To claim House Rent Allowance (HRA) in your income tax filings, you need a properly formatted rent receipt. A rent receipt serves as proof of payment and must include essential details such as the tenant’s name, landlord’s name, rental amount, payment date, and address of the rented property.

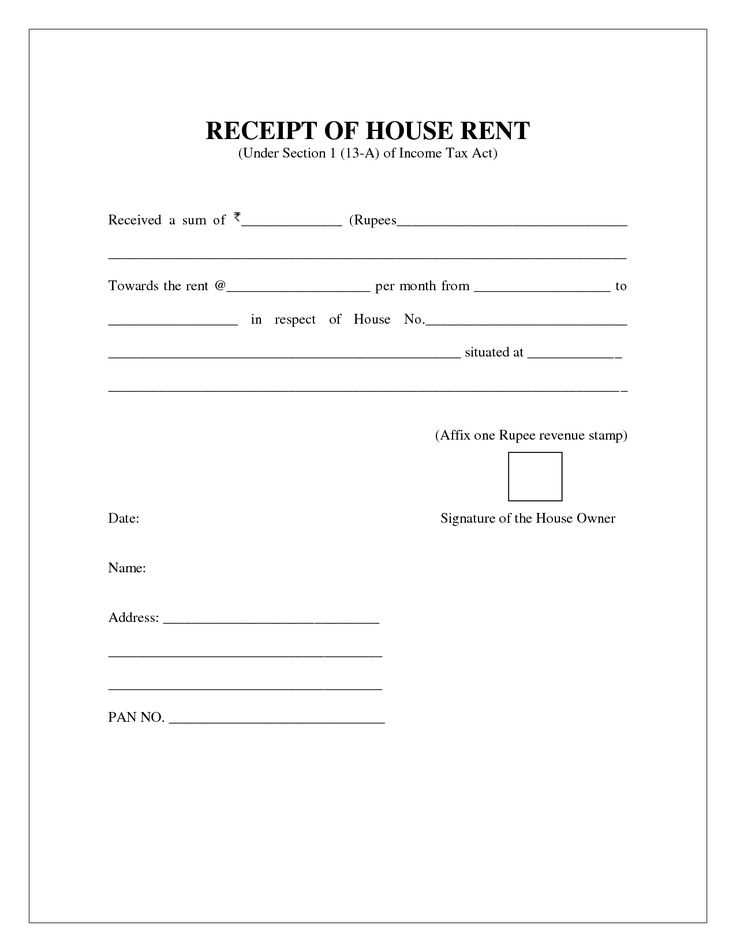

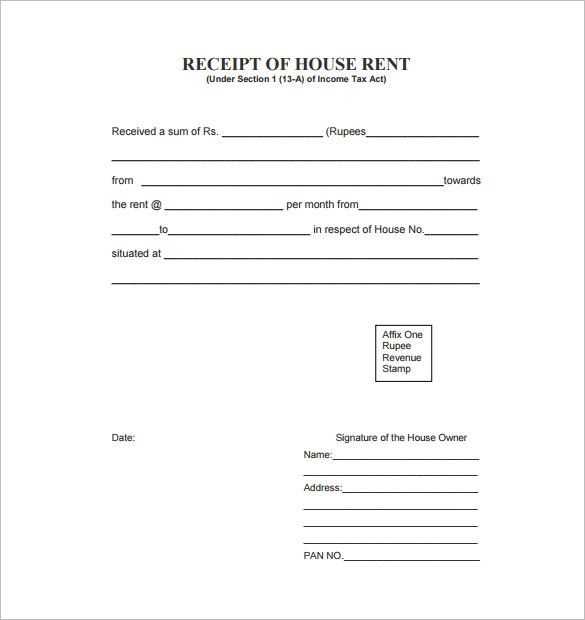

For a valid HRA claim, ensure your rent receipt includes the landlord’s PAN if the annual rent exceeds ₹1,00,000. Without this, your claim may be rejected. Additionally, payments should ideally be made through traceable methods such as bank transfers or cheques to avoid discrepancies during verification.

When filling out a rent receipt template, use clear and legible handwriting or opt for a digital format. Many employers require receipts with revenue stamps for cash payments exceeding ₹5,000 per receipt. Keeping monthly rent receipts instead of generating them in bulk at the end of the financial year helps maintain consistency and credibility.

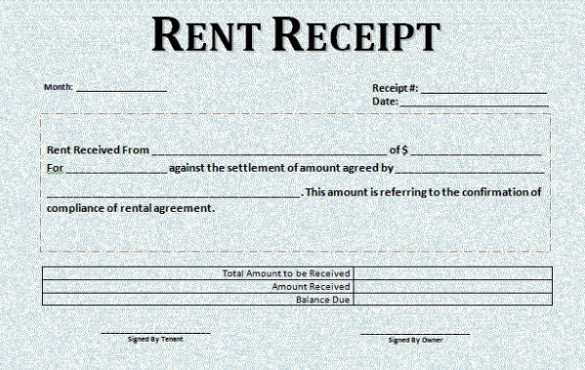

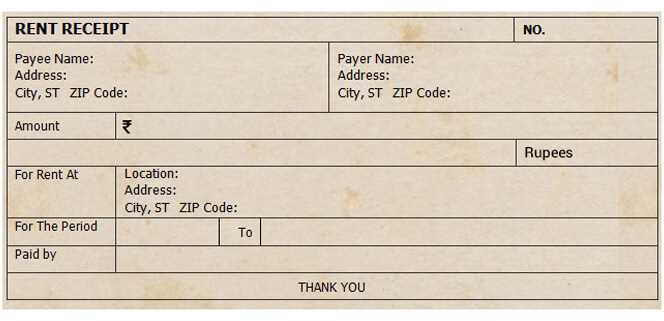

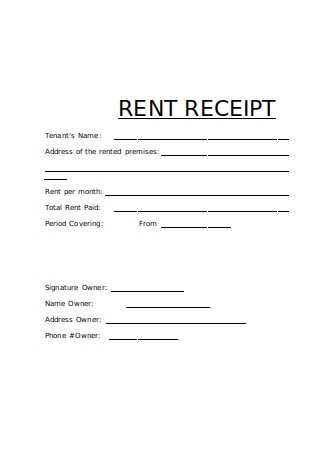

Below, you’ll find a structured template for your rent receipts, ensuring compliance with tax regulations and employer requirements.

Here is the corrected version with redundancies removed:

If you need a rent receipt template for HRA purposes, ensure it contains the necessary details. Include the tenant’s name, landlord’s details, rental period, rent amount, and property address. Make sure the receipt is signed by the landlord and dated. You can also add a note about the payment method (cash, bank transfer, etc.) for better clarity.

Key Points to Include:

- Tenant and landlord names

- Rental amount and payment date

- Property address

- Signature and date of issuance

- Payment method (optional)

This template will help avoid issues when applying for HRA benefits, providing clear proof of rent payments. Make sure the template matches the format required by your employer or tax authority.

- Rent Receipt Template for HRA Claims

A rent receipt template for HRA claims should clearly show details that are necessary for your tax or reimbursement process. The following elements should be included in your rent receipt:

| Element | Description |

|---|---|

| Landlord Name | The full name of the landlord or property owner. |

| Tenant Name | Your name as the tenant paying the rent. |

| Property Address | The complete address of the rented property. |

| Rent Amount | The exact amount of rent paid during the specified period. |

| Payment Date | The specific date on which the rent was paid. |

| Payment Mode | Specify whether the rent was paid via cash, cheque, or bank transfer. |

| Rental Period | Indicate the rental period covered by the receipt (e.g., January 2025). |

| Landlord’s Signature | The signature of the landlord or their representative confirming receipt of the rent. |

Ensure the details on your rent receipt match your rental agreement. This will help you avoid delays when filing for HRA claims. Keeping a record of all rent receipts is also advised for future reference.

A rent receipt must contain certain details to be both clear and legally valid. Below are the key elements to include:

Date of Payment

Always include the exact date when the rent was paid. This helps both the tenant and landlord track payments accurately.

Tenant and Landlord Information

Clearly list the names of both parties involved–tenant and landlord. Include addresses if necessary for added clarity.

Payment Amount

Specify the exact amount paid for the rent. If applicable, break down the payment (e.g., rent, late fees, or other charges).

Rental Property Address

Provide the full address of the rental property being paid for. This ensures the payment is linked to the correct property.

Payment Method

State the method used for the payment, whether it’s cash, cheque, or bank transfer. This adds transparency to the transaction.

Signature

Include a space for both parties to sign, confirming the payment was made. This helps prevent any future disputes regarding payment history.

Receipt Number

Assign a unique receipt number to each transaction. This makes it easier to organize and reference payments.

Ensure your rent receipt meets all HRA compliance requirements by including the following details:

- Landlord’s Information: Clearly mention the landlord’s name, address, and contact details. This helps verify the relationship between the tenant and the landlord.

- Tenant’s Information: Include the tenant’s name and address. This proves the individual is renting the property and paying rent for HRA claims.

- Rent Amount: Specify the exact rent paid, including the currency. If applicable, note any adjustments or additional fees separately.

- Payment Date: Mention the date the rent was paid, ensuring it matches the relevant month for HRA claims.

- Payment Mode: Clearly indicate whether the payment was made via cheque, bank transfer, cash, or any other method. This adds credibility to the transaction.

- Period of Payment: Specify the period for which the rent is being paid (e.g., monthly, quarterly), as HRA eligibility often depends on the payment period.

- Signature: The landlord should sign the receipt to authenticate the document. This ensures its validity for HRA purposes.

- Property Details: Include the address of the rented property. For HRA purposes, the property must be a legitimate rental property, so clarity here is vital.

Additional Notes for HRA Compliance

- Ensure the rent receipt is issued on an official letterhead if possible, making it look more formal and legitimate.

- If rent exceeds a certain threshold, the landlord may need to provide a PAN number for tax purposes.

Ensure all receipts are legible before submission. A blurry or hard-to-read receipt can delay processing or result in rejection. Check for clear dates, amounts, and vendor details.

Do not omit required details, such as the address of the rental property or the landlord’s information. Missing these can make your receipt invalid for tax purposes or HR claims.

Avoid submitting receipts that have been altered or tampered with. Even small changes can raise questions about authenticity, leading to rejection or fraud investigations.

Be cautious about mixing personal and rental-related expenses on the same receipt. Keep receipts for rent and related payments separate from other purchases to avoid confusion.

Do not submit receipts that exceed the allowed rental amount. If your rent payment exceeds the specified limit for housing rent allowance (HRA), it may disqualify you from reimbursement.

Ensure the receipt format aligns with the requirements of the organization or authority receiving it. Whether paper or digital, verify that your submission method matches the specified guidelines.

Always keep backup copies of your receipts. If a submission is lost or rejected, having a duplicate on hand can save time and effort in resubmitting.

Meaning is preserved, repetitions minimized.

To create a rental receipt template for HRA (House Rent Allowance), focus on the key details required for validation and transparency. Start by clearly identifying the tenant and the landlord. Include the tenant’s full name, address, and the rental property’s details. The date of payment, amount paid, and rental period should be prominently displayed. Additionally, mention the payment method used (e.g., bank transfer, cash). If applicable, include any deductions, such as maintenance fees or taxes, that affect the rent amount. Finally, both parties should sign the receipt to confirm the transaction.

Template Example:

- Tenant Name: [Tenant’s Full Name]

- Landlord Name: [Landlord’s Full Name]

- Rental Property Address: [Address]

- Amount Paid: [Amount in figures]

- Payment Method: [e.g., Cash, Bank Transfer]

- Rental Period: [Start Date – End Date]

- Signature (Tenant): ______________________

- Signature (Landlord): ______________________

Once you have this structure, you can customize it based on local requirements or personal preferences. Keep the language simple and clear to avoid confusion in future references.