A renters receipt template simplifies the process of documenting rental transactions. It ensures that both the landlord and the tenant have a clear record of payments made, helping to avoid misunderstandings. By using a standardized template, you can guarantee that all relevant information is included each time, ensuring consistency.

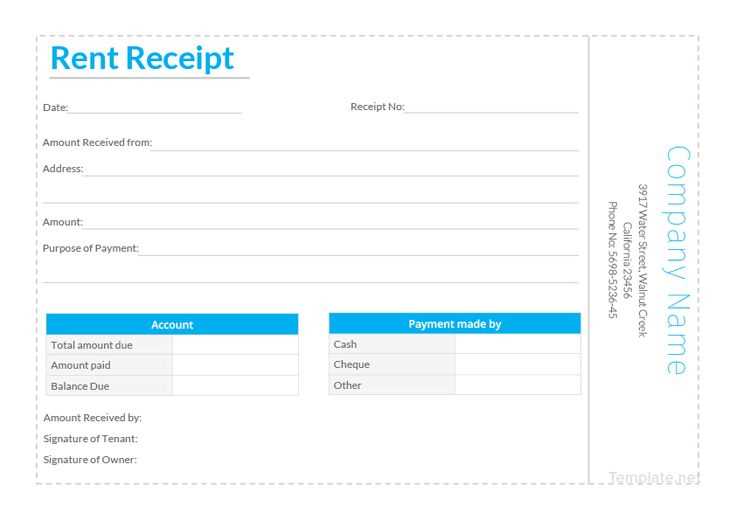

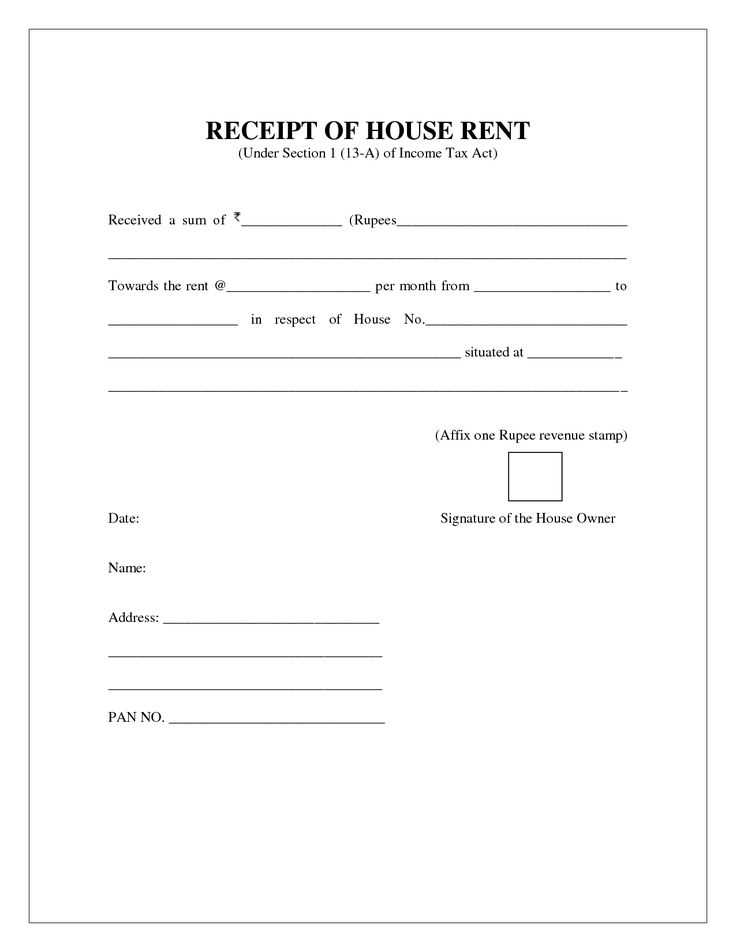

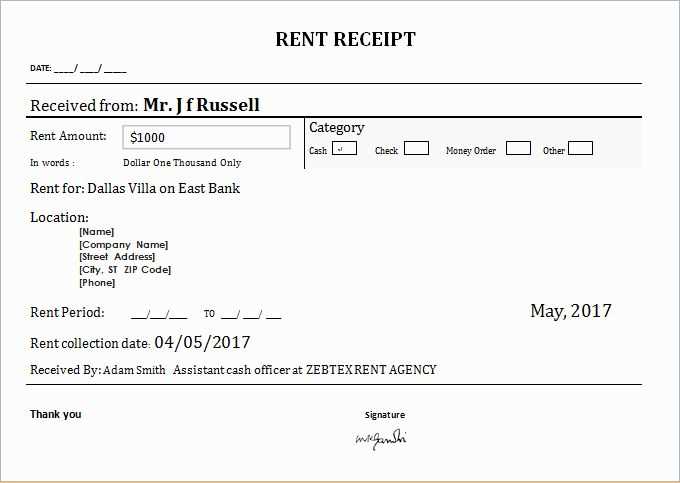

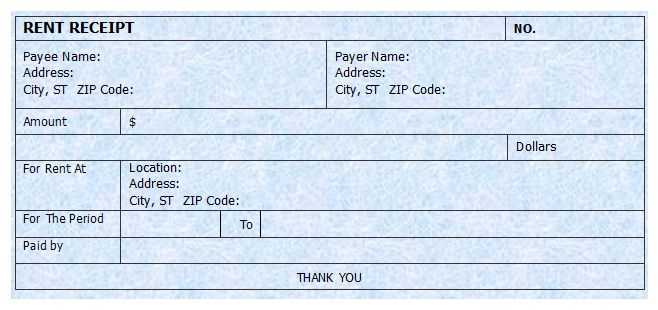

Key elements to include in a renters receipt template are the tenant’s name, the rental property’s address, the payment amount, the payment method, and the date of payment. This information provides a solid foundation for future reference and ensures the receipt serves its intended purpose–proof of payment.

To make your template more practical, consider including a unique receipt number for easy tracking, especially if multiple payments are involved over time. Additionally, providing a space for both the landlord’s signature and the tenant’s acknowledgment reinforces the authenticity of the transaction.

Using a template like this not only adds professionalism but also helps maintain clear records for both parties. This simple yet effective tool can prevent future disputes and streamline communication between landlords and tenants.

Renters Receipt Template Guide

Include the following components in your renters receipt to ensure clarity and accuracy:

Important Details

- Tenant’s Name – List the full name of the tenant paying the rent.

- Landlord’s Name – Include the full name of the landlord or property management company.

- Amount Paid – Clearly state the payment amount in both numbers and words.

- Payment Method – Specify whether the payment was made by check, cash, or another method.

- Rental Period – Indicate the time frame that the rent covers (e.g., February 2025).

- Payment Date – Mention the exact date the payment was received.

- Late Fees (if applicable) – State any additional charges if rent was paid late.

Formatting Tips

Use clear headings for each section to maintain organization. Include a space for the landlord’s signature and a statement confirming the payment is complete. A renters receipt should reflect all relevant transaction details in a straightforward and concise manner.

How to Create a Clear Rent Receipt for Your Tenants

Include the full name of both the landlord and tenant at the top of the receipt. Clearly state the rental property address and the date the rent was paid. Specify the amount paid and the payment method, such as check, cash, or bank transfer. If the rent covers a specific period, mention the start and end dates for clarity.

List any additional charges, such as late fees, parking fees, or utilities, separately from the base rent. Be transparent about any discounts or adjustments made to the payment. Clearly label these amounts and explain their origin, so tenants can easily understand their breakdown.

Make sure to include a unique receipt number for tracking purposes. This ensures both parties can reference the transaction in the future. A signature line at the bottom for both landlord and tenant provides further confirmation that the transaction was completed as agreed.

Finally, maintain a consistent format for each receipt, ensuring all details are easy to find. This reduces confusion and helps both landlord and tenant keep accurate records.

Legal Requirements for Rent Receipts in Different States

In some states, landlords are required to provide rent receipts when tenants request them, while others make it optional. For example, in California, landlords must issue a receipt if the tenant pays in cash. In contrast, Florida does not have a specific law mandating receipts for rent payments unless the tenant asks for one. Tenants in Illinois must receive a written receipt if they pay in cash, but the landlord is not obligated to provide one for payments made by check or money order unless the tenant requests it.

Some states, like New York, have clear guidelines for rent receipts, which must include the landlord’s name, the amount paid, the rental period, and the address of the rented property. In Texas, landlords must provide receipts if the tenant pays rent in cash, but this requirement doesn’t apply to other forms of payment. Meanwhile, in New Jersey, the law mandates that the receipt should specify the amount paid, the rental period, and the date of payment, but it doesn’t specify a requirement for written documentation unless the tenant pays in cash.

It’s important for both landlords and tenants to be aware of these state-specific requirements. While providing rent receipts is often a matter of good practice, knowing when it’s legally required can help avoid disputes. Landlords should also keep detailed records, especially when dealing with cash payments, to prevent misunderstandings.

How to Handle Partial Payments and Late Fees in Rent Receipts

Incorporate clear details of partial payments and late fees directly on the rent receipt. This ensures both parties are aware of any outstanding balances and the specific charges applied.

- Document Partial Payments: If the tenant pays only a portion of the rent, indicate the exact amount received, along with the remaining balance. Note the date of the partial payment for reference.

- State the Due Date: Include the original rent due date on the receipt. If the full payment hasn’t been made by that date, make sure to calculate and display any applicable late fees.

- Include Late Fee Information: If a late fee is charged, clearly state the fee amount and the reason for its application. List the date when the fee is assessed to avoid any confusion.

Keep a consistent format that separates the payment amount, remaining balance, and late fee. This reduces misunderstandings and ensures accurate record-keeping. Make sure the tenant understands how partial payments affect their account, especially if there are any recurring charges or fees.

- Example Format:

- Rent Due: $1000

- Partial Payment: $500 (Paid on 02/05/2025)

- Remaining Balance: $500

- Late Fee: $50 (Applied on 02/06/2025)

Provide a summary at the end of the receipt showing the total amount due, including any partial payments and late fees. This helps clarify any outstanding obligations for both parties.