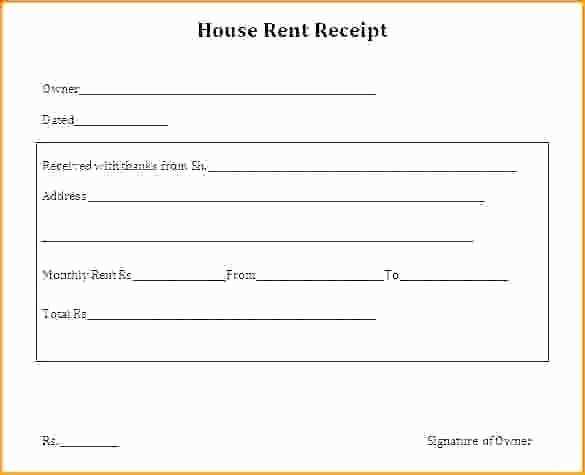

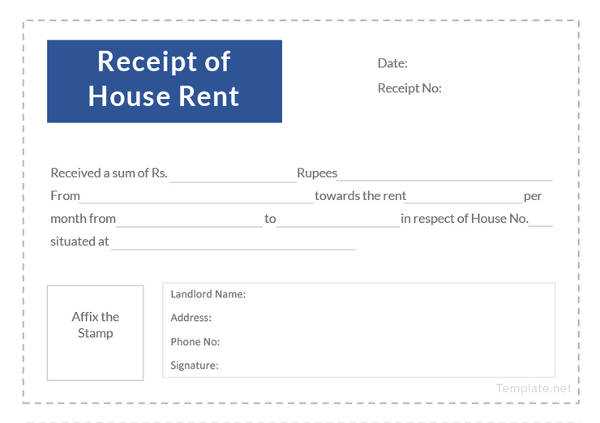

To create a precise and clear rent receipt, always include key information like the amount paid, the date of the payment, and the rental period. These details provide transparency and serve as a reference for both the landlord and the tenant. It’s important to have this template handy, as it simplifies the process and ensures consistency in record-keeping.

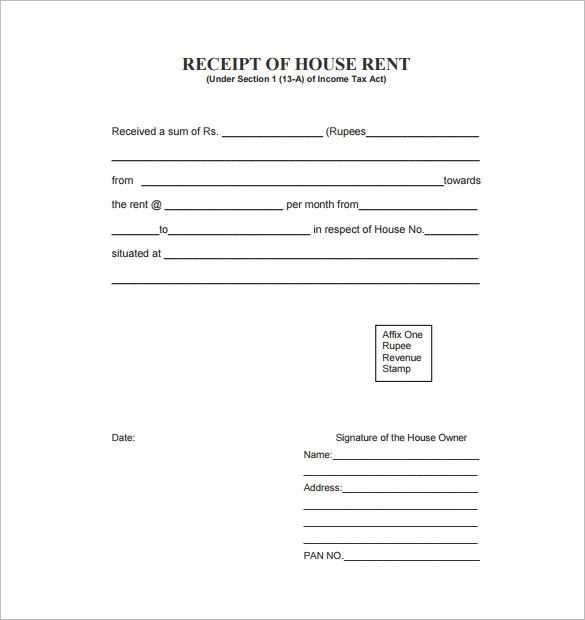

For numerical accuracy, make sure the rent amount is clearly written both in numbers and words. This reduces the chance of errors or misunderstandings between the landlord and tenant. Include the rent period, whether it’s monthly, quarterly, or yearly, to avoid confusion about the time frame the payment covers.

Lastly, always provide a receipt number or reference code to make each transaction easily traceable. This small detail makes it simpler to search and track payments, especially when handling multiple tenants or large property portfolios. By adhering to these tips, you’ll keep everything organized and clear for both parties involved.

Here’s the revised version of the text with the repetitions removed while preserving the meaning:

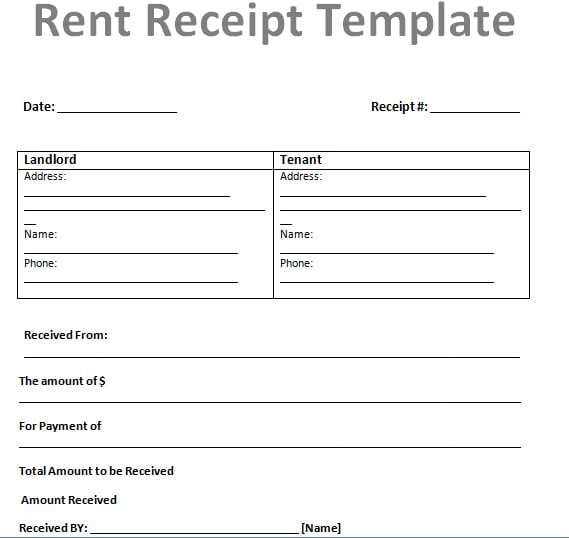

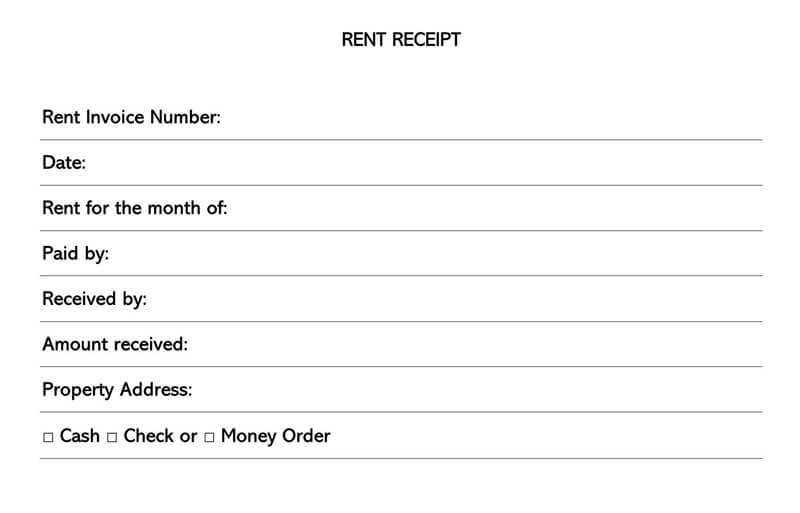

Use clear, concise language when drafting a rent receipt template. Ensure that the tenant’s name, rental property address, payment date, and the amount paid are specified. Avoid unnecessary details that could complicate the document or create confusion. A straightforward format will improve readability and ensure all required information is easy to find.

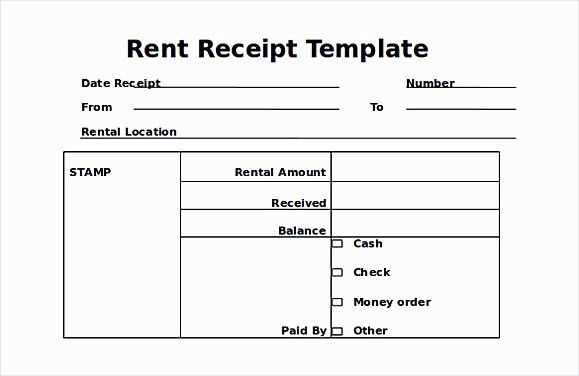

Key Elements for Rent Receipt Template

| Field | Description |

|---|---|

| Tenant Name | Full name of the tenant who made the payment. |

| Property Address | Complete address of the rental property. |

| Payment Amount | The exact sum the tenant paid for the rental period. |

| Payment Date | The date the payment was made or received. |

| Receipt Number | A unique identifier for the transaction. |

Format Suggestions

List details clearly, separating each section. Use bold text for headers to guide the reader. It’s beneficial to include a space for both the landlord’s and tenant’s signatures to acknowledge the receipt. Keep the language direct and factual, avoiding ambiguity in every field.

- Rent Receipt Template for Numbers

To create an accurate rent receipt for numeric records, structure the template with the following key details:

- Date of Payment: Clearly list the date the rent was paid. Include both the payment and receipt dates if they differ.

- Tenant’s Details: Add the tenant’s full name and contact information.

- Payment Amount: Specify the exact amount paid, including the payment method (e.g., cash, bank transfer, check).

- Rental Period: Define the start and end dates for the rent period covered by the payment.

- Property Details: Mention the address of the rental property, including the unit number if applicable.

- Landlord’s Information: Include the landlord’s or property manager’s name, phone number, and email address.

- Receipt Number: Assign a unique number to the receipt for tracking and reference purposes.

This template provides a clear record for both the landlord and the tenant, simplifying future verification and accounting tasks.

Set up a dedicated folder, either physical or digital, where you can keep all rent receipts in one place. This ensures that every transaction is accounted for and easily accessible. Label each receipt with the month and year to help identify them at a glance. If you’re using a digital folder, consider scanning physical receipts and saving them as PDF files.

Group receipts by tenant or property if you’re managing multiple units or renters. Creating subfolders or separate sections within your folder makes it easy to locate any specific receipt. For example, name the subfolders with tenant names or property addresses for quick reference.

For each month, keep a running tally of rent payments received. A simple spreadsheet can track these amounts, noting whether they were paid on time or if there were any issues. This serves as a backup to your receipts and provides a quick summary of the payments.

Review receipts periodically to ensure everything is up-to-date. A quick check every quarter can prevent errors from accumulating over time. If you notice any discrepancies between your spreadsheet and receipts, address them immediately.

Storing receipts for tax or legal purposes requires keeping records for several years, depending on your location’s regulations. Make sure that both physical and digital copies are legible and complete. Digital receipts should be backed up regularly to prevent data loss.

For clear and accurate rent receipts, always ensure that numeric entries are properly formatted to avoid confusion. Use consistent decimal points and align all numbers to the right for easy readability. If the rent includes cents, ensure two decimal places are used to prevent misinterpretation. For example, $100.00 is clearer than $100. Or, if the amount is $1500, avoid using unnecessary zeros like $1500.00.

Alignment and Spacing

Aligning numeric values to the right ensures that they are clearly distinguishable from text, especially in columns. This creates a cleaner and more professional look, making it easier for both the landlord and tenant to verify amounts. If listing multiple charges or payments, consider using a table format with equal column widths to maintain consistent spacing across all entries.

Currency Symbols

Always include the currency symbol before the number (e.g., $1,200) to make it clear what currency is being used. Avoid unnecessary symbols or abbreviations that could cause confusion. Stick with a standard format and be consistent across all receipts to ensure clarity and professionalism.

Always ensure the receipt includes the exact rental amount paid, without rounding or omitting cents. Missing this detail can create confusion and disputes. Double-check that the payment method is clearly stated–cash, check, or bank transfer–along with the transaction reference number if applicable.

Don’t forget to include both the tenant’s and landlord’s full names. Inaccurate or incomplete names can lead to complications in proving the transaction. Additionally, it’s important to include the correct rental period. Errors in the dates may result in ambiguity about what the payment covers.

Ensure that the receipt has a unique identification number. Without this, tracking payments can become challenging, especially for both parties. Avoid using vague terms like “received payment” or “settled balance.” Instead, clearly mention the exact amount paid for that particular rent period.

Be mindful of spelling and grammatical errors. They may seem trivial, but they can make the receipt appear unprofessional and could lead to misunderstandings. Always proofread before finalizing the document.

To create a clear rent receipt template, focus on listing numbers in a structured format. Here’s how:

- Start with the date of payment at the top. Specify the exact day, month, and year to avoid confusion.

- Include the tenant’s details such as name and address. This ensures both parties are identified.

- Clearly write the amount paid in both numbers and words. This eliminates any potential ambiguity.

- Provide the rental period covered by the payment, mentioning the start and end dates.

- Describe the payment method used. Whether it’s cash, check, or bank transfer, this adds clarity.

- Finally, sign the receipt. This serves as proof of the transaction and is important for record-keeping.

By following these points, your rent receipt will be both professional and easy to understand.