For landlords in Ontario, providing a rent receipt is a straightforward but necessary part of the rental process. A rent receipt serves as proof of payment for tenants and can be vital for tax purposes, personal records, or disputes. It’s easy to create a rent receipt that meets all legal requirements while being clear and professional.

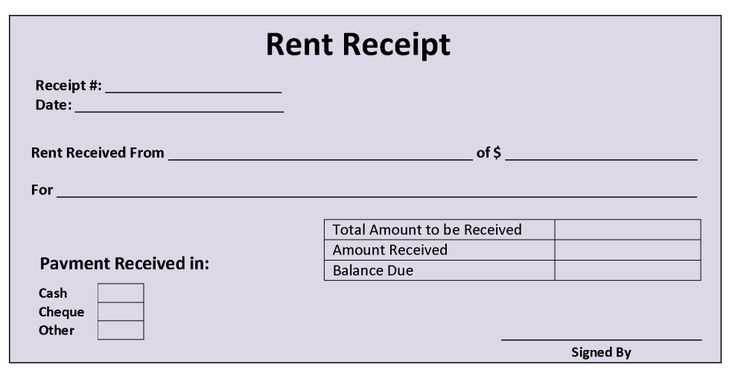

The Ontario rent receipt template should include specific details to ensure it’s valid. Start with the date of payment, the full name of the tenant, and the property address. Make sure to specify the amount paid, the rental period it covers, and the payment method used (whether cash, cheque, or electronic transfer). Also, including your name as the landlord and a unique receipt number will help keep track of payments.

By using a simple template that includes these key elements, you can ensure that both you and your tenants have accurate records. This reduces the risk of misunderstandings and ensures compliance with Ontario rental laws.

Here are the corrected lines:

Make sure to include the full address of the rental property in the receipt. This ensures both parties have clear records of the location.

Clearly specify the payment period, such as “for the month of January 2025,” to avoid confusion about the timing of the rent payment.

Always include the full name of the tenant and the landlord. If either party is a business entity, provide the legal name of the company.

Use a simple, clear format for the amount paid, ensuring the figures match the agreement. Write the amount in both words and numerically to avoid disputes.

If applicable, mention any deposits or pre-paid rent. This helps keep track of outstanding balances or future payments.

Ensure the receipt includes the payment method (e.g., cash, cheque, e-transfer) to confirm how the payment was made.

It’s beneficial to add a brief note confirming that no further payments are due unless specified otherwise in the rental agreement.

Keep the receipt short and to the point. A cluttered receipt can make it harder to understand and could cause unnecessary confusion.

- Rent Receipts Ontario Template

For landlords in Ontario, providing a rent receipt is an important responsibility. A well-organized receipt should include clear and accurate details to ensure proper documentation for tenants. Make sure to include the following elements in your rent receipt template:

- Landlord’s full name and address

- Tenant’s name

- Rental property address

- Receipt number (for record-keeping)

- Date of payment

- Amount paid (in dollars and cents)

- Payment method (e.g., cash, cheque, electronic transfer)

- Period for which the rent was paid (e.g., February 1-28, 2025)

- Signature of the landlord or their representative

Use clear language and ensure that all the information is accurate to avoid confusion. This simple template will not only help keep track of payments but also serve as proof of payment for tenants. Make it available in both printed and digital formats to accommodate various needs.

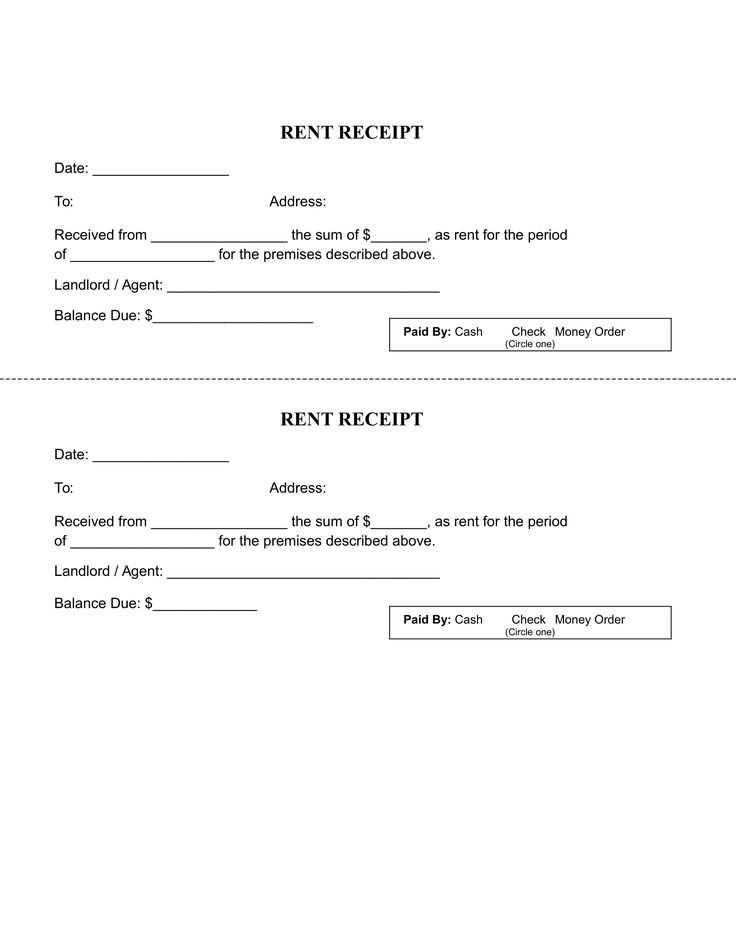

To ensure your rent receipt template is legally compliant in Ontario, include the following key elements:

1. Property Details

Clearly state the address of the rental property. This should match the information on the lease agreement.

2. Tenant’s Information

Include the full name of the tenant who is paying the rent. This helps to verify the transaction.

3. Payment Details

Specify the amount of rent paid, the payment method, and the date the payment was made. This should also match the rental agreement terms.

4. Landlord’s Information

List the name of the landlord or property management company receiving the payment. Ensure you include their contact information for reference.

5. Receipt Number

Provide a unique receipt number for each transaction. This helps in organizing records and avoids confusion in case of disputes.

6. Rental Period

Clearly mention the period the payment covers, such as “January 1, 2025 – January 31, 2025.” This makes it clear which month’s rent is being paid.

7. Signature

Although not mandatory, a signature (either digital or physical) can add an extra layer of verification for both parties.

8. Legal Compliance

Ensure your receipt complies with the Residential Tenancies Act. It should provide enough detail to support any claims related to rent payments in the future.

By following these guidelines, your rent receipt will be both functional and legally sound, offering protection for both landlords and tenants.

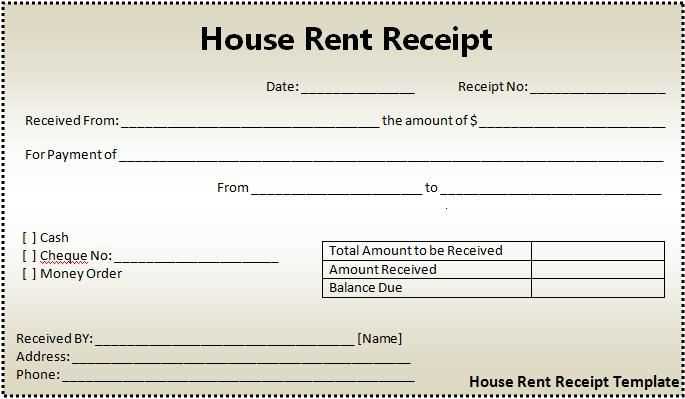

To create a valid Ontario rent receipt, ensure the following details are included for accuracy and legal purposes:

- Landlord’s Name and Address: Clearly state the full name of the landlord or property manager, along with their address. This helps identify the individual responsible for the rental transaction.

- Tenant’s Name: The name of the person renting the property must be listed. If multiple tenants share the lease, include all relevant names.

- Rental Property Address: Include the full address of the property being rented, ensuring that it matches the lease agreement.

- Amount Paid: Specify the exact amount of rent paid during the rental period. If partial payments were made, note each payment separately.

- Payment Date(s): Indicate the specific date(s) the rent was received. This can be a single date or multiple dates if payments were made in installments.

- Payment Method: Note how the rent was paid (e.g., cheque, bank transfer, cash). This clarifies the transaction method for both parties.

- Rental Period: Define the start and end dates of the rental period for which the payment was made, such as “January 1, 2025 – January 31, 2025.”

- Receipt Number: Assign a unique receipt number to keep a record of each payment made. This helps with organization and tracking.

- Signature: If possible, include a space for both the landlord and tenant’s signatures to confirm the transaction.

Additional Considerations

- Late Fees: If applicable, include details of any late fees or adjustments made to the rent, along with the reasons for these charges.

- Security Deposit: If a security deposit was received, list it separately on the receipt, noting whether it’s refundable or applied to rent payments.

Ensure the receipt includes the correct landlord name and address. Omitting or misspelling this information could cause confusion for both the landlord and the tenant. Double-check that the details are accurate.

List the exact rental period. Many people forget to specify the start and end dates for each payment, which can lead to disputes or misunderstanding about rent due dates. Always match the dates to the period covered by the payment.

Common Data Entry Mistakes

Accurate payment amounts are critical. Rounding the rent or listing incorrect amounts creates discrepancies. Verify that the payment amount on the receipt matches what was paid, including any deposits or extra charges.

Missing Signature or Date

Failing to sign or date the receipt is a common mistake. Always add the date the receipt was issued and sign it to ensure it’s valid. Without these, a rent receipt may not be legally accepted as proof of payment.

| Common Mistake | Consequences |

|---|---|

| Omitting rental period | Potential confusion on payment dates |

| Incorrect payment amounts | Disputes regarding the actual rent paid |

| Missing signature or date | Receipt may be invalid or non-legal |

Stay clear of using vague payment descriptions. Detail what the payment covers, such as rent, utilities, or deposits, to avoid future questions about what was included in the payment.

To create a proper rent receipt template in Ontario, include key details to ensure it’s legally valid. Specify the full name of the tenant, address of the rental property, and the period the rent covers. Clearly state the total amount paid, along with the payment method (cash, cheque, etc.). Don’t forget to include the landlord’s signature and the date of the transaction for accuracy.

For clarity, break down the payment period by month or week, depending on the rental agreement. This helps prevent misunderstandings between parties. If the tenant paid via electronic transfer, include relevant transaction details such as a reference number.

While this template can be customized, ensure that the basic requirements listed above are always included. Any missing information can lead to confusion, and the receipt may not hold up in legal situations.