Use a rent receipt template with a revenue stamp to simplify documentation for rental transactions. This approach provides clear evidence of payment and ensures compliance with local regulations.

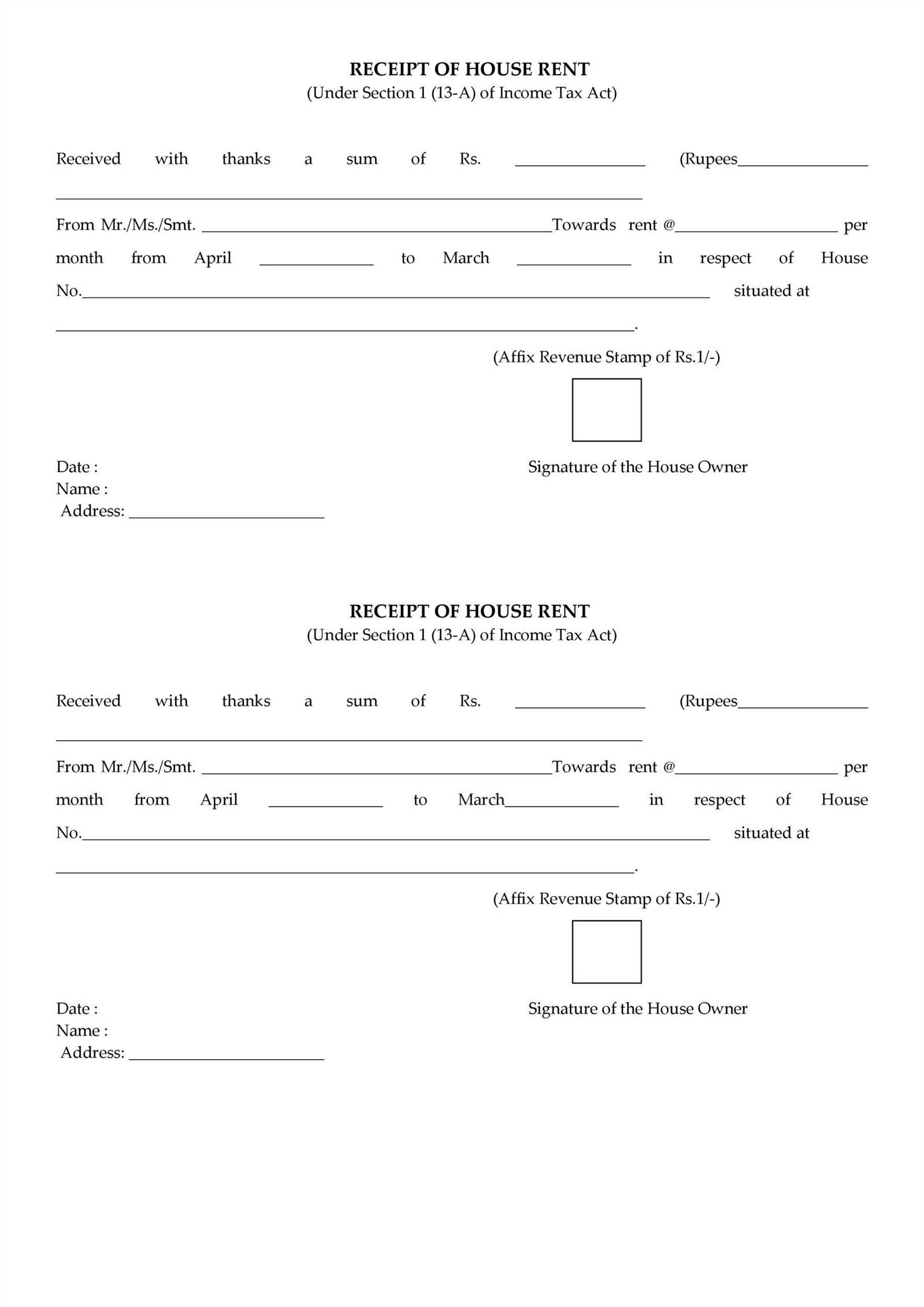

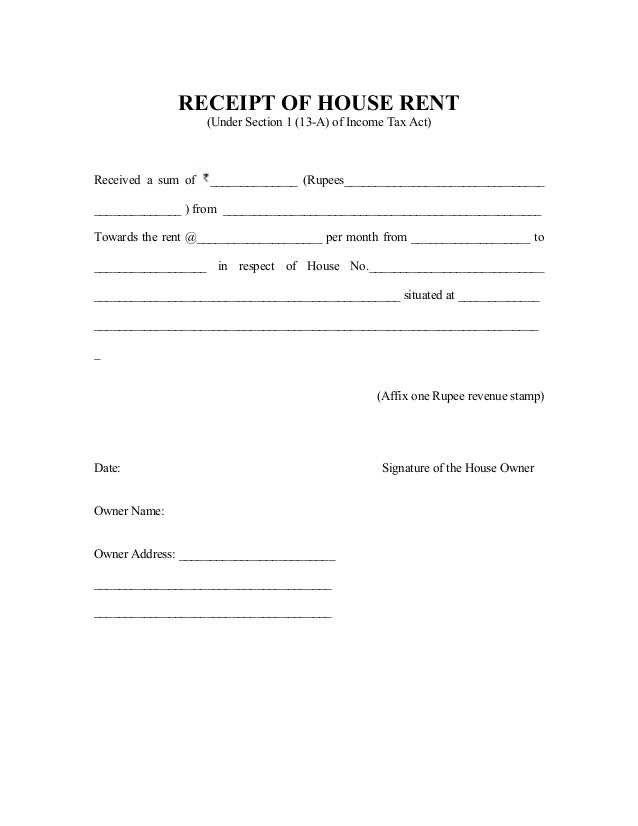

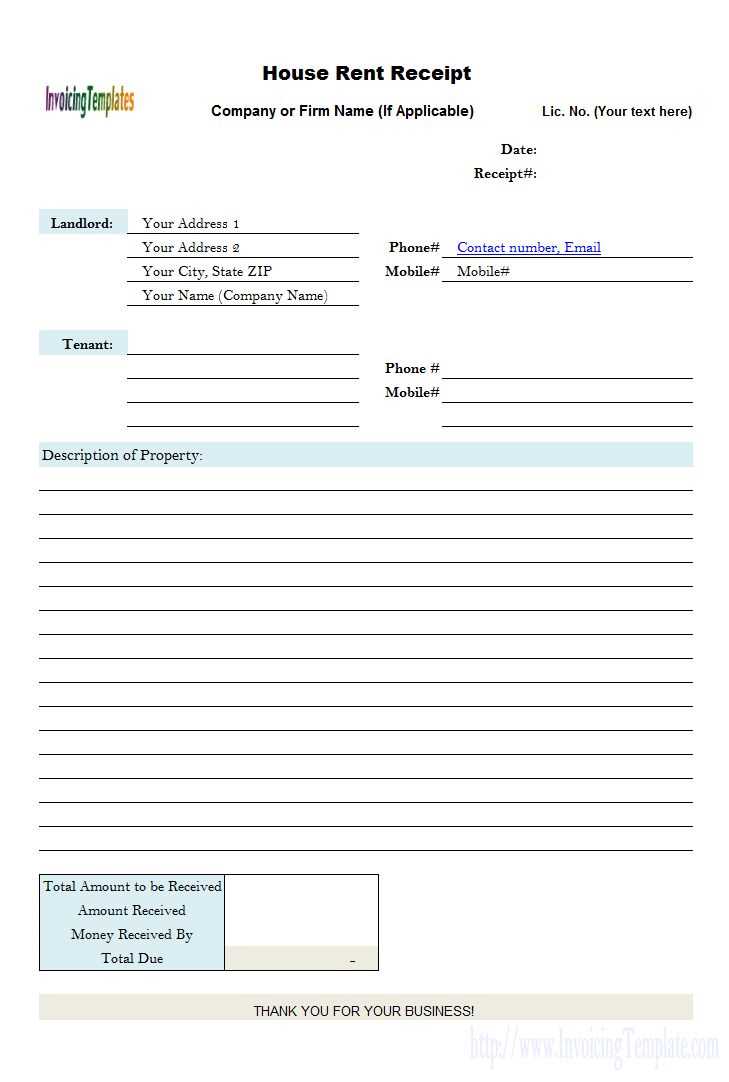

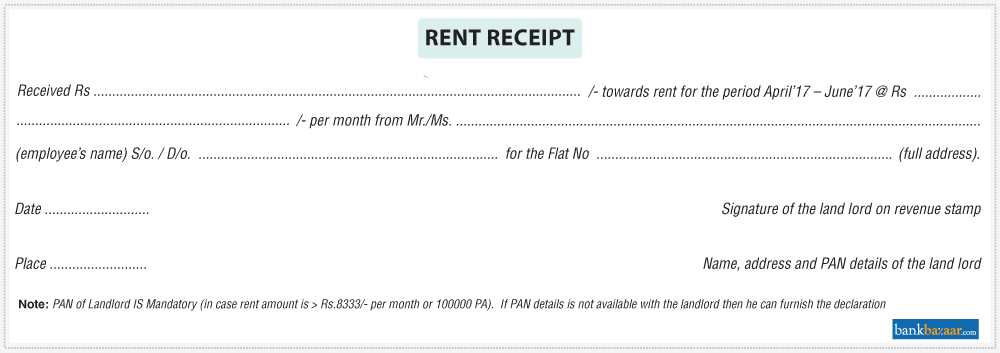

Choose a template that includes essential details such as the landlord’s name, tenant’s name, rental property address, payment amount, and date. Include a section for the revenue stamp to verify the transaction’s legitimacy. This stamp often varies by region, so check local guidelines to ensure you use the correct type and amount.

Implementing this template enhances transparency and accountability between landlords and tenants. Both parties can easily keep records for future reference, facilitating smoother communication and reducing potential disputes. Utilize this structured method for your rental agreements to streamline the process and maintain accurate financial records.

Here’s a revised version of your text, ensuring that words are not repeated more than necessary while maintaining the original meaning: Here’s a detailed plan for an informational article on the topic “Rent Receipt with Revenue Stamp Template,” structured in HTML format with specific headings: htmlEdit

To create an effective rent receipt template with a revenue stamp, follow these guidelines:

Key Components of the Template

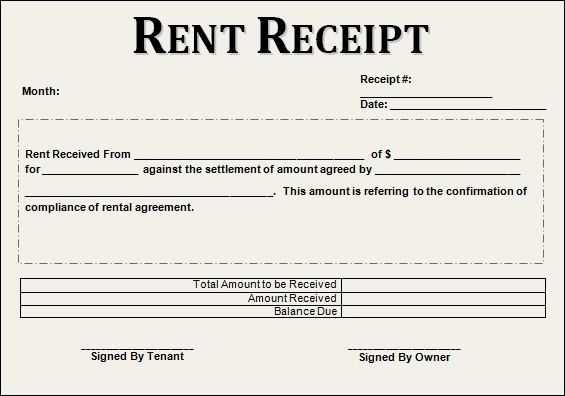

- Header: Include the title “Rent Receipt” prominently at the top.

- Date: Specify the date of payment clearly.

- Landlord and Tenant Information: Provide names and addresses for both parties.

- Property Details: Describe the rental property, including the address and unit number.

- Payment Amount: State the total amount received for rent.

- Payment Method: Indicate whether the payment was made by cash, check, or another method.

- Revenue Stamp: Ensure a designated space for the revenue stamp, indicating that the receipt is officially recognized.

Benefits of Using a Revenue Stamp

A revenue stamp adds legal validity to the receipt. It serves as proof of payment, helping to protect both the landlord’s and tenant’s interests. When disputes arise, having a stamped receipt simplifies the resolution process.

Incorporate these elements into your template to ensure clarity and compliance with local regulations. By following this structure, both landlords and tenants can easily navigate their rental agreements.

Understanding the Importance of Revenue Stamps

Revenue stamps validate transactions and signify that applicable taxes or fees have been paid. Always affix these stamps to rent receipts to ensure legal compliance and enhance document credibility. Their presence may prevent disputes between landlords and tenants by providing clear proof of payment.

Ensure that the correct denomination is used based on the rental amount. Familiarize yourself with local regulations regarding revenue stamps, as requirements can vary by jurisdiction. Accurate placement on the receipt is crucial; it should be affixed in a manner that prevents removal without damage.

Stamps contribute to the transparency of rental agreements, reassuring all parties involved. When keeping financial records, retain copies of stamped receipts for future reference and auditing purposes. This practice strengthens financial integrity and may assist in tax-related inquiries.

Key Components of a Rent Receipt Template

Include the landlord’s name and contact details at the top of the receipt. This information ensures clear communication and identification.

Next, state the tenant’s name along with their address. Accurate identification of both parties is crucial for record-keeping.

Clearly specify the rental property’s address. This detail helps distinguish between multiple properties, especially for landlords with several rentals.

Indicate the rental period, including the start and end dates. This transparency clarifies the timeframe covered by the receipt.

Record the payment amount received. Use a clear and bold format for easy visibility, ensuring the tenant knows the exact figure.

Include the payment method, such as cash, check, or electronic transfer. This information serves as a reference for future inquiries.

Add a section for the landlord’s signature and the date of receipt issuance. This validates the document and confirms the transaction.

If applicable, mention any revenue stamp affixed to the receipt. This indicates compliance with local regulations regarding rental agreements.

Finally, retain a copy for your records. This practice aids in future reference and maintains a solid financial history.

How to Properly Use Revenue Stamps on Receipts

Place the revenue stamp clearly in the designated area on the receipt. Ensure it is affixed securely to avoid detachment or damage. The stamp must cover a portion of the document without obscuring any important information such as the amount, date, or recipient’s name.

Make sure the stamp is not placed over any part of the receipt’s text. This ensures the information remains legible and complies with legal requirements. Align the stamp on the receipt in such a way that it does not interfere with any other markings or signatures required for the transaction.

- Verify that the stamp’s value matches the required tax amount. If in doubt, check local regulations to ensure compliance.

- Place the stamp in a way that ensures it is not easily removed, and consider using adhesive stamps for added security.

- If using a stamp with a date, ensure it is applied immediately after the transaction to reflect the accurate timeline.

- Ensure the stamp is legible and not damaged, as it may affect the receipt’s validity.

After applying the stamp, allow time for it to dry, especially if using ink-based stamps, to avoid smudging. Always double-check that the stamp does not obscure any critical information. Properly affixed revenue stamps help to avoid issues with legal validity and ensure smooth processing of receipts.

Customizing Your Rent Receipt Template

Incorporate your logo to personalize the receipt. This adds a professional touch and reinforces your brand identity. Choose a clear font for the text to enhance readability, ensuring that all information stands out.

Include specific fields like tenant’s name, address, and payment details. This information makes the receipt clear and useful for both parties. Consider using a table format to organize the data effectively, separating payment dates, amounts, and any additional charges.

Utilize a consistent color scheme that aligns with your branding. This not only makes the receipt visually appealing but also creates a cohesive look across your documentation. Ensure that all essential elements are included, such as the rental period, payment method, and any relevant notes.

Finally, save the template in a readily accessible format, such as PDF or Word. This allows for easy edits in the future while maintaining a professional appearance. Regularly review and update the template as necessary to reflect any changes in your business practices.

Common Mistakes to Avoid When Issuing Receipts

Ensure that you accurately fill in all necessary details on the receipt. Missing or incorrect information can lead to confusion or disputes. Always include the date of the transaction, the amount received, and the purpose of the payment.

Double-check the name and contact details of both the payer and the payee. Incorrect names or addresses can create issues in record-keeping or tax reporting.

Use a clear and consistent format for your receipts. A well-structured receipt improves readability and ensures that all required information is presented logically. Consider using tables for better organization:

| Date | Payer Name | Amount | Purpose |

|---|---|---|---|

| MM/DD/YYYY | John Doe | $100 | Rent Payment |

Always provide a copy of the receipt to the payer. This practice not only serves as proof of payment but also helps in maintaining transparent communication between parties.

Finally, avoid using generic language or terms that may not clearly describe the transaction. Specific descriptions enhance understanding and prevent misinterpretation.

Legal Considerations for Rent Receipts with Revenue Stamps

Ensure that rent receipts include a revenue stamp where applicable. The stamp’s value must align with the rent amount and local tax laws. Verify if your jurisdiction mandates a revenue stamp for transactions above a certain threshold. Failure to comply may lead to penalties or disputes in the event of legal proceedings. Check whether the landlord or tenant is responsible for affixing the stamp. Record the stamp number on the receipt to confirm its authenticity. Always use proper documentation to prevent future challenges to the rental agreement.

Feel free to ask if you need further modifications or additional assistance!

If you require any adjustments to the template, don’t hesitate to reach out. It’s easy to customize the rent receipt with a revenue stamp to suit your needs. Simply provide the details you want to change, and we can make it happen quickly.

Common Modifications

Some typical requests involve updating the format for different languages, adding more fields for specific tenant information, or changing the overall design. Whatever it is, we can tailor the template to your exact requirements.

Additional Assistance

If you’re unsure about any step or need guidance on how to properly fill out the template, feel free to ask. We’re happy to walk you through the process or provide examples to make it clear.