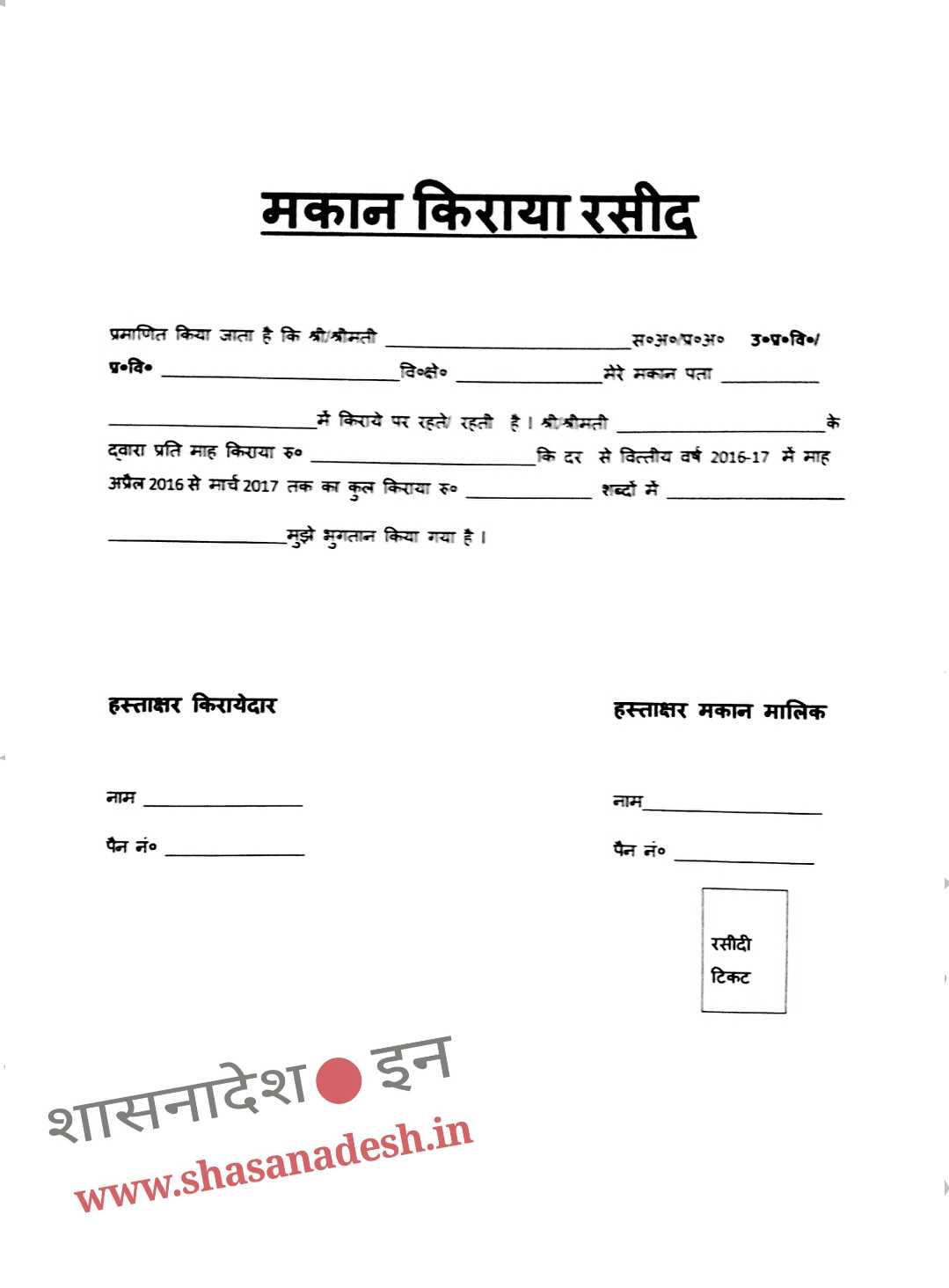

If you’re looking to create a rent receipt with a revenue stamp, it’s crucial to follow specific guidelines. Start by ensuring that the template includes essential details such as the landlord’s name, tenant’s name, rental property address, rental period, and the amount paid. A clear breakdown of the rent payment and the mode of payment should also be mentioned for transparency.

The inclusion of a revenue stamp depends on the legal requirements of your region. Typically, a revenue stamp is applied to documents that deal with financial transactions to indicate that the proper taxes have been paid. Make sure to affix the stamp in the designated space on your rent receipt, adhering to local laws to avoid complications.

To ensure your rent receipt is legally valid, always double-check that both parties sign the document. This helps to avoid misunderstandings and provides legal backing in case of disputes. Keep records of the receipt and ensure that both parties receive a copy for their reference.

Sure, here is a revised version of the sentences with the repetition of words minimized:

To create a rent receipt template with a revenue stamp, begin by clearly listing the tenant’s details and the rental payment amount. Include the property address, rent period, and payment date. Ensure that the document is concise but covers all relevant information for both parties.

Use a distinct section for the revenue stamp, placing it at the bottom of the receipt. This serves as verification of the legal validity of the transaction. Indicate the total amount paid and specify if the stamp covers the full payment amount or just a portion.

Consider using a simple format with separate fields for each detail: tenant name, property address, rent amount, payment date, and revenue stamp. This layout ensures clarity and avoids confusion. Keep the language straightforward to enhance readability and minimize errors.

Remember to sign the document for authenticity, and ensure the receipt is dated. This will confirm that both the payment and the stamp are valid for the specified period.

- Understanding the Role of a Revenue Stamp on Rental Receipts

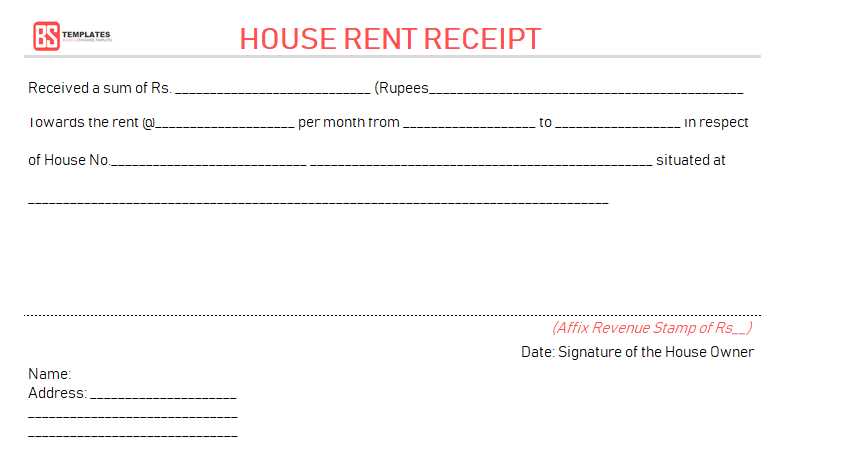

When issuing a rental receipt, including a revenue stamp is a legal requirement in many countries. It confirms the receipt of payment and signifies that the document is officially recognized. Without the stamp, the receipt may not be considered valid for official purposes such as tax filings or dispute resolution.

Why a Revenue Stamp Matters

The presence of a revenue stamp validates the receipt as a legitimate record of the transaction. In most cases, the stamp serves as proof that the tax associated with the rental income has been paid. This helps both the landlord and tenant maintain transparent financial records for tax and legal purposes.

How to Apply the Revenue Stamp

The stamp is typically affixed in a designated space on the receipt. Ensure it is properly placed to avoid complications. The amount of the stamp duty may vary based on the rental amount or local tax laws. Always check the latest regulations to ensure compliance.

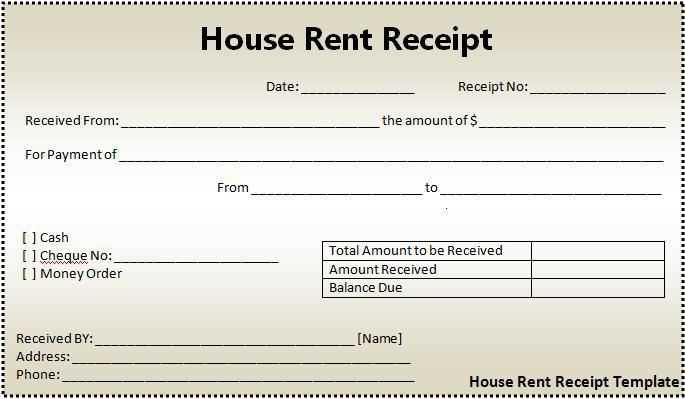

A well-organized rent receipt template should include the following key elements to ensure clarity and proper documentation. Each section plays a role in verifying the transaction and offering transparency to both parties involved.

Tenant and Landlord Information

Start with the full name and contact details of both the tenant and the landlord. This provides clear identification in case of any future disputes or inquiries. It should include the full legal names, addresses, and phone numbers of both parties.

Rental Payment Details

Clearly outline the amount of rent paid, the date of payment, and the period covered by this payment. Specify the payment method (e.g., cash, bank transfer, check). Including this data ensures there is no confusion about the amount or the timing of the payment.

Another vital component is the inclusion of a revenue stamp, where required by local regulations. This stamp can serve as proof of tax compliance, adding legitimacy to the receipt.

Lastly, a unique receipt number is useful for tracking and referencing payments, especially in cases of multiple rental agreements or payments within a month.

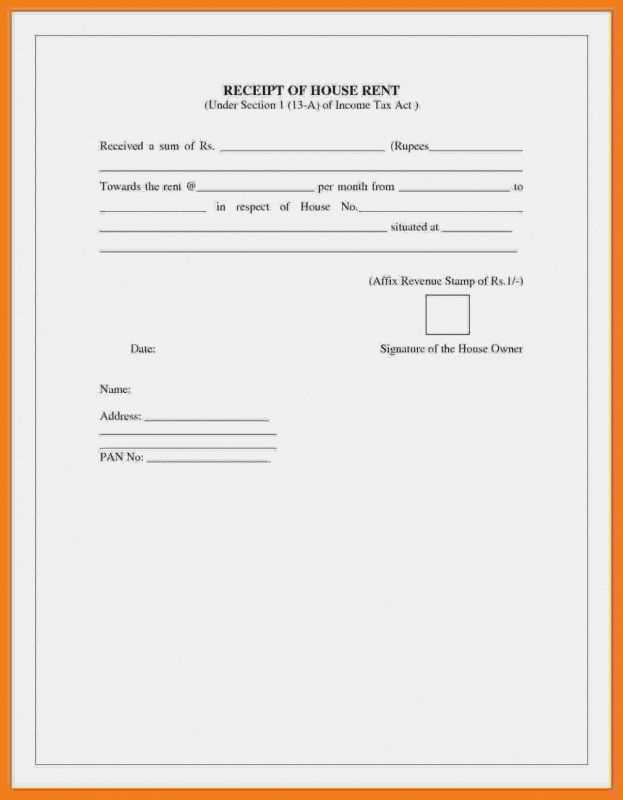

The revenue stamp requirement depends on the amount of rent being paid and the local tax regulations. Generally, a stamp duty is applied to rental receipts above a specific threshold. Here’s how to calculate it:

Step-by-Step Calculation

- Determine the monthly rent amount.

- Check the minimum threshold for stamp duty in your jurisdiction (e.g., in some places, it’s applicable for rents above $1000/month).

- If the rent exceeds the threshold, calculate the stamp duty based on the percentage specified in local regulations (e.g., 0.25% of the rent).

- Apply the percentage to the rent amount to determine the total stamp duty required. For example, if the rent is $2000, the stamp duty at 0.25% would be $5.

Important Factors to Consider

- Stamp duty may vary depending on the duration of the rental agreement. Longer leases might require a higher duty.

- Check for any exemptions or reduced rates based on the type of rental property (commercial, residential, etc.).

- Some regions might have flat rates or caps, so review local regulations carefully.

Begin with a clean layout for your rent receipt template. Use clear sections to separate key information such as the tenant’s name, rental property address, rent amount, and payment date. Place these fields in a structured manner to ensure easy readability.

Incorporate a space for the revenue stamp. The stamp should be placed in the designated area, typically in the bottom right or left corner, depending on local requirements. Ensure the stamp size is proportionate to the receipt for a neat and professional look.

Ensure the receipt includes specific payment details, such as the amount paid, payment method (e.g., cash, bank transfer), and the payment period. This helps avoid confusion and clarifies the terms of the agreement for both parties.

Use a formal font for the receipt’s text, keeping it legible and professional. Avoid overly stylized fonts, as they can reduce readability and create confusion. Include your business name or logo at the top for identification purposes.

Make space for both the landlord’s and tenant’s signatures. This adds an extra layer of verification and security to the document. Signatures should be placed at the bottom of the receipt with enough space for clarity.

After the design is complete, review all elements to ensure compliance with legal requirements. Verify the position of the stamp and check that all required information is clearly visible and properly formatted.

Not using a revenue stamp on rental receipts can lead to legal complications. Authorities may consider the receipt invalid without the stamp, which could result in disputes between landlord and tenant regarding payment confirmation or lease terms.

Failure to comply with the revenue stamp requirement may lead to fines or penalties under local tax laws. The amount varies based on jurisdiction, but landlords could face monetary consequences that could significantly impact their business operations.

In some cases, not using the revenue stamp could result in the rental agreement being considered unenforceable in court. This would mean that in a legal dispute, the tenant may not be obligated to pay rent or follow other terms outlined in the agreement.

Landlords are advised to ensure proper usage of revenue stamps to avoid these issues. Using a revenue stamp not only ensures compliance but also strengthens the legality of the rental agreement and protects both parties’ interests.

Failure to use a revenue stamp may also complicate the tax filing process. Landlords could face difficulties in proving their rental income during tax audits, which may lead to higher tax liabilities or penalties for underreporting income.

Double-check the date of payment and issue to ensure they match. This helps prevent confusion about when the rent was paid or received.

Incorrect Amounts

Always verify that the rent amount listed matches the agreed-upon figure. Errors in the amount can lead to disputes or tax issues later on.

Missing Revenue Stamp Details

Ensure that the revenue stamp is properly affixed and the stamp value matches the required amount for the receipt. Leaving out this detail makes the receipt invalid for legal purposes.

| Error | Correction |

|---|---|

| Incorrect or missing stamp value | Ensure correct stamp value based on local tax laws |

| Unclear tenant and landlord details | Provide full names and addresses for both parties |

| Invalid date or missing payment details | Match payment date with receipt issuance date |

Ensure to include a revenue stamp on the rent receipt to comply with local tax regulations. The stamp must be affixed in a clearly visible place on the receipt, typically on the top right corner. The value of the stamp depends on the rent amount and the jurisdiction’s requirements. Always check current laws for accuracy.

Use a template that has designated spaces for both the rent amount and the stamp. The inclusion of the revenue stamp serves as official documentation of the transaction. Make sure the stamp is canceled (marked with a cross or other indicator) to prevent reuse. Keep copies of the stamped receipt for your records.

If you’re uncertain about the exact stamp value, consult with a local tax authority or a legal advisor. They can provide precise guidance on how much the stamp should be based on your specific location and rent amount.