A rental receipt letter is a key document that confirms payment has been made for renting a property. This letter serves as proof of payment for both the tenant and the landlord, providing clear details of the rental transaction.

Make sure to include specific information such as the rental period, payment amount, the property being rented, and the method of payment. Including these details helps both parties avoid any future disputes regarding payments.

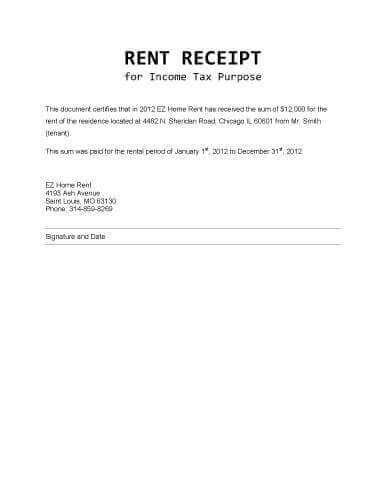

Ensure the letter is clear and concise, with no room for confusion. It’s helpful to keep a copy for both the tenant and landlord records. A well-drafted rental receipt can also be used for tax or legal purposes in case of any complications.

Here’s a revised version of the text with repetitions removed while maintaining the meaning and correctness:

For creating a rental receipt letter, ensure the information is clear and concise. Include the following key details:

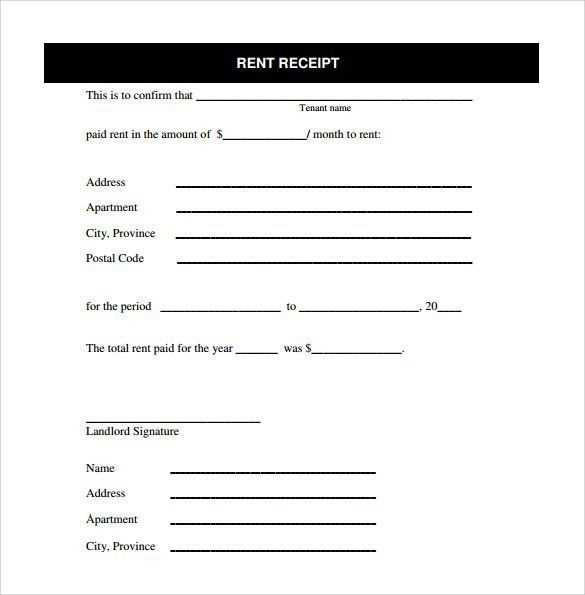

- Tenant’s name and address: Clearly state the tenant’s full name and the rental property’s address.

- Landlord’s name and contact details: List the landlord’s name, address, and phone number for easy reference.

- Rental amount: Specify the exact rental payment amount for the relevant period.

- Payment date: Indicate the exact date when the payment was received.

- Rental period: Clearly define the period for which the payment applies, such as the start and end dates.

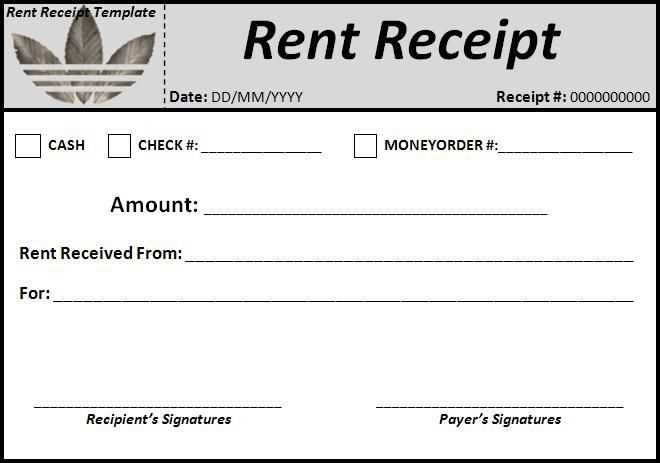

- Payment method: State the method used for payment, whether it’s cash, check, or bank transfer.

Keep the language formal yet approachable. Double-check all figures and dates for accuracy. This will ensure that both parties have a clear record of the transaction. Finally, make sure the tenant receives a copy of the letter for their reference.

Here’s a detailed HTML plan for an article on “Rental Receipt Letter Template,” with 6 specific and practical headings:

Creating a rental receipt letter is a simple but important task. This letter serves as proof of payment for rent and helps both the landlord and tenant keep accurate records. Below is an effective plan for writing this letter:

1. Introduction to Rental Receipt Letter

Provide a brief explanation of what a rental receipt letter is and its primary purpose. Mention that it is issued by landlords to tenants after rent payment has been made. Make sure to state that the letter must include specific details such as the date, amount, and payment method.

2. Key Information to Include

List all the essential details to be included in the receipt. This should cover the tenant’s name, property address, rental amount, payment date, and method (e.g., cash, check, bank transfer). Add a note about the importance of including the landlord’s signature to validate the transaction.

Next, ensure the receipt reflects any additional information like late fees or deposits, if applicable. This ensures clarity in financial records for both parties.

3. Formatting the Rental Receipt

Provide recommendations on how to organize the letter. Start with the title “Rental Receipt,” followed by the necessary details mentioned above. The format should be simple and professional, with clear sections separating different types of information. Avoid clutter and ensure everything is easy to read.

4. Sample Rental Receipt Template

Offer a practical example of what a rental receipt should look like. This should include the following structure:

– Title (“Rental Receipt”)

– Tenant’s name and address

– Rental period

– Total rent amount

– Payment method

– Landlord’s name and signature

This sample will give readers a clear idea of what they need to include in their own letters.

5. Importance of Issuing a Rental Receipt

Explain why issuing a rental receipt is beneficial for both parties. Emphasize that it helps maintain financial records and can be useful in case of disputes or audits. A rental receipt ensures that both the tenant and landlord have documentation of payments made and received.

6. Conclusion and Final Tips

Wrap up by reiterating the importance of accuracy and clarity when creating rental receipt letters. Offer a final tip about regularly issuing receipts for every rent payment to keep both parties’ records up to date. Suggest that the receipt be issued as soon as payment is received to avoid confusion later on.

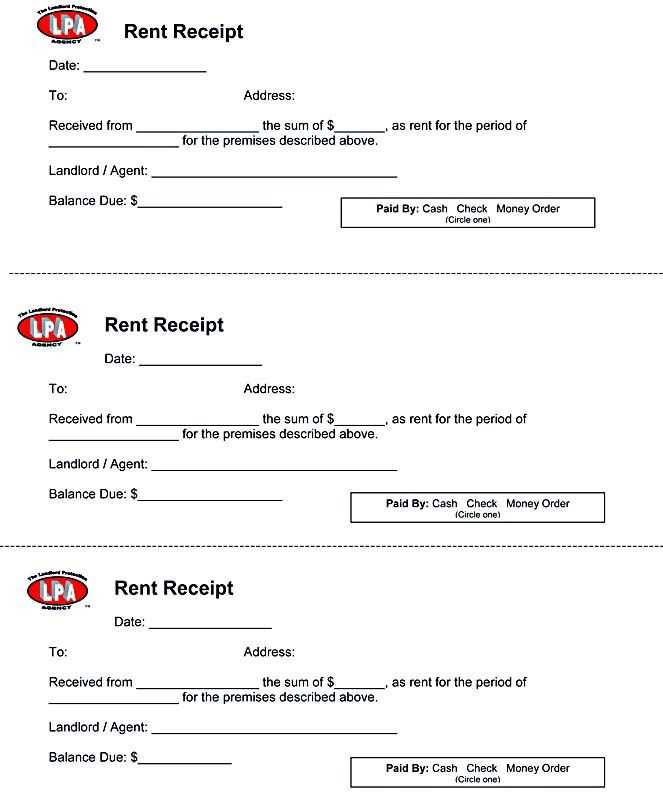

- What Information Should a Rental Receipt Contain?

Include the full names of both the tenant and the landlord. Specify the rental property address and unit number if applicable. Clearly state the payment amount, along with the rental period it covers. Make sure to mention the payment method, whether it’s cash, check, or electronic transfer. Note the date the payment was made and the receipt’s issuance date. If there are any outstanding balances, mention them as well. Finally, include a unique receipt number for tracking and reference purposes.

Begin with the header. Include the landlord’s name, address, and contact information. This should be aligned at the top of the letter, left-justified. Below that, place the tenant’s name and their address.

Next, date the letter. This marks the official receipt date and provides a clear timeline for record-keeping.

Specify the payment details in the body. Include the rental period covered, the total amount paid, and the payment method. If applicable, reference any remaining balance or late fees.

Use a table to organize payment information clearly:

| Payment Date | Amount Paid | Payment Method | Balance |

|---|---|---|---|

| January 15, 2025 | $1,200 | Bank Transfer | $0 |

Finish with a closing remark, confirming the receipt of payment and acknowledging the tenant’s timely settlement. Close with a formal sign-off, such as “Sincerely,” followed by the landlord’s signature and name.

A simple rental receipt template should include key details like the tenant’s name, rental period, and payment amount. Here’s an example structure:

Receipt for Rental Payment

Tenant Name: [Tenant’s Name]

Rental Property: [Property Address]

Payment Amount: $[Amount]

Date of Payment: [Date]

Payment Method: [Cash/Credit Card/Bank Transfer]

Landlord Name: [Landlord’s Name]

Signature: [Landlord’s Signature]

This format provides all the necessary information while keeping things clear and concise. Adjust the layout to fit your needs, like adding a breakdown of the payment if required. For digital receipts, you can also include a payment reference number or invoice ID for tracking purposes.

Another example might look like this:

Rental Payment Receipt

Tenant Name: [Tenant’s Name]

Property: [Address or Unit Number]

Total Rent Due: $[Amount]

Paid: $[Amount]

Balance Due: $[Remaining Amount]

Payment Method: [Cash/Check/Bank Transfer]

Date of Payment: [Date]

Signature: [Landlord’s Signature]

This template includes a section for balances due, which is useful for tenants making partial payments. This format ensures both parties have a record of the payment history.

Ensure the date is accurate and clearly visible. Missing or incorrect dates can lead to confusion and complications, especially if the receipt is needed for refunds or accounting purposes. Double-check the transaction date and the issuance date.

Incomplete Details

List all relevant details, including the full name or company name of the renter, the rental period, and the item or service rented. Omitting these details could cause misunderstandings in future interactions.

Unclear Payment Information

Be clear about the payment amount, including taxes, discounts, or deposits. Failing to itemize costs can lead to disputes later. Also, clearly state whether the payment was made via cash, credit card, or other methods.

Do not forget to include a unique receipt number for tracking purposes. Without it, retrieving or verifying specific transactions becomes difficult. Always use a numbering system for organization.

Adjust the receipt details based on the payment method used to ensure clarity and proper documentation. For cash payments, include the exact amount paid, the date of the transaction, and a note confirming no further balance is owed. For credit or debit card payments, record the last four digits of the card number and the payment processor used. This helps identify the transaction while maintaining privacy. For checks, include the check number and bank details, along with the payment date. If the payment is via an online platform or digital wallet, include the transaction ID or confirmation number for traceability.

Consider adding payment-specific fields to your receipt template. For example, you could offer a section for payment references or include a confirmation code for electronic payments. Always ensure the payment method section is clear and organized to avoid confusion during record-keeping or audits.

Rental receipts should include specific details to ensure they are legally valid. Include the names of both the landlord and the tenant, along with the rental property address. Clearly state the amount paid, the rental period, and the method of payment. This prevents future disputes over payment details.

Include a date on the receipt to establish the timeline of payment. A receipt without a date may lead to confusion or issues if any questions arise about payment timing.

If the rental payment covers a future period, specify the time frame in the receipt. This ensures clarity on whether the payment was for past or future rental periods, avoiding any misunderstandings.

Both parties should sign the receipt to indicate acknowledgment of the transaction. In some regions, a signature is a requirement for validity, so always check local regulations.

Keep a copy of all receipts for record-keeping purposes. Landlords should retain copies for tax reporting and future reference, while tenants may need them as proof of payment in case of any disputes.

- Ensure accuracy in the payment details (amount, dates, etc.).

- Maintain clear documentation of any late fees or additional charges.

- Understand local laws regarding rental receipts in your area.

Ensure clarity by listing the rental terms in your receipt. Provide a summary of key details like rental amount, payment date, and property address. This transparency helps prevent misunderstandings.

Details to Include

Start with the tenant’s name, rental period, and the total amount due. It’s also beneficial to include payment methods and any deposits received, as this reinforces both parties’ responsibilities.

Why Specifics Matter

Being clear about terms such as late fees or additional charges helps avoid confusion later on. It’s crucial to state both the start and end dates of the rental period to solidify agreement terms.