If you’re a landlord or a tenant, it’s important to keep clear records of rental transactions. A written rent receipt serves as proof of payment and can protect both parties in case of disputes. To create an effective rent receipt, include the essential details of the transaction to avoid confusion.

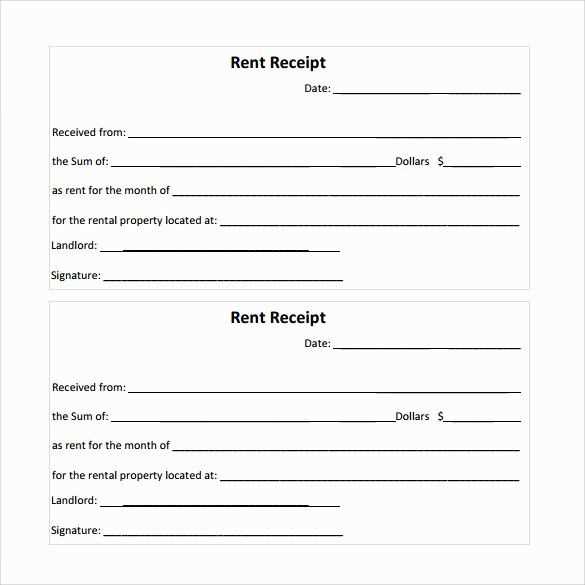

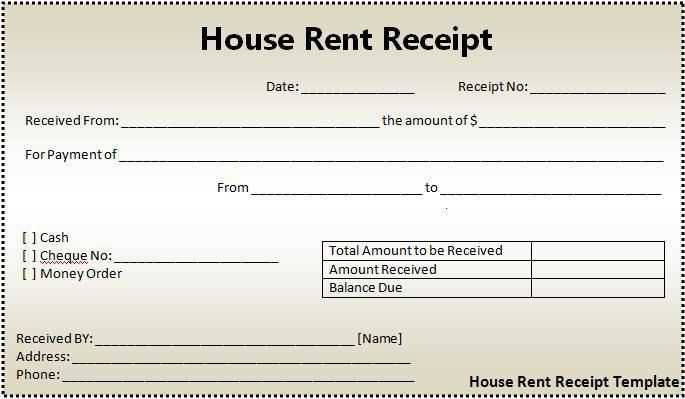

Start by listing the tenant’s name, the landlord’s name, and the rental property address. Include the date of payment and the amount received. If applicable, note any late fees or adjustments made to the rent amount. It’s also helpful to specify the payment method, such as cash, check, or bank transfer, for further clarity.

Ensure that the receipt is signed by the landlord or authorized agent. This signature adds authenticity and serves as confirmation of the transaction. If you want to go a step further, consider including a space for the tenant’s signature as well, confirming that they acknowledge the payment has been made.

Having a clear and organized rent receipt template not only benefits record-keeping but also helps maintain trust between tenants and landlords. Make sure your template includes all the necessary information and is easy to understand for all parties involved.

Here’s a detailed plan for an article on the topic “Written Rent Receipt Template” in HTML format with six practical and specific headings:

Start by providing a concise and clear explanation of the importance of a written rent receipt. Include its role in protecting both the landlord and tenant, especially in cases of disputes or tax purposes. Emphasize the need for clarity and accuracy in the document.

1. Key Components of a Rent Receipt

Outline the specific elements that should be included in any rent receipt. Mention the tenant’s name, landlord’s name, property address, payment amount, date of payment, and the rental period. Ensure that all fields are clearly labeled for easy understanding.

2. Formatting Tips for Clarity

Provide guidelines for structuring the document. Suggest using a simple layout with clearly defined sections. Advise using readable fonts, appropriate spacing, and alignment to make the receipt easy to read and professional in appearance.

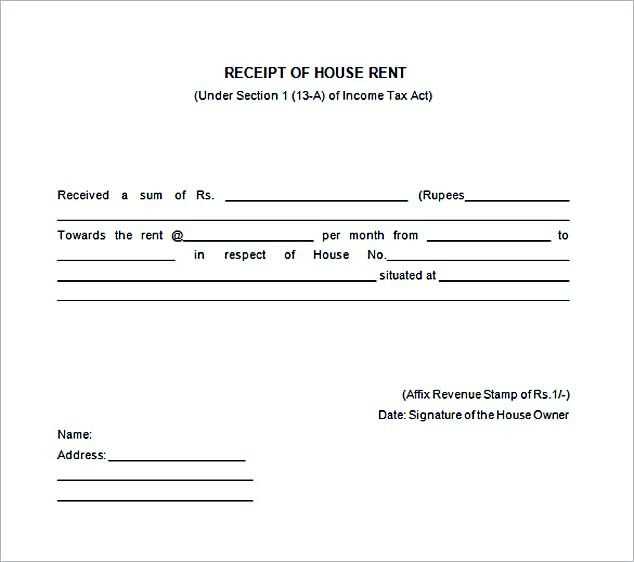

3. Legal Considerations for Rent Receipts

Explain the legal significance of a rent receipt, especially in regions where it is required for tax documentation. Clarify whether a receipt is mandatory by law and how it can serve as proof of payment if legal issues arise.

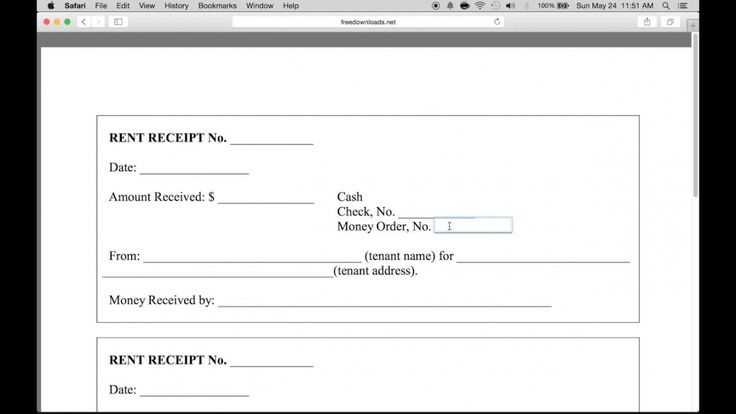

4. Digital vs. Paper Rent Receipts

Discuss the advantages of digital receipts, such as ease of storage and accessibility. Mention the pros and cons of paper receipts and when a physical copy may be necessary. Provide options for both types, ensuring tenants and landlords can choose based on their preferences.

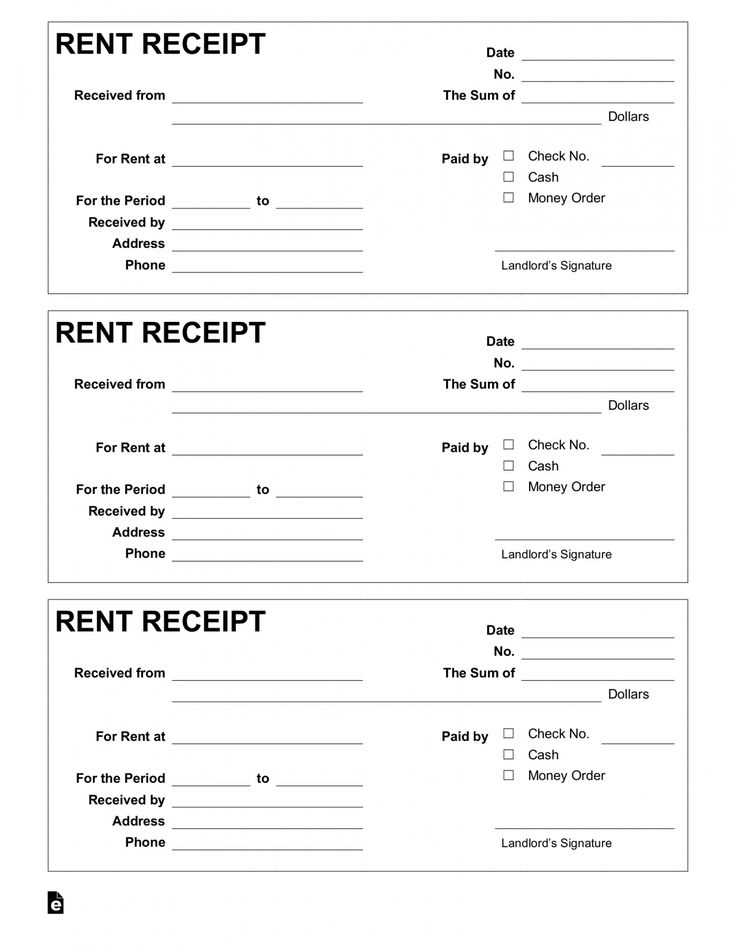

5. Sample Template for Rent Receipts

Include a simple, ready-to-use rent receipt template. List each required section with placeholders, allowing users to easily adapt the template for their own use. Keep the design straightforward, avoiding unnecessary details.

6. Best Practices for Distributing Rent Receipts

Provide tips for distributing rent receipts to tenants. Suggest using secure methods, such as email for digital receipts or signed copies for paper versions. Include suggestions for keeping records in case of disputes or audits.

- htmlEditWritten Rent Receipt Template

To create a straightforward and functional rent receipt template, start by organizing key details that confirm payment. A clean, simple layout enhances clarity and ensures that all necessary information is included.

Basic Information to Include

- Landlord’s Name and Address: Include the full name and contact details of the landlord for any future reference.

- Tenant’s Name and Address: List the tenant’s name and the rented property address. This ensures clarity on both sides.

- Receipt Number: Add a unique identifier for each receipt to keep records accurate and easily traceable.

- Rent Amount: Clearly state the amount paid, including the currency if necessary.

- Payment Date: Always mention the exact date when the rent was paid.

- Payment Method: Specify if the payment was made via check, cash, bank transfer, or another method.

- Rental Period: State the period covered by the rent payment (e.g., “for the month of January 2025”).

Final Details

- Landlord’s Signature: Include a space for the landlord to sign, confirming the payment has been received.

- Tenant’s Signature: Provide a space for the tenant to sign, acknowledging the receipt of the payment.

- Notes Section: If needed, leave space for any additional notes such as late fees or payment adjustments.

A rent receipt serves as proof of payment. It helps both the tenant and landlord avoid misunderstandings about whether rent has been paid. Without a receipt, disputes can arise over missed payments or incorrect amounts.

Clarifies Payment History

Rent receipts create a clear record of payment dates and amounts. This is especially helpful if a tenant needs to prove payments for tax purposes or as part of a rental dispute. A written receipt ensures both parties have an official, verifiable record.

Supports Legal Protection

Having a receipt can protect both tenant and landlord in case of legal issues. If a disagreement about rent payments arises, a receipt can serve as solid evidence that the rent was paid on time and in full. It minimizes potential conflicts and helps maintain a transparent rental agreement.

Include the full name of the landlord and tenant. Clearly state the rental property’s address. Mention the rental amount paid, along with the payment date. If applicable, note any late fees or discounts. Specify the rental period covered by the payment, such as monthly or weekly. Ensure the receipt is signed by the landlord or authorized representative. Record the payment method, whether it’s cash, cheque, or bank transfer. Include a receipt number for record-keeping and future reference.

Make your rent receipt straightforward by including key details. Ensure it contains the full name of the tenant and landlord, the property address, the amount paid, and the date of payment. Add the payment method, whether cash, check, or bank transfer, for transparency. Always include the rental period being covered (e.g., January 1-31, 2025). A clear acknowledgment of receipt with the signature of the landlord or agent is a must.

Clarity and Accuracy

Be specific in the description of the payment. Instead of vague terms, state the exact amount paid and note if it covers multiple months or includes utilities. This ensures no confusion on either side. If the rent amount changes, reflect this in the receipt with the new payment details.

Additional Notes

If applicable, include any deposits or adjustments for repairs or other conditions. Make sure the receipt is dated the day payment is made, and avoid any ambiguous phrasing. A simple and clear layout improves understanding and avoids unnecessary back-and-forth between landlord and tenant.

Ensure you avoid these mistakes to create clear, accurate rent receipts:

- Missing or Incorrect Tenant Information: Double-check that the tenant’s name and address are accurate. Incomplete or wrong information can cause confusion.

- Incorrect Rent Amount: Verify the exact rent amount received, including any additional fees or adjustments, to prevent misunderstandings.

- Failure to Include Payment Date: Always include the date the payment was made. It’s crucial for tracking payments and confirming timely rent collection.

- Omitting Payment Method: Note the payment method, whether cash, check, or digital transfer, to provide a complete record.

- Absence of Landlord’s Information: Always include your name and contact details. This ensures both parties know who to reach if needed.

- Unclear or Missing Terms: Clearly specify the rental period covered by the payment. Be explicit about what the payment applies to–whether it’s for the month, a specific period, or partial payment.

- Failure to Sign the Receipt: A signature verifies the document’s authenticity. Without it, the receipt may not hold up as proof of payment.

Double-Check Your Details

Before finalizing a rent receipt, always review all fields for accuracy. Even minor errors can cause complications down the line.

Keep Copies of Receipts

Always retain a copy of the receipt for your own records. This ensures you can refer back to it if any questions arise later.

Include the tenant’s full name, address, and contact information to make the receipt personal and specific to the renter. Mention the rental period clearly, stating the exact dates the payment covers. Customize the payment method section by adding options like bank transfer, check, or cash, depending on the method used. Ensure that the amount received is prominently displayed, including any additional details such as late fees or discounts, if applicable. A section for the landlord’s signature will add authenticity and clarity. You can also add your business logo or property name at the top to brand the receipt. Tailor the template to fit your unique rental terms and practices, creating a clear, professional document for both parties.

Ensure that the rent receipt clearly identifies both the landlord and the tenant by including their full names and contact information. This will help verify the parties involved in the transaction. Always include the property address, as this provides clear evidence of the rental agreement’s scope.

Accurate Payment Details

List the payment amount, the date received, and the payment method. It is critical to be specific about whether the rent was paid by cash, check, or electronic transfer. This eliminates any future confusion about the payment’s nature and timing.

Legal Terminology and Language

Use straightforward, clear language to describe the transaction. Avoid using complex or ambiguous terms that may confuse the parties. Legal clarity is key, especially if the receipt may need to be used as evidence in a dispute.

Ensure your rent receipt template is clear and includes all necessary details. Here’s what you need:

| Field | Description |

|---|---|

| Tenant’s Name | Include the full name of the tenant paying the rent. |

| Landlord’s Name | List the full name of the landlord or property manager receiving the rent. |

| Payment Amount | Clearly state the amount paid for the rental period. |

| Payment Date | Indicate the exact date the payment was made. |

| Property Address | Specify the address of the rental property being paid for. |

| Rental Period | Define the time frame for which the rent is being paid (e.g., monthly, weekly). |

| Payment Method | Note how the payment was made (e.g., cash, check, bank transfer). |

| Receipt Number | Assign a unique receipt number for easy tracking. |

By filling out these fields, you ensure both the tenant and landlord have a proper record of the transaction.