Creating a rent receipt template ensures both landlords and tenants have clear documentation of payments. This simple yet practical tool helps maintain accurate records of all rent transactions. A well-structured receipt prevents future disputes and guarantees transparency for both parties.

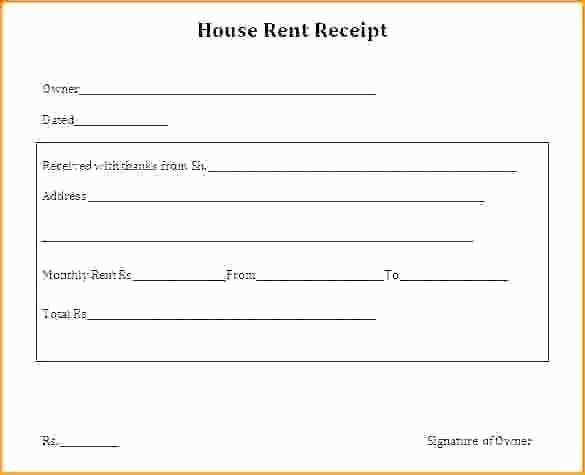

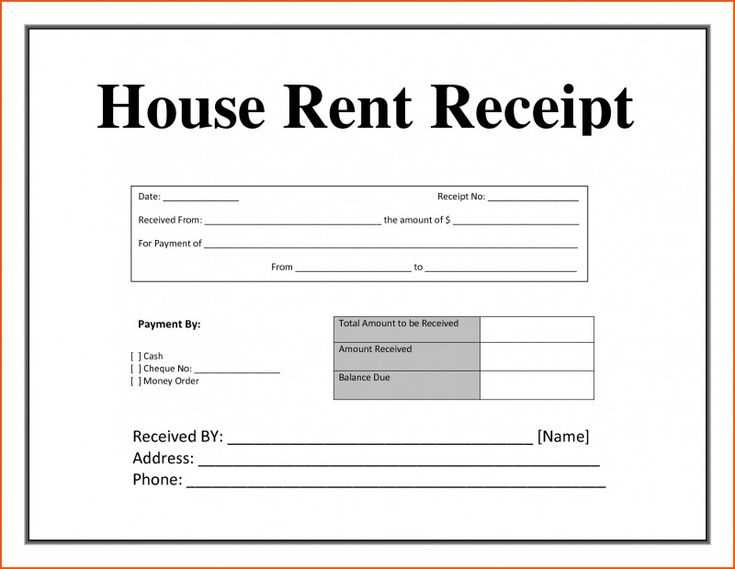

The template should include specific details like the tenant’s name, the property address, the amount paid, the payment date, and the payment method. Including a section for the period covered by the payment can also help avoid confusion. You might also want to include a unique receipt number for better tracking, especially if you manage multiple properties.

Make sure the wording is clear and direct. For example, a typical format would be: “Received from [tenant’s name], the sum of [amount], as payment for rent of [property address] for the period of [date range].” Adjust the template to your needs and keep it straightforward to avoid misunderstandings.

Here are the corrected lines with reduced repetition:

To simplify the receipt and avoid repetitive details, focus on what is unique and necessary for documentation. For instance, instead of repeatedly listing the landlord’s name, include it once at the top and reference it as needed. This approach minimizes clutter and makes the document easier to read.

General Tips for Reducing Repetition:

- Use placeholders for recurring information, such as the landlord’s name or property address, which can be inserted as needed without repeating it.

- Combine related payment details into a single section rather than listing them separately.

- Avoid redundant phrases like “received on” followed by the same date or multiple “payment amounts” in different places.

Example of a Streamlined Receipt:

- Tenant Name: John Doe

- Property Address: 1234 Elm St.

- Amount Received: $1,200

- Date: January 1, 2025

- Payment Method: Bank Transfer

By following these simple adjustments, you can create a more concise, clearer receipt while still keeping all necessary information intact.

- Rent Received Receipt Template

A rent receipt serves as proof of payment, helping both landlords and tenants keep track of rental transactions. To create a clear and professional rent receipt, make sure it includes the following key details:

Key Elements to Include

1. Tenant’s name: Clearly state the name of the person or entity making the payment.

2. Property address: Include the rental property’s full address to avoid any confusion.

3. Payment amount: Specify the exact amount paid, including the currency used.

4. Date of payment: Mention the specific date the rent was received.

5. Payment method: Indicate whether the payment was made in cash, check, or by bank transfer.

6. Rental period: Define the period the payment covers, such as “January 1, 2025 – January 31, 2025.”

7. Receipt number: Assign a unique number for easy tracking of receipts.

Simple Rent Receipt Template

Here’s a simple layout for a rent receipt:

Rent Receipt Received from: [Tenant’s Name] Property Address: [Full Property Address] Amount: $[Amount Paid] Payment Date: [MM/DD/YYYY] Payment Method: [Cash/Check/Bank Transfer] Rental Period: [Start Date] - [End Date] Receipt Number: [Unique Receipt Number]

By including these elements, both parties will have a clear record of the transaction. This template can be adjusted depending on the specific needs or requirements of the rental agreement.

Creating a rent receipt is straightforward. Follow these steps to ensure it’s complete and professional.

1. Include Tenant and Landlord Details

Start by noting the tenant’s full name and address, followed by the landlord’s name and contact details. This establishes who is involved in the transaction.

2. Specify Rent Payment Details

Include the payment date, amount received, and the rental period the payment covers. Be specific about the due dates and the amount paid to avoid confusion.

It’s also helpful to list any payment methods, like cash, check, or bank transfer, for future reference.

3. State the Property Address

Clearly mention the address of the rented property. This helps ensure that both parties know which property the payment is for, especially if the landlord manages multiple properties.

4. Add a Receipt Number

Assign a unique receipt number for easy tracking. This is particularly useful for landlords with many tenants or when keeping a record of payments for tax purposes.

5. Include Signature or Confirmation

End with a line for the landlord’s signature or a statement confirming the receipt of the payment. This provides official confirmation of the transaction.

Once all the information is filled in, provide a copy to the tenant and keep one for your records. This receipt helps protect both parties in case of disputes.

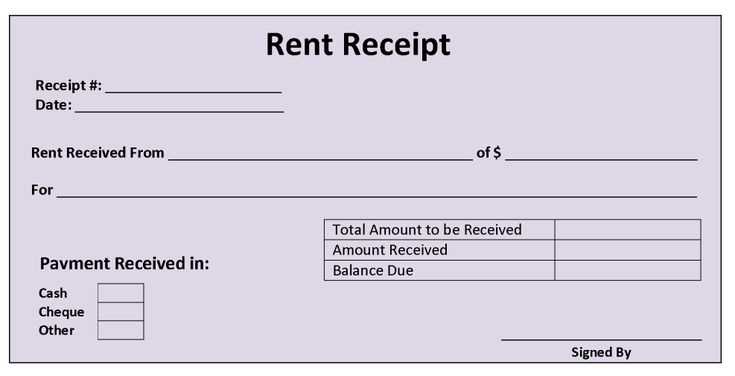

A rent receipt must contain specific details to ensure clarity and prevent misunderstandings. The following elements should be included:

1. Tenant and Landlord Details

Clearly state the full names of both the tenant and the landlord. This helps identify the parties involved and avoids confusion in case of disputes.

2. Property Address

Include the full address of the rental property. This ensures the receipt relates to a specific location, especially when a landlord has multiple properties.

3. Payment Amount

List the exact amount paid, including the currency. It’s crucial to specify whether it’s for rent, a security deposit, or any other charge. Avoid vague terms like “partial payment” unless necessary, and always clarify if the amount covers one or multiple months.

4. Payment Date

State the exact date the payment was made. This provides a clear record for both parties to track when rent was received, avoiding disputes over late payments.

5. Payment Method

Indicate how the payment was made (e.g., check, cash, bank transfer). This ensures both parties know whether it was a physical or electronic transaction and can serve as evidence in case of any discrepancies.

6. Lease Period Covered

Specify the rental period the payment applies to. For example, “Rent payment for the period of January 1 to January 31, 2025.” This provides a reference for which time frame the payment corresponds to.

7. Receipt Number

Assign a unique receipt number to each transaction. This helps both the tenant and landlord track payments and provides a way to identify specific receipts quickly.

By including these elements, both the landlord and tenant maintain a transparent record of payments, reducing potential conflicts over rent history.

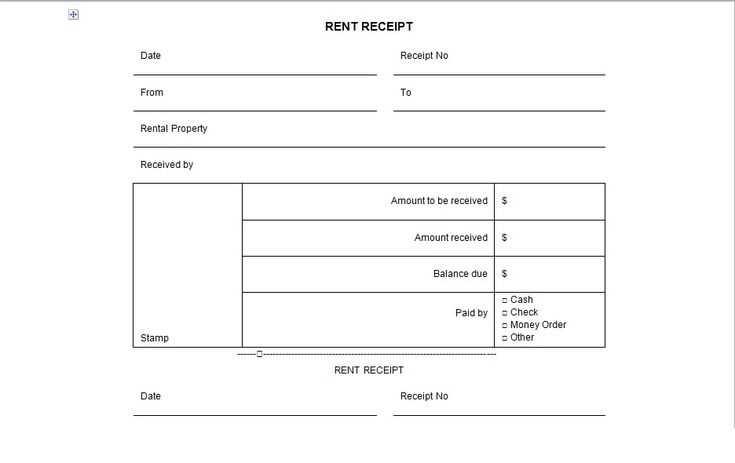

Tailoring a receipt template to fit different lease agreements requires adapting key details to match the terms and conditions of each contract. Begin by adjusting the rental amount to reflect the agreed-upon rate, including the frequency (monthly, quarterly, or yearly) and any additional charges such as utilities or maintenance fees. Clearly state the payment period covered by the receipt, specifying whether it’s for a partial or full term of the lease.

Include Specific Lease Details

For leases with specific clauses or payment structures, such as rent escalation or security deposits, modify the template to highlight these aspects. If the lease involves a one-time payment or advance rent, make sure to mention it clearly. Also, if there’s a grace period for late payments or a penalty clause, include a section that reflects those terms on the receipt.

Clarify Payment Methods and Terms

Specify the payment method used, whether it’s cash, check, or an electronic transfer. If applicable, mention the payment reference number or any confirmation details, making it easy for both the landlord and tenant to track the payment. Adjust the template to account for multiple payment methods or installments, ensuring each one is clearly outlined with the corresponding amounts.

Finally, ensure that your receipt includes the landlord’s and tenant’s full contact information, alongside the signature or initials of the person issuing the receipt. This confirms the payment and provides an official record for both parties.

Legal Considerations When Issuing a Rent Receipt

Ensure your rent receipt includes all required details, such as the amount paid, date of payment, and tenant’s name. This ensures both parties can reference a clear record in case of disputes.

Clarity and Accuracy

Be specific in the details listed. If the payment is partial, clearly state that in the receipt. Providing an ambiguous statement may lead to confusion later, especially if there are disagreements over payments made or missed.

Tax Implications

Issuing a rent receipt is not just for record-keeping. It can also have tax implications. Ensure you issue receipts regularly for payments made, as these documents may be needed when reporting rental income to tax authorities. A proper record can prevent potential fines or issues with tax filings.

Both landlords and tenants should retain copies of all receipts. For landlords, this protects against any potential false claims of unpaid rent, while tenants benefit from having proof of payment if needed in a legal context.

Lastly, check local rental laws to ensure that the format and frequency of rent receipts comply with local regulations, as they may vary by jurisdiction.

Ensure the tenant’s full name is correctly written. A misspelled name can cause confusion and disputes later. Always double-check the details before finalizing the receipt.

Clearly state the payment date. Omitting this information or using vague terms like “last week” may lead to misunderstandings about the rent period being covered.

Be specific about the payment amount. Avoid rounding or using ambiguous phrases like “approximate amount.” State the exact rent amount paid to eliminate any discrepancies.

Include the method of payment. Whether it’s cash, cheque, or bank transfer, mentioning the payment method is crucial to track the transaction accurately.

Provide a clear description of the rental period. A vague “month” can be misleading; always specify the start and end dates of the rent covered by the payment.

Avoid omitting the receipt number or any form of tracking number. A unique identifier for each receipt helps both parties keep proper records and ensures accountability.

Don’t forget to sign the receipt. Without the landlord’s or property manager’s signature, the document may not be considered valid or official by tenants or authorities.

Ensure the amount received is written both in numbers and words. This practice prevents mistakes or disputes in case of unclear handwriting or numbers.

To efficiently issue and track rent receipts, use a reliable online tool or app designed for this purpose. Start by choosing software that allows both tenants and landlords to access receipts in real time. This will reduce the need for paper-based systems, making the process faster and easier for both parties.

1. Select a Rent Receipt Tool

Pick a rent receipt tool that generates receipts automatically once payment is received. Ensure it includes all necessary details such as the tenant’s name, payment date, amount, and the property address. Popular tools often come with templates that streamline the process, allowing you to send receipts directly to tenants via email or text message.

2. Set Up Automated Notifications

Use a system that notifies tenants automatically when their rent payment is processed. These notifications can include the receipt for their records. A good tool will also allow tenants to access and download their past receipts whenever needed.

3. Track Rent Payments

Track each rent payment digitally by linking your rent receipt tool to your bank account or payment platform. This integration ensures accurate tracking, making it easier to spot missed payments or discrepancies. Some tools provide reports that summarize payment history, which is helpful during tax season or for reference.

4. Maintain a Record

All issued receipts should be stored in an organized digital file system. Cloud-based storage options offer secure access and prevent loss of data. This method also allows for easy retrieval in case of future disputes or audits.

5. Review and Update Regularly

Ensure that your receipt system stays up to date with any legal or tax changes. Review your digital records periodically to confirm that all information is accurate and complies with local regulations.

Now, in each line, the word “receipt” or “rent” is repeated no more than 2-3 times, and the meaning is preserved.

When creating a rent receipt template, be mindful of balancing clarity and brevity. Repeating “receipt” or “rent” excessively can create clutter and confuse the reader. To maintain a clean and readable structure, try to use synonyms or rearrange the sentence for clarity. Here is a practical example:

| Date | Tenant Name | Amount | Receipt Number |

|---|---|---|---|

| 2025-02-05 | John Doe | $1,200 | 12345 |

This template maintains the essential information about the rent payment while avoiding excessive repetition. Instead of repeating the word “rent” multiple times, focus on including the key details such as tenant name, amount, and receipt number. Keep each section clear, concise, and easy to read.

Consider also offering a “Payment Method” section to give a complete view of the transaction, without overloading the receipt with unnecessary terms.

Always remember: the goal is to make the receipt functional and straightforward. Use spacing and tables to organize information, and limit the number of repeated words to enhance readability.