If you’re a landlord or property manager using Zillow to list your rental property, having a rent receipt template is a must. It streamlines the process of documenting payments, helps keep your records organized, and ensures both parties stay on the same page. You can easily customize this template to fit your specific needs and avoid the hassle of creating one from scratch each time you receive a payment.

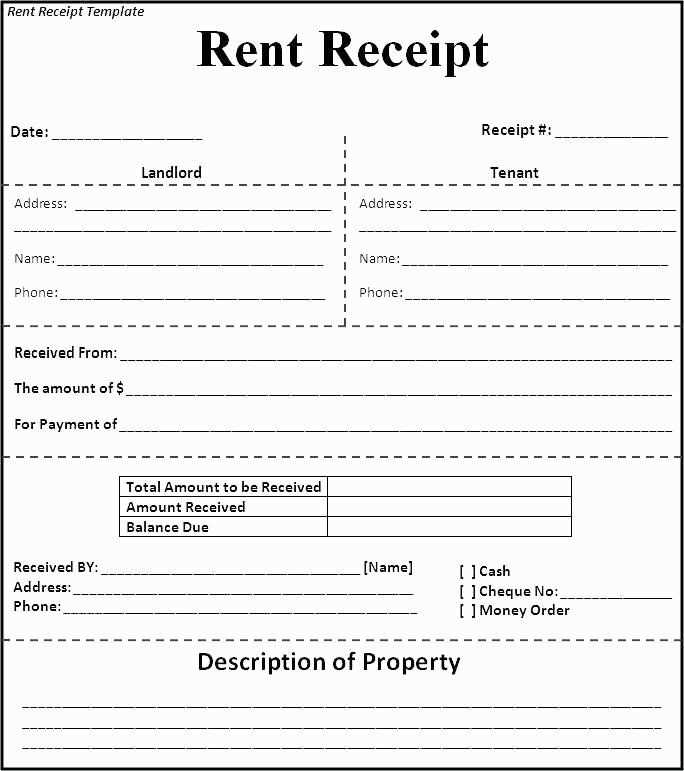

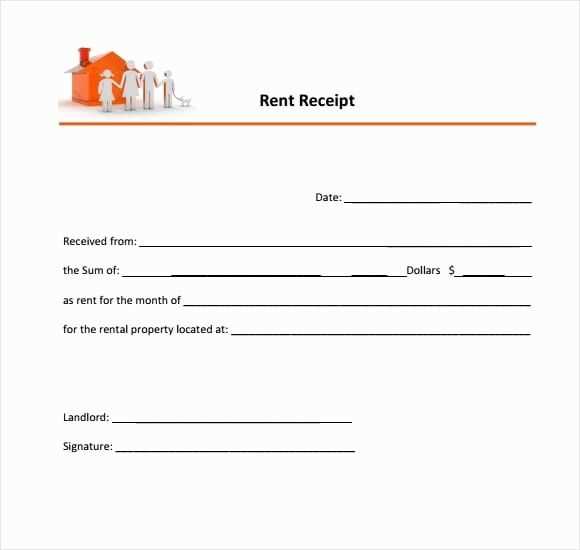

A basic rent receipt should include key information such as the tenant’s name, the amount paid, the payment date, and the rental period covered. This ensures clarity for both landlord and tenant. Additionally, it’s useful to include the property address, especially if you manage multiple units. This small detail can save time when you’re reviewing payments for multiple properties.

Using a pre-made template from platforms like Zillow helps avoid confusion. These templates are designed to meet legal and best practice standards. While you can make minor adjustments to personalize it, you won’t have to worry about missing crucial details like tenant contact info or payment methods. Once you’ve set it up, it’s easy to fill out for every payment, keeping your records accurate and up to date.

Here is the revised text with minimized repetition:

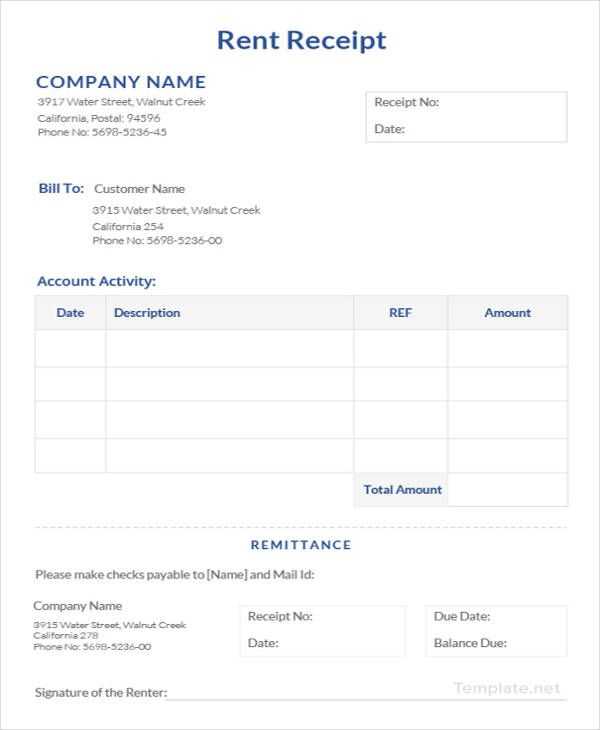

To create a rent receipt template on Zillow, make sure you include key details that confirm the transaction. Specify the tenant’s name, rental property address, and the payment date. List the payment amount and the payment method (e.g., check, cash, bank transfer). Include the landlord’s name and contact information for clarity. Also, make space for any additional notes, such as late fees or payment adjustments, if applicable.

Required Information

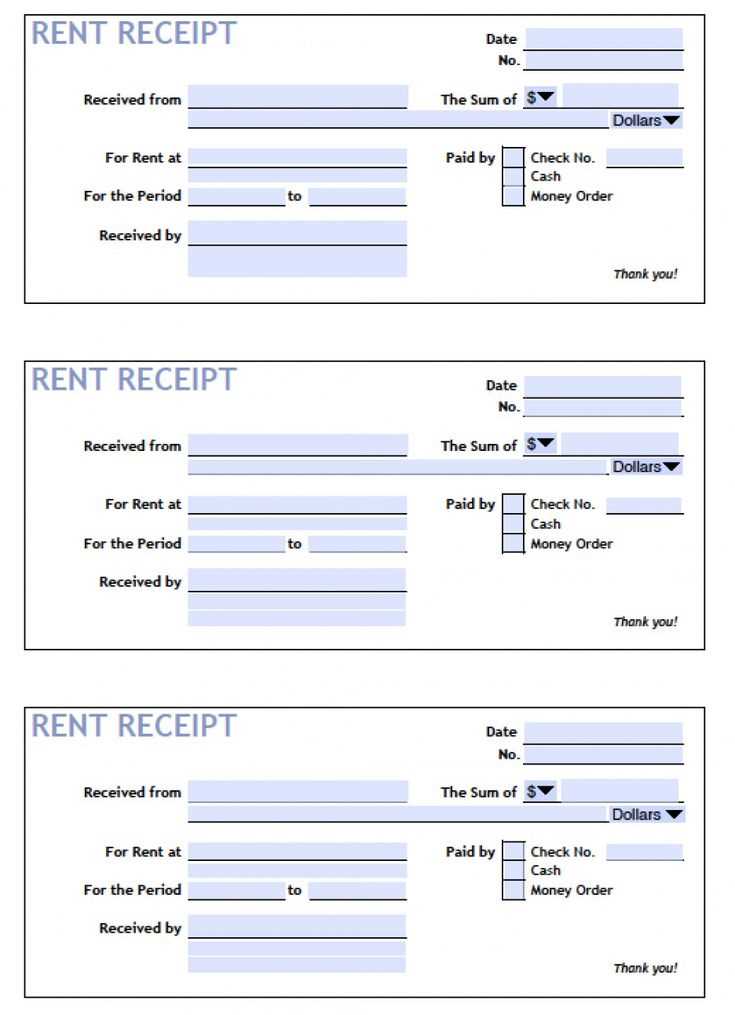

Ensure that the receipt accurately reflects the rental period and the amount paid. Each receipt should have a unique receipt number for record-keeping. It is also helpful to include the rental agreement terms in the notes section, in case of disputes later. Keep a copy for both parties involved and update the record as necessary.

Additional Tips

While Zillow offers a platform to track payments, it’s important to verify that the receipt includes all relevant details. Always double-check that the payment method is clear, as this can avoid confusion in case of any discrepancies. If you send the receipt electronically, consider adding a statement confirming receipt of the payment and the transaction date.

- Rent Receipt Template Zillow: A Practical Guide

Creating a rent receipt template on Zillow ensures clarity in rental transactions, benefiting both landlords and tenants. This template should include key details such as tenant name, rental period, payment amount, property address, and payment date. It’s vital that these details are clear to prevent future disputes.

Key Elements to Include

A rent receipt template on Zillow should always have the following fields:

- Tenant Information: Name of the tenant responsible for the payment.

- Landlord Information: Name or business name of the landlord or property manager.

- Property Address: Full address of the rental property.

- Payment Details: Amount paid, payment method, and the date of the transaction.

- Rental Period: The start and end dates for which the payment covers.

- Signature or Confirmation: Space for either the tenant or landlord to acknowledge receipt of payment.

How to Use the Template

After setting up the template with the appropriate fields, use it for each payment. Both landlord and tenant should keep copies for record-keeping. The receipt can be provided digitally through Zillow or printed as needed. Make sure both parties confirm the information before filing the document for future reference.

Creating a rent receipt with Zillow templates is straightforward and quick. Follow these steps to ensure all necessary details are included and the document meets legal standards.

1. Log in to your Zillow account and navigate to the “Landlord” section of your dashboard.

2. Select the “Rent Receipt” option from the available templates. Zillow offers pre-made formats that you can easily customize with the required information.

3. Fill in the following details:

| Field | Details to Include |

|---|---|

| Tenant’s Name | Full name of the tenant making the payment. |

| Landlord’s Name | Your full name or your property management company name. |

| Payment Amount | Exact amount paid for the rental period. |

| Payment Date | The exact date the payment was received. |

| Rental Period | Specific dates for which the rent payment applies. |

| Payment Method | Specify whether the payment was made by check, bank transfer, cash, etc. |

| Receipt Number | A unique identifier for the receipt. |

4. After filling out the details, review the information carefully. Zillow’s template ensures the layout is professional and clear.

5. Save the receipt and either send it electronically or print it for your tenant’s records. You can also download a PDF version for future reference.

By following these steps, you’ll create a rent receipt that is clear, accurate, and professionally formatted, all with minimal effort using Zillow’s templates.

To ensure your rent receipts are clear and professional, customize them by adding specific tenant and payment details. Start with the tenant’s full name, rental address, and lease term. This helps avoid confusion and makes the receipt more personalized.

Tenant Information

Include the tenant’s contact information, such as phone number and email address. This is useful in case there are any questions or issues about the payment. Additionally, specifying the lease agreement date or the unit number can help clarify which rental property the payment applies to.

Payment Details

Clearly list the amount paid, the payment method (e.g., check, bank transfer, cash), and the payment date. If there were any additional charges, such as late fees or maintenance costs, mention them separately. This transparency prevents misunderstandings and keeps both parties accountable.

Adding a brief section for payment history (e.g., for the current month or previous months) can also be helpful. Include whether the payment is for partial rent or if it covers the entire month. If applicable, note any deposits or prepayments as well.

Include key legal terms to protect both parties involved in the rental transaction. Start by specifying the rental period, including start and end dates. This provides clarity on the timeframe of the payment. Clearly state the amount of rent paid and the payment method, whether it’s cash, check, or electronic transfer. This will avoid future disputes about payment history.

Make sure to include a late fee clause if applicable. Specify the penalty for delayed payments and the grace period, if any. Also, include the property address, as this can prevent confusion if multiple units are being rented out.

It’s crucial to specify whether the payment is for the current month’s rent or for a previous balance. If applicable, note any deductions or adjustments to the rent amount, like repair costs or early payment discounts.

Finally, ensure that both the landlord and tenant’s contact information is included, along with the signature of the landlord or authorized agent. This adds legal weight to the receipt and helps verify the transaction in case of disputes.

Send receipts on time, ideally within 24 hours of receiving rent payments. Use Zillow’s Rent Payment platform to automatically generate and send receipts. This ensures accuracy and saves time for both you and your tenants.

Include Detailed Information

Make sure each receipt clearly states the following:

- Tenant name

- Property address

- Payment date

- Payment amount

- Payment method

This clarity helps avoid misunderstandings and makes record-keeping easy for tenants.

Send Receipts via Email and Zillow

While Zillow offers automatic receipt distribution, email receipts provide an extra layer of convenience. Send a copy through email alongside the Zillow-generated receipt, ensuring your tenants have it in multiple formats.

Regularly check your Zillow settings to make sure automatic receipts are enabled, and verify tenant contact information is up-to-date. This reduces the chances of missed communications.

Tracking rent payments using Zillow’s templates helps simplify the process for both landlords and tenants. The platform offers templates that automatically update payment history and can provide clear documentation for each transaction.

Steps to Use Zillow Rent Receipt Templates

1. Log into your Zillow account and navigate to the “Payments” section.

2. Choose the relevant rental property for which you need to track payments.

3. Zillow’s template will automatically generate a rent receipt, including payment amounts, dates, and tenant details.

4. Customize the receipt by adding any additional notes if necessary, such as payment method or reference number.

5. Once finalized, you can download or email the receipt directly to your tenant, keeping a copy for your records.

Advantages of Using Zillow’s Rent Templates

These templates allow for easy tracking of recurring payments and help maintain accurate financial records. Tenants also benefit from having an official document for their payment history, which can be useful for future references or disputes.

| Feature | Benefit |

|---|---|

| Automatic Payment Logging | Saves time by automatically tracking payments and eliminating manual entries. |

| Customizable Receipt Details | Ability to add notes or specific details based on your needs. |

| Digital Records | Provides easy access and retrieval of payment histories in digital format. |

Using a Zillow rent receipt template helps keep financial records organized and accurate. Rent receipts document the payments made by tenants, providing landlords with a clear and traceable record of transactions. These receipts play a key role in resolving disputes and ensuring tax compliance.

- Accurate Record-keeping: A Zillow rent receipt template automatically fills in key details, such as the amount paid, payment date, and tenant information. This eliminates the risk of manual errors and saves time.

- Proof of Payment: Rent receipts provide tenants with proof of payment, which is often needed for tax deductions or legal matters. It serves as evidence of financial transactions in case of disputes.

- Simplifies Tax Filing: Landlords can easily track rental income, helping them prepare for tax season. The consistent format also ensures that all necessary information is included for tax purposes.

- Minimizes Legal Issues: By keeping accurate and well-organized rent receipts, landlords reduce the likelihood of legal disputes over payments or outstanding balances.

- Streamlined Communication: Tenants can easily access their receipts, creating a transparent and efficient communication channel between landlords and renters.

Now, there are fewer repetitions, but the meaning and structure remain intact.

To create a rent receipt template in Zillow, focus on including specific details to ensure accuracy. Start by listing the tenant’s name, address of the rental property, and the landlord’s contact information. Add the rental amount, the payment date, and any late fees or discounts applied. Make sure to include the rental period (e.g., monthly or weekly) to avoid confusion. Clearly mention the method of payment used (cash, check, or online transaction). Lastly, provide a statement confirming that the payment was received in full. A clean, well-organized template ensures transparency and helps avoid misunderstandings.