For anyone managing rental properties, providing a rent receipt is a quick yet effective way to document payments. A well-organized rent receipt template helps both landlords and tenants maintain clear records. This can be especially helpful in case of disputes or when preparing for tax filings.

When creating a rent receipt template, include the date, tenant’s name, property address, amount paid, payment method, and the period covered. A clear breakdown ensures both parties are on the same page. You can also consider adding the landlord’s contact information for future correspondence.

Ensure the template is simple and easy to customize. The goal is to provide all the necessary details without making the document overly complicated. Use a format that both the landlord and tenant can easily understand, and keep the receipts organized for future reference.

Here’s the corrected version:

Ensure the rent receipt includes the date of payment and the exact amount paid. Clearly list the landlord’s name, address, and contact details. Specify the rental period covered by the payment, and provide a reference number for easy tracking.

Key Elements to Include

For clarity, include the property address. Mention the payment method (e.g., bank transfer, check). If applicable, note any deductions or extra charges, such as late fees or maintenance costs.

Final Details

Conclude with both parties’ signatures and the date. This confirms that both the tenant and landlord acknowledge the receipt of payment. Keep a copy for your records for future reference.

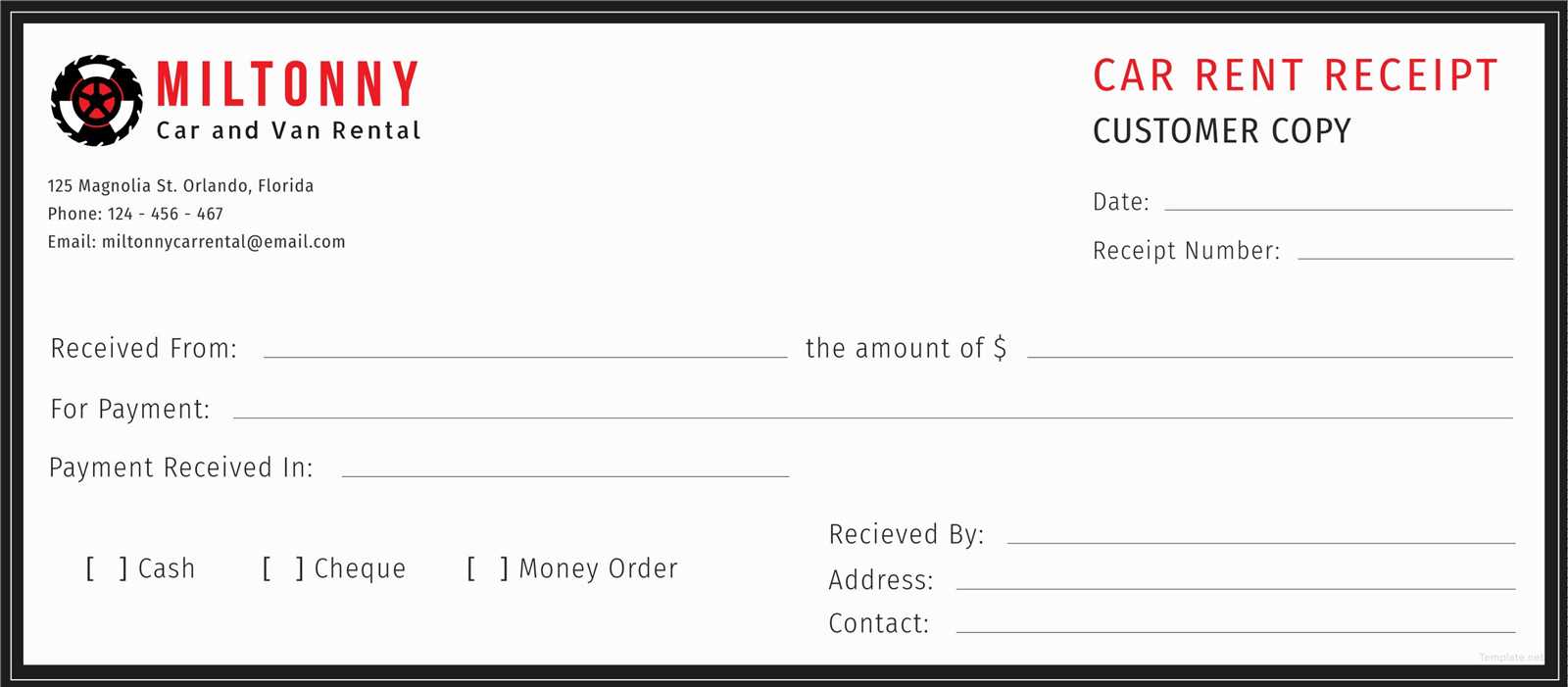

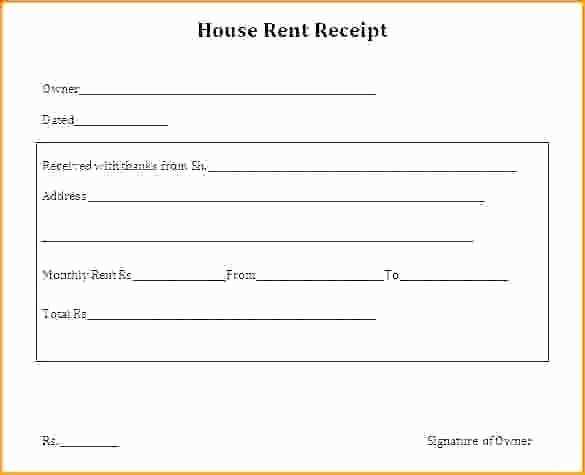

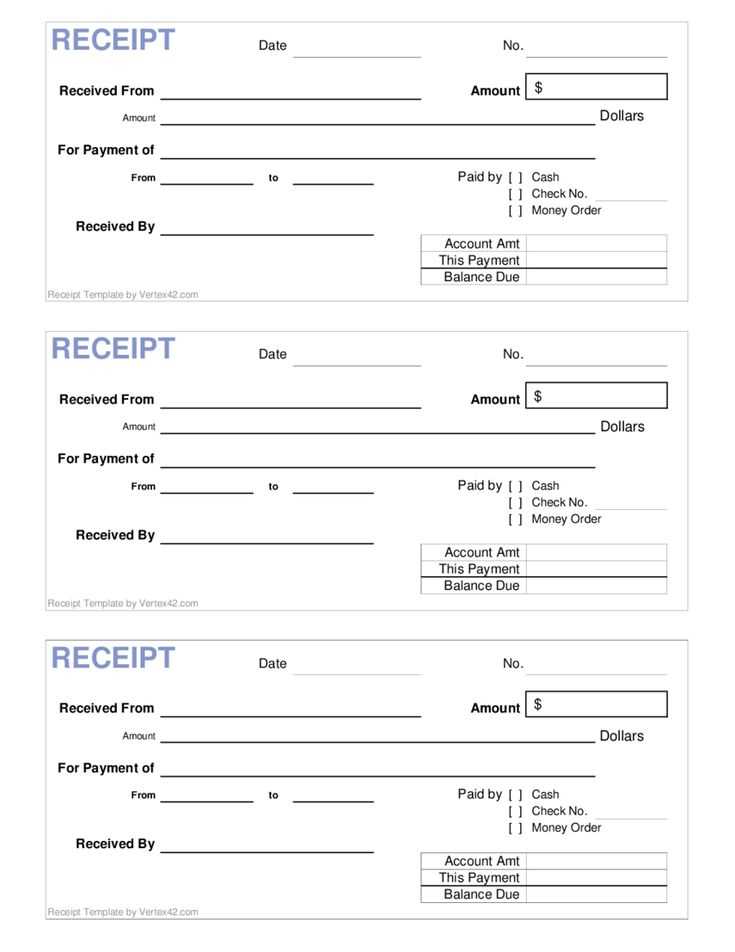

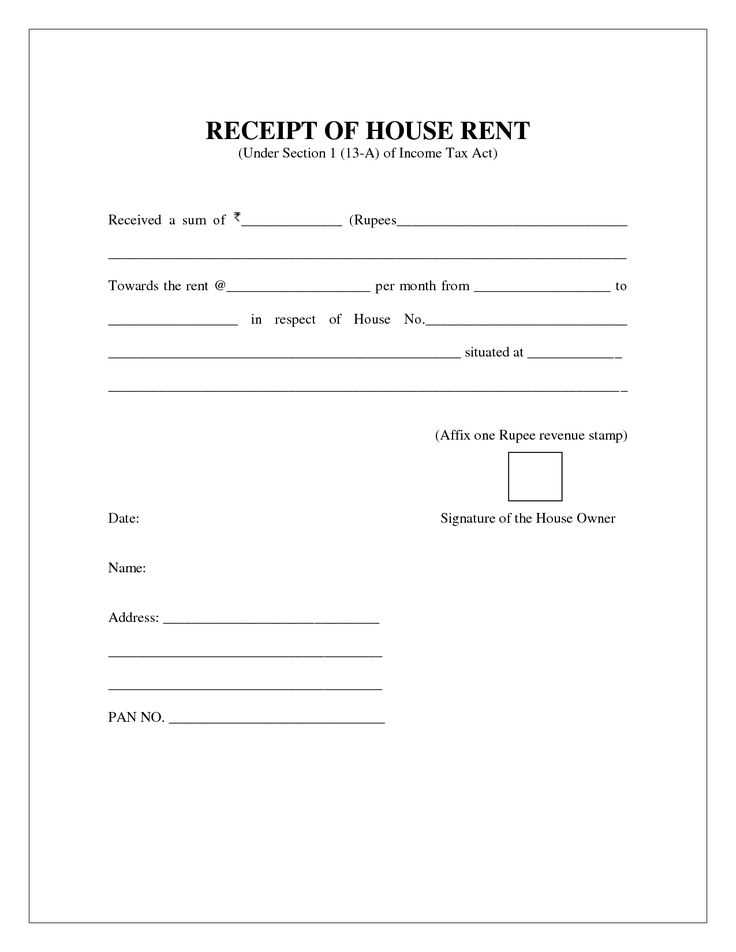

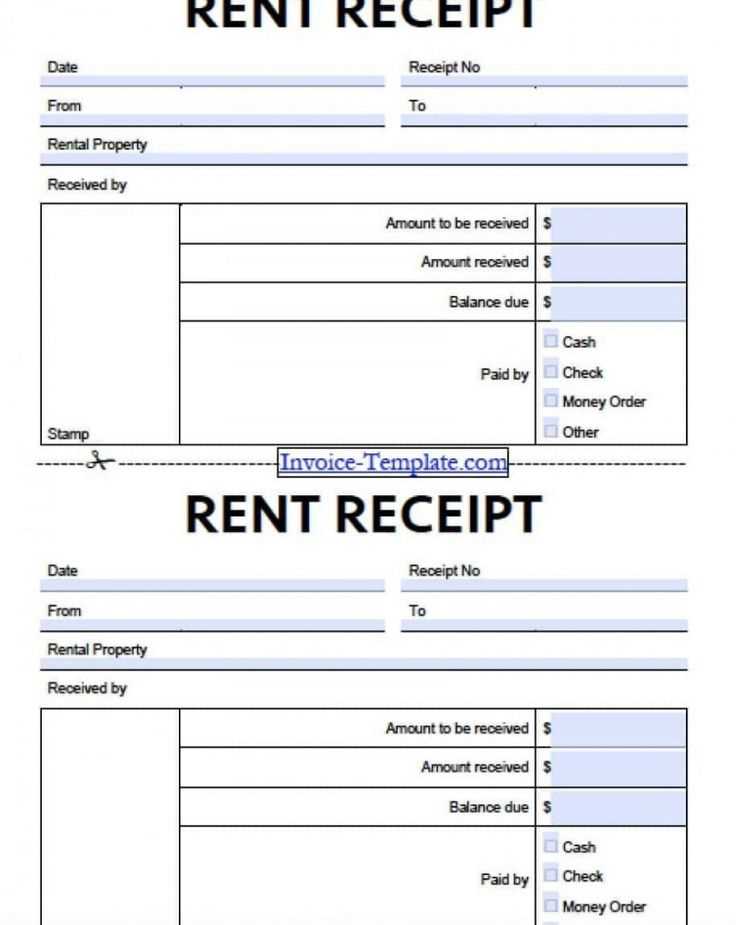

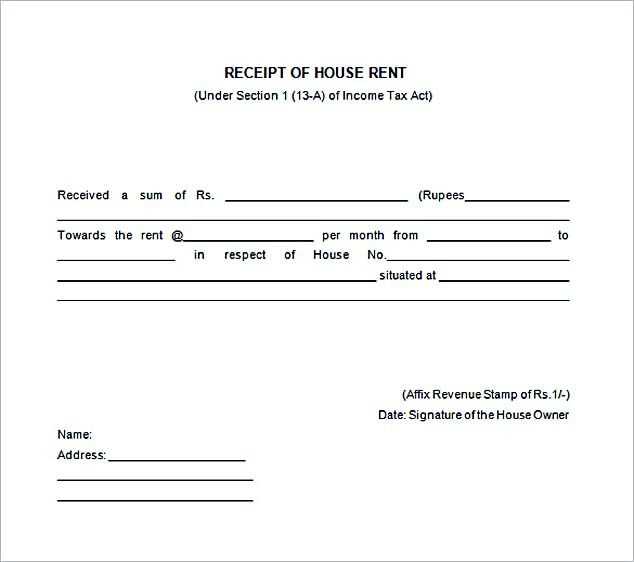

Template of Rent Payment Receipt

To create a rent receipt, ensure the following key elements are included: the landlord’s and tenant’s full names, the rental property’s address, the payment amount, the date of payment, the payment method, and the rental period covered by the payment. This ensures clarity and accountability for both parties involved.

Key Elements of a Rent Receipt Template

The rent receipt template should contain:

- Landlord and Tenant Information: Full names and contact details of both parties.

- Property Details: The address of the rental property.

- Payment Details: The exact amount paid, the payment method (cash, cheque, etc.), and the payment date.

- Rental Period: The time period that the payment covers, such as the month or week.

- Receipt Number: A unique identification number for record-keeping purposes.

- Signature: The signature of the landlord or the authorized person issuing the receipt.

How to Format and Structure a Rental Receipt for Legal Purposes

For legal clarity, make sure to format the rent receipt clearly, ensuring all the necessary details are easy to read. The information should be structured in a logical order: start with the landlord and tenant details, followed by payment specifics, and end with the signature. This structure helps avoid any confusion or disputes in the future. You should also make sure that a duplicate copy is provided to the tenant for their records.

Additionally, include a statement on the receipt confirming that the payment has been received in full for the specified rental period. This provides both parties with a record that can be referred to in case of disagreements or future legal proceedings.

Common Errors to Avoid When Issuing Rent Receipts

Avoid these common mistakes to ensure your rent receipts are accurate and legally sound:

- Incomplete Information: Missing tenant or property details can create confusion. Always double-check all fields.

- Incorrect Amounts: Ensure the payment amount is accurate and matches what was agreed upon.

- Failure to Issue a Receipt: Always provide a receipt for any payment made, regardless of the method.

- Not Including a Payment Date: A rent receipt without a date is incomplete and might be questioned in legal disputes.