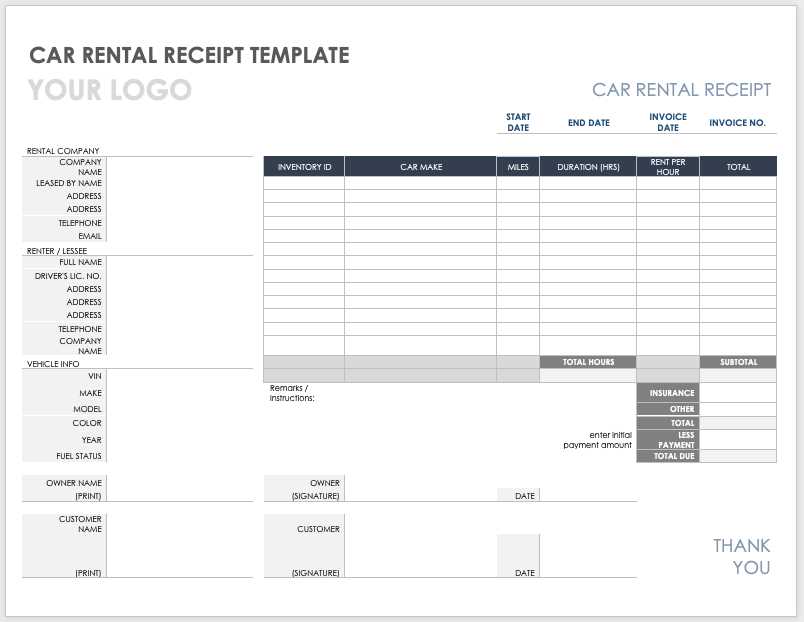

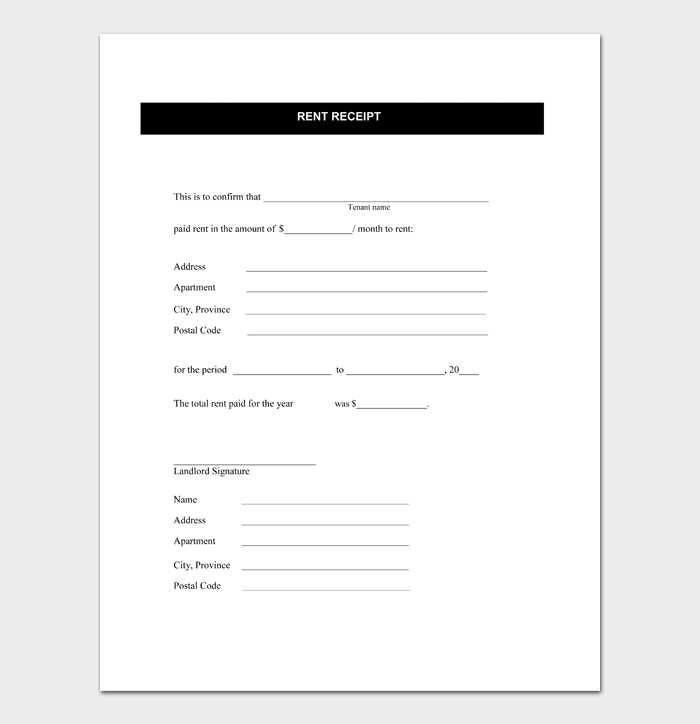

Creating a truck rental receipt template is a straightforward task when you focus on the key details. Begin by including the rental company’s name and contact information. This establishes the business identity and helps customers easily reach out if needed. Alongside this, list the customer’s details, including their full name, address, and contact number, ensuring clear identification for both parties.

Next, include a clear breakdown of the rental period, specifying the start and end dates of the truck rental. This ensures that both parties agree on the time frame for the vehicle’s use. Follow up with the rental rate per day or hour, making sure to list any discounts or additional fees that apply, such as insurance or fuel charges. This transparency avoids confusion during the transaction.

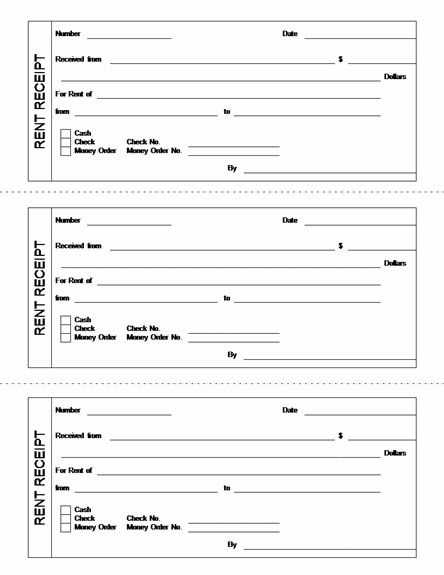

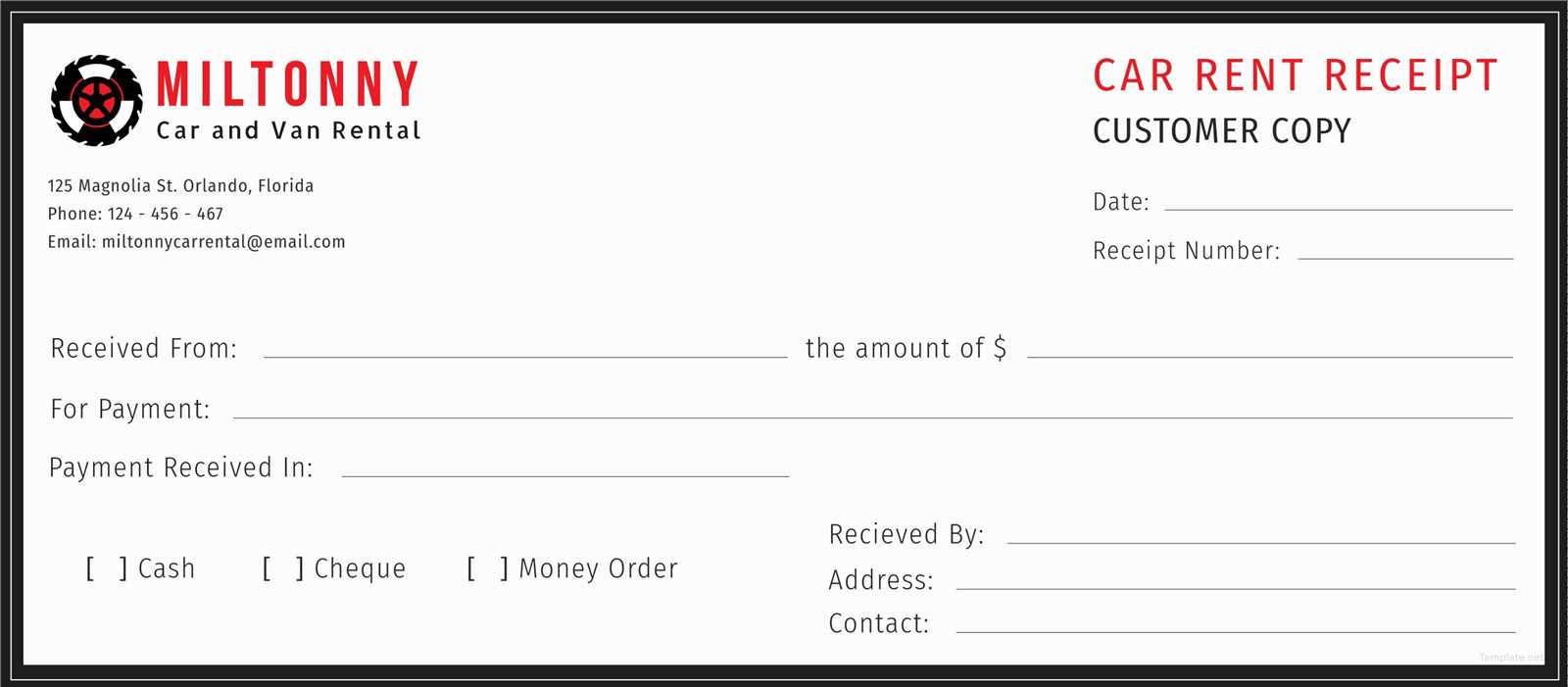

Lastly, make space for a section that outlines payment details and method of payment, whether it’s via cash, credit card, or another option. Include a line for the signature of both parties, confirming that all terms are agreed upon. A well-structured template can save time, ensuring that all vital points are covered in a professional and organized manner.

Truck Rental Receipt Template

A well-structured truck rental receipt should include all essential details to ensure clarity for both parties. List the rental company’s name, address, and contact information at the top. Below, include the renter’s details, ensuring accuracy in the name, phone number, and billing address.

Key Information to Include

- Rental Details: Specify the truck type, license plate number, and rental duration.

- Cost Breakdown: List the base rental fee, taxes, mileage charges, fuel costs, and any additional fees.

- Payment Details: Indicate the total amount paid, payment method, and any outstanding balance.

- Terms and Conditions: Highlight key policies, such as late return fees and fuel requirements.

- Signatures: Provide space for both the renter and the rental company’s representative to sign.

Optimizing Your Receipt Format

Use a clear, structured layout with bold headings for easy readability. A digital format with automated calculations reduces errors and improves efficiency. If issuing paper receipts, ensure legibility by using a standardized template with pre-defined fields.

How to Structure Key Information in a Truck Rental Receipt

Company and Renter Details: Clearly list the rental company’s name, address, and contact details at the top. Include the renter’s full name, phone number, and billing address to ensure proper record-keeping.

Rental Period: Specify the exact pickup and return dates and times. If the rental includes an hourly rate option, note the start and end times to prevent disputes.

Vehicle Information: Include the truck’s make, model, year, and license plate number. If applicable, add the vehicle identification number (VIN) for additional verification.

Pricing Breakdown: Outline the base rental rate, additional mileage charges, fuel policy fees, insurance costs, and any deposits or surcharges. List each charge separately to provide full transparency.

Payment Details: Record the total amount paid, the payment method (credit card, cash, or check), and any remaining balance. If a security deposit applies, specify the conditions for its refund.

Terms and Conditions: Summarize key policies, including mileage limits, late return penalties, fuel requirements, and liability coverage. Keep this section concise but clear.

Signatures: Include signature fields for both the renter and a company representative. A signed receipt confirms agreement to the terms and prevents future misunderstandings.

What to Include for Accurate Financial Tracking in Your Receipt

Include a unique receipt number to ensure easy reference and prevent duplication. Assign sequential or structured numbers that align with your internal tracking system.

Detailed Rental Information

Specify the rental period, vehicle type, and mileage limitations. If additional fees apply for extra mileage or late returns, break them down clearly.

Payment Breakdown

List the base rental rate, taxes, insurance, and any optional services. Show the total amount paid and the outstanding balance, if applicable. Indicate the payment method for reconciliation.

Include company details such as name, contact information, and tax identification number. If required, add the renter’s information for accurate record-keeping.

Use a timestamp showing the exact date and time of the transaction. This helps track financial flow and resolve potential disputes efficiently.

Legal and Regulatory Considerations for Truck Rental Receipts

A truck rental receipt must comply with tax regulations, consumer protection laws, and contract requirements. Ensure all required details are included to avoid disputes and legal issues.

Mandatory Information

- Business Identification: The receipt must display the rental company’s legal name, address, and tax ID.

- Transaction Details: Date, time, and location of rental pickup and return must be clearly stated.

- Payment Breakdown: Itemized charges, including rental fees, insurance, deposits, and taxes, must be transparent.

- Customer Information: The name and contact details of the renter must be included for accountability.

- Terms and Conditions: Late return fees, damage liabilities, and mileage limits should be outlined.

Compliance with Tax Regulations

Receipts must reflect applicable sales taxes and surcharges based on local laws. If a business rents trucks frequently, proper documentation ensures deductible expenses and avoids penalties.

- Tax Identification: Include the tax registration number for VAT, GST, or local levies.

- Separate Tax Lines: Clearly list taxes applied to the rental cost to meet reporting requirements.

Failure to meet these requirements can result in fines or rejected claims during audits. Always verify compliance with local tax authorities.