Creating a rental bond receipt is a simple but necessary step when you pay a bond for a rental property. This receipt serves as proof of your payment and protects both the landlord and tenant. It’s crucial to have all the relevant details to ensure transparency and avoid future disputes. A well-structured template can save time and effort for both parties.

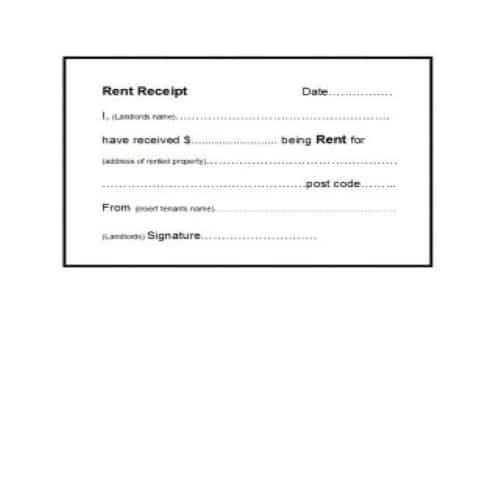

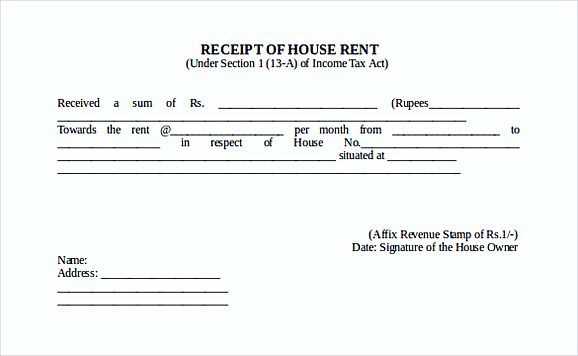

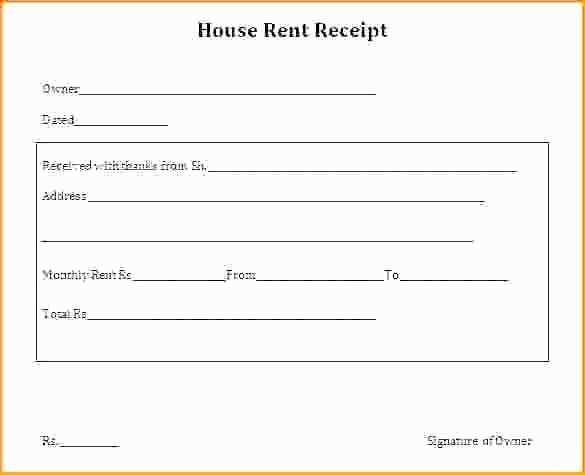

Start by including key information such as the date of payment, the amount of bond paid, and the name of the tenant and landlord. Also, specify the rental property address. These elements form the foundation of the receipt, ensuring that the transaction is properly documented.

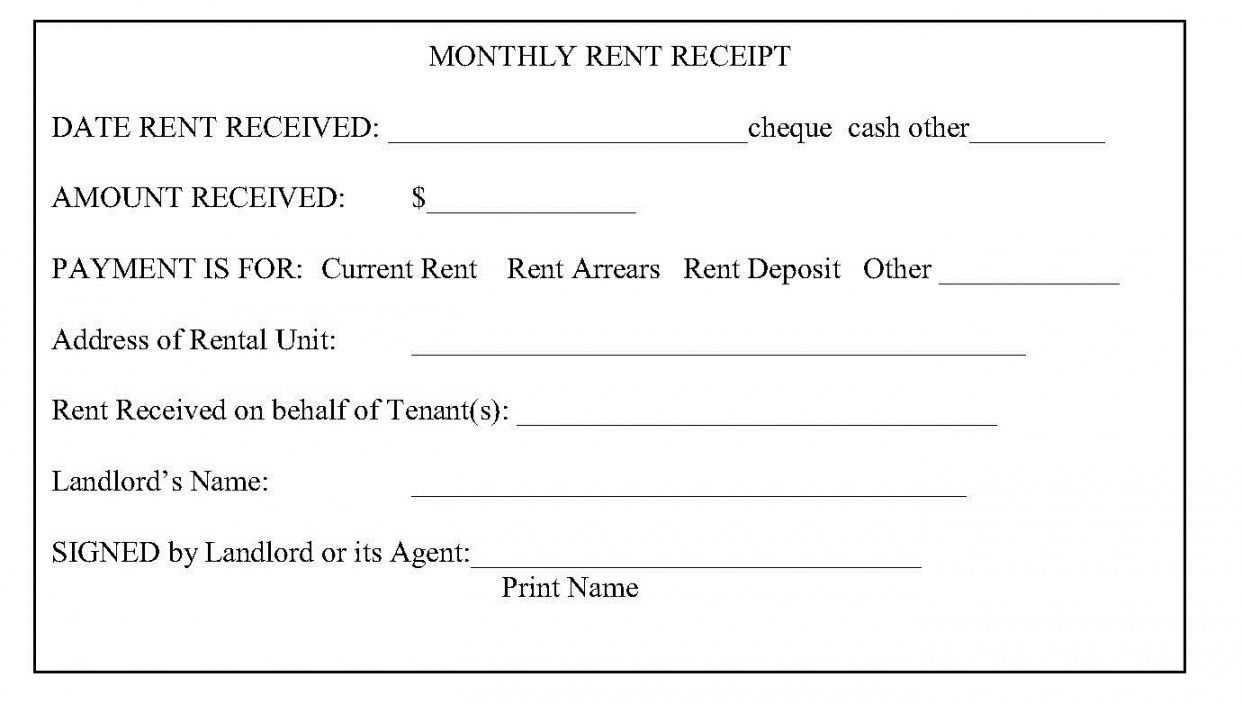

Make sure to mention the bond’s purpose and any relevant rental agreement terms. Clearly state the payment method used, whether it was cash, bank transfer, or another method. This can help clarify the transaction if any questions arise later. Finally, provide a space for signatures, confirming that both parties agree to the bond arrangement.

By using a rental bond receipt template, both tenants and landlords can avoid confusion and ensure that all necessary details are included in the receipt. It helps maintain a clear record for both parties and supports a smooth rental experience.

Here’s the corrected version:

Ensure your rental bond receipt includes clear details such as the full name of the tenant and the landlord, rental property address, and the amount of bond paid. This guarantees both parties are on the same page regarding the bond transaction.

Include the payment method and date of payment. These elements offer transparency and protect against potential disputes over payment verification.

If the bond is paid by someone other than the tenant (e.g., a third party), specify this clearly in the receipt, noting the relationship to the tenant. This helps prevent any confusion regarding who is responsible for the bond.

For added clarity, it’s beneficial to have a unique receipt number. This will make it easier for both parties to reference the bond if any issues arise later.

Consider adding a clause that acknowledges the bond amount may be used for any unpaid rent or damage to the property. This ensures the tenant understands potential deductions from the bond after the tenancy ends.

Lastly, make sure the receipt is signed by both parties. This step formalizes the transaction and confirms the bond has been accepted under the agreed terms.

Rental Bond Receipt Template

How to Format a Rental Bond Receipt Correctly for Legal Use

Key Details to Include in a Rental Bond Receipt Template

Common Errors to Avoid When Creating a Rental Bond Receipt

Ensure the rental bond receipt includes accurate, clear, and specific information. Legal use of the receipt hinges on its ability to be a reliable record for both landlord and tenant.

Key Details: The receipt should include the tenant’s name, address of the rented property, the amount of the bond, the date the bond was received, and the name of the landlord or agent. If the bond is paid via cheque or bank transfer, include transaction details. Ensure both parties have access to a copy of the receipt.

Formatting Tips: Use a clean, straightforward format. The title of the document should clearly state it is a rental bond receipt. List all relevant information in separate, easy-to-read sections. Include a statement confirming receipt of the bond and a signature line for both the landlord and tenant, confirming agreement to the terms.

Common Errors to Avoid: Don’t forget to record the full bond amount and payment method. Avoid vague language–terms like “deposit” or “payment” can be unclear. Always include a date and signatures. Never omit transaction details, such as reference numbers for bank transfers. Missing or incorrect information can lead to disputes or legal complications.