Using a rent receipt template can simplify the process of tracking payments and maintaining clear records. A rent receipt serves as proof of payment, which is beneficial for both tenants and landlords. By utilizing templates, landlords save time on creating receipts from scratch while ensuring consistency and accuracy in documentation.

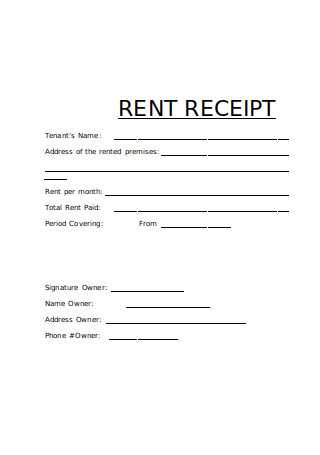

Choose a rent receipt template that includes all the necessary details: the tenant’s name, the amount paid, the date, and the rental period covered. Ensure that your template offers space for both the landlord’s and tenant’s contact information, as well as a unique receipt number for better organization. This helps in maintaining a transparent history of payments, which can be useful for future references or legal purposes.

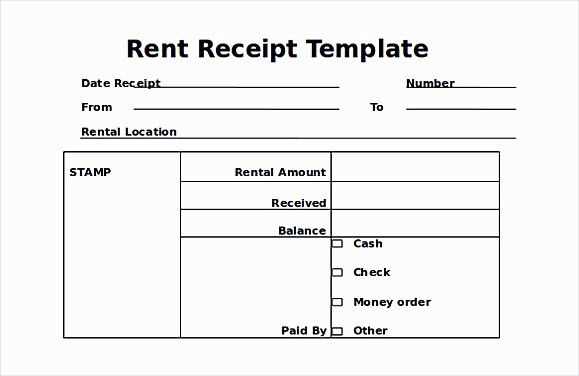

Some templates also offer features like tracking late fees or deposits, which can make record-keeping even easier. Keep your templates accessible in both digital and printed formats to ensure flexibility in how you issue receipts. This approach minimizes confusion, prevents errors, and guarantees that you and your tenants have clear records of all transactions.

Here’s the corrected version without repetitions:

Ensure your rent receipts are clear and professional. Include the tenant’s name, rental property address, the rental period, and the total amount paid. It’s also helpful to state the payment method and include both the landlord’s and tenant’s signatures. Provide a unique receipt number for each transaction to help with record-keeping.

For added clarity, mention whether the payment includes any additional fees, such as late charges or utilities. Avoid using vague terms like “various fees” or “miscellaneous charges.” Be specific to avoid any confusion. Also, include the date the payment was received and any outstanding balance, if applicable.

Having a clean and straightforward layout makes the receipt more readable. Choose legible fonts and keep the design simple. Avoid unnecessary graphics or excessive text that could distract from the important details.

If you are using a digital format, ensure the document is easily accessible and that the tenant can download or print it without any issues. Always keep a copy for your own records as well.

Rent Receipt Templates: A Practical Guide

How to Create a Basic Receipt Template for Rent

Key Information to Include in a Rent Receipt Format

Customizing Rent Receipts for Different Lease Agreements

How to Format Receipts for Digital and Paper Versions

Common Mistakes to Avoid When Using Receipt Templates

Legal Requirements for Rent Receipts Across Jurisdictions

Creating a rent receipt template requires including the basic details that validate the rental transaction. This includes the tenant’s name, the landlord’s name, rental amount, payment date, and the address of the rental property. The template should also clearly state the payment method (e.g., cash, check, or bank transfer) and any outstanding balance if applicable.

Key Information to Include

Ensure that the receipt contains the following mandatory information:

1. Tenant’s full name

2. Landlord’s full name

3. Rental property address

4. Date of payment

5. Amount paid

6. Payment method (cash, check, transfer, etc.)

7. Lease period (start and end date)

8. Signature of the landlord or authorized person

Customizing for Different Lease Agreements

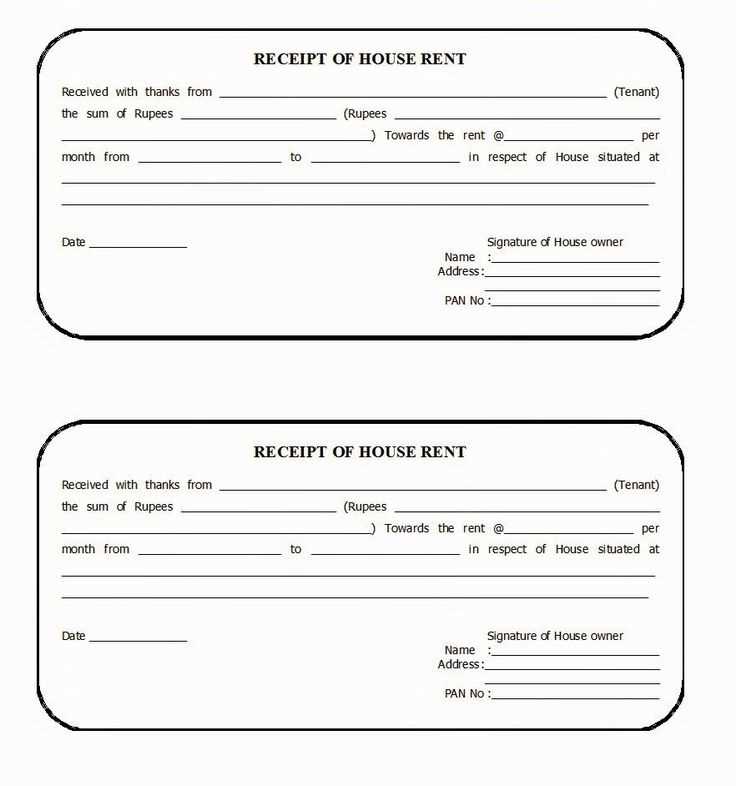

When customizing rent receipts, adjust the template for various lease conditions. For example, if the lease includes utilities or other fees, these should be clearly itemized. If the tenant is paying a partial amount or making an early payment, include these details to avoid any confusion in the future.

Digital and paper receipts should follow the same format but may differ in how they are presented. For paper receipts, consider a physical signature, while digital receipts can incorporate an e-signature or automated timestamp for verification.

Avoid mistakes like failing to include all necessary details, such as the payment method or missing a signature. These errors can cause confusion or legal disputes. Double-check the format for clarity and accuracy.

Check local legal requirements for rent receipts as they vary by jurisdiction. Some regions require landlords to provide receipts for every payment, while others may only require them upon request. In some places, receipts must be signed by the landlord and include specific language to comply with tax or rental laws.