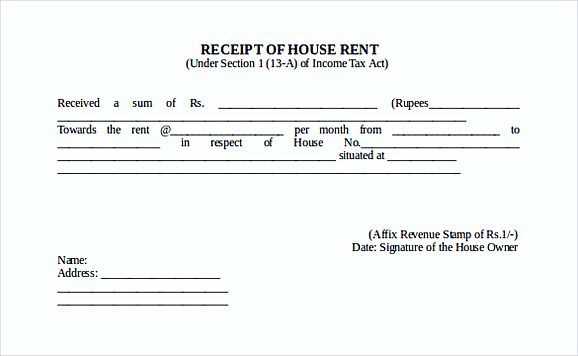

For landlords and tenants in New South Wales, having a well-structured rental receipt is necessary for both legal and financial clarity. A rental receipt acts as proof of payment, outlining key details such as the tenant’s name, rental period, amount paid, and the property address. This document can prevent future disputes and serve as a clear record for both parties.

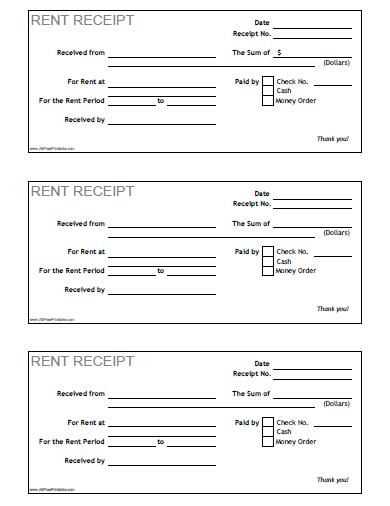

When creating a rental receipt, ensure the template includes the date of payment, the rent amount, and the payment method used. It should also include the landlord’s contact details and a unique receipt number for reference. This helps establish a formal record of every transaction.

Consider using an easily editable template that allows for customization. Adjust the format to suit specific needs, such as including additional charges or noting partial payments. Consistency in maintaining these receipts is key to keeping accurate financial records.

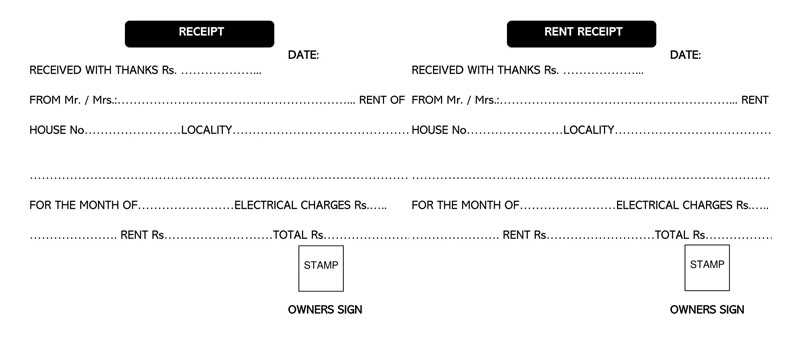

Rental Receipt NSW Template

A well-structured rental receipt ensures compliance with New South Wales tenancy laws and provides clear documentation for both landlords and tenants. Every receipt should include key details to avoid disputes and misunderstandings.

Essential Information to Include

- Date of Payment: Clearly indicate when the payment was received.

- Tenant’s Name: Specify the full name of the individual making the payment.

- Landlord’s or Agent’s Details: Include the name and contact information of the recipient.

- Rental Property Address: Identify the exact location of the leased premises.

- Payment Amount: Record the total sum paid, including any breakdown if necessary.

- Payment Method: State whether the transaction was completed via bank transfer, cash, or another means.

- Receipt Number: Assign a unique identifier for tracking purposes.

Formatting the Receipt for Clarity

- Use a clear layout with well-defined sections.

- Ensure all monetary amounts are written numerically and in words.

- Include a statement confirming that the payment has been received in full or indicate any outstanding balance.

- Sign the receipt or provide a digital signature for authenticity.

A properly formatted receipt helps maintain transparency and serves as valuable evidence in case of disputes. Keeping copies for future reference is highly recommended.

How to Create a Legally Compliant Rental Receipt

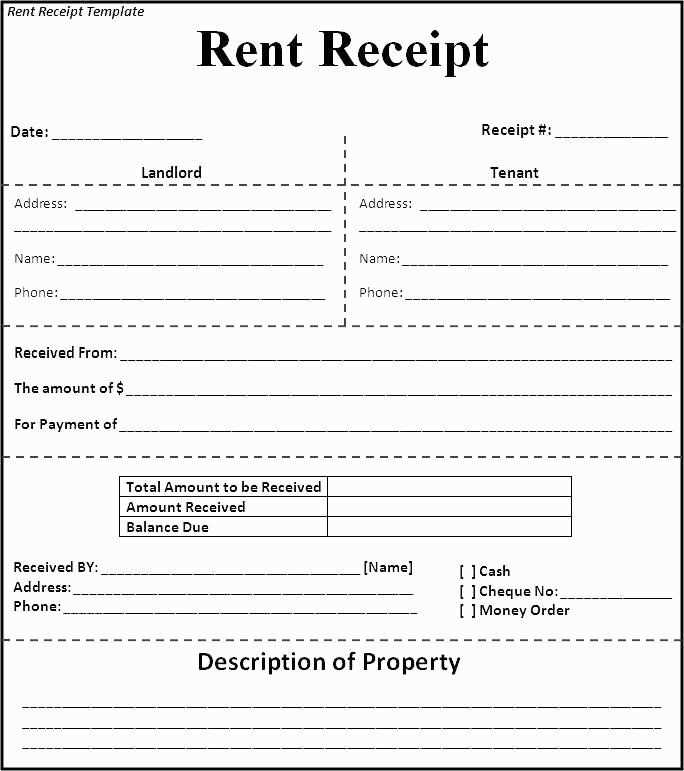

Include the full names of both landlord and tenant. This ensures clarity on who made and received the payment.

Specify the property address to avoid any confusion about which rental agreement the receipt pertains to.

Record the payment date and the period covered. For example, if the payment is for June rent, state the exact dates covered.

Mention the amount paid and the payment method, whether cash, bank transfer, or another form.

Include a receipt number for tracking purposes, especially if issuing multiple receipts.

State whether the payment covers rent in full or is a partial payment. If partial, indicate the remaining balance.

The landlord or agent should sign the receipt or provide an official business stamp to authenticate the document.

Provide the tenant with a copy while keeping a record for accounting and legal purposes.

Customizing the Template for Different Payment Methods

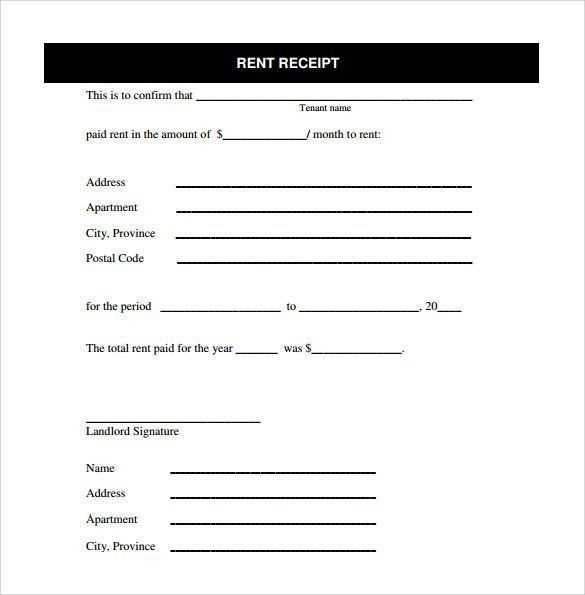

Ensure the receipt includes clear payment details for each method. For cash payments, specify the amount received and include a section for the payer’s signature. If using bank transfers, add fields for the transaction reference number and payment date.

For credit card transactions, include the last four digits of the card and a confirmation code. When handling digital wallets, mention the platform used and provide a reference ID. If payments are made via checks, include the check number and issuing bank.

Adapt the template by adding dropdown menus for payment methods and auto-filling fields based on selection. Keep formatting consistent to maintain clarity, and ensure all necessary details are recorded for future reference.

Common Mistakes to Avoid When Issuing Rental Receipts

Failing to include all necessary details creates confusion and disputes. Always specify the tenant’s name, rental property address, payment date, amount paid, payment method, and the rental period covered. A receipt missing any of these elements can lead to misunderstandings.

Using Generic or Incomplete Descriptions

Simply writing “rent payment” without specifying the rental period makes it unclear which month the payment covers. Instead, state “Rent payment for March 2025” or “Rent paid for the period 01/03/2025 – 31/03/2025” to remove any ambiguity.

Failing to Sign or Issue a Digital Signature

A receipt without a signature or authorized validation can be questioned in disputes. If issuing paper receipts, sign them before handing them to the tenant. For digital receipts, include an electronic signature or a statement such as “This is a valid digital receipt issued by [Your Name/Business].”

Avoid these errors to ensure rental receipts are legally compliant and easy to understand for both landlords and tenants.