Essential Details to Include

A well-structured rent receipt confirms payment and protects both the landlord and tenant. Include the following key details:

- Receipt Number: Assign a unique identifier for tracking.

- Landlord’s Name and Address: Ensure clarity in case of disputes.

- Tenant’s Name and Address: Match this with the rental agreement.

- Payment Date: Record the exact date funds were received.

- Rental Period: Specify the covered time frame.

- Amount Paid: Indicate the full amount received.

- Payment Method: Cash, check, bank transfer, or other.

- Landlord’s Signature: Validate the receipt with an official signature.

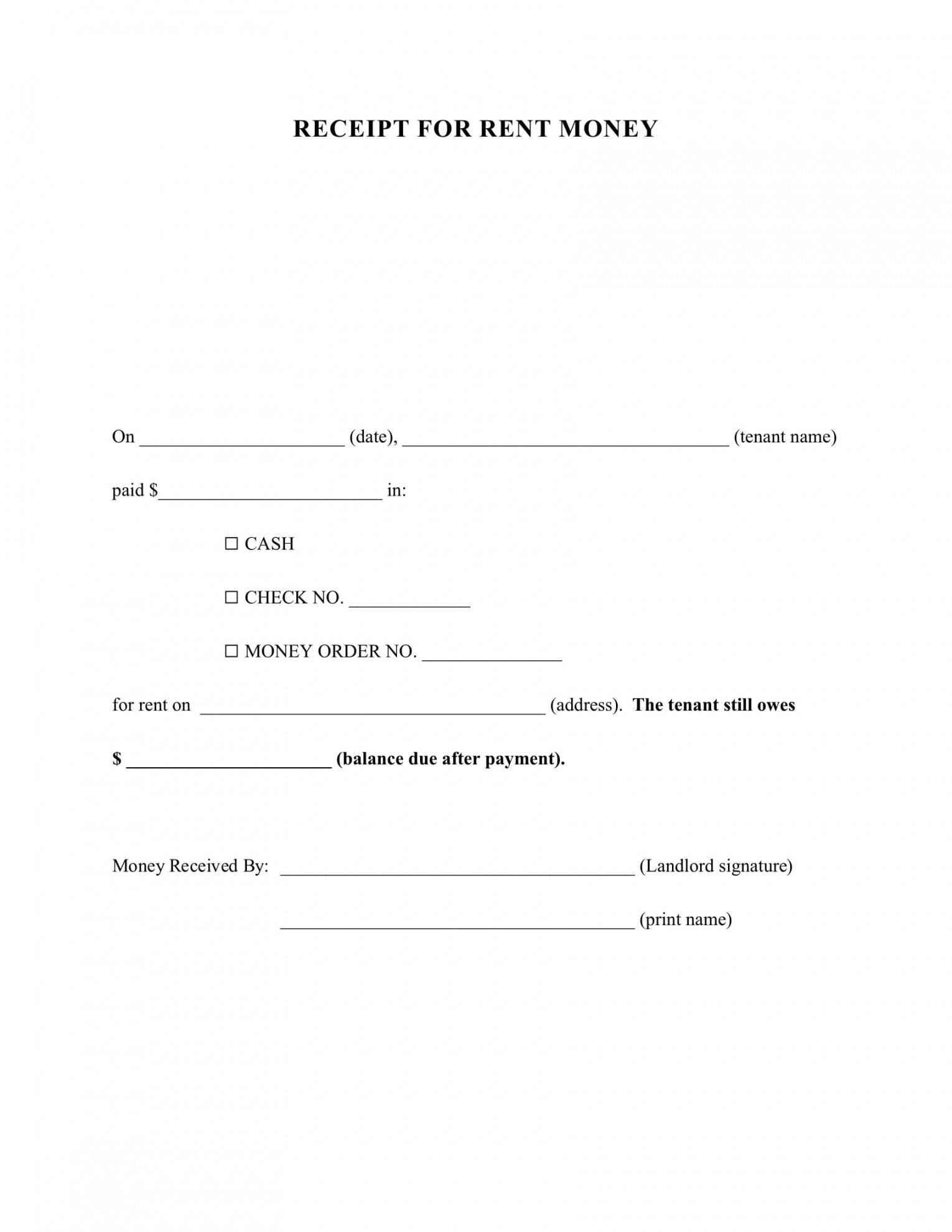

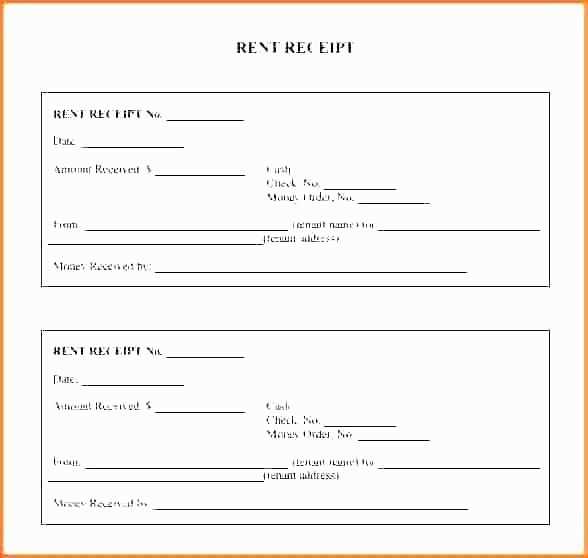

Simple Rent Receipt Template

Use this structure for a straightforward and professional document:

RENT RECEIPT Receipt No: [Unique Number] Date: [MM/DD/YYYY] Received from: [Tenant’s Full Name] Tenant Address: [Full Address] Amount Paid: $[Amount] Payment Method: [Cash/Check/Bank Transfer] Rental Period: [MM/DD/YYYY] to [MM/DD/YYYY] Landlord Name: [Full Name] Landlord Address: [Full Address] Signature: ___________________

Best Practices

Provide a copy to the tenant and keep a record for tax or legal purposes. If payments are digital, generate receipts using accounting software for convenience and accuracy.

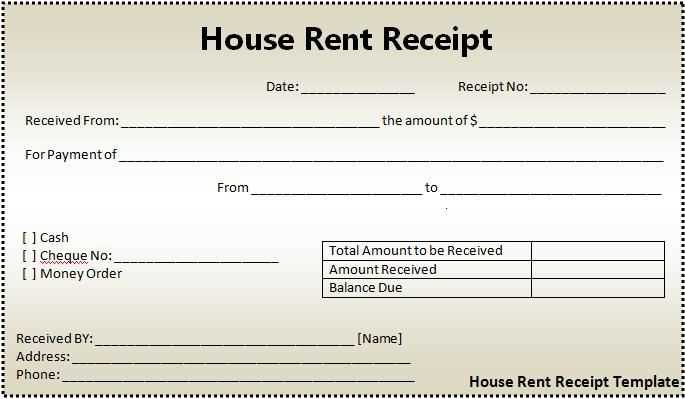

Template for Money Lease Receipt

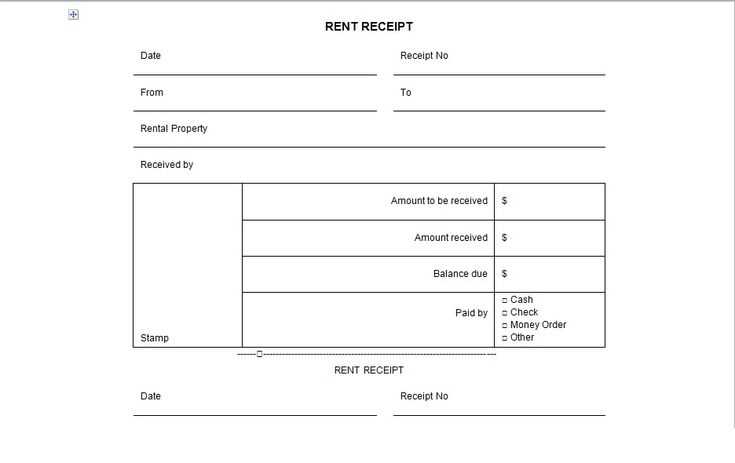

Key Elements to Include in a Rental Payment Template

How to Format a Lease Receipt for Legal and Tax Purposes

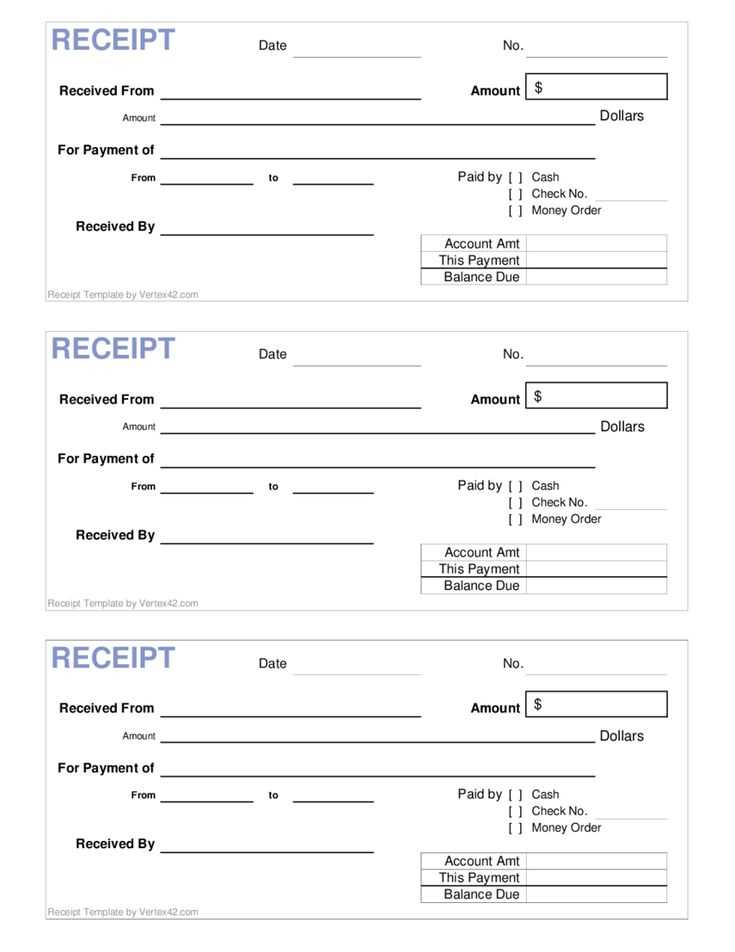

Printable and Digital Payment Confirmation Options for Landlords

Key Information Every Rental Payment Receipt Should Contain

Include the landlord’s full name and contact details, the tenant’s name, and the rental property address. Specify the payment date, amount, and method used. Clearly state the rental period covered and any additional charges or credits applied. Conclude with a signature section for authentication.

Legal and Tax Compliance in Lease Receipts

Ensure the document includes a unique receipt number for tracking. Use clear, professional language and structure to avoid misinterpretation. If applicable, include tax-related details, such as VAT or income tax considerations, depending on local regulations. Keep a digital or printed copy for accurate financial records.

For landlords managing multiple tenants, digital templates with automated numbering and built-in calculation features simplify record-keeping. Printable versions remain useful for immediate, in-person transactions, ensuring both parties receive a documented confirmation of payment.