If you’re a landlord in the UK, providing a rent receipt is a simple but important way to maintain clear records of payments. A rent receipt is a document that confirms a tenant has paid rent, and it serves as proof for both parties. You can create this document easily using a template designed specifically for rent payments. This ensures both you and your tenant have accurate records for tax or legal purposes.

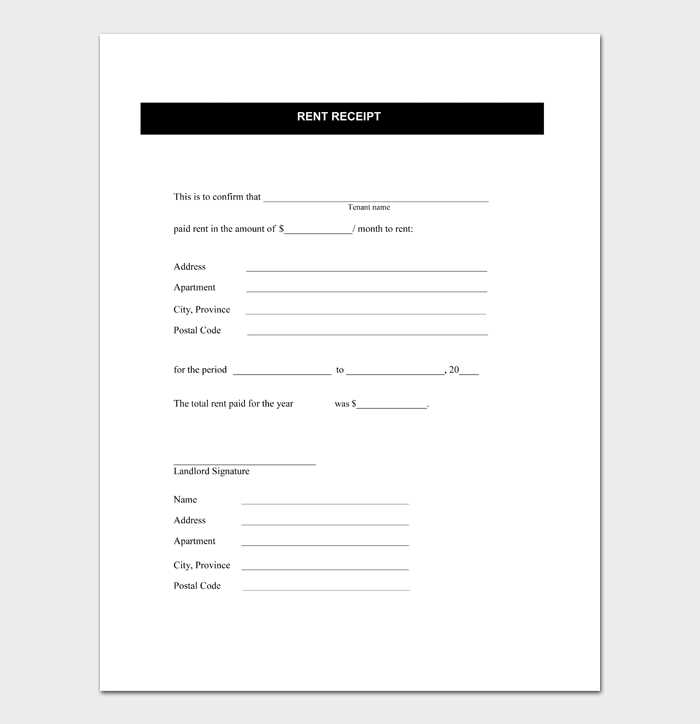

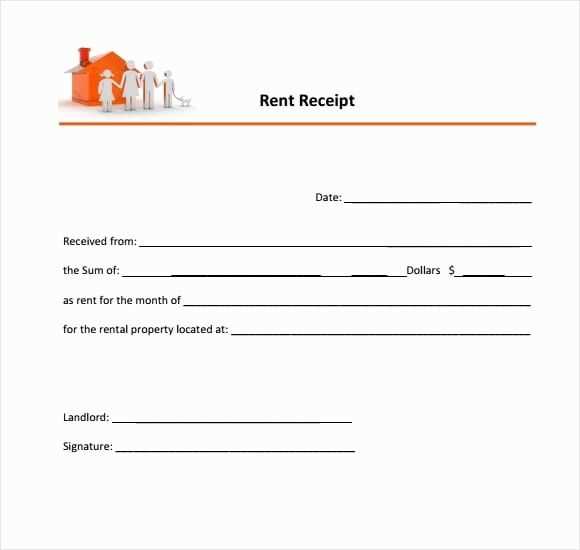

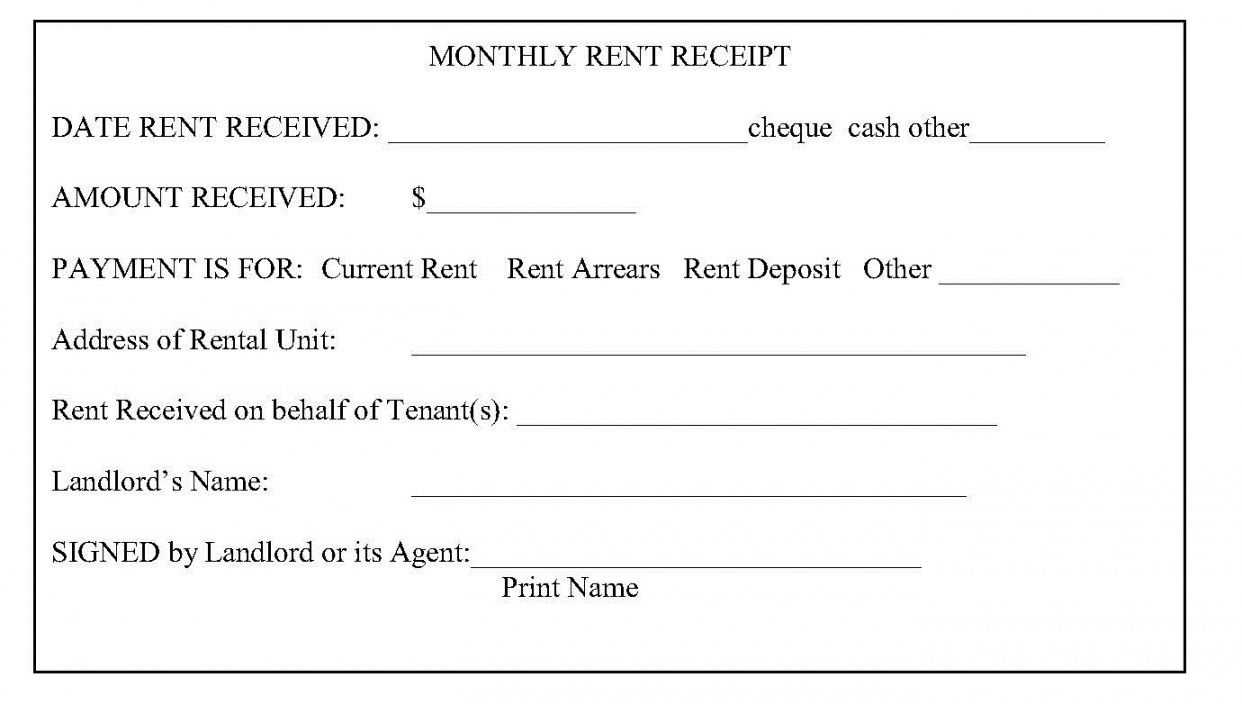

The template should include the tenant’s name, property address, payment amount, and the date of the payment. It’s also a good idea to include the payment method (e.g., bank transfer, cheque) to avoid confusion later on. Keep in mind that a rent receipt doesn’t need to be complex–it simply needs to be clear and accurate. A well-structured receipt provides reassurance to both you and your tenant that all transactions are recorded properly.

Using a template makes the process faster and more reliable. It can also help you avoid any errors in the information provided. There are plenty of free templates available online that are tailored for UK rental properties. By using these, you ensure your receipt meets the necessary requirements without spending too much time on formatting.

Here are the corrected lines without repetitions:

Make sure the tenant’s name is listed accurately on the receipt. This will prevent confusion in future reference. The property address should be complete, including unit or apartment number if applicable.

Clearly state the rental period with start and end dates. This ensures both parties are aware of the terms of the lease agreement.

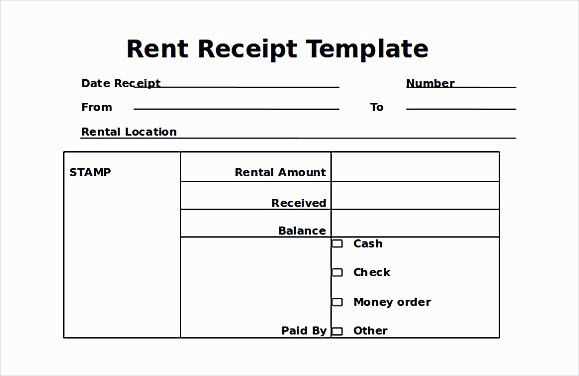

Detail the amount paid along with any additional charges, like utilities or maintenance fees, if applicable. This helps clarify the total payment made for that period.

Include the payment method used (e.g., bank transfer, cash, cheque), as it provides a clear record of the transaction.

Ensure the landlord’s name or business name is clear and their contact information is included in case of future inquiries or disputes.

Conclude with a clear receipt number or reference code for easy tracking and record-keeping.

- Rent Receipt Template UK: A Practical Guide

To create a rent receipt in the UK, include the date of payment, landlord’s details, tenant’s information, the rent amount paid, and the period for which the payment covers. Always ensure the receipt is clear and accurate, as it serves as proof of payment.

Key Details to Include

The following elements should be present in a rent receipt:

- Receipt Number: A unique identifier for each transaction.

- Date of Payment: The exact date the rent was paid.

- Tenant’s Name: The person who made the payment.

- Landlord’s Name: The person receiving the payment.

- Payment Amount: The total sum paid by the tenant.

- Rental Period: The time frame covered by the payment.

- Method of Payment: Cash, bank transfer, cheque, etc.

Why You Need a Rent Receipt

A rent receipt is crucial for both tenants and landlords. Tenants can use it to verify payment history when needed, while landlords can keep records for tax purposes or disputes. Always issue receipts for every payment, ensuring transparency and accountability.

To create a rent receipt, begin by including the date of the payment. Clearly state the amount paid and specify the rental period it covers. Include both the tenant’s and landlord’s full names for clarity. Be sure to mention the address of the rental property to avoid confusion. Add a receipt number to keep records organized, especially for future reference or audits.

Next, indicate the method of payment (cash, cheque, bank transfer, etc.), along with any payment reference number if applicable. This will make the transaction traceable. If the payment is for more than one month, note this in the receipt. Don’t forget to thank the tenant for the payment; this small gesture can go a long way in maintaining a positive relationship.

Finally, sign the receipt to verify its authenticity. Keep a copy for your records, and give the original to the tenant. This will provide both parties with proof of payment, and ensure transparency in the rental agreement.

To create a valid rental receipt in the UK, include these key details: the landlord’s name and address, tenant’s name, rental property address, rental payment amount, date of payment, and the rental period covered by the payment. This ensures transparency and accuracy in record-keeping.

Make sure to specify the method of payment, whether by cheque, bank transfer, or cash. If applicable, include the payment reference or transaction number. A clear breakdown of any deductions or charges, such as late fees or deposits, should be noted to avoid confusion.

Always include a unique receipt number for easy reference and organization. This helps both parties keep track of payments over time. For added clarity, confirm whether the payment is for rent, a deposit, or other charges related to the tenancy.

Finally, a landlord’s signature is not mandatory but may add authenticity. Providing a copy of the receipt to the tenant is a standard practice to ensure both parties have the same documentation for future reference.

Choosing between digital and paper receipts depends on convenience, accessibility, and your organizational needs. Here’s what to consider:

- Space and Storage: Digital receipts save physical space, making them ideal for reducing clutter. You can store them on your device, eliminating the need for paper filing systems.

- Environmental Impact: Opting for digital receipts reduces paper waste. If sustainability matters, going digital is a straightforward choice.

- Accessibility: Digital receipts are easy to access on your phone or computer. However, paper receipts are still needed in some places where digital options aren’t offered or accepted.

- Security: While digital receipts are convenient, they can be lost if your device is compromised. Paper receipts, on the other hand, offer a tangible backup, but they can easily be misplaced or damaged.

- Legal and Tax Use: Some jurisdictions may require paper receipts for specific tax filings or warranty claims. Make sure you verify if this applies to your situation before going completely digital.

In short, if you prefer simplicity and reducing paper waste, digital receipts will suit you well. However, if you need a tangible backup or deal with situations where digital receipts are unavailable, paper options remain a valid choice.

Rent Receipt Template Details

For a clear and straightforward rent receipt template, include key information: tenant’s name, landlord’s name, property address, rental amount, payment date, and rental period. Ensure the receipt includes the method of payment, whether cash, cheque, or bank transfer, for accuracy and record-keeping. It’s also helpful to add a receipt number to organize your documentation. If the tenant makes partial payments, note the balance due to maintain transparency. Always keep a copy for your records and provide the tenant with a copy as well for their reference.