Providing a well-structured rent receipt is necessary for both tenants and landlords in Ireland. A properly documented receipt serves as proof of payment, helping to resolve disputes and meet tax requirements. It should include key details such as the tenant’s name, rental property address, payment amount, and the landlord’s signature.

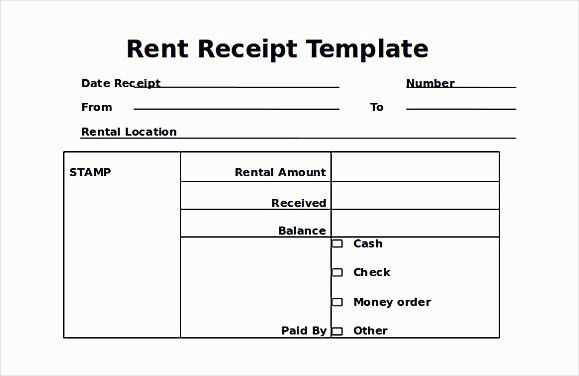

What to Include: The receipt must specify the payment date, rental period covered, and the preferred method of payment–whether cash, bank transfer, or another method. Additionally, adding a unique reference number can help streamline record-keeping.

Legal Requirements: In Ireland, landlords are legally required to issue receipts for cash payments. While not mandatory for electronic transactions, providing one ensures clarity and prevents misunderstandings. Including the landlord’s contact information and registration number (if applicable) further strengthens its validity.

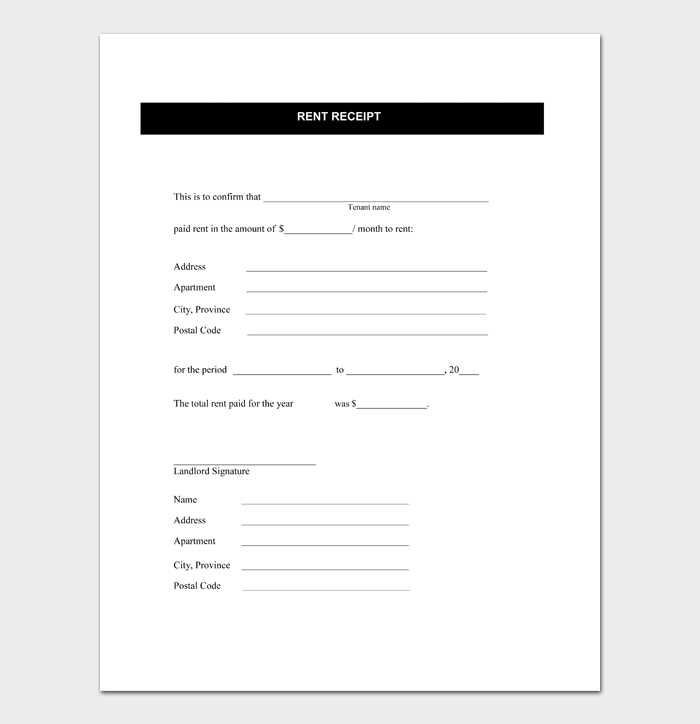

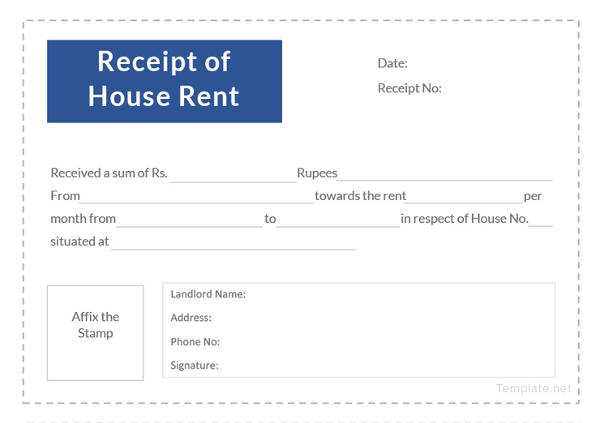

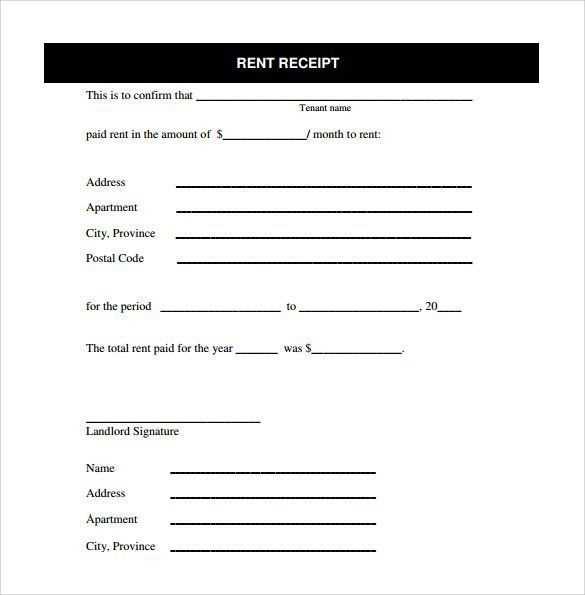

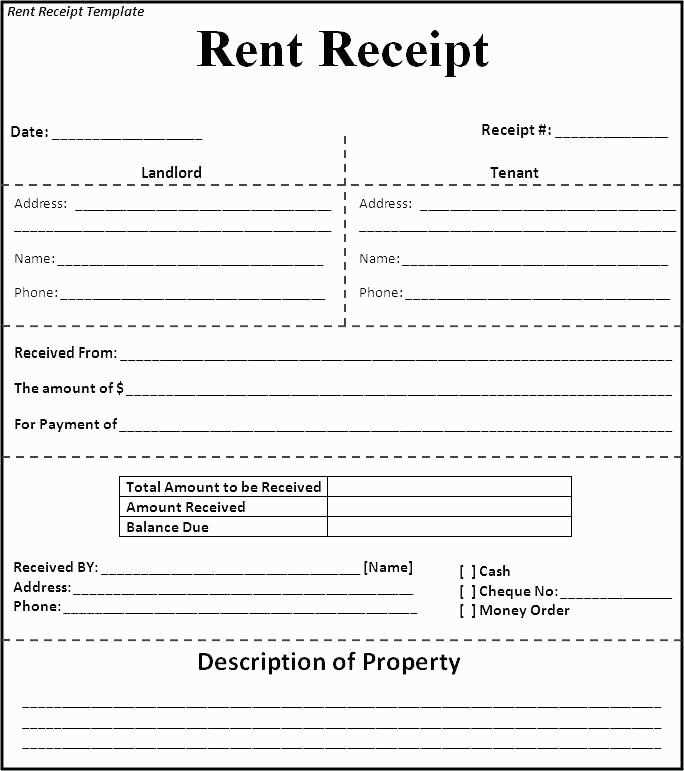

Using a structured template saves time and ensures compliance. A clear format with predefined sections helps both parties maintain accurate records. Whether printed or digital, a standardized receipt improves transparency and simplifies financial tracking.

Rent Receipt Template in Ireland

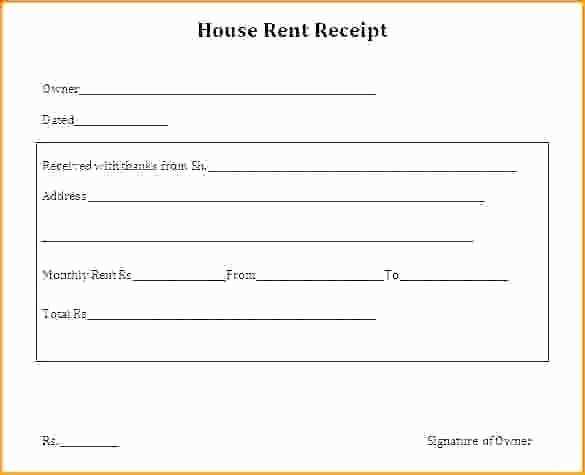

Ensure your rent receipt includes the full name of the landlord and tenant, the rental property’s address, and the exact amount paid. A clear breakdown of rent, utilities, or other charges is useful for record-keeping.

Key Details to Include

Always mention the payment date, the method used (cash, bank transfer, etc.), and the period covered. If paid in cash, a signature from the landlord or agent adds legitimacy.

Format and Structure

A structured layout improves clarity. A simple table format can list payment details efficiently, while a signed section confirms receipt. Keep a digital copy for future reference.

Key Legal Requirements for Rental Receipts

Include the landlord’s full name, address, and contact details. The receipt must clearly state the tenant’s name and the property address.

Mandatory Information

Specify the date the payment was received and the amount paid. Indicate the payment method, such as bank transfer, cash, or cheque. If there are any outstanding balances, note them.

| Required Detail | Description |

|---|---|

| Landlord’s Details | Full name, address, and contact information |

| Tenant’s Information | Full name and rental property address |

| Payment Date | Exact date of receipt |

| Amount Paid | Total sum received |

| Payment Method | Cash, bank transfer, or other |

Signature and Acknowledgment

A signed receipt confirms the transaction. The landlord or agent should sign it, and the tenant should retain a copy for reference.

Mandatory and Optional Details to Include

Include the full name and address of both the tenant and landlord. Specify the rental property’s complete address to avoid any ambiguity. Clearly state the payment amount, currency, and date of payment.

Indicate the payment method, such as bank transfer, cash, or check. If applicable, add a unique receipt number for tracking. Include a breakdown of charges if the payment covers more than rent, like utilities or deposits.

Optional details can enhance clarity. Mention the rental period the payment applies to, even if it aligns with a standard monthly cycle. Adding a signature from the landlord or agent adds authenticity. If payments are made in installments, noting outstanding balances can prevent disputes.

Formatting Guidelines for Clear Documentation

Use a structured layout with distinct sections for payer details, payment specifics, and landlord information. Align content for readability and ensure all fields are clearly labeled.

Maintain consistency in font size and style. Use a sans-serif typeface for clarity, and keep font sizes uniform to avoid distractions.

Ensure dates follow the standard Irish format (DD/MM/YYYY) to prevent misinterpretation. Clearly separate numerical amounts from textual descriptions to enhance legibility.

Include a signature line for authentication. If using a digital format, provide space for an electronic signature or a printed name.

Limit the use of bold and italic styles to key details such as total amount paid and receipt number. Avoid excessive capitalization, as it reduces readability.

Leave adequate spacing between sections to improve visual separation. Margins should be wide enough to prevent text from appearing cluttered.

Ensure the final document fits on a standard A4 page without excessive empty space. If needed, adjust spacing or font size to maintain a balanced appearance.

Common Mistakes and How to Avoid Them

- Missing Key Details

Always include the tenant’s name, rental address, amount paid, payment date, and landlord’s details. Skipping any of these can make the receipt invalid.

- Incorrect Payment Dates

Use the exact date the payment was received, not when it was due. A wrong date can cause disputes and tax issues.

- Unclear Payment Method

Specify how the rent was paid–cash, bank transfer, or check. This prevents confusion if proof of payment is needed later.

- Lack of Signature

For paper receipts, the landlord’s signature adds authenticity. If using a digital format, an email confirmation serves the same purpose.

- Not Keeping Copies

Store duplicates for at least six years. This helps resolve disputes and supports tax filings.

Printable and Digital Receipt Options

For landlords and tenants who prefer a physical copy, printable receipts offer a straightforward way to document payments. Using pre-designed templates in PDF or Word format ensures consistency and professionalism. Many free and paid templates include essential details such as tenant and landlord names, property address, payment amount, and date. Always keep a signed copy for records.

Going Paperless with Digital Receipts

Digital receipts streamline record-keeping and reduce paper waste. Landlords can create reusable templates in Excel or Google Docs, allowing for quick modifications and automated calculations. Emailing receipts provides instant confirmation, while cloud storage ensures easy access to past transactions. Rental management apps often include built-in receipt generators, simplifying the process further.

Choosing the Right Format

For legally binding documentation, PDFs prevent alterations and maintain formatting across devices. Editable formats like Word or Google Docs allow flexibility for recurring transactions. If automation is a priority, spreadsheet software can generate itemized receipts with minimal effort. Consider tenant preferences when selecting the most convenient option.

How to Store and Organize Receipts for Tax Compliance

Keep receipts in a well-organized system for easy access during tax season. A few simple steps can save you time and hassle when it’s time to file taxes.

1. Categorize Receipts by Expense Type

- Group receipts based on categories like rent, utilities, office supplies, or travel expenses.

- Create separate folders or files for each category, either digitally or physically.

- Label each folder clearly to avoid confusion later on.

2. Store Receipts Digitally

- Use a scanner or mobile app to create digital copies of receipts. Store them on cloud platforms for easy access.

- Organize the digital receipts into folders that match your expense categories.

- Ensure the file names include relevant information, like the date, vendor, and amount, for quick identification.

3. Keep Track of Important Details

- Always record the purpose of each expense. This will be helpful if you need to provide proof during audits.

- If receipts are lost or unreadable, try to request duplicates from the vendor.

4. Regularly Update Your Records

- Schedule a time each month to file and organize new receipts.

- Consider using accounting software to track receipts and categorize expenses automatically.

5. Retain Receipts for the Recommended Duration

- Keep receipts for at least 6 years as required by the tax authorities in Ireland.

- After the retention period, safely dispose of receipts that are no longer needed.