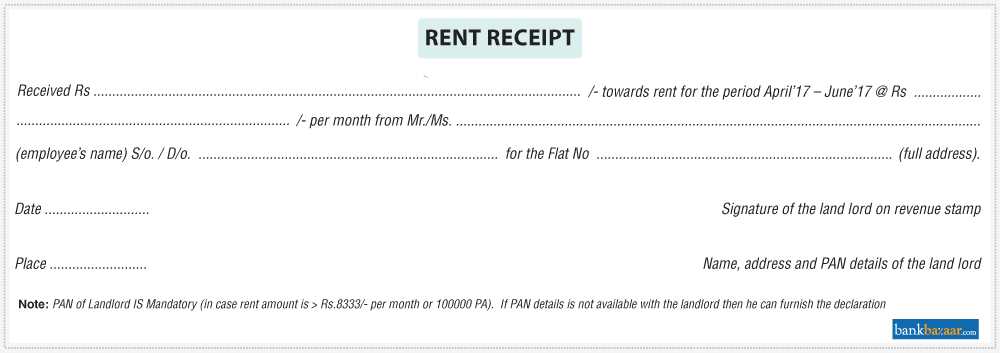

To create a legally valid rental receipt in India, include essential details such as the tenant’s and landlord’s names, the rental amount, payment date, and the property’s address. Always mention the payment method and specify whether the rent includes maintenance charges. For added credibility, affix a revenue stamp if the payment exceeds ₹5,000.

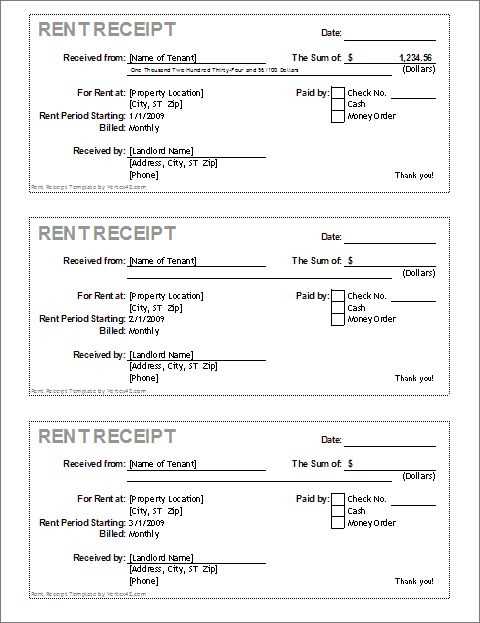

Ensure the receipt states the rental period clearly, indicating the month or months covered. The landlord’s signature is mandatory, and for digital transactions, an acknowledgment of the online transfer enhances authenticity. Keeping multiple copies benefits both parties, preventing disputes over rent payments.

Using a structured template saves time and ensures compliance with legal requirements. Opt for a format that allows customization while maintaining clarity. A well-drafted rental receipt acts as proof of payment and serves as a crucial document for tax or legal purposes.

Rental Receipt Template India

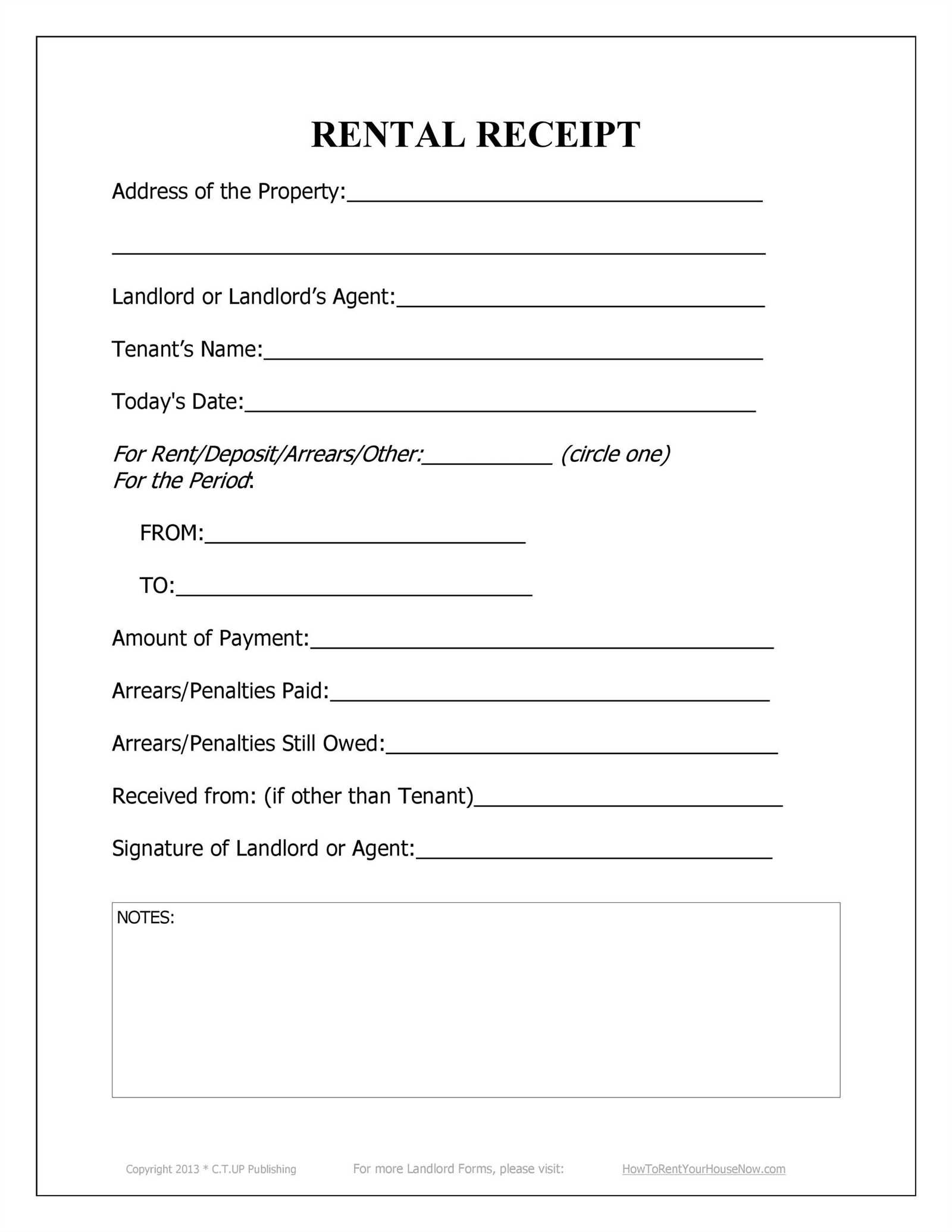

A well-structured rental receipt protects both the landlord and tenant by serving as proof of payment. It should include key details to ensure legal clarity and prevent disputes.

Essential Information to Include

- Date of Payment: Clearly mention when the rent was received.

- Tenant and Landlord Details: Full names and contact information for both parties.

- Rental Period: Specify the month or duration covered by the payment.

- Amount Paid: State the exact sum and payment method (cash, cheque, bank transfer).

- Property Address: Include the full rental property address.

- Signature: The landlord’s or authorized representative’s signature for authenticity.

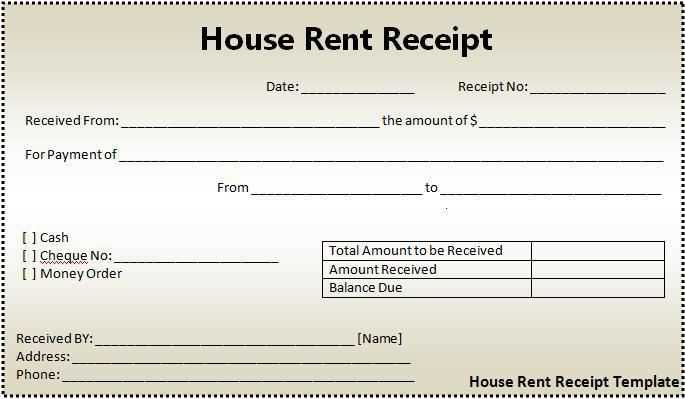

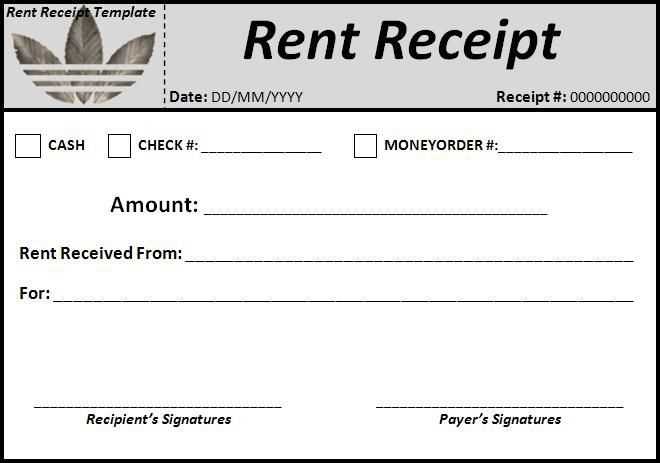

Formatting a Simple Rental Receipt

Use a clear format with distinct sections for better readability. A basic structure:

- Header: “Rental Receipt” in bold.

- Landlord’s Details: Name, address, and contact.

- Tenant’s Details: Full name and address.

- Payment Details: Amount, date, and payment mode.

- Rental Period: Clearly define the time frame covered.

- Signature & Stamp: Essential for validation.

Digital receipts should include an acknowledgment message and a unique reference number for tracking. Always issue a duplicate copy to avoid discrepancies.

Mandatory Details to Include in a Rental Receipt

Include the full name and address of both the landlord and the tenant. This ensures clear identification of the parties involved and prevents any disputes.

Payment Information

Specify the exact amount paid, the payment method, and the date of the transaction. If the tenant pays in installments, mention the period covered by the payment.

Property and Rental Period

Clearly describe the rented property, including the address and unit number if applicable. State the rental period covered by the payment to avoid misunderstandings.

Add the landlord’s signature or official stamp to authenticate the document. If issued digitally, include an electronic signature or a unique receipt number for tracking.

Legal Validity and Compliance with Indian Laws

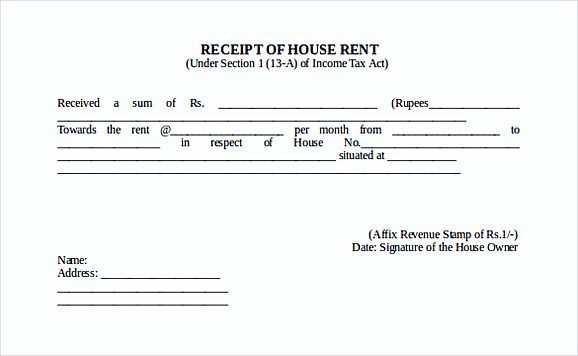

A rental receipt in India holds legal weight only if it meets key statutory requirements. The document must include essential details such as the landlord’s name, tenant’s name, property address, rental amount, payment date, and period covered. A revenue stamp is mandatory for cash payments exceeding ₹5,000 to ensure admissibility as proof of payment.

Compliance with Tax Regulations

Tenants claiming House Rent Allowance (HRA) deductions under Section 10(13A) of the Income Tax Act must submit receipts with the landlord’s PAN if annual rent exceeds ₹1,00,000. Landlords receiving rental income should report it under ‘Income from House Property’ to avoid tax discrepancies.

Stamp Duty and Legal Recognition

While a rental receipt does not require independent stamping, leases exceeding 11 months must be registered with appropriate stamp duty. Courts accept properly documented rental receipts as evidence in disputes, reinforcing the importance of accurate details and compliance with tax laws.

Digital vs. Physical Rental Receipts: Pros and Cons

Choose digital receipts for convenience and efficiency. They reduce paper waste, are easy to store, and can be retrieved instantly from cloud storage. Automated generation minimizes errors, and sharing receipts with tenants or landlords takes seconds.

Physical receipts provide tangible proof, which some prefer for legal or tax purposes. Handwritten receipts can be customized, but they require careful storage to avoid loss or damage. Printing costs and manual record-keeping add extra effort.

For a balanced approach, issue digital receipts while keeping a signed physical copy for significant transactions. This ensures accessibility and compliance with documentation requirements.