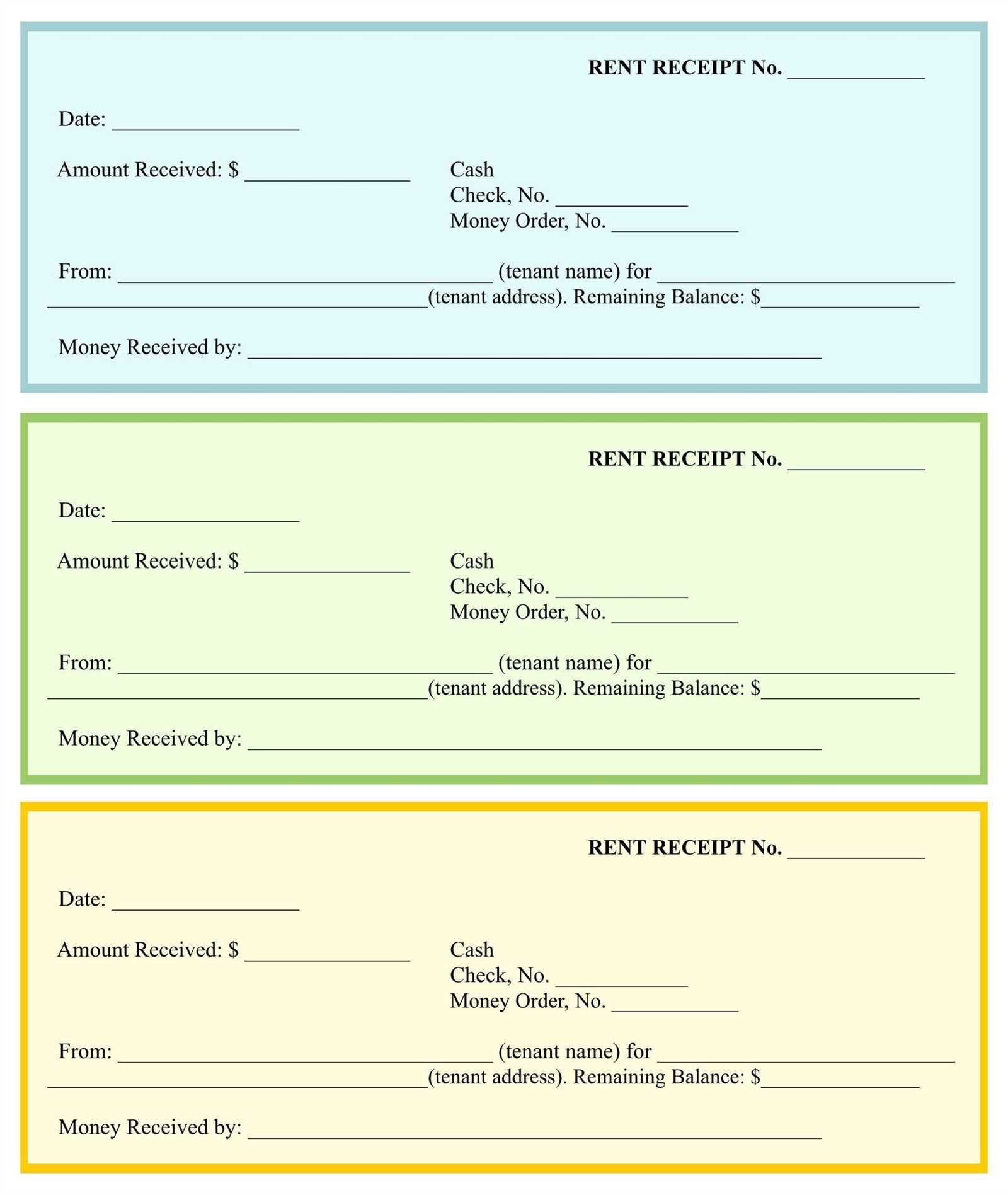

Many websites offer free or paid rent receipt templates. Look for ones that include key details such as the tenant’s name, landlord’s name, property address, payment date, amount, and the rental period. Some templates also allow you to add a unique receipt number for better tracking.

Customizing the Template

After downloading the template, make sure to fill in all relevant fields. Personalize the receipt by adding the name of the tenant, rent amount, and other specifics. You can also add your own branding if needed, especially if you manage multiple properties. Printing the receipt after filling out the form is ideal for both parties.

Receiving a rent receipt offers legal proof of transactions, safeguarding both tenant and landlord. It ensures transparency in financial dealings, helping avoid disputes over payment amounts, dates, or arrears. Having a documented record can also be critical for tax purposes, as tenants may claim rent deductions under section 80GG of the Income Tax Act. Without a receipt, proving rent payments can become a challenge.

For landlords, providing rent receipts helps maintain a clear financial record, reducing the chances of miscommunication. It also protects them in case of legal issues regarding the tenancy. A rent receipt clearly outlines the amount paid, the due date, and any additional charges, providing clarity for both parties.

Additionally, rent receipts serve as an important document for any future verification or loan applications. Whether you are a tenant or a landlord, having a receipt keeps you covered in all situations involving financial verification or legal matters.

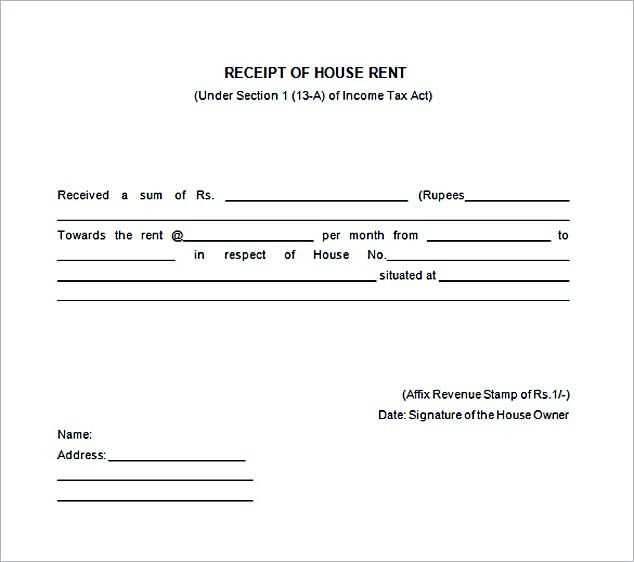

To download a rent receipt form in India, follow these simple steps:

Step 1: Visit a Trusted Website

Start by visiting a reputable website that offers free or paid rent receipt templates. Make sure the site provides forms that comply with local legal requirements.

Step 2: Choose the Right Format

After selecting the form, choose the format that best suits your needs (PDF, Word, Excel). PDF is commonly preferred for its ease of printing and sharing.

Once selected, click the download link to save the template on your device. You can then open the file and enter the necessary details such as tenant name, address, rental amount, and payment date.

A rent receipt template should include a few key elements to ensure it serves its purpose effectively. These components are crucial for clarity and transparency in the rental transaction.

1. Landlord and Tenant Details

Start by clearly stating the names of both the landlord and tenant. Include full names and contact information such as phone numbers or email addresses for ease of communication.

2. Property Information

Specify the address of the rental property. This helps in identifying the location clearly, especially when managing multiple properties.

By including these basic elements, a rent receipt template ensures all necessary information is documented, preventing misunderstandings between both parties.

Tailor your rent receipt to reflect the specific details relevant to your transactions. Include the tenant’s full name, the rental property address, the amount paid, and the payment date. If applicable, add extra fields such as the rental period or any adjustments like late fees or discounts. You can also incorporate the method of payment (cash, cheque, bank transfer) to keep records clear. Ensure the receipt includes a unique receipt number for easy tracking.

If you wish to maintain a professional appearance, consider adding your business logo or the landlord’s contact information. Use a clean, simple layout with legible fonts and clear sections for each piece of information. If you are offering receipts in multiple languages, ensure the translation is accurate and the layout remains consistent.

Make sure the receipt format complies with local regulations. In India, for instance, ensure the receipt meets requirements such as including the GST registration number, if applicable. Providing a custom rent receipt not only keeps you organized but also offers clarity and transparency to tenants, making the renting process smoother for both parties.

In India, a rent receipt serves as proof of payment for rental transactions. It is legally important for both tenants and landlords to comply with certain guidelines while issuing or receiving rent receipts. Here’s what you need to know:

First, the rent receipt must include specific details such as the tenant’s name, landlord’s name, rental amount, address of the property, and the date of payment. These details ensure that the receipt is legally valid and can be used for tax-related matters.

The receipt should clearly state whether the rent is paid on a monthly or annual basis. It is recommended to keep a copy of each receipt for future reference. For tenants, these receipts can be crucial when claiming deductions under Section 80GG of the Income Tax Act for house rent allowances.

It’s also mandatory for the landlord to provide a rent receipt if requested. Failure to do so can create issues during disputes, especially when it comes to tax filings or claims. Moreover, a rent receipt must be signed by the landlord or authorized agent, making it a legally binding document.

If the rent exceeds ₹3,000 per month, it’s advisable to make payments through bank transfers or cheques to ensure proper documentation. Cash payments are harder to track and may lead to complications.

To summarize, rent receipts in India are vital for both legal and tax purposes. Tenants should ensure that these receipts meet the necessary legal standards, while landlords should always issue receipts upon receiving rent payments.

Always ensure you include accurate details. Incomplete or incorrect information can lead to confusion and disputes. Double-check dates, names, and amounts before finalizing the receipt.

- Leaving out the rental period: Specify the exact period for which rent is being paid. Without it, the receipt becomes unclear and could create issues if referenced later.

- Missing signatures: A valid signature from both the landlord and the tenant adds credibility to the receipt. Lack of signatures can render it ineffective.

- Using vague descriptions: Always mention the rental property’s address and other relevant details to avoid ambiguity. A general description could lead to future misunderstandings.

- Incorrect format: Stick to a standard receipt format. A disorganized layout can make the document look unprofessional and harder to read.

- Not specifying the payment method: Clearly state whether the rent was paid in cash, by cheque, or via bank transfer. This helps both parties keep track of transactions.

- Failure to update for adjustments: If the rent amount changes or discounts are applied, make sure the receipt reflects these updates accurately.

Avoid these errors to make sure your rent receipts are clear, professional, and legally sound.

For an accurate rent receipt template in India, ensure it includes the date, landlord and tenant names, rental amount, and duration of the payment. Clearly specify whether it covers monthly or yearly rent. The receipt should also have a space for the property address and payment method used, whether cash, cheque, or online transfer. Include a statement confirming the receipt of the rent amount, along with the landlord’s signature for validation. Avoid omitting any critical details like payment due dates or any applicable tax information to ensure clarity.

Download Options: You can find downloadable rent receipt templates from various online resources, including government-approved sites and legal advisory pages. These templates usually come in Word or PDF formats, providing easy editing options. Ensure the template you select aligns with Indian legal standards, particularly regarding GST or income tax obligations if applicable to your situation.

Legal Notes: Rent receipts serve as an official document for tax purposes. Ensure all information is accurate and legible. In case of disputes, the rent receipt can act as proof of payment. Customize the template to suit your particular needs, such as adding multiple property details or adjustments to payment terms.