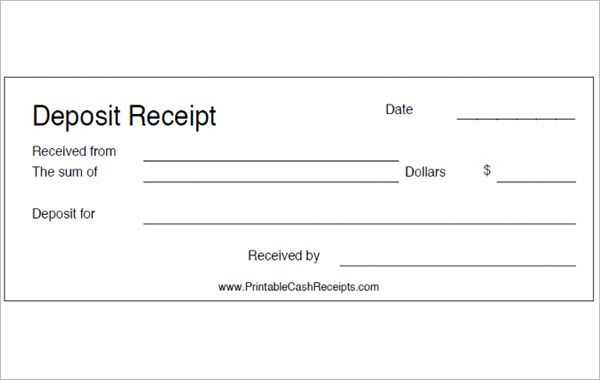

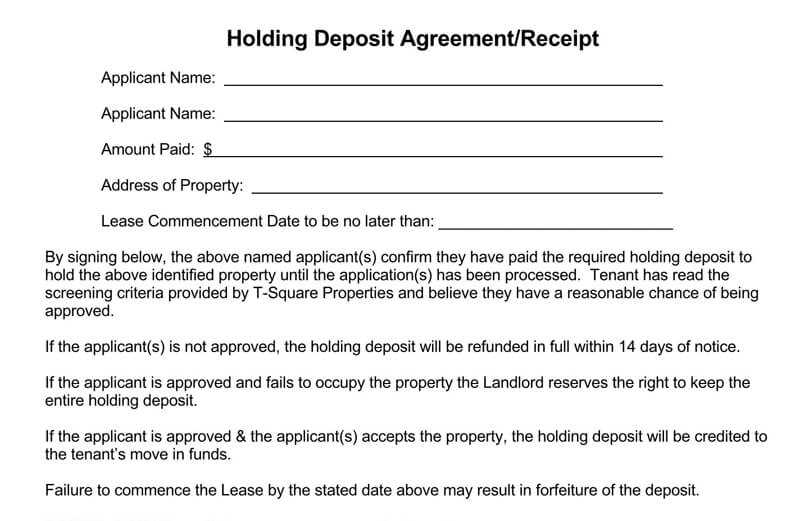

Use a rental deposit receipt template to clearly document the receipt of a security deposit from tenants. This template serves as proof of payment, protecting both tenants and landlords in case of disputes regarding the return of the deposit at the end of the tenancy. A properly structured receipt helps avoid misunderstandings about the amount paid and its purpose.

The receipt should include details such as the tenant’s name, the amount received, the date of the payment, and the property address. It’s also helpful to specify whether the deposit covers damages, unpaid rent, or other tenant obligations. This transparency builds trust and clarifies the terms of the agreement.

By using a rental deposit receipt template, landlords can ensure they meet legal requirements for documenting transactions and safeguarding the security deposit. The template can be easily adapted to suit the specifics of any rental agreement, ensuring both parties are clear on the deposit’s terms. This step is a straightforward way to minimize potential legal issues and keep rental agreements hassle-free.

Here’s the corrected version:

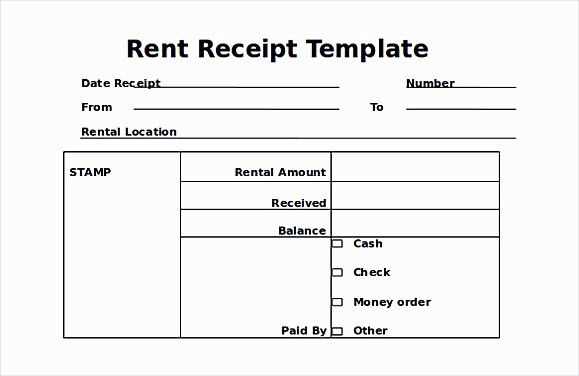

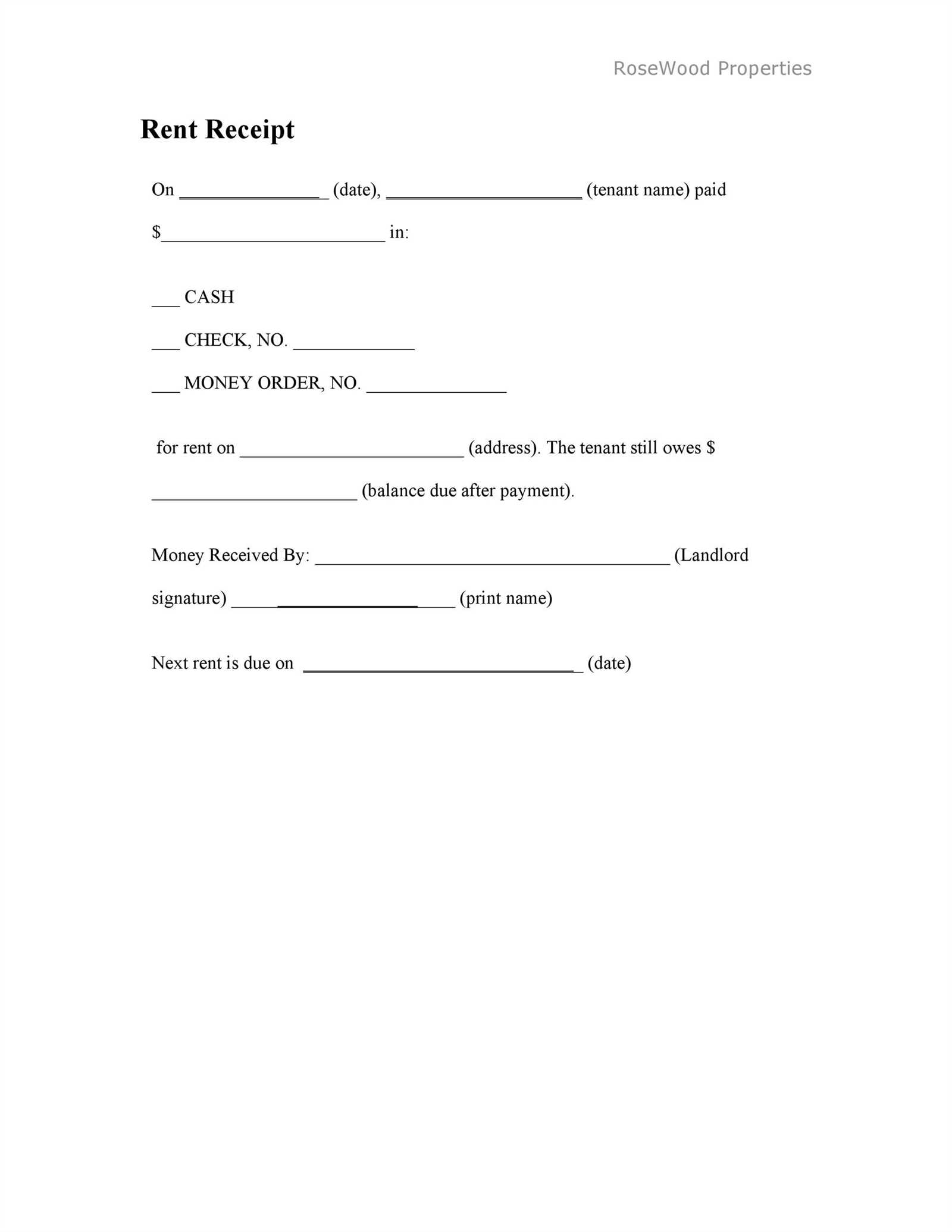

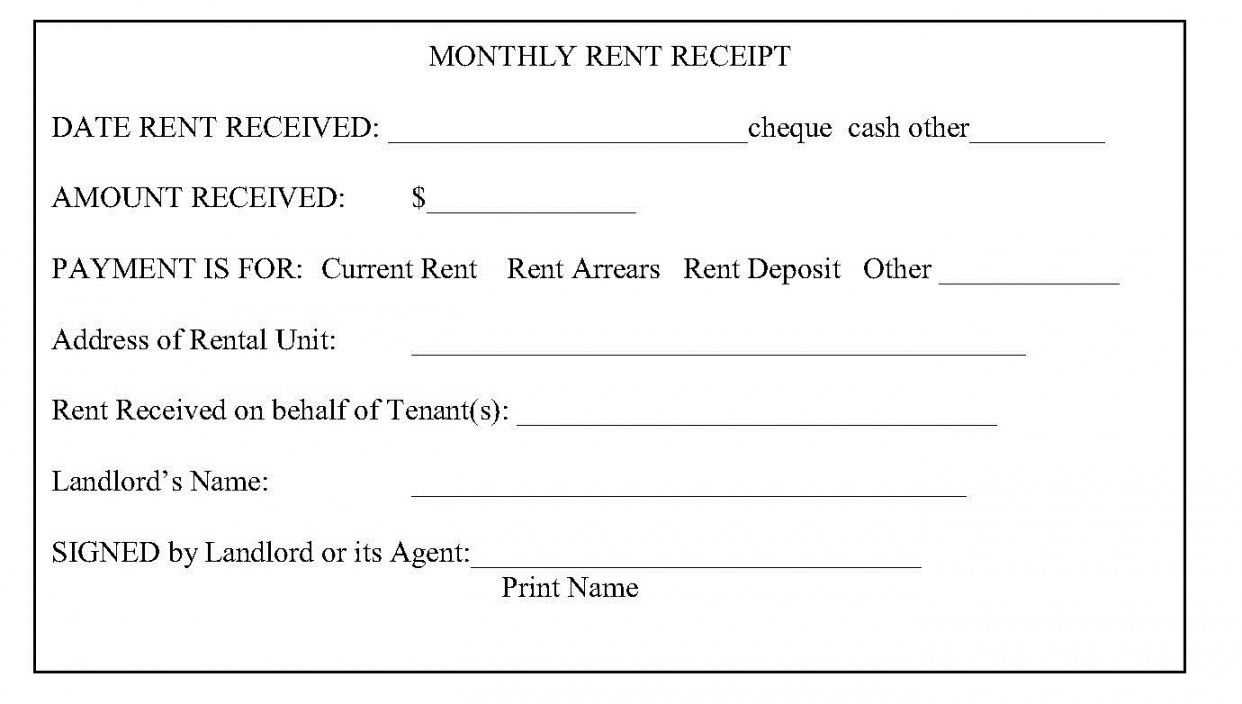

When issuing a rental deposit receipt, make sure it clearly outlines all necessary details. Include the tenant’s and landlord’s names, rental property address, deposit amount, payment method, and the date the payment was made. It’s also important to mention any reference numbers related to the transaction, if applicable.

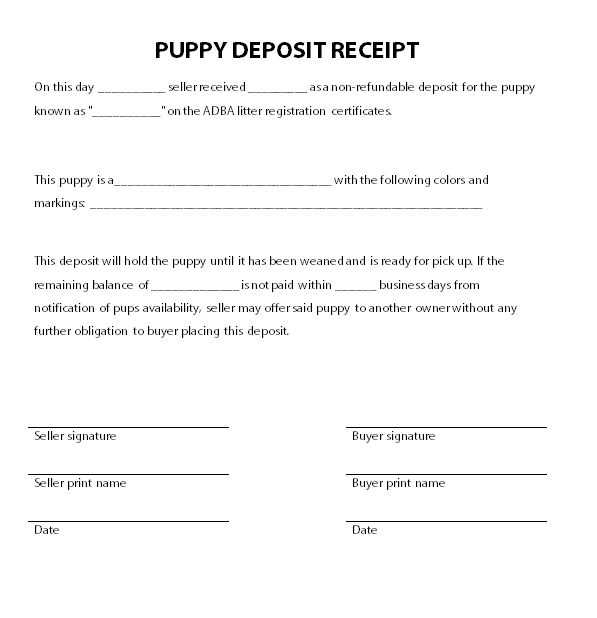

Deposit Return Terms

Specify the conditions for returning the deposit. Typically, this should include the timeframe (usually 10 days) in which the deposit will be refunded after the end of the tenancy. State any reasons the deposit may be withheld or partially refunded, such as for damages, unpaid rent, or cleaning costs.

Signatures and Copies

Ensure both parties sign and date the receipt. This creates a record of agreement for both the landlord and the tenant. Both parties should keep a copy of the signed receipt for future reference, preventing disputes later on regarding the deposit.

Rental Deposit Receipt Template UK

For landlords and tenants in the UK, a rental deposit receipt is a critical document that proves the receipt of a deposit for a rental property. The template should include key details to ensure clarity and avoid disputes. Below are the essential components of a rental deposit receipt:

- Tenant’s Full Name: Clearly state the name of the person who is renting the property.

- Landlord’s Full Name: Include the full name or company name of the landlord or agent receiving the deposit.

- Property Address: Specify the exact address of the rented property.

- Deposit Amount: Clearly mention the amount paid by the tenant for the rental deposit.

- Date of Payment: Indicate the date the deposit was paid by the tenant.

- Purpose of Deposit: State that the deposit is to cover damages or unpaid rent, as applicable.

- Terms and Conditions: Briefly outline any specific conditions under which the deposit may be refunded or withheld.

- Signature: Both the tenant and the landlord should sign the document to confirm the transaction.

Ensure both parties keep a copy of the receipt for reference. A clear and well-structured rental deposit receipt protects both the tenant and landlord, promoting transparency and avoiding future conflicts regarding the deposit.

To create a rental deposit receipt for tenants in the UK, include the following key elements:

- Receipt Title – Clearly label the document as a “Rental Deposit Receipt” to avoid confusion.

- Landlord or Agent’s Information – Include the full name, address, and contact details of the landlord or property agent managing the property.

- Tenant’s Information – List the tenant’s full name and contact details.

- Property Details – Mention the property address for which the deposit is being paid.

- Deposit Amount – Specify the exact amount of the deposit received. This should match the amount agreed in the rental agreement.

- Date of Payment – State the exact date when the deposit was paid.

- Payment Method – Indicate the method used for payment (bank transfer, cheque, cash, etc.).

- Deposit Protection Scheme Information – If the deposit is protected under a government-authorized scheme, include the name of the scheme and the details on how the tenant can contact them in case of disputes.

- Signatures – Ensure that both the landlord and tenant sign the document, acknowledging the payment and agreement.

Keep the receipt safe, as it serves as proof of payment and is vital for resolving any potential disputes at the end of the tenancy. Be clear and accurate with all details to avoid misunderstandings later on.

In the UK, landlords must adhere to specific legal requirements when providing a rental deposit receipt. A proper receipt protects both tenants and landlords and ensures compliance with the law.

First, the receipt must clearly state the amount of the deposit paid by the tenant. This ensures transparency and avoids any confusion over the deposit amount at the start of the tenancy.

The landlord or agent must also include the address of the rental property. This provides clarity on the specific rental agreement the receipt pertains to, avoiding any disputes related to the property location.

It is also required to note the date when the deposit was received. This is important for keeping a timeline of payment, which could be referenced later if there are any disputes regarding the return of the deposit at the end of the tenancy.

Another legal requirement is the inclusion of the tenant’s and landlord’s or agent’s names and contact details. This provides a clear record of the parties involved, ensuring any communication regarding the deposit can be easily facilitated.

The receipt must confirm that the deposit has been protected within a government-approved tenancy deposit protection (TDP) scheme. This legal obligation ensures the tenant’s money is safeguarded, and the landlord complies with the regulations set out in the Housing Act 2004.

Lastly, the receipt should contain information on how the tenant can reclaim the deposit at the end of the tenancy. This includes details on the process and any time limits for making a claim. Failure to include this information may cause delays or confusion when the tenant seeks to retrieve their deposit.

| Requirement | Details |

|---|---|

| Deposit Amount | Exact sum of money paid by the tenant |

| Property Address | Clear identification of the rental property |

| Date Received | Specific date the deposit was paid |

| Party Details | Name and contact details of landlord and tenant |

| TDP Scheme Confirmation | Confirmation of deposit protection in an approved scheme |

| Reclaim Process | Instructions on how to reclaim the deposit at tenancy end |

Adjust your deposit receipt template to suit your property’s specifics. Include key details like the full address of the rental property and the precise amount paid by the tenant. Clearly specify the date the deposit was received and the method of payment. Ensure the tenant’s name and contact information are correct.

List any terms and conditions related to the deposit, such as whether it’s refundable or non-refundable, and any potential deductions. If deductions are possible, specify the circumstances, like damage to the property or unpaid rent.

Customize the format to be clear and easy to read. Use a straightforward layout with headings and bullet points to highlight the most critical information. This helps avoid misunderstandings and gives tenants quick access to the details they need.

To add a personal touch, consider including a thank-you note or an acknowledgment of the tenant’s responsibility to keep the property in good condition. This can help build a positive rapport and encourage responsible behavior.

Finally, make sure to include a section for both parties to sign, confirming the accuracy of the details provided. This can help prevent disputes and ensure transparency throughout the rental period.

Rental Deposit Receipt Template UK

A rental deposit receipt should clearly document the amount paid, the date of payment, and the property involved. Ensure that the receipt specifies the reason for the deposit and any conditions that apply to its return. Use straightforward language, avoiding unnecessary legal jargon.

The receipt should include the landlord’s or agent’s name and contact details, along with the tenant’s information. Include the payment method and the exact sum paid. If applicable, note any deductions that may occur when the deposit is returned.

Keep a copy of the receipt for your records. This serves as proof of the deposit paid and can prevent disputes if there are disagreements about the return of the deposit at the end of the tenancy.

It’s recommended that the receipt also state whether the deposit is protected under a government-approved scheme, as this is a requirement under UK law. Mention the scheme and provide the reference number if possible.