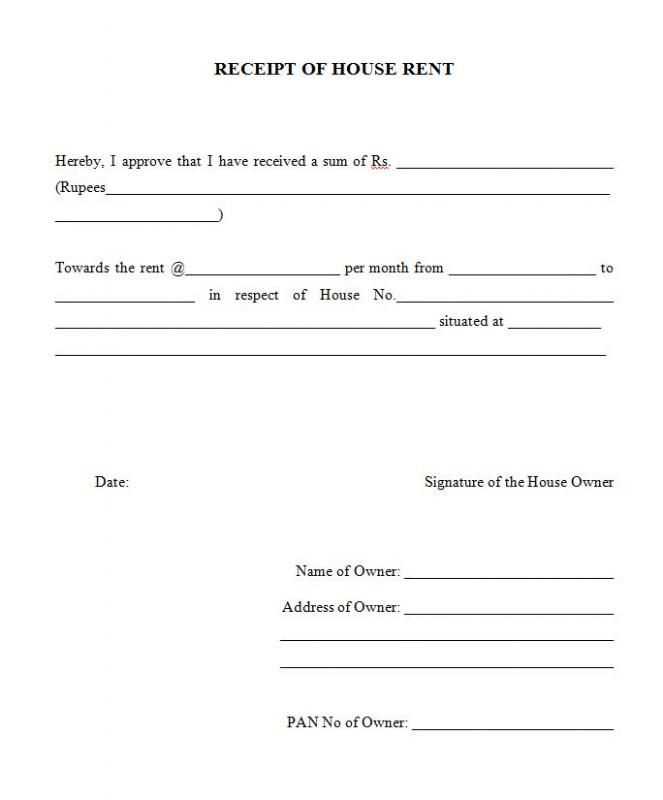

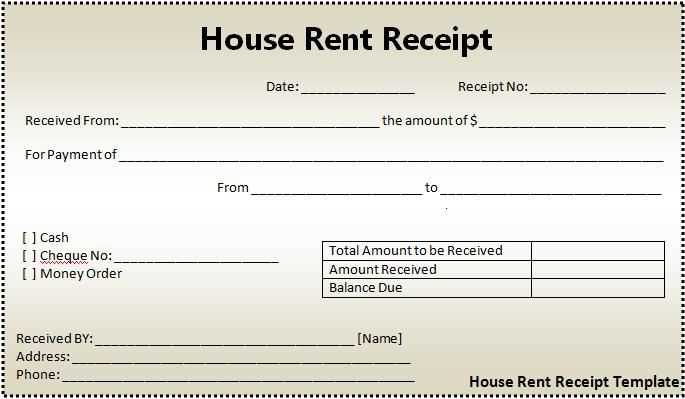

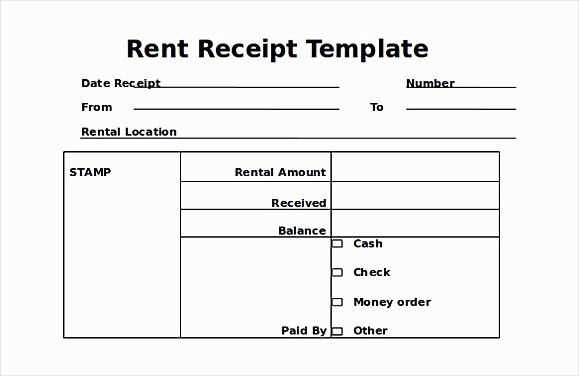

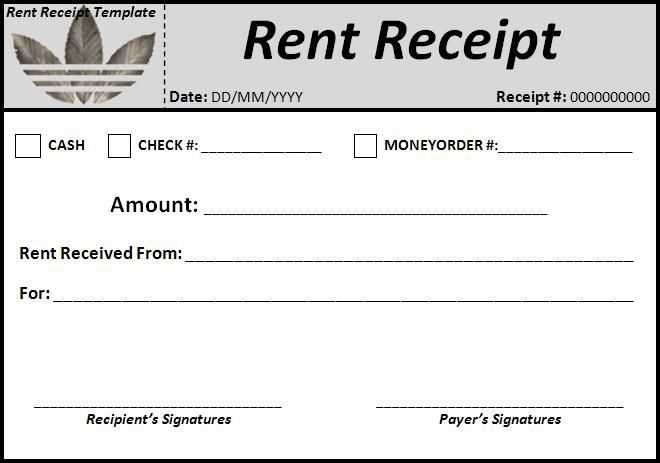

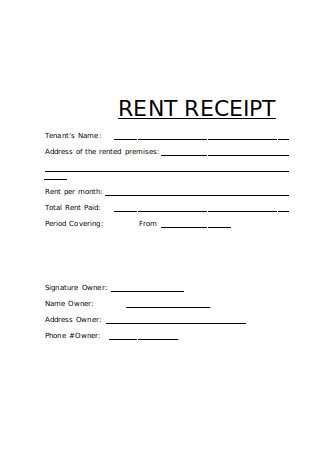

For landlords and tenants, having a clear and well-structured rent receipt can prevent misunderstandings. A simple template ensures that both parties have a record of payment, which can be vital for tax purposes or disputes. A rent receipt should include the tenant’s name, address of the rental property, amount paid, the date of the payment, and the payment method used.

Always ensure the receipt is signed by the landlord or property manager. This helps confirm that the payment was received in full and avoids confusion. If the payment is made in installments, record each partial payment to maintain an accurate history.

Some templates also include a balance due section, especially for leases with ongoing payments or rent adjustments. This can be helpful for tenants who pay rent on a schedule or if any deductions were made (such as for late fees).

Here’s the revised version:

Include your full name, address, and phone number at the top of the document. This makes it easy for both parties to contact each other if needed.

Clearly state the rental property address. Be specific and provide the full details so there’s no confusion about the property in question.

Specify the rental period, including the start and end dates. This ensures both landlord and tenant are on the same page about the lease duration.

List the rent amount paid and the payment date. This is critical for keeping accurate financial records and providing proof of payment.

If applicable, note any security deposit paid, along with details of the terms regarding its return. This helps clarify any potential issues regarding the deposit in the future.

Lastly, include a signature section for both the landlord and tenant to confirm the agreement. This confirms both parties are in agreement with the details and helps prevent misunderstandings.

- Rent Receipt Template in the USA

A rent receipt template in the USA should include the following key components to ensure clarity and proper documentation:

- Landlord Information: The name, address, and contact details of the landlord or property manager.

- Tenant Information: The full name of the tenant(s) paying rent, along with their address.

- Receipt Date: The date when the payment was made.

- Payment Amount: The total rent amount paid by the tenant, with an indication of any late fees if applicable.

- Payment Method: Specify whether the rent was paid via check, cash, bank transfer, or another method.

- Rental Period: The specific month or time frame that the rent payment covers.

- Property Address: The address of the rental property.

- Receipt Number: A unique identifier for each transaction, especially useful for tracking payments.

Additional Tips for Rent Receipts

- Clear Format: Use a simple and organized format to make sure all the details are easily readable.

- Template Access: Offer tenants an electronic or printed copy for their records. This ensures both parties have the same documentation.

- Consistency: Ensure receipts are provided regularly to build trust and maintain accurate records of transactions.

Begin by including the landlord’s full name, address, and contact details at the top. Next, add the tenant’s name and address. These details help to clearly identify both parties involved in the transaction.

Specify the rental period, indicating the exact dates covered by the payment, such as “Rent for the period of January 1, 2025, to January 31, 2025.” This ensures clarity on the exact time frame for which payment is being made.

List the amount paid by the tenant in clear figures (e.g., “$1,000.00”) and in words (e.g., “One thousand dollars”). This reduces any potential confusion regarding the payment.

Include a description of the payment method, such as “Cash,” “Check,” or “Bank Transfer,” along with any reference number or check number if applicable. This makes the payment traceable.

Finally, note the receipt’s issue date and any other relevant remarks, like partial payments or outstanding balances. Close with the landlord’s signature or initials to confirm the document’s authenticity.

Include the full name and contact information of both the landlord and the tenant. This ensures clarity in case of any disputes. Add the property’s address to specify the rental unit. Clearly state the amount paid, specifying whether it covers rent, utilities, or other charges.

Include the payment date and payment method used. If the payment was made via check, include the check number. Specify the rental period, such as the start and end dates for which the payment applies.

Include a note that confirms the payment was received in full, with no balance remaining. A signature from the landlord or their agent provides an additional level of verification and accountability.

One of the most common errors is leaving out key details such as the rental property address or the names of both landlord and tenant. Be sure to include the full address of the property to avoid confusion.

Missing Payment Terms

Clearly state the rent amount, due date, and payment method. Ambiguity here can lead to misunderstandings. Avoid phrases like “rent is due on the first” without specifying whether it is the first of the month or the first business day.

Neglecting to Specify Lease Duration

Omitting the start and end dates of the lease can create uncertainty about the rental agreement. Always include specific dates for the term of the lease.

| Common Mistake | What to Include |

|---|---|

| Inadequate Property Description | Provide full details about the rental property (size, rooms, amenities). |

| Unclear Terms of Maintenance | Specify who is responsible for repairs and maintenance tasks. |

| Forgetting Security Deposit Details | Clearly define the amount, conditions for refund, and any deductions. |

Also, avoid using vague or overly complex language. A rent document should be straightforward, and all terms should be easy to understand for both parties. Always read through the document for accuracy before signing.

Adjust the receipt format based on specific rental types to reflect accurate and relevant information. For short-term rentals, such as vacation homes or apartments, include the check-in and check-out dates. This will help tenants confirm their rental period at a glance. For long-term leases, add the rental agreement number and next payment due date to remind tenants of their commitments. This ensures both parties are on the same page regarding payment terms.

For commercial property rentals, you may want to list any additional charges, like utilities or maintenance fees. Include the detailed breakdown in a separate section for transparency. This could help clarify any potential confusion regarding total costs.

When renting equipment or vehicles, include specifics such as the item or vehicle ID, rental duration, and insurance coverage. This information assures the tenant that they are covered during the rental period.

| Rental Type | Key Customization |

|---|---|

| Short-Term Rental | Check-in/check-out dates, security deposit details |

| Long-Term Lease | Agreement number, next payment due date |

| Commercial Property | Additional charges, breakdown of costs |

| Equipment/Vehicle | Item ID, insurance coverage |

For subletting scenarios, provide the original leaseholder’s information, along with the subtenant’s contact details. This ensures both parties understand who is responsible for payments and damages.

Keep customization simple but thorough to avoid confusion, and make sure every rental type has the necessary details. Personalizing the receipt format shows professionalism and builds trust with tenants.

Send rent receipts via email or a secure online platform. Attach the receipt as a PDF or image file to ensure tenants can easily download and print it if necessary. Use a professional email address for added credibility, and always include a clear subject line, such as “Rent Receipt for [Month] [Year].” Include the payment details in the email body for transparency.

Using Online Rent Payment Systems

Many landlords use online payment systems to collect rent. These platforms often offer automatic rent receipts. After processing a payment, tenants receive an instant electronic receipt in their email inbox. This method ensures timely documentation and reduces administrative effort.

Creating and Sending Custom Receipts

If you manage payments manually, create rent receipts using templates available in word processors or spreadsheet programs. Include the tenant’s name, payment date, amount, and the rental period covered. Save the document in a PDF format, and send it via email or through secure messaging apps to provide tenants with an easily accessible record.

How can I assist you today?

To create a rent receipt template in the USA, ensure it includes these key elements:

- Landlord and tenant details: Include full names, addresses, and contact information for both parties.

- Payment details: Specify the rental amount, due date, payment date, and method (e.g., check, cash, bank transfer).

- Property description: Mention the rental property address and unit number if applicable.

- Payment period: Clearly state the rent period covered (e.g., January 1 – January 31).

- Signature and date: Both landlord and tenant should sign the receipt with the date of issuance.

- Late fees: If applicable, include any late payment fees charged and the date they apply.

This format helps avoid confusion and provides a clear record of transactions for both parties.