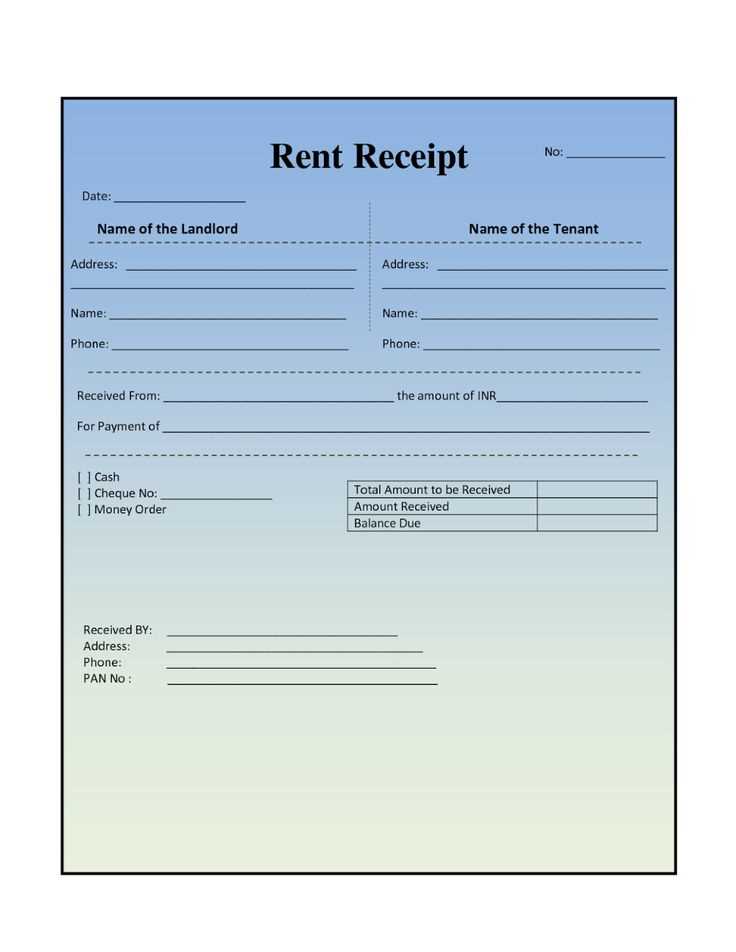

To create a rent receipt in Manitoba, make sure to include all key details necessary for both tenant and landlord. The template should capture essential information such as the tenant’s name, the landlord’s name, rental property address, and the rental period. Clearly indicate the amount paid, payment method, and the date the payment was made. This helps maintain accurate records for both parties.

Customizing the template is simple. Add sections for both the landlord’s and tenant’s contact information, as well as a line for any late fees or additional charges, if applicable. Providing a space for a signature from the landlord or authorized agent can also help confirm the transaction. Make sure the receipt is easy to understand and clearly formatted for easy reference in case of any disputes or future tax-related matters.

For Manitoba tenants and landlords, ensure the rent receipt complies with local regulations. While it’s not a legal requirement to issue a receipt, it’s a smart practice for record-keeping and transparency. A properly filled-out rent receipt is not only a proof of payment but also a safeguard in case any issues arise down the line.

Here are the corrected lines where repetitive words are limited to 2-3 times:

When creating a rent receipt template, make sure that the word “rent” appears no more than three times. Repetition of this term may make the document feel redundant. Try adjusting sentences like “The rent payment is due every month. Rent is accepted through various payment methods.” to avoid unnecessary repetition. You could rewrite it as: “The rent payment is due each month and can be made using various methods.”

Similarly, the word “tenant” should not be repeated excessively. For example, instead of saying, “The tenant is required to pay rent on time. The tenant also has to follow all rules,” simplify it by saying: “The tenant must pay rent on time and adhere to all rules.” This keeps the sentence concise while maintaining clarity.

Also, in the case of “payment” being used multiple times, try to rephrase for variety. Instead of “Payment can be made by check or online payment. The payment should be processed before the due date,” consider this alternative: “Payments can be made by check or online, and must be completed before the due date.” This prevents redundancy and keeps the information clear.

- Rent Receipt Template for Manitoba

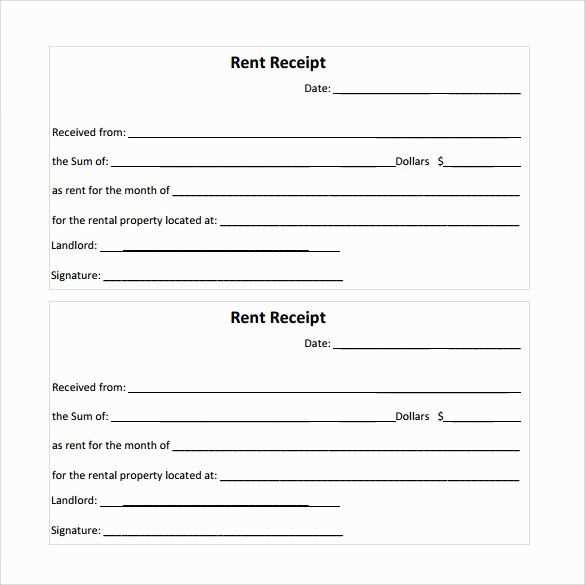

To create a rent receipt template for Manitoba, ensure it includes specific details required by law to make it valid. Start with the landlord’s full name and address, followed by the tenant’s full name and address. Specify the rental property address clearly, so there’s no ambiguity regarding which property is being rented.

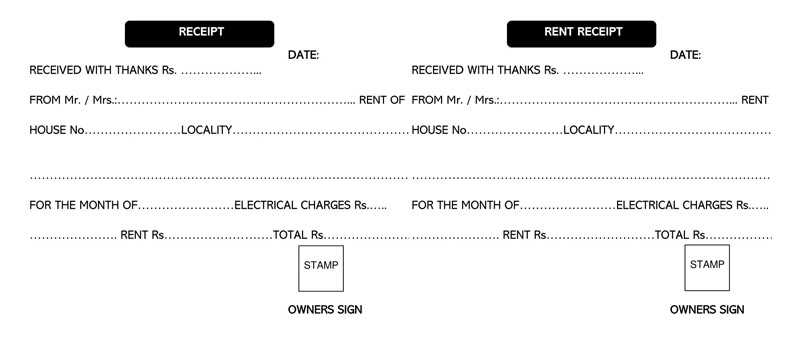

Include the date the rent was paid and the payment period covered (e.g., monthly, quarterly). Mention the amount paid and the payment method (cash, cheque, bank transfer, etc.). If any additional charges were included (like utilities or maintenance), list them separately.

Provide a space for the landlord’s signature or an electronic confirmation that verifies the receipt of payment. Keep a copy of each receipt for both the tenant and the landlord. This is necessary for record-keeping and potential future disputes.

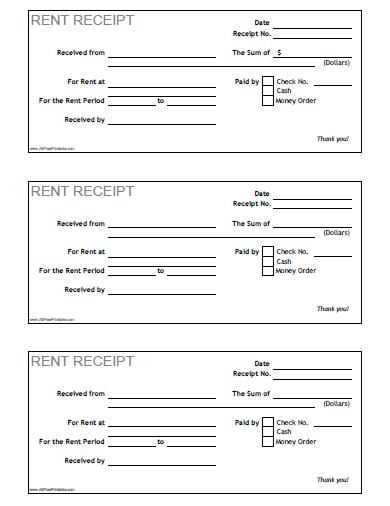

Here’s a basic outline for the template:

Landlord's Name: [Full Name] Landlord's Address: [Full Address] Tenant's Name: [Full Name] Tenant's Address: [Full Address] Property Address: [Rental Property Address] Date of Payment: [MM/DD/YYYY] Amount Paid: $[Amount] Payment Method: [Cash/Cheque/Bank Transfer] Covered Period: [From MM/DD/YYYY to MM/DD/YYYY] Additional Charges (if any): $[Amount] Landlord's Signature: [Signature or Electronic Confirmation]

This format ensures both parties have a clear understanding of the rental transaction and creates a legal record. Always keep the details simple and transparent for easy reference.

To ensure compliance with Manitoba’s rental laws, a rent receipt must include specific details. Begin by listing the date the payment was received. Include the tenant’s full name, the rental property’s address, and the payment amount. Clearly state whether the payment covers rent for a specific period, such as the month or week. For convenience, provide both the amount paid and any outstanding balance, if applicable.

It’s also important to specify the payment method (cash, cheque, e-transfer, etc.). If you accept cash payments, offer a written receipt immediately to avoid disputes. In the case of electronic payments, ensure the payment method is documented, and reference the transaction ID when possible.

| Detail | Required Information |

|---|---|

| Tenant’s Name | Full legal name |

| Rental Property Address | Complete address of the property |

| Payment Amount | Exact amount paid |

| Payment Period | Start and end date of the rental period covered by the payment |

| Payment Method | Cash, cheque, e-transfer, or other (include transaction ID if applicable) |

| Landlord’s Signature | Landlord’s signature or official seal |

Don’t forget to sign the receipt, as a landlord’s signature or official seal adds credibility and ensures the receipt is legally valid. Keep a copy of the receipt for your own records, and provide a copy to the tenant. By following these steps, your rent receipts will meet Manitoba’s legal requirements and serve as proof of payment in case of any disputes.

When creating a rent receipt in Manitoba, make sure to include the following key details to ensure its clarity and compliance:

1. Tenant’s Name: Clearly state the full name of the tenant who made the payment.

2. Property Address: Include the address of the rental property to avoid any confusion between multiple properties.

3. Landlord’s Name or Business Name: Identify the landlord or the managing company responsible for the property.

4. Payment Date: Specify the exact date when the rent was paid. This is important for record-keeping purposes.

5. Payment Amount: Clearly state the total amount of rent paid for the specific period.

6. Payment Method: Include details about how the rent was paid (e.g., cash, cheque, e-transfer). This helps both parties track the transaction.

7. Rent Period: Indicate the start and end dates of the rental period for which the payment is being made.

8. Receipt Number: Assign a unique number to each receipt for organization and future reference.

9. Signature of the Landlord or Authorized Representative: A signature ensures the validity of the receipt and confirms the payment was received.

These elements will help create a well-documented record for both tenants and landlords, simplifying any future disputes or inquiries.

Issuing accurate rent receipts is crucial for both landlords and tenants in Manitoba. Avoid these common mistakes to ensure that your rent receipts are properly formatted and legally compliant.

1. Failing to Include All Required Information

Each rent receipt must include key details to be valid. This includes the tenant’s name, the landlord’s name, the rental address, the amount paid, the payment date, and the rental period covered by the payment. Omitting any of these pieces of information can make the receipt incomplete and cause issues if challenged later.

2. Not Specifying the Payment Method

Clarifying the payment method (cash, cheque, bank transfer, etc.) is necessary. This helps track payments and provides transparency for both parties. Without this detail, confusion may arise if a dispute occurs about the method or timing of payment.

3. Incorrectly Recording Payment Dates

Ensure that the date listed on the receipt corresponds to the actual date the payment was received. Mistakes in the payment date can lead to discrepancies in rent records and affect tax filings or legal proceedings.

4. Using Inconsistent Formats

Maintain a consistent format for all receipts. Whether you issue paper or digital receipts, use a uniform layout that includes the same fields in the same order. Consistency makes it easier to track payments and reference past receipts in the future.

5. Missing Signature or Tenant Acknowledgment

Both the landlord’s and tenant’s signatures (or acknowledgment, in digital receipts) serve as confirmation that the payment has been made and received. A missing signature may complicate things if the receipt is ever used as evidence in a dispute.

6. Not Keeping a Copy of the Receipt

Always keep a copy of the receipt for your records. It’s essential for landlords to track payments, and tenants may need them for tax purposes or proof of payment. Ensure all copies are securely stored to avoid potential loss of important documentation.

7. Incorrectly Recording Rent Amounts

Double-check that the rent amount listed matches the agreed-upon rental rate. Incorrect amounts could lead to legal complications or confusion in future payments.

Rent Receipt Template Recommendations

To create a clear and professional rent receipt, ensure it includes the following key components:

- Tenant’s name

- Landlord’s contact details

- Amount paid

- Payment date

- Rental period covered

- Property address

Use concise language and avoid redundancy. Limit the repetition of terms like “Rent” and “Receipt” to maintain clarity and readability. For example, start with a simple header: “Rent Payment Confirmation” followed by the necessary details.

Consider using bullet points for itemized charges or payments, and clearly outline any adjustments made during the rental period. Keep the format clean and structured to ensure the tenant and landlord both understand the details at a glance.

By focusing on accuracy and simplicity, the receipt remains professional while minimizing confusion over payment terms.