If you’re a landlord in Quebec, providing a clear and accurate rent receipt is crucial for both you and your tenant. A well-structured receipt serves as proof of payment and helps maintain transparency. Ensure that the template you use includes essential details such as the tenant’s name, the rental period, the amount paid, and the payment method.

The rent receipt should also specify the property address, making it easy to identify the location of the rental. Including a unique receipt number can help keep track of payments over time, particularly if you’re managing multiple properties.

Additionally, it’s a good practice to include the date of payment and the landlord’s contact information. This makes the receipt official and accessible for any future references or disputes. By using a clear template, both landlords and tenants can avoid misunderstandings and ensure proper documentation for tax purposes or any legal matters.

Here are the revised lines with reduced word repetition while preserving meaning:

When creating a rent receipt in Quebec, make sure the format is clear and includes all necessary details, such as the tenant’s name, rental period, and the amount paid. The document should also specify the payment method and any applicable taxes. To avoid confusion, avoid unnecessary details that don’t directly relate to the transaction.

Key Information to Include

For clarity, focus on these essential elements: the date of payment, the amount received, the address of the rental property, and the tenant’s signature. Avoid restating the payment method unless required for tax purposes. Including too much information can make the receipt seem cluttered and harder to read.

Common Mistakes to Avoid

Make sure to avoid redundant phrases like “received on the specified date” or “amount paid for the rental period.” These can create unnecessary repetition. Stick to a simple, straightforward format that clearly conveys the necessary information without extra wording.

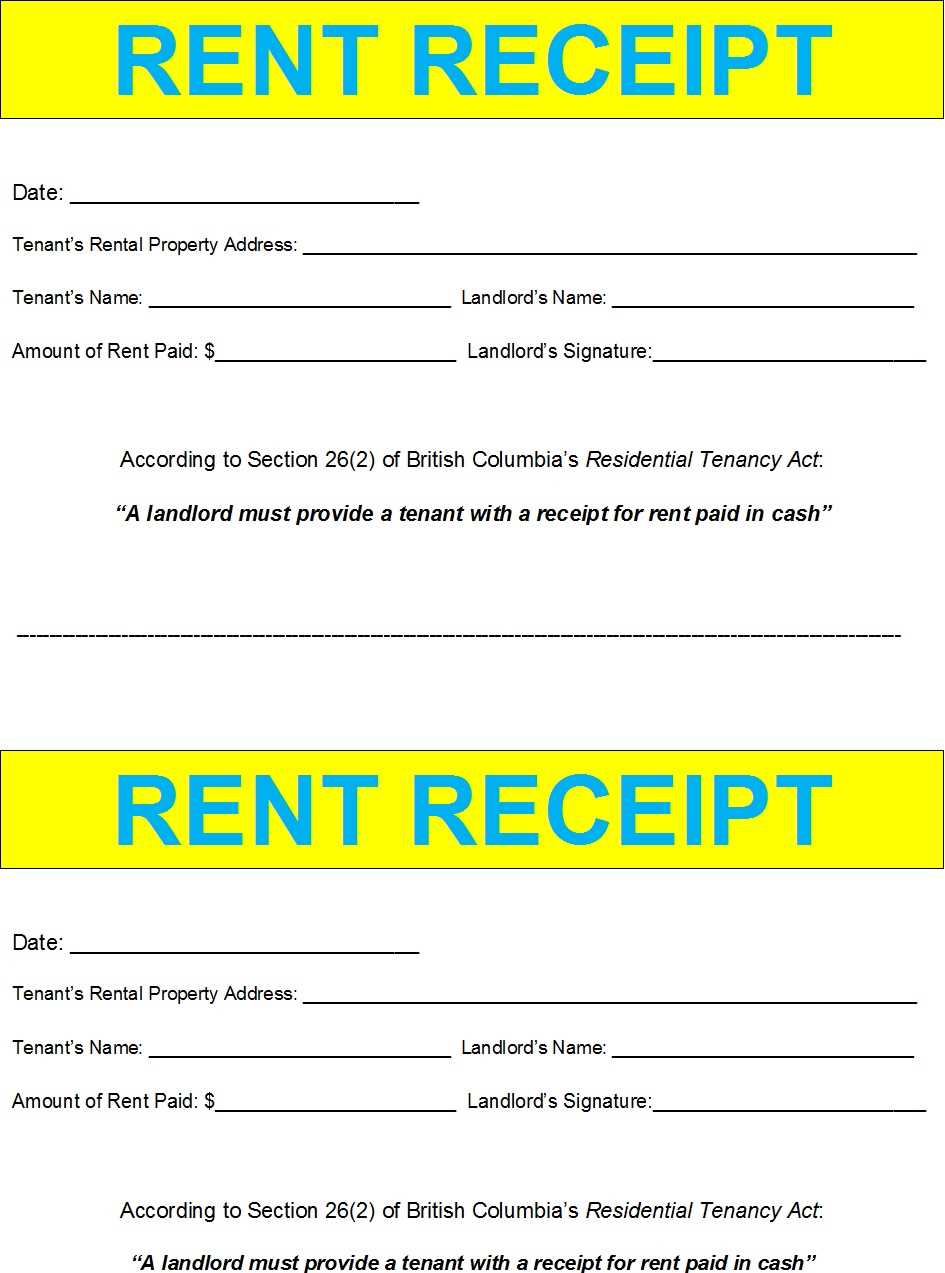

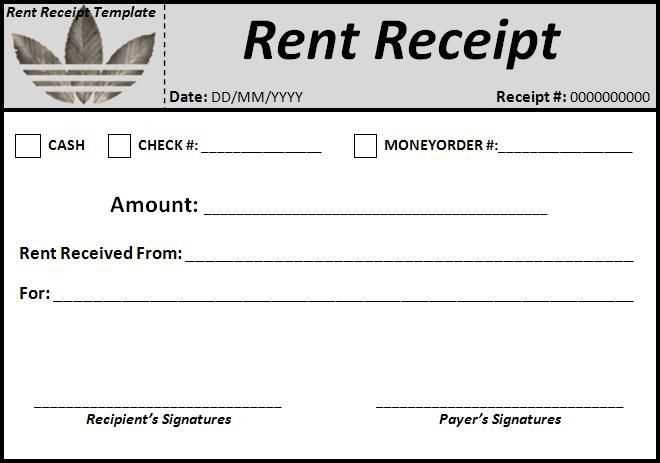

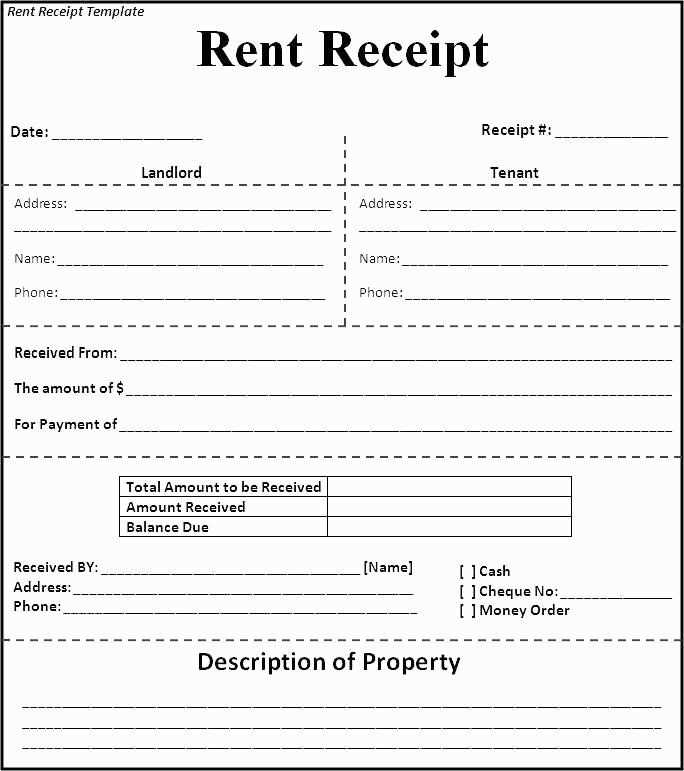

- Rent Receipt Template Quebec

To create a valid rent receipt in Quebec, include specific details that are legally required and provide clear documentation for both tenant and landlord. A well-structured template will help ensure transparency and avoid any misunderstandings. Here are key components to include:

Key Elements to Include in Your Rent Receipt

- Landlord’s Information: Include the landlord’s full name and contact details.

- Tenant’s Information: The name of the tenant who paid the rent should be listed.

- Payment Date: The exact date on which the rent payment was made.

- Rental Period: Clearly state the period the payment covers, such as monthly or quarterly.

- Amount Paid: Specify the total amount paid, including any applicable taxes or fees.

- Payment Method: Note how the payment was made (e.g., cheque, bank transfer, cash).

- Receipt Number: Assign a unique number for reference.

- Landlord’s Signature: This validates the document and acknowledges receipt of payment.

Additional Tips for Accuracy

Ensure that all the information is accurate and legible. Both tenant and landlord should keep a copy of the receipt for their records. If the payment was for a partial month or includes additional charges, make sure to specify those details clearly. Use a professional format to maintain clarity and avoid errors.

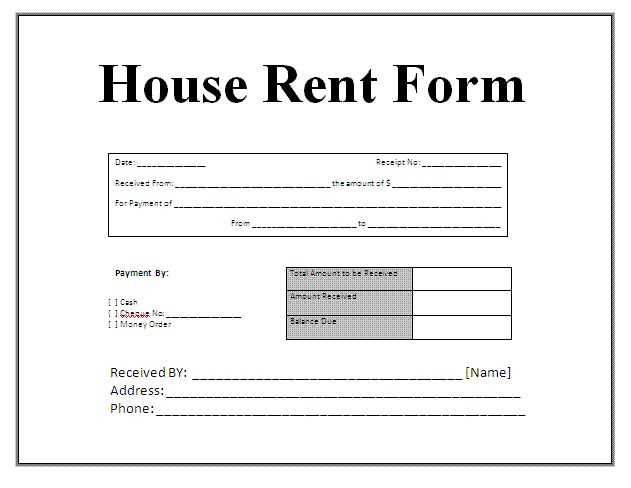

A Quebec rental receipt must include several key pieces of information to ensure both parties are protected. These details confirm the payment was made and provide clarity for future reference.

Tenant’s Name: Clearly state the tenant’s full name to identify who made the payment.

Landlord’s Name: Include the full name or business name of the landlord or property management company.

Address of the Rental Property: Specify the address of the property being rented. This ensures there is no confusion about the location of the rental agreement.

Amount Paid: Include the exact amount paid, including the currency used (CAD). Be clear about whether it covers rent, utilities, or any additional fees.

Payment Date: State the exact date when the payment was received. This helps both the tenant and landlord track payment history.

Payment Method: Indicate how the payment was made, whether it was via cheque, bank transfer, or cash. This provides a record of the transaction method.

Receipt Number: Assign a unique receipt number for record-keeping. This makes it easier to reference the transaction in the future.

Rental Period: Mention the rental period for which the payment is made, such as the month or specific dates.

Landlord’s Signature (optional but recommended): While not mandatory, a signature can confirm the authenticity of the receipt.

To create a legally valid rent receipt in Quebec, include the following key elements: the full name and contact information of both the landlord and tenant, the address of the rental property, and the rental period covered by the payment. Specify the exact amount of rent paid, the payment date, and the method of payment (e.g., cheque, cash, or bank transfer). The receipt should also indicate if any additional fees or charges were included in the payment.

Details for Clear Documentation

Ensure that the rent amount is clear and unambiguous. If the rent includes utilities or other services, list these separately. If the rent payment was made in installments, indicate the amount paid for each installment. A statement like “Paid in full for the month of [month]” can help prevent confusion.

Signature and Date

Both the landlord’s and tenant’s signatures are necessary for confirmation. The date of the receipt should match the payment date, and the receipt must be signed by the landlord. This serves as proof of the transaction, which may be required for legal disputes or tax purposes.

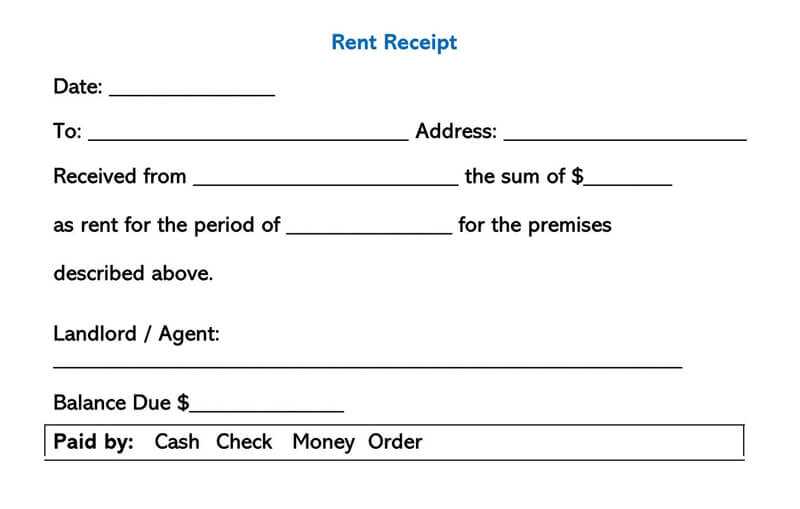

When renting a shared space, it’s important to include key details on the receipt to avoid any confusion between landlords and tenants. A clear, concise receipt ensures both parties are on the same page regarding the payment and rental terms.

Include Clear Identification

Start by including the full names and contact details of both the landlord and tenant(s). For shared spaces, make sure to specify which tenant is responsible for the payment, especially if the rent is split among multiple people. The receipt should clearly state the amount paid by each individual, as well as their share of the rent.

Provide Detailed Payment Breakdown

Include a breakdown of the total rent amount. This can be split by the total cost of the space and how much each tenant is contributing. If there are additional charges (e.g., utilities, maintenance fees), make sure they are listed separately to avoid misunderstandings.

- Full rent amount

- Tenant’s contribution

- Any additional fees (e.g., utilities, internet, parking)

- Payment method (cash, cheque, bank transfer)

- Date of payment

Providing this transparency helps avoid disputes, as all parties have a record of the transaction. Make sure the receipt is signed by both the landlord and tenant, or at least the responsible individual, as proof of the agreement.

Ensure Correct Dates

Clearly state the rental period covered by the payment. If rent is paid on a monthly or weekly basis, include the exact dates to clarify the period for which the payment was made. This helps tenants understand what time frame they are paying for, especially in shared rentals where dates can overlap.

By keeping the receipt straightforward and informative, you prevent confusion and ensure that both parties have a clear record of their financial transaction in the shared rental space.

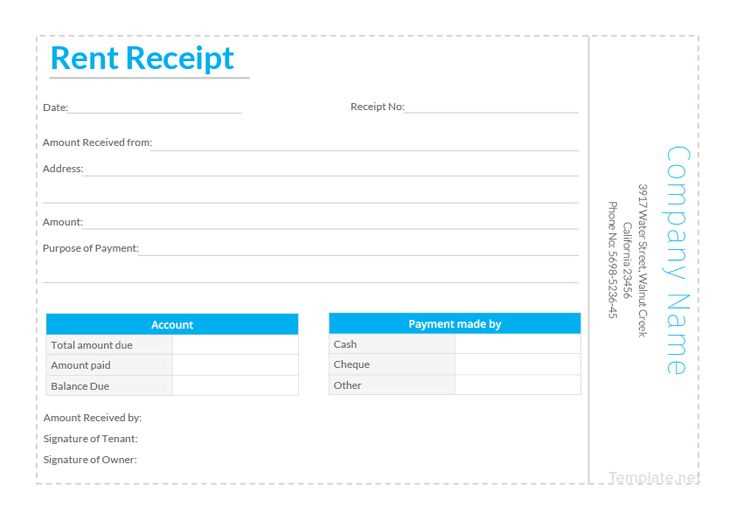

Landlords in Quebec must issue a rental receipt whenever a tenant makes a payment. This receipt is legally required to document the transaction and protect both parties. It’s important to provide a receipt every time rent is paid, whether the payment is made monthly, quarterly, or at any other agreed interval.

Timely Issuance

A receipt should be provided as soon as the payment is received. Whether the tenant pays by cash, cheque, or electronically, the landlord should issue a receipt to acknowledge the payment. This ensures transparency and can help avoid disputes regarding payment records.

Payment Documentation

When rent is paid in installments, a receipt should be issued after each payment. This applies to any partial payments or full payments made. Keeping clear records through receipts also simplifies tax filing and helps in resolving any future discrepancies.

Ensure the receipt includes the correct date for the rental payment. Missing or incorrect dates can create confusion or legal complications in case of disputes.

Double-check the amount paid. The total should reflect exactly what the tenant owes and the payment they made. Any discrepancies can lead to misunderstandings or claims of overcharging.

Always specify the rental period covered by the payment. Failing to mention this can make it unclear which month or period the payment applies to.

Be clear about the payment method used. Whether it was cash, cheque, or electronic transfer, make sure it’s clearly stated on the receipt. This helps both you and the tenant keep track of transactions.

Don’t forget to include both the tenant’s and the landlord’s names on the receipt. Omitting these details can create confusion and make the receipt less credible.

Avoid using vague language. Be specific about the purpose of the payment. For example, instead of just saying “payment received,” state “rent payment for March 2025.”

Keep the receipt professional and legible. A poorly written or unclear receipt can lead to complications if it’s ever required as proof in a dispute.

- Don’t forget to sign the receipt.

- Always issue a copy to the tenant for their records.

- Be cautious of using incorrect templates or outdated formats.

In Quebec, rent receipts can be used to claim tax credits for rental payments. Tenants can use these receipts when filing taxes to reduce their provincial tax burden under the Quebec rent subsidy program. Ensure that your rent receipt is accurate and includes the necessary information to qualify for this benefit.

Key Information on the Rent Receipt

The rent receipt should include the following details to ensure it’s accepted by the tax authorities:

- Landlord’s name and contact details

- Tenant’s name

- Amount of rent paid

- Period of the payment (start and end dates)

- Address of the rented property

- Date of the receipt issuance

Steps for Using the Rent Receipt for Tax Filing

Follow these steps to include the rent receipt when filing your taxes:

- Obtain a copy of your rent receipt from your landlord or property manager.

- Review the details for accuracy, ensuring that the dates and amounts match your rent payments.

- Include the rent paid in the appropriate section of your tax return, specifically for rent credits or housing-related deductions.

- Submit your tax return electronically or on paper with the required receipts and documents.

Tax Credit Amount

The tax credit available for rent in Quebec depends on your income and other factors such as the location of your rented property. Check the latest Quebec tax guides for up-to-date figures or consult with a tax professional.

| Criteria | Tax Credit Eligibility |

|---|---|

| Income Level | Lower income individuals are eligible for higher credits. |

| Property Location | Credits may vary depending on the municipality. |

| Amount of Rent Paid | Higher rent payments can lead to larger credits. |

To create a rent receipt in Quebec, ensure the document includes key information required by law. Start by clearly stating the names of both the tenant and the landlord, along with the rental property address. Include the amount of rent paid, the date the payment was made, and the rental period covered by the payment. Make sure to mention the payment method (e.g., cash, cheque, electronic transfer), and add a statement that confirms the receipt of the payment in full. This helps maintain transparency for both parties.

It’s also helpful to include a receipt number or unique identifier for tracking purposes. While not mandatory, landlords may find it useful for accounting or future reference. The receipt should be signed by the landlord or property manager to validate the transaction.

For tenants, ensure that you receive a copy of the signed receipt as proof of payment. This can be important if there are any disputes in the future regarding rent payments. Always store your receipts in an organized manner for easy access when needed.