If you need a template for a rent receipt, it’s simple to create a document that covers all the necessary information. A rent receipt serves as proof of payment for tenants and should clearly list the amount paid, the date, and the details of the landlord or property manager. Use a template to save time and ensure consistency across all receipts.

Start by including the tenant’s name, the address of the rental property, and the date of payment. It’s important to specify the rental period the payment covers, as this helps avoid confusion later. Don’t forget to state the payment amount and any applicable late fees if necessary.

Next, consider adding a space for the landlord or property manager’s signature to confirm receipt of payment. This adds a layer of professionalism and ensures both parties have a record of the transaction. A clean and straightforward format is key–avoid clutter and keep the template easy to read for both tenant and landlord.

Here are the revised lines where repetitive words have been reduced while maintaining the meaning:

Ensure clarity in your template by using concise language. Instead of repeating “rent receipt” in every line, use synonyms or reference it more succinctly. For example, “This document serves as a confirmation of payment for rent” can be shortened to “This receipt confirms rent payment.” This maintains the message while avoiding redundancy.

Streamline Phrasing for Better Flow

In some cases, using phrases like “proof of payment” or “payment record” can replace repetitive terms, making the document easier to read. This also helps to keep the focus on the core details without overloading the reader with unnecessary repetition.

Maintain Formality with Fewer Words

Avoid using overly complex structures. For example, “The rent payment has been successfully completed” can be simplified to “Rent payment completed.” This makes your template clearer while preserving the necessary formal tone.

- Template for Rent Receipt Guide

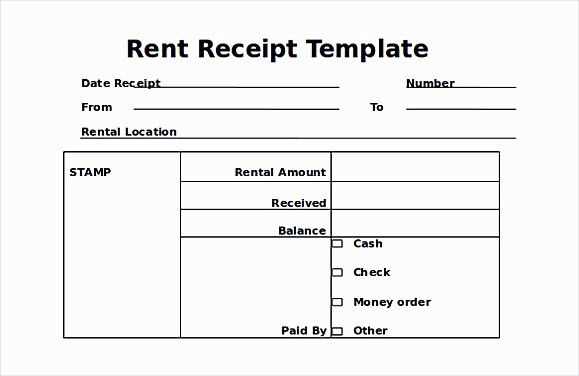

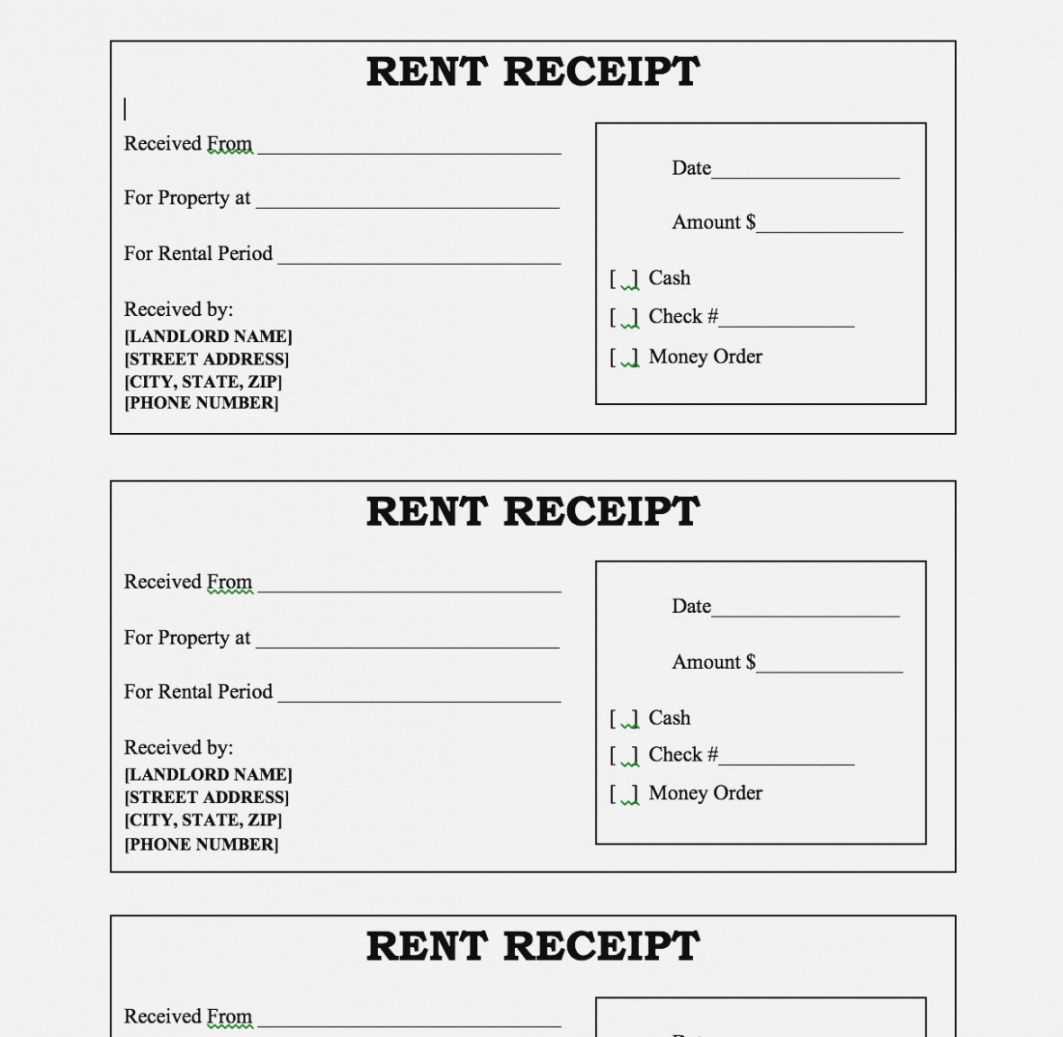

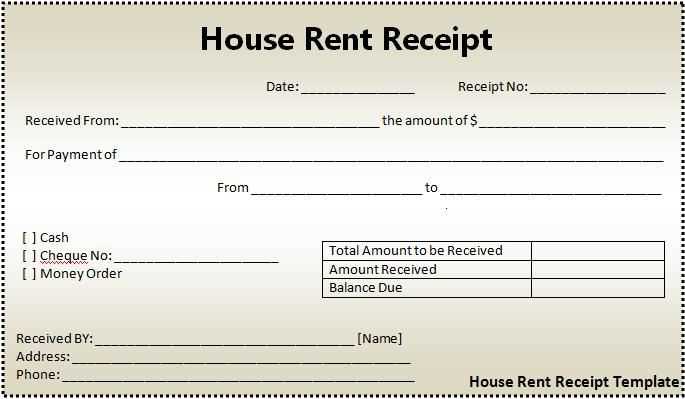

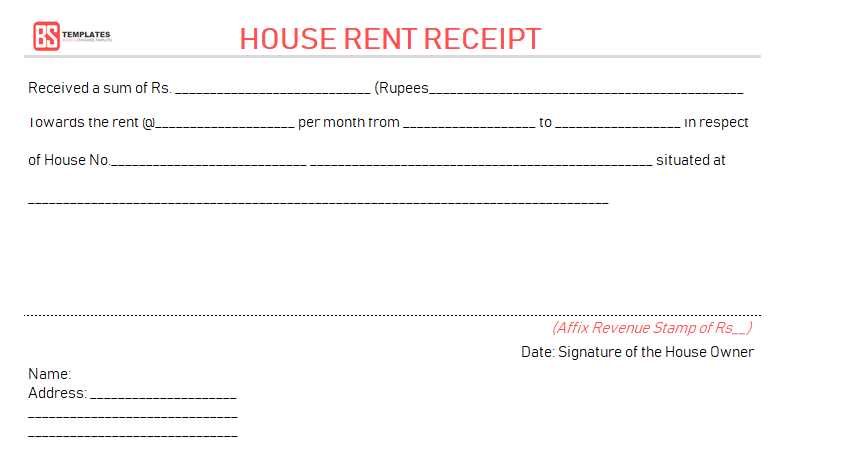

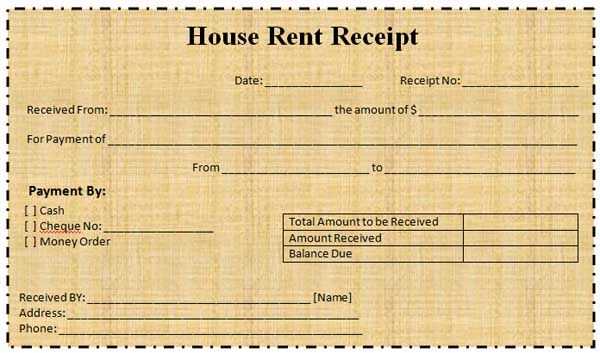

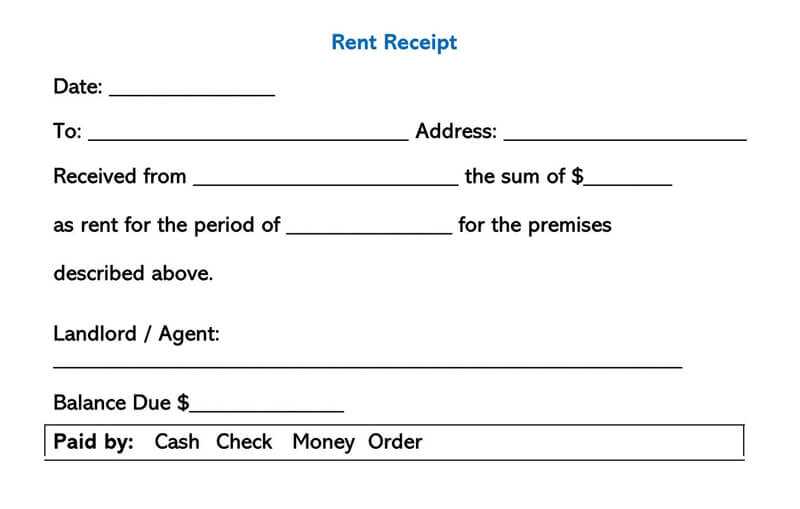

A rent receipt template should contain the necessary details to confirm that a rent payment has been made. The key information includes the tenant’s name, the rental property address, payment amount, and the date of payment.

Start by clearly stating the tenant’s name and the address of the rented property. These two elements ensure both parties know exactly which rental agreement is being referenced. Specify the payment amount received and payment date to avoid confusion. For added clarity, you can include the payment method (e.g., cash, bank transfer) to confirm how the payment was made.

Include a receipt number or reference number for record-keeping. This can be helpful in case of disputes or future inquiries. If the tenant has paid for a specific period (e.g., monthly rent), note the rental period covered by the payment.

Lastly, add a section for both parties to sign. This confirms the details of the transaction and acknowledges that the payment has been received and recorded accurately.

By using a well-structured template, both the landlord and tenant can keep clear records of rent payments and maintain transparency in their relationship.

A rent receipt should clearly present the following key details:

- Landlord’s Name and Contact Information: Include the full name of the landlord or property management company, along with their phone number or email address.

- Tenant’s Name: The full name of the tenant who made the payment should be listed.

- Amount Paid: Clearly state the exact amount of rent paid, including any additional charges like late fees or utilities.

- Date of Payment: The date when the payment was received must be included, ensuring it matches the rental period.

- Payment Method: Specify how the payment was made, such as cash, check, bank transfer, or online payment.

- Rental Period: Mention the start and end dates of the rental period for which the payment is being made.

- Property Address: Include the address of the rental property to clarify what the payment is for.

- Receipt Number: Numbering receipts is helpful for record-keeping purposes. Include a unique identifier for each receipt.

Additional Information

- Late Fees: If applicable, list any late fees separately from the rent amount.

- Signature: Some receipts may include a space for the landlord’s or property manager’s signature to authenticate the transaction.

To make your rent receipt template easy to use, begin by including basic details like the tenant’s name, property address, and rental period. These are necessary for clarity and reference. Next, structure the receipt in a clean, organized layout. Use clear labels for each section, such as “Date of Payment,” “Amount Paid,” and “Payment Method.” This helps anyone reviewing the receipt find information quickly.

Include a distinct area for both the landlord’s and tenant’s signatures. This validates the transaction and avoids confusion. Make sure that the payment details, such as the amount and date, are highlighted and easy to identify. This way, both parties can quickly verify that the payment has been processed correctly.

Incorporate a section that specifies the payment method, whether it’s cash, check, or another form. If the payment is made via a bank transfer or online, consider adding a transaction number or reference for added security.

Finally, consider adding a section for any adjustments or late fees. This gives transparency to the transaction and prevents disputes. Keep the format simple and easy to read, avoiding clutter that could complicate the process.

Ensure the rent amount is accurately listed. Mistakes in the figure can lead to confusion or disputes between the landlord and tenant. Double-check the rent amount and confirm it matches what was agreed upon in the lease or rental agreement.

Incorrect Date Entries

Always verify the rental period and ensure the correct date is mentioned. Mixing up dates can cause legal complications or issues with accounting records. Include both the payment date and the period the rent covers (e.g., from January 1st to January 31st).

Missing or Incorrect Payment Method

Clearly state the method of payment, whether it’s cash, check, or online transfer. Leaving this information out or recording it incorrectly can make it harder to track payments, especially when multiple methods are used.

Failure to include all required details, like the tenant’s full name, address of the rented property, and the landlord’s contact information, is another common issue. These details help confirm the transaction and make the receipt more reliable.

Lastly, don’t forget to provide a signature or other form of verification. A rent receipt should be a legally valid document, and omitting this could make it less authoritative in case of a dispute.

In many regions, rent receipts serve as critical documentation for both landlords and tenants. These receipts often have legal significance, confirming payment and outlining the terms of the rental agreement. In some areas, it is mandatory for landlords to issue receipts, while in others, it is only recommended. Be sure to follow the regional guidelines for creating and maintaining accurate receipts. This protects both parties from potential disputes.

North America

In the United States and Canada, rent receipts are typically required by tenants for tax purposes, particularly when they claim rental deductions. Many states and provinces mandate that landlords provide receipts upon request, and some areas even require the landlord to provide them automatically for payments made in cash. Digital receipts are increasingly accepted, but paper receipts still hold legal weight in many jurisdictions. Ensure that the receipt includes all relevant details: the amount paid, date of payment, and the rental period covered.

Europe

In Europe, regulations surrounding rent receipts vary by country. In the UK, landlords are encouraged to provide receipts, especially for cash transactions, as they are crucial for tenant protection. Meanwhile, countries like Germany have stringent rules about written contracts and rent receipts, requiring formal documentation for each payment. In France, tenants are entitled to receive a receipt after every rent payment, which can be used in case of legal disputes or tax matters. It’s important to verify local rules to ensure compliance with regional laws regarding rent receipts.

Modify rent receipt templates to reflect the specifics of each lease agreement. For example, for a short-term rental agreement, include details like the rental period and payment frequency, ensuring clarity on dates and amounts. In contrast, long-term leases should highlight payment due dates, monthly amounts, and any security deposits.

For commercial leases, consider adding business-related terms such as property maintenance or insurance payments. Specify any special provisions, like escalations, which may affect the rent amount. Customizing templates with such details ensures accuracy and avoids misunderstandings between landlords and tenants.

Additionally, tailor your template to accommodate specific tenant or property information, including names, addresses, and unit numbers. This makes the receipt uniquely identifiable and useful for both parties. Always check for compliance with local laws, which may require certain details to be included on receipts, such as the payment method or tax information.

Each lease type benefits from these adjustments, allowing both landlords and tenants to stay organized and clear about their financial transactions.

Distributing rent receipts efficiently is key to maintaining clear communication and trust with both tenants and property owners. The most straightforward method is to use a reliable system, such as email or printed receipts, depending on preferences and legal requirements.

Electronic Distribution

Sending rent receipts via email allows quick delivery and easy record-keeping. It’s an environmentally friendly option and provides an instant proof of payment. Be sure to include key details such as the tenant’s name, rental period, amount paid, and payment method in the receipt to ensure it serves its purpose. Attach the receipt as a PDF file to maintain a formal record.

Printed Receipts

For those who prefer hard copies, you can print receipts on official letterhead or a designated receipt template. This method is often used for tenants who do not have access to email or when physical documentation is required. Deliver printed receipts in person or mail them to the tenant’s address.

| Method | Pros | Cons |

|---|---|---|

| Fast, Eco-friendly, Easy to store | Requires tenant’s email, potential tech issues | |

| Printed | Physical proof, Suitable for non-tech-savvy tenants | Time-consuming, Paper waste |

For property owners, receiving rent receipts from tenants can be handled similarly, either by email or physical mail. Ensure that both parties maintain clear records for tax purposes and future reference. A systemized approach to distribution helps keep transactions transparent and organized.

To create a rent receipt template, ensure it includes all necessary details for clarity and legal purposes. Begin by clearly labeling the document as a “Rent Receipt” at the top, followed by the tenant’s name, address, and rental period. Below is a quick guide for constructing the template:

- Date of Payment: Always record the exact date when the payment was made. This ensures accuracy in case of any disputes.

- Tenant Information: Include the full name of the tenant, the address of the rented property, and their contact details.

- Landlord Information: Provide the landlord’s full name, contact number, and address. This helps maintain transparency.

- Payment Amount: Specify the total rent amount paid. If partial payments were made, note each individual payment along with its date.

- Payment Method: Include how the payment was made, whether by check, bank transfer, or cash.

- Receipt Number: Assign a unique receipt number to each payment for easy record-keeping and future reference.

- Signature: Have both the landlord and tenant sign the receipt to confirm that the payment was received.

Sample Template

- Receipt Number: 001

- Tenant Name: John Doe

- Property Address: 123 Main St, Apartment 4B

- Payment Date: February 5, 2025

- Amount Paid: $1,200.00

- Payment Method: Bank Transfer

- Landlord Signature: ____________________

- Tenant Signature: ____________________

Additional Notes

- Ensure that the rent receipt is printed or saved digitally for future reference.

- Consider keeping a copy for your own records and providing one to the tenant immediately.