Essential Components of a Rent Receipt

A valid rent receipt must include specific details to be legally recognized and useful for tax purposes. Ensure the following elements are present:

- Tenant’s Name: The full name of the tenant making the payment.

- Landlord’s Name: The property owner’s full name.

- Property Address: The complete address of the rented premises.

- Rent Amount: The exact amount paid for the specified period.

- Payment Date: The date the payment was made.

- Mode of Payment: Cash, bank transfer, cheque, or UPI.

- Period Covered: The duration the rent payment covers (e.g., January 2024).

- Landlord’s Signature: A signature or stamp from the landlord.

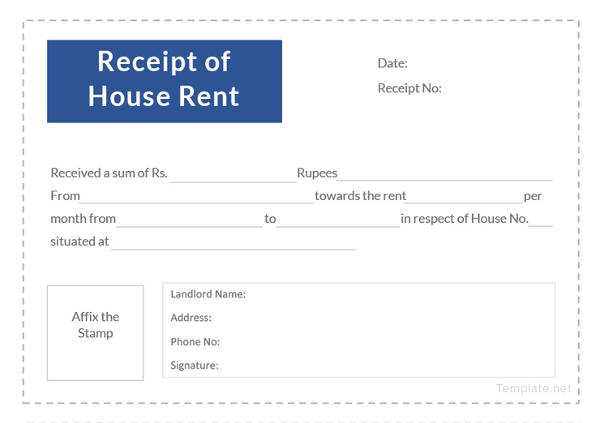

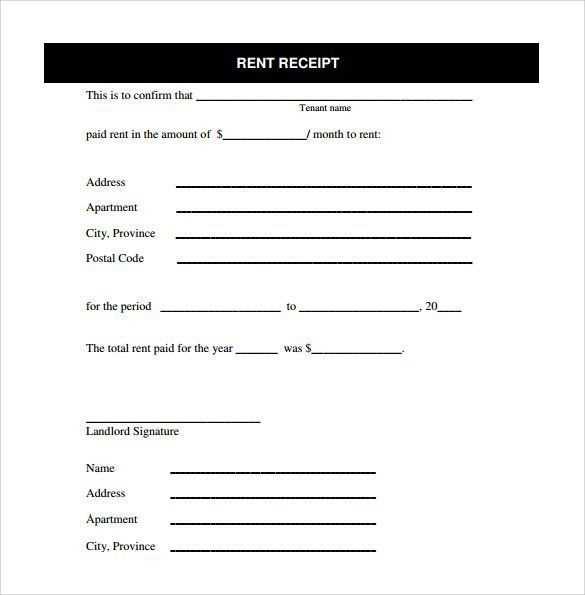

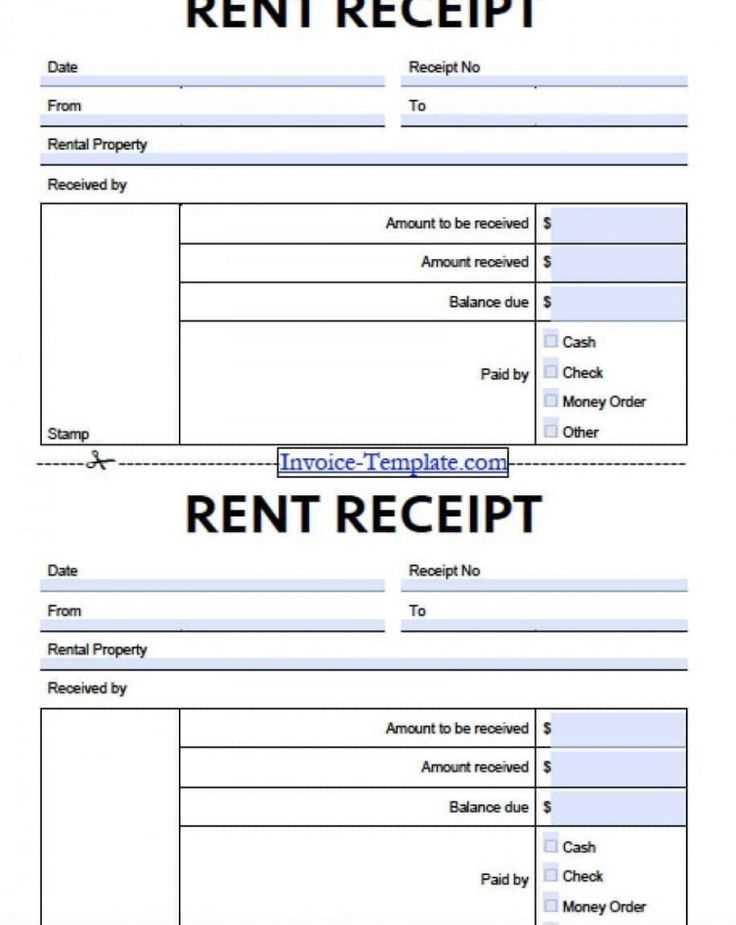

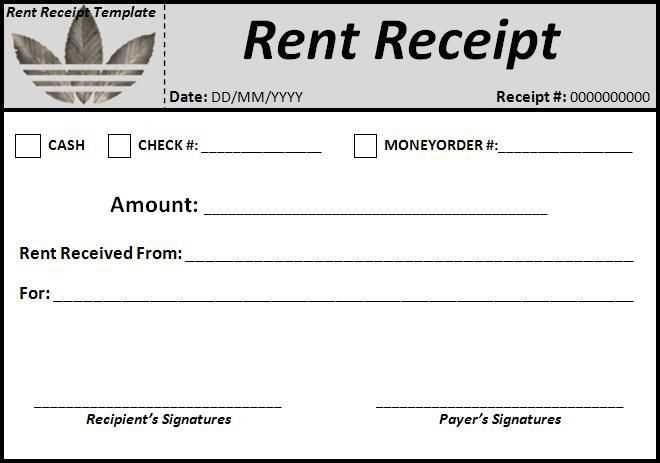

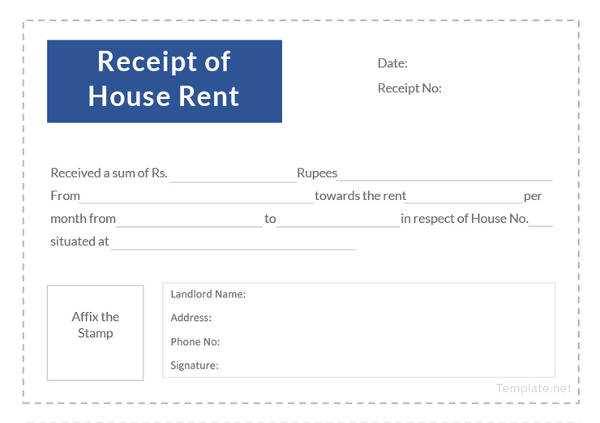

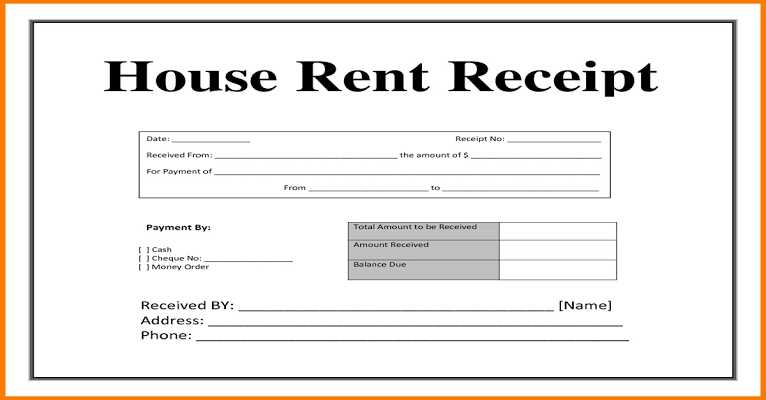

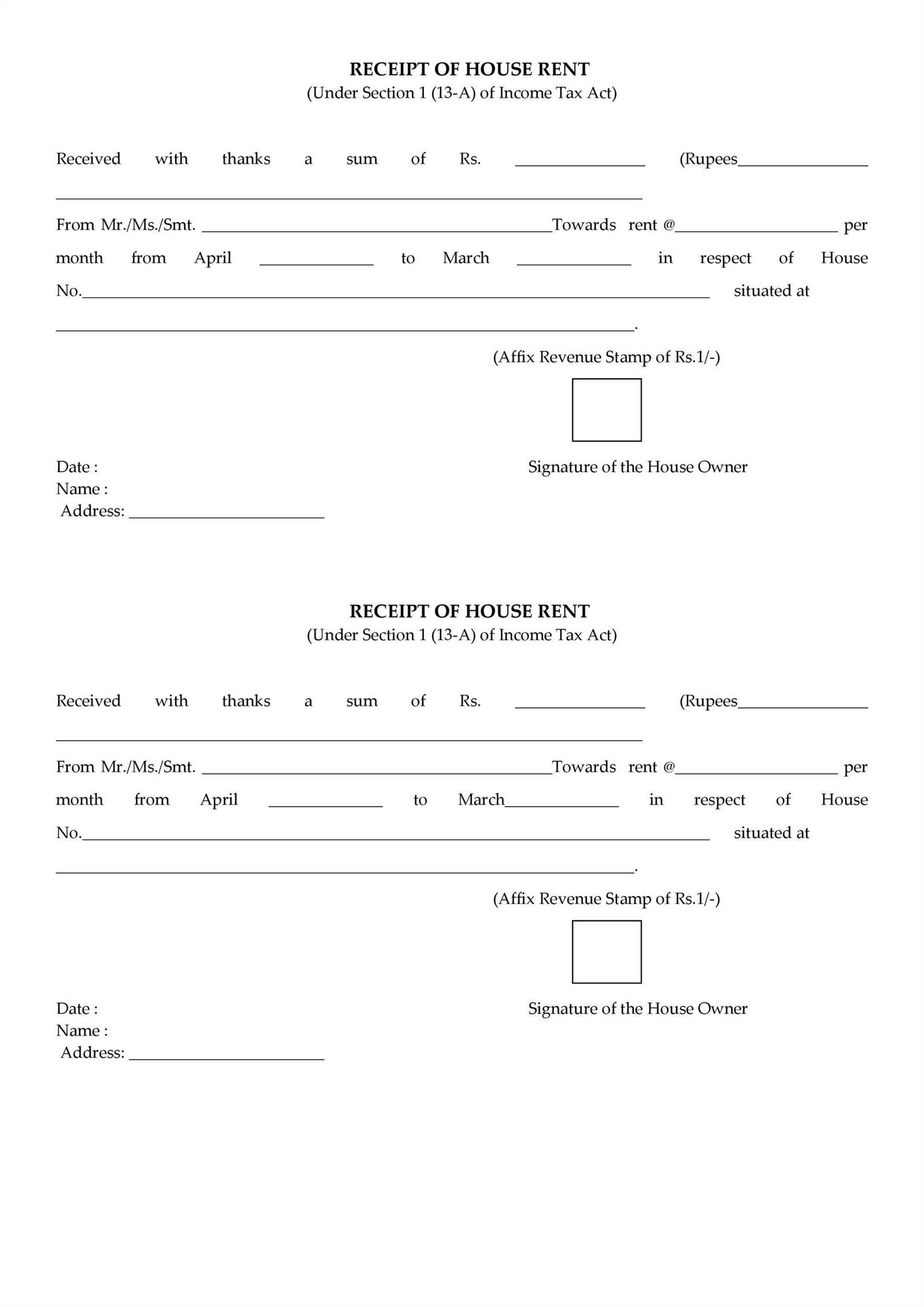

Sample Rent Receipt Format

Use the following format for a professional and compliant rent receipt:

Rent Receipt Date: [DD/MM/YYYY] Received from: [Tenant’s Full Name] Address of Rented Property: [Full Address] Rent Amount: ₹[Amount] Period: [Month/Year] Mode of Payment: [Cash/Bank Transfer/UPI] Landlord’s Name: [Full Name] Landlord’s Signature: _______________

Tax Benefits and Compliance

Employees seeking House Rent Allowance (HRA) exemptions should collect receipts for rent payments exceeding ₹3,000 per month. If the annual rent surpasses ₹1,00,000, the tenant must provide the landlord’s PAN to claim deductions.

Key Points for Tenants and Landlords

- Always request a signed rent receipt for proof of payment.

- Keep records of receipts for tax filing and dispute resolution.

- Ensure rent transactions are documented to avoid legal issues.

Rent Receipt Template in India

Ensure the receipt includes the tenant’s full name, rental amount, payment date, and complete address of the rented property. Specify the mode of payment and mention if any taxes were deducted. Always include the landlord’s name, signature, and contact details.

Legal Requirements for Rental Receipts in India

Receipts must comply with state regulations and should include a revenue stamp if the payment exceeds ₹5,000 in cash. Digital receipts must contain an electronic signature or unique authentication to be legally valid.

Key Information to Include in a Lease Receipt

- Tenant and landlord details with full addresses

- Monthly rent amount and payment mode

- Transaction reference number for digital payments

- Duration of the rental agreement

- Revenue stamp and landlord’s signature for cash transactions

Stamp Duty and Tax Implications for Rental Documents

Lease agreements over 11 months require stamp duty and registration. Tenants claiming tax deductions under HRA must submit rent receipts with the landlord’s PAN if the rent exceeds ₹1 lakh per year.

Digital vs. Paper Lease Slips: Pros and Cons

- Digital receipts: Convenient, easy to store, and traceable but require proper authentication.

- Paper receipts: Legally accepted, but prone to loss and damage.

Common Mistakes When Creating a Rental Proof

- Missing landlord’s PAN for tax exemption claims

- Incorrect or incomplete address details

- Lack of proper authentication in digital receipts

- Failure to attach a revenue stamp for cash payments above ₹5,000

How to Verify the Authenticity of a Payment Receipt

Cross-check landlord details with the rental agreement. For digital receipts, confirm the payment through bank statements. Ensure the landlord’s signature matches official documents. Avoid accepting handwritten receipts without a revenue stamp.