For tenants and landlords in India, having a rent receipt template in Excel can streamline the process of documenting rent payments. By using this template, you can ensure all necessary details, such as the tenant’s name, property address, rental amount, and payment date, are accurately recorded. This not only simplifies accounting but also helps in fulfilling legal requirements.

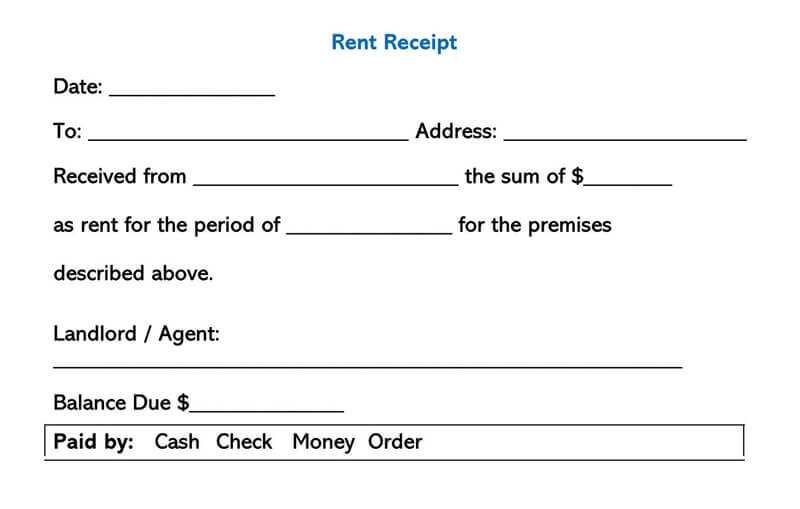

Start by entering tenant details, followed by the rent payment amount for the respective period. Ensure that the template includes a section for the payment method, which can be cash, bank transfer, or cheque. This adds transparency and offers an easy way for both parties to track payments. Also, adding a unique receipt number for each transaction enhances organization.

Utilize built-in Excel functions to automatically calculate totals and generate monthly reports. This helps both landlords and tenants maintain clear records without the hassle of manual calculations. Customizing the template to meet specific needs, such as adding late fee details or security deposit information, can make it more adaptable to different rental agreements.

Here is the revised version without excessive repetition of words:

Creating a rent receipt in Excel for India can be simplified with the right template. First, ensure that your document includes necessary details such as the tenant’s name, property address, amount paid, and the rent period. This ensures both landlord and tenant have a clear record of the transaction.

Key Elements to Include

Include a clear heading like “Rent Receipt” at the top of the template. Below, list the tenant’s name, the payment date, and the amount. Ensure the rent period (e.g., monthly or quarterly) is mentioned. Don’t forget to include the property details, such as the complete address, to avoid confusion.

How to Format the Template

Make use of rows and columns in Excel to organize each piece of information. Add a row for each month’s payment and columns for the payment date, rent amount, and property address. This will help track payments over time. For extra clarity, use bold for headings and ensure the text is aligned for easy readability.

- Rent Receipt Template Excel India

For accurate record-keeping, download and customize the rent receipt template in Excel tailored for India. This template includes necessary fields such as tenant details, property address, payment amount, and date of payment. Ensure to update the template with each payment to maintain a clear and organized financial record.

| Field | Description |

|---|---|

| Tenant Name | Full name of the tenant paying rent |

| Property Address | Complete address of the rented property |

| Amount Paid | Exact amount of rent paid by the tenant |

| Date of Payment | Specific date when the payment was made |

| Receipt Number | A unique reference number for tracking |

| Landlord’s Signature | Signature of the landlord confirming receipt of rent |

Update all fields accurately before issuing the receipt. A properly filled rent receipt serves as proof of payment for both tenants and landlords in case of any disputes or legal matters.

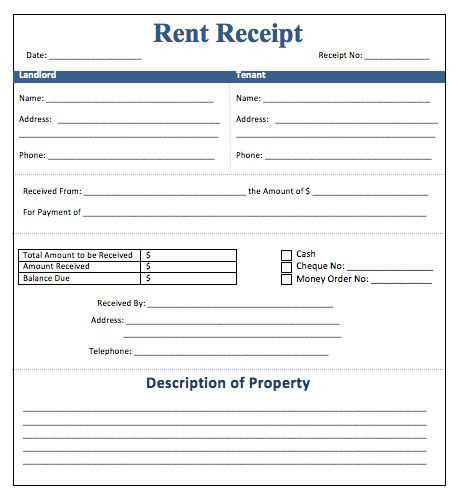

Create a simple yet functional rent receipt form in Excel by following these steps. Begin with setting up the header, which should include basic information like the landlord’s name, tenant’s name, address, and rent payment details. You can organize these sections in a table format for easy readability. Below is an example of how you can structure it:

| Field | Details |

|---|---|

| Landlord Name | [Enter Name] |

| Tenant Name | [Enter Name] |

| Property Address | [Enter Address] |

| Rent Amount | [Enter Amount] |

| Payment Date | [Enter Date] |

| Receipt Number | [Enter Receipt Number] |

Next, create a section where both the landlord and tenant can sign. This adds validity to the receipt. Make sure to leave space for both parties to enter their signatures and the date of signing.

Use Excel’s features to format the receipt neatly. Merge cells where needed for clear sectioning, and apply bold formatting to headings. This will make the form easy to understand and ensure the necessary fields stand out. For better clarity, highlight the rent amount and payment date fields, so they are easily visible at a glance.

Finally, save the file in an easily accessible location, and you’re done! Excel’s simple table and text formatting features can provide a professional-looking rent receipt that is both practical and customizable.

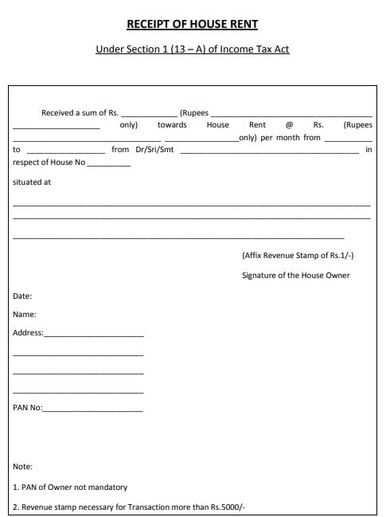

Receipts in India must meet certain legal guidelines to be valid. To comply with the law, ensure that your rent receipt includes specific details such as the tenant’s name, the landlord’s name, the amount paid, the date of payment, and the rental period. Always state whether the rent payment is made in cash or by cheque, and provide a unique receipt number for tracking purposes.

Mandatory Information

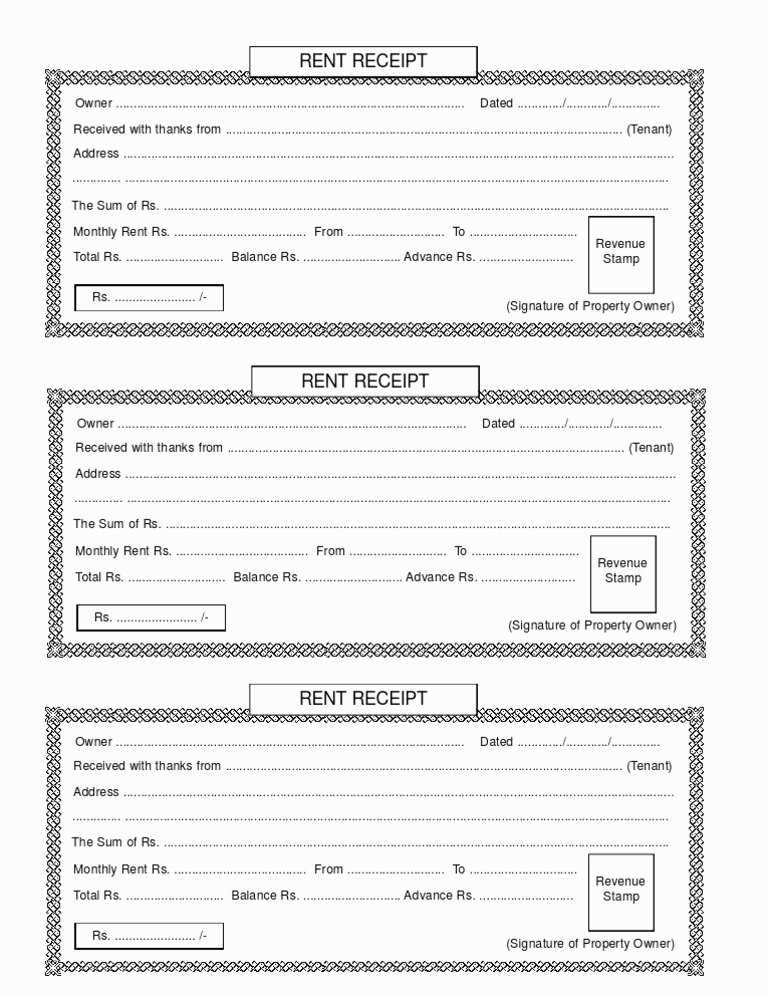

The receipt must explicitly mention the property address and rental amount in both words and figures. Including the GST registration number of the landlord is necessary if the rent exceeds a certain threshold. It helps to verify that the landlord is registered for GST. Landlords should also include their PAN (Permanent Account Number) if the total annual rent exceeds a specified limit, as per tax regulations.

Stamp Duty and Tax Considerations

For rent agreements exceeding 11 months, stamp duty applies and must be paid. The receipt does not require stamp duty unless specified by a court or legal procedure. However, landlords should ensure rent receipts align with tax filings to avoid complications, especially for GST and income tax returns.

To adjust your rent receipt template for different payment periods, focus on modifying the date range and total amount fields. For monthly payments, set the start and end dates as the first and last days of each month. If you use a quarterly or yearly payment system, update the dates to reflect those periods, and adjust the amount accordingly.

To avoid confusion, include a clear label next to the payment period, such as “Monthly Payment” or “Quarterly Payment.” Make sure the template automatically calculates the total based on the frequency selected. For example, if a tenant pays quarterly, multiply the monthly rent by three. Update the payment date at the top to match the start date of the period.

Additionally, consider adding a section for partial payments or adjustments. If a tenant makes a mid-period payment, you can adjust the total amount for the receipt to reflect the accurate payment history. Include a separate box to list any adjustments or extra charges like utilities or repairs.

Use the SUMIF function to quickly calculate total payments based on specific criteria, such as payment type or tenant name. For instance, to track payments made by a specific tenant, use: =SUMIF(A2:A100, “Tenant Name”, B2:B100). This will sum all values in column B that correspond to “Tenant Name” in column A.

To keep a detailed log, use IF statements to flag late payments. For example: =IF(C2 > TODAY(), “On Time”, “Late”). This checks if the payment date in column C is after the current date and labels it accordingly.

For better organization, categorize payments with VLOOKUP. It helps you retrieve payment information from a larger dataset based on a unique identifier, like a tenant ID. The formula =VLOOKUP(D2, A2:C100, 3, FALSE) will look up the tenant ID in D2 and return the corresponding payment amount from the third column.

To track outstanding balances, combine SUM and IF functions. For example, =SUMIF(E2:E100, “Unpaid”, F2:F100) sums all unpaid amounts in column F where column E marks them as “Unpaid”.

To ensure accuracy, include GST and any applicable taxes directly on the rent receipt. Follow these steps for seamless calculation:

- Identify the applicable GST rate for the rental property (typically 18% for commercial properties, but this may vary based on the type of property or agreement).

- Calculate the GST amount by multiplying the rent amount by the GST rate. For example, if the rent is ₹10,000 and the GST rate is 18%, the GST would be ₹1,800.

- Include the GST amount separately on the receipt, clearly indicating it as a tax charge.

- If other taxes are applicable (such as service tax or local taxes), add them in a similar fashion, ensuring each tax type is listed distinctly.

- Sum up the total rent, taxes, and any additional charges to display the final amount due.

- Provide a breakdown of taxes for transparency, helping tenants understand their payment structure.

Ensure that the rent receipt template includes a space for tax details to maintain clarity and comply with tax regulations.

Save receipts digitally by scanning them using a smartphone or scanner. Store the scanned copies in a cloud storage service like Google Drive or Dropbox for easy access. This method ensures that receipts remain secure and organized, eliminating the risk of physical damage.

For sharing, convert receipts to PDF format before sending them via email or file-sharing platforms. This format maintains the document’s integrity and ensures it’s viewable on any device. Here’s how:

- Scan or take a picture of the receipt.

- Use an app or software to convert the image to PDF (e.g., Adobe Acrobat, PDF Converter).

- Upload the PDF to cloud storage or send it directly via email.

Set up a consistent naming convention for receipts so you can easily search and find them later. For example, use the date and store name (e.g., “2025-02-05_Market_receipt.pdf”).

To prevent clutter, create folders within your cloud storage service to categorize receipts by month, type, or purpose (e.g., “February 2025”, “Business Expenses”, or “Personal”).

Ensure your receipts are backed up regularly. Most cloud services offer automatic backup options, reducing the risk of losing important documents.

Use an Excel template for rent receipts in India to simplify the tracking of payments and ensure clarity in documentation. Include essential details like tenant’s name, address, payment date, amount, and rental period. Always provide a receipt number for reference and make sure the tenant’s and landlord’s contact information is visible. The template should be easy to edit for future use, including dropdown lists for payment types like cash, cheque, or online transfer.

Key Features to Include

Include fields such as rental agreement number, GST details if applicable, and a description of the rental property. Providing a breakdown of monthly rent and any applicable dues will make the receipt more transparent. A digital signature option can be included for electronic versions of the document.

Using the Template Effectively

Regularly update the template to reflect any changes in the rental agreement or payment schedule. For digital receipts, ensure the file is saved securely to avoid discrepancies in record-keeping. If you’re unsure about the structure, start by reviewing examples to ensure compliance with local tax laws and guidelines.