Using a rent receipt template can save you time and ensure accuracy in documentation. A well-designed template eliminates the hassle of creating receipts from scratch each time, providing a clear record of transactions. Simply fill in the necessary details, such as the tenant’s name, rent amount, and payment date, and your receipt is ready.

Choose a template that includes all the required information, such as tenant contact details, the rental period, and the payment method. This way, both the tenant and landlord have a complete reference for future transactions. For additional clarity, include a note about late fees or payment conditions if applicable.

When selecting a template, opt for a layout that suits your needs. A clear, organized format will help both parties stay on the same page, making it easier to track payments over time. Using a digital version also allows you to save and send receipts instantly, keeping everything accessible in case of disputes.

Here is a revised version of the text with repetitions reduced:

To create a more concise and readable rent receipt template, eliminate unnecessary redundancies. Use simple, clear language for key details such as tenant name, rental period, and payment amount. Keep sentences brief while maintaining accuracy. For example, instead of repeating “rental property” multiple times, use it once and reference it appropriately thereafter. This avoids clutter and ensures the document remains straightforward.

Key Information to Include

Ensure the template contains the tenant’s full name, address, payment amount, and the rental period. Indicate payment method (check, bank transfer, etc.) and the date it was received. A concise layout with these elements will allow both parties to easily verify the transaction details.

Clear Formatting for Easy Reference

Organize the rent receipt in a clean, structured format. Use headings or bullet points for clarity, making it easy to scan through the details. For example, use a simple list to display payment breakdowns or additional fees. This enhances readability without adding excessive information.

Here is a detailed HTML structure for an article on the topic “Rent Receipt Template Pages” with six specific, practical headings:

To begin, use a structured format that includes specific, actionable headings for your rent receipt template article. Below is a suggested outline for your content:

1. Overview of Rent Receipt Templates

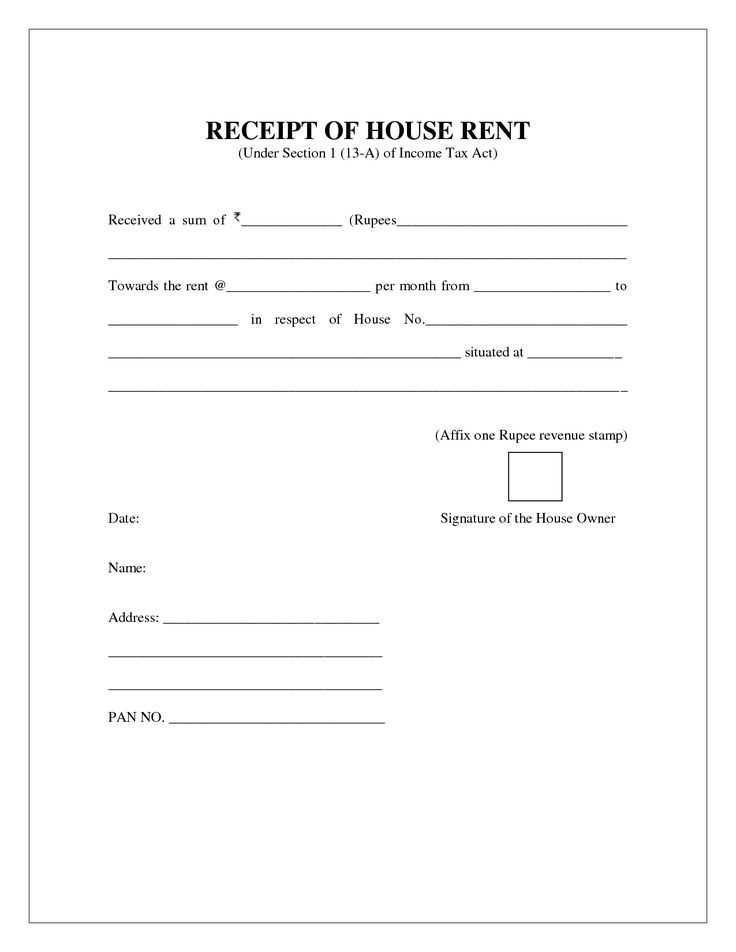

Introduce the concept of rent receipts. Include the basic information typically included in a rent receipt, such as tenant name, payment date, amount paid, and rental property details. Focus on the core elements necessary for validation and tracking payments.

2. Benefits of Using a Rent Receipt Template

Explain the advantages of using a template, such as consistency, legal compliance, and ease of use. Mention how a standardized receipt simplifies documentation and helps prevent disputes between landlords and tenants.

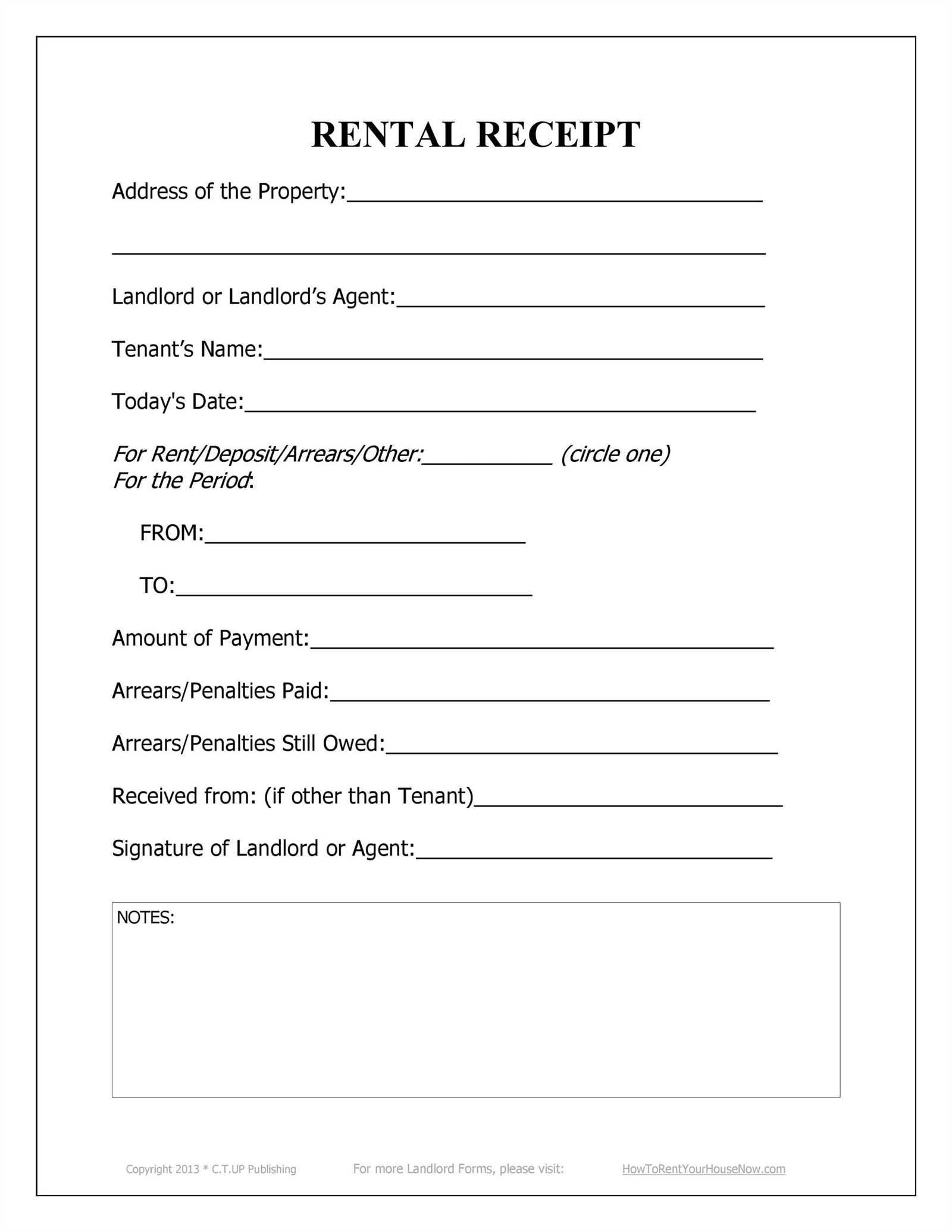

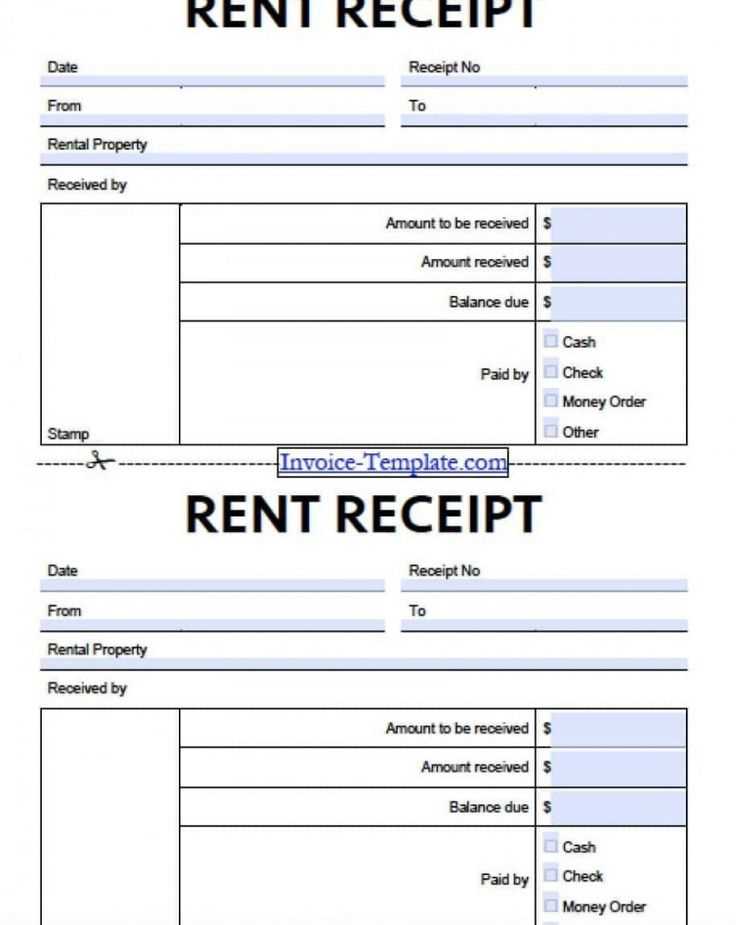

3. Key Features to Include in Your Template

Detail the essential components of a rent receipt. This may include tenant and landlord information, rent amount, payment method, property address, and payment period. Suggest additional features like a unique receipt number for better organization.

4. Customizing Your Rent Receipt Template

Discuss how to tailor the template to specific needs, such as adding company logos, adjusting payment terms, or including additional fields like security deposit details. Show how customization can improve clarity and professionalism.

5. Common Mistakes to Avoid

Highlight frequent errors such as missing payment dates, incorrect tenant details, or lack of a clear payment breakdown. Provide tips on how to prevent these mistakes for a more effective template.

6. How to Use a Rent Receipt Template Effectively

Offer practical advice on how to implement the template in day-to-day operations. Discuss the importance of keeping organized records and how tenants can request receipts for each payment to maintain a clear history of rental transactions.

- How to Create a Basic Rent Receipt

Begin by clearly stating the date of payment. This helps both parties track when the rent was paid. Write the full name of the tenant who made the payment, as well as the address of the rental property.

Include the rental period the payment covers. For instance, “Rent payment for the month of January 2025” makes it easy to understand which period the receipt refers to.

Specify the total amount paid and how it was paid (cash, check, or bank transfer). This information adds transparency and confirms the method of payment.

End the receipt by adding the landlord’s name or business name. Also, include their contact details in case there are follow-up questions. You can also add a line for a signature if necessary.

Include the full name and address of both the landlord and tenant. This provides clarity in case of any disputes and ensures accountability.

Clearly state the rental period covered by the receipt. Specify the exact dates for which the rent is paid to avoid confusion about payment timing.

List the amount of rent paid and the method of payment. Whether it’s cash, check, or electronic transfer, it helps to track the transaction accurately.

Include any late fees or additional charges if applicable. This avoids misunderstandings about extra payments and clarifies all financial details between both parties.

Provide the rental property’s address. This prevents any ambiguity in identifying the property associated with the payment.

Sign the receipt to confirm the transaction. A signature offers additional security for both landlord and tenant, confirming that the payment has been received.

Use a clean and consistent font throughout the document. Stick to professional fonts such as Arial, Times New Roman, or Calibri. Ensure that the font size is easy to read, typically 10-12 points for body text and larger for headings.

Maintain uniform margins (typically 1 inch on all sides) to give your document a balanced appearance. Avoid overcrowding the page with excessive text or images, leaving ample white space to enhance readability.

Organize your content into clear sections. Use headings and subheadings to guide the reader through the document. Ensure each section starts with a bolded heading, followed by concise, well-structured paragraphs.

| Formatting Element | Recommended Usage |

|---|---|

| Font | Arial, Times New Roman, or Calibri |

| Font Size | 10-12 points for body text, larger for headings |

| Margins | 1-inch on all sides |

| Spacing | 1.15 or 1.5 line spacing |

Use bullet points or numbered lists for clarity when presenting information in a sequence. This helps break down complex data into easily digestible parts.

Ensure proper alignment. Left-align the text for most documents to improve readability. Justify text only when necessary, as it can create uneven spacing.

Adjusting a template requires focusing on your specific requirements. Modify fields such as rent amount, due date, and tenant details to reflect the unique terms of your agreement. Add any necessary clauses, like late fees or maintenance responsibilities, to ensure clarity.

Key Elements to Personalize

| Element | Customization Tip |

|---|---|

| Tenant Information | Include the tenant’s full name, contact details, and property address for accurate identification. |

| Payment Details | Specify the payment method (check, bank transfer, etc.) and due date, including grace periods if necessary. |

| Late Fees | If applicable, outline the fees for late payments and the consequences of non-payment. |

Formatting the Template for Clarity

Ensure that the layout is clean and easy to follow. Use clear headings, bullet points, and consistent fonts. A well-structured template prevents confusion and ensures both parties understand the terms. Keep the text concise but complete, highlighting important sections like payment terms and property details.

Organize your rent receipts by using cloud storage services such as Google Drive or Dropbox. This ensures easy access and protection from physical damage. Upload receipts as soon as you receive them to avoid losing track.

- Scan physical receipts and save them as PDF or image files for better quality and clarity.

- Label each receipt with the date, amount, and property details for quick reference.

- Group receipts by year or property to simplify financial tracking and tax preparation.

Use apps or software to track payments. Programs like Expensify or QuickBooks allow you to store receipts digitally, categorize expenses, and track your rental history automatically. This can save time and minimize errors.

- Set reminders in your calendar to review receipts periodically and ensure all payments are recorded.

- Ensure that backups of your digital receipts are made regularly, either via automatic sync or manual uploads.

By transitioning to digital records, you reduce the clutter, increase your security, and improve the efficiency of managing rent receipts.

In many regions, rent receipts are legally required to ensure transparency in rental transactions. These receipts provide a written record of payment, which can be crucial for both landlords and tenants. Below are key legal requirements for rent receipts in different areas:

United States

- Landlords must issue a rent receipt if a tenant requests one. While not all states mandate receipts, it’s recommended for legal protection.

- The receipt should include the date of payment, amount paid, the rental period, and the property address.

- If the rent is paid in cash, the landlord is typically required to provide a receipt immediately.

United Kingdom

- In England and Wales, rent receipts are not legally required unless the tenant requests one. However, landlords are advised to keep detailed records of all payments for tax purposes.

- Landlords must provide written evidence of payments when tenants are in arrears.

Australia

- In most states, landlords must provide receipts for rent payments upon request. The receipt should list the amount paid and the date of payment.

- For cash payments, a receipt is required immediately, and tenants are advised to keep copies for their records.

Canada

- Rent receipts are mandatory in some provinces, especially for cash payments. These must include the payment amount and date.

- Landlords are also required to keep records of payments for at least one year for tax and legal purposes.

Compliance with local rent receipt laws is necessary for protecting both parties and avoiding disputes. Always check the specific requirements for your region to ensure proper documentation.

To create a well-structured rent receipt, always include the tenant’s name, address, and contact details. Clearly specify the rental period, the amount paid, and the date of payment. Provide a breakdown if there are additional charges like utilities or late fees.

Use clear and consistent formatting for the rent receipt to avoid confusion. Start with the tenant’s details followed by the payment section. If you include a receipt number, ensure it is easy to reference. Use bullet points or numbered lists for clarity.

Double-check all information for accuracy before issuing the receipt. Ensure the total amount matches the payment made and verify any included additional charges. Mistakes in this section could lead to disputes or confusion.

Finally, offer the tenant a copy of the receipt via their preferred method–email or printed. This will help with record-keeping on both ends.