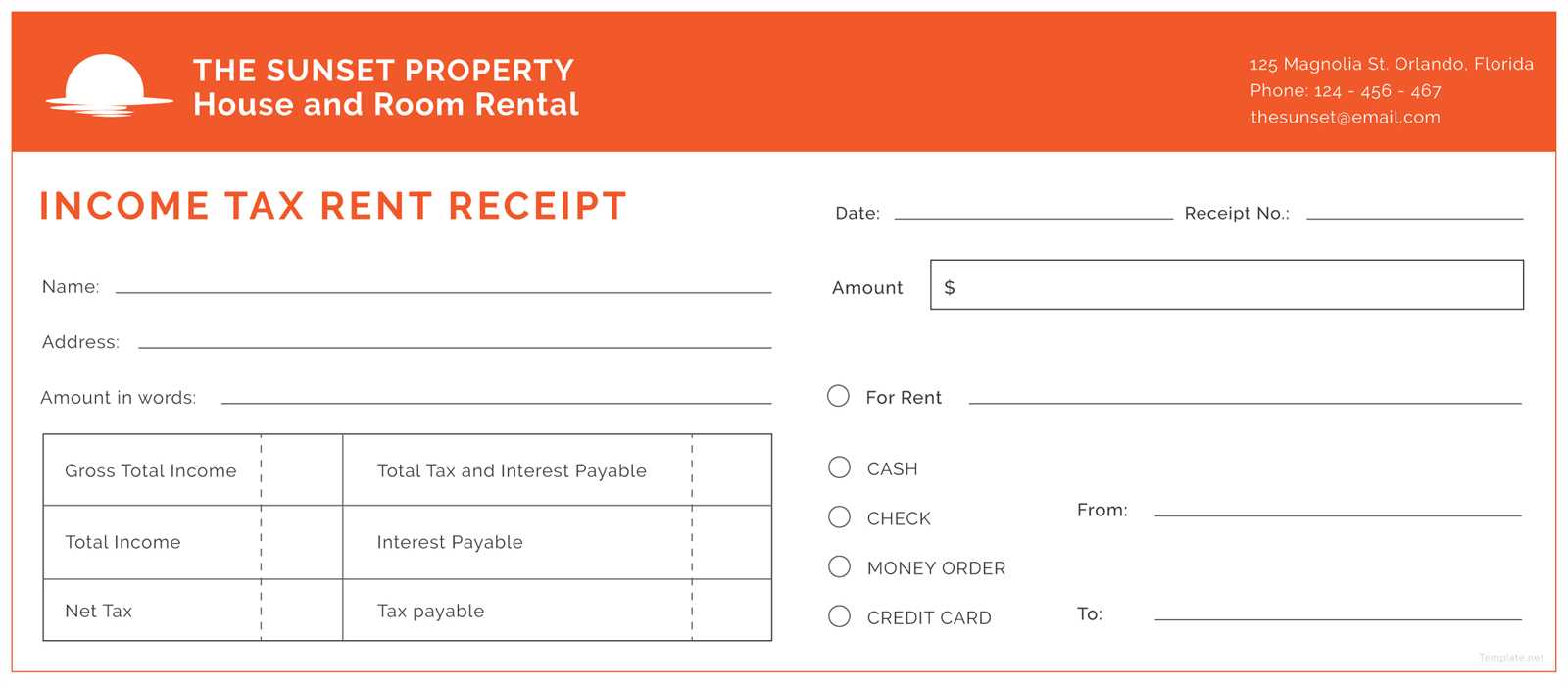

Use a rental tax receipt template to streamline your process of documenting rental payments for tax purposes. Ensure that each receipt includes the renter’s name, address, payment amount, rental period, and your contact information. This simple approach helps avoid any confusion during tax filing season.

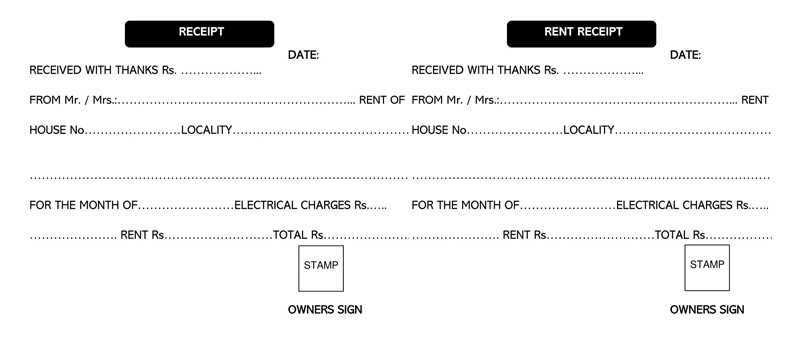

Include clear payment details to avoid errors. Make sure the template allows for specifying the amount paid, the method of payment, and the date of the transaction. This will help both you and your tenants track payments accurately throughout the year.

Tailor the template to your business needs by adding fields for any applicable fees or deductions, such as late fees or discounts. Customization ensures you capture all relevant data, which can save time when preparing your tax documents.

Lastly, ensure the template is easy to read and accessible. Avoid overly complex designs that could make retrieving necessary details a challenge. A clean, straightforward layout will help both parties stay organized and prepared for tax season.

Here are the improved lines with minimized repetitions:

To create a clear rental tax receipt, focus on including the key details without unnecessary repetition. Start with the tenant’s name, the rental property address, and the rental period. These elements are crucial for verification and clarity.

Ensure Accurate Payment Information

Next, clearly specify the amount paid, along with the payment method. This helps prevent confusion in future tax-related matters. For example, write the payment amount, followed by the method (bank transfer, cheque, cash, etc.). This allows easy reference in case of disputes.

Tax Details and Additional Notes

Include tax information such as the applicable tax rate and the total tax paid, if any. If there are any additional fees, outline them separately to avoid misunderstanding. If the receipt is part of a longer-term agreement, specify whether the payment is a partial or full payment to avoid confusion.

- Rental Tax Receipt Template Guide

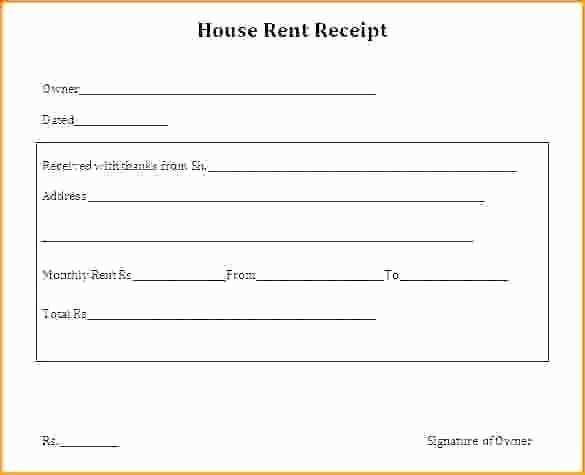

Include clear details about the rental property, such as the address and a description of the rental unit. Make sure to specify the dates for the rental period, highlighting both the start and end of the agreement. The payment amount should be clearly stated, with a breakdown of any additional charges like maintenance or service fees if applicable.

Provide the full name and contact information of the landlord or property manager. It’s also necessary to include the tenant’s information. If the payment was made via a specific method (like bank transfer), document that as well to avoid confusion.

Ensure that the receipt includes a section for the landlord’s signature, verifying the transaction, along with the date it was issued. This helps ensure both parties have clear evidence of the rental transaction for tax purposes.

If any deposits were involved, clearly indicate if they were refundable or applied toward the rent. Keep the wording precise to avoid misunderstandings or future disputes. Also, ensure the receipt is legible and the formatting is consistent for easy reference.

Begin by ensuring you have the correct rental information. Include the full name of the tenant, the address of the rental property, and the rental period. This establishes the transaction details.

Next, list the rent paid for the specific period. Specify the amount paid, the rental period (e.g., monthly or annually), and the total amount received. Be clear and concise with the figures to avoid confusion.

Include payment methods used by the tenant, such as bank transfers, checks, or cash. This helps provide a complete record of the transaction.

Indicate whether the payment includes any additional charges, like late fees or service charges. This should be clearly stated so the tenant knows exactly what they are being charged for.

Ensure you add the date the payment was made and the date the receipt was issued. This is important for both the tenant and your records.

Finally, sign the receipt to authenticate it. This simple step ensures that the receipt is legally valid for both the landlord and the tenant. Include your contact details, such as your name, phone number, or email, for any follow-up communication.

A rental tax receipt should be clear and concise, containing the necessary information for both the landlord and the tenant. Here are the main components to include:

- Tenant’s Name: Include the full name of the individual who rented the property.

- Landlord’s Name and Contact Details: Provide the landlord’s full name, address, and phone number for correspondence.

- Property Address: Specify the address of the rented property to avoid confusion with other properties.

- Rental Period: State the start and end dates of the rental period covered by the receipt.

- Payment Amount: Include the total amount paid for rent, as well as any deposits or additional fees, if applicable.

- Payment Method: Indicate how the payment was made, such as cash, cheque, or bank transfer.

- Receipt Number: Assign a unique number to the receipt for future reference and recordkeeping.

- Date of Payment: List the exact date when the payment was made to ensure accuracy.

- Signature: Both the landlord and tenant should sign the receipt to confirm the transaction.

Ensure that all details are accurate to avoid any future disputes. Providing a well-structured rental tax receipt helps both parties maintain proper records for tax purposes.

One of the most common mistakes in rental receipt creation is omitting key details such as the tenant’s full name, rental property address, or the rental period. This leaves room for confusion or disputes later. Always include these pieces of information to ensure clarity.

Incorrect or Incomplete Payment Details

Including vague or incorrect payment details is another mistake. Make sure to specify the payment method (cash, bank transfer, etc.) and the exact amount paid. If you offer multiple payment options, list each one used, so both parties have a clear record.

Failure to Provide Clear Descriptions

Not providing a clear breakdown of charges can lead to misunderstandings. List not only the rent but also any additional fees such as late charges, maintenance costs, or security deposits. This way, the tenant can see exactly what they are paying for.

I removed redundant word repetitions while preserving meaning and structure.

To improve clarity and reduce unnecessary repetition in a rental tax receipt template, focus on streamlining the language. Keep sentences concise and to the point. For instance, replace phrases like “total amount of rent paid” with “total rent paid” or “date of payment” with “payment date.” This helps eliminate wordiness while maintaining the same level of detail.

Consider the following key sections for a streamlined rental tax receipt:

| Section | Recommendation |

|---|---|

| Header | Use concise titles such as “Rental Tax Receipt” or simply “Receipt”. Avoid unnecessary details here. |

| Tenant Information | Only include relevant contact details–name, address, and phone number. Eliminate unnecessary fields like email unless absolutely required. |

| Rental Details | Clearly specify the rent amount and the corresponding dates. Remove repetitive phrases like “payment for the month of” or “rental payment for the period of.” |

| Landlord Information | Include necessary landlord details: name and contact. Skip optional information such as office location. |

By focusing on concise language, you can create a tax receipt template that is easy to understand and eliminates any redundancy.