Provide tenants with a detailed and clear year-end rent receipt to ensure smooth record-keeping and transparency. The receipt should include all relevant payment information, including the total rent paid, the period covered, and any additional fees or deductions. This documentation serves as proof of payment for both parties, especially when tax season arrives.

Ensure the receipt contains the tenant’s name, rental property address, and a breakdown of the payments. Include the start and end dates of the rental period covered by the payment. Don’t forget to note any outstanding balances or payments made towards deposits, repairs, or maintenance costs that were part of the rental agreement.

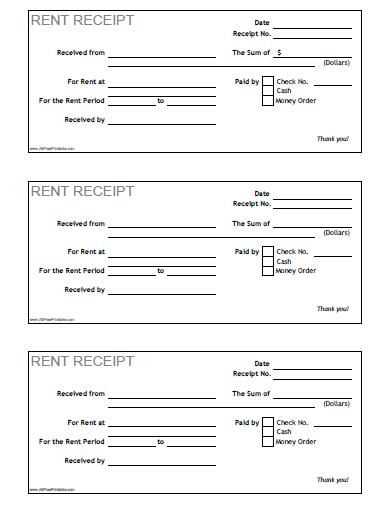

It’s a good idea to include a statement confirming that all payments have been processed correctly and in full. This can help resolve any potential disputes and make tax reporting simpler for both landlord and tenant. Offering a template can save you time and avoid confusion when creating these receipts year after year.

Here are the corrected lines with minimized repetition:

To create a clear and concise year-end rent receipt, focus on these key details:

- Tenant’s full name and address

- Landlord’s name and contact information

- Property address for which rent was paid

- Exact rental amount paid for the year

- Payment dates and method used

- Signature and date from the landlord

Avoid unnecessary redundancy in wording. For example, instead of repeating “paid for the rent” multiple times, state the total amount once and include specific payment dates.

Example:

- Tenant Name: John Doe

- Property Address: 123 Main Street

- Total Rent Paid: $12,000

- Payment Period: January 1, 2024 – December 31, 2024

- Payment Method: Bank Transfer

- Landlord’s Signature: ______________________

- Date: ______________________

This format ensures clarity while maintaining a professional tone. Avoid unnecessary repetition of terms and structure for readability.

- Year-End Rent Receipt Template

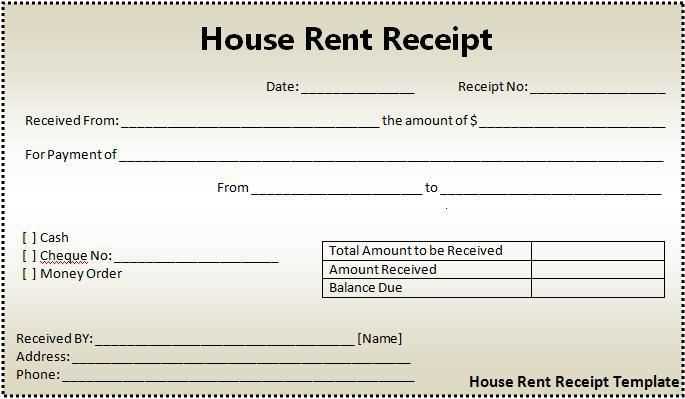

Creating a year-end rent receipt template requires clarity and accuracy. A well-structured receipt ensures both the tenant and the landlord have proper documentation for tax purposes. Here are key elements to include:

Key Elements of a Rent Receipt

- Landlord Information: Include the landlord’s full name, address, and contact details.

- Tenant Information: List the tenant’s full name and address where the rental property is located.

- Rental Property Details: Specify the address of the rented property and the lease agreement number if applicable.

- Payment Details: Record the amount paid, payment method, and payment period (e.g., monthly, quarterly).

- Date of Payment: Clearly state the payment date or the date the payment was processed.

- Signature: Both the landlord and tenant should sign the receipt, confirming the transaction.

Sample Template

Here is a basic format for a year-end rent receipt:

Landlord Name: [Full Name] Landlord Address: [Street Address, City, State, Zip Code] Tenant Name: [Full Name] Tenant Address: [Street Address, City, State, Zip Code] Rental Property Address: [Street Address, City, State, Zip Code] Lease Agreement Number: [If applicable]Payment Amount: $[Amount] Payment Method: [Cash, Check, Bank Transfer, etc.] Payment Period: [Month/Year or Start Date - End Date] Payment Date: [MM/DD/YYYY]Signature of Landlord: ___________________ Signature of Tenant: ___________________

Ensure all sections are filled accurately to avoid confusion during audits or tax reporting. Both parties should retain a copy of the receipt for their records. Consider saving the receipt electronically for easy access in the future.

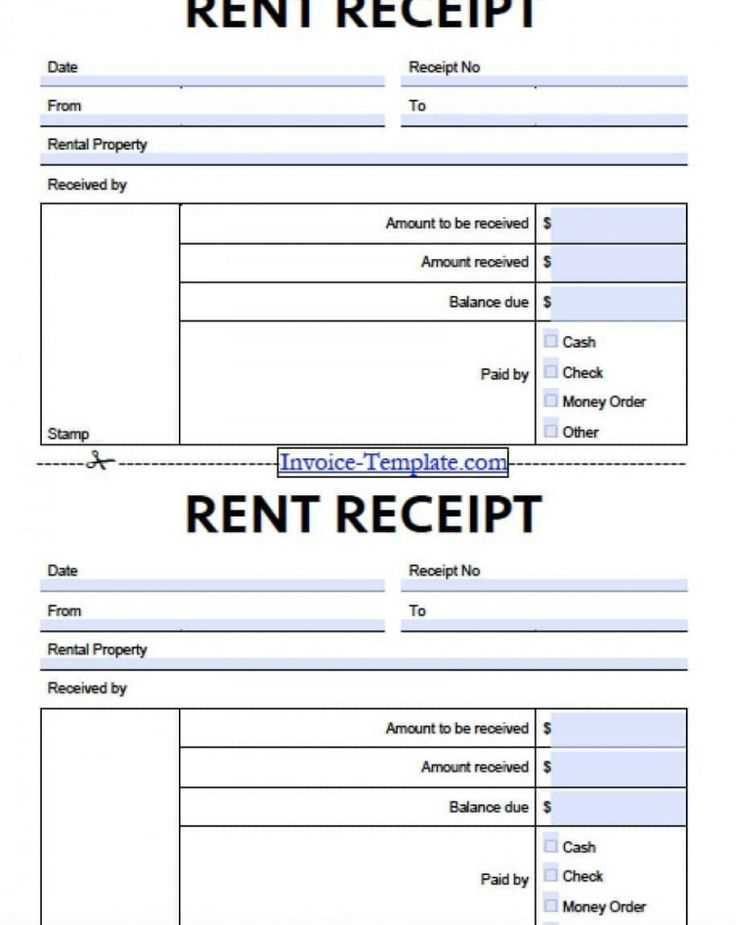

Begin by including the tenant’s name and rental property address at the top of the receipt. This ensures clarity and confirms the specific rental agreement being referenced.

Include Payment Details

List the total rent paid during the year. Include each payment date and corresponding amount, ensuring transparency for both parties. If applicable, mention any adjustments or partial payments made throughout the year.

Payment Methods and Confirmation

Clearly state the method used for payment, such as bank transfer, cheque, or cash. Provide confirmation that the payment has been received in full, including any transaction numbers or references if available. This creates an accurate record for future reference.

Lastly, add a signature line at the bottom, allowing the landlord or property manager to confirm the receipt of the rent payment. This serves as a formal acknowledgment of the transaction for both parties.

Ensure that rent receipts meet local requirements. In many jurisdictions, a rental receipt must clearly state the payment amount, date, and landlord details. Double-check that all relevant legal elements are included, as incomplete receipts can lead to disputes or tax issues.

Clarity of Information

Each receipt should clearly outline the period covered by the rent payment. This prevents misunderstandings between tenants and landlords. Make sure to specify whether the payment is for monthly rent, late fees, or other services to avoid confusion.

Tax Implications

In some cases, tenants may need these receipts for tax purposes, such as claiming deductions. Ensure receipts are accurate, legible, and in line with local tax laws. This can prevent future complications for both parties.

Be mindful of the length of time you keep records. Depending on local law, receipts may need to be stored for a certain period for legal or tax purposes. Consider digitizing records to keep them safe and accessible.

Tailor your rent receipt to match the unique terms of each tenancy agreement. Start by adjusting the rent amount field to reflect any specific clauses regarding partial payments, late fees, or rent adjustments for the tenant. Include space for noting the payment method, such as check, bank transfer, or cash, to track how the rent was settled.

If the agreement includes utilities or other fees bundled with rent, add separate lines to indicate these charges. For agreements with rent increases, clearly state the previous and new amounts, along with the effective date of the increase. This ensures that both parties have a clear understanding of any changes over time.

Consider adding a section for the tenant’s reference number or lease agreement number to provide additional context, especially for tenants in multiple properties. For tenants with a longer-term lease, add a section for annual summaries or adjustments, which can help simplify year-end reporting for tax purposes.

Finally, ensure the receipt includes the landlord’s contact information, property details, and any other identifiers relevant to the specific agreement. This guarantees that both landlord and tenant have a complete, accurate record for their reference.

Provide clear details of the rental payments on the year-end rent receipt. This includes the full amount paid by the tenant, the rental period, and any applicable taxes or adjustments. Ensure that the receipt contains the landlord’s or property manager’s contact information, as well as the tenant’s name and rental address. It should be easy to understand and error-free, offering transparency for both parties.

Template Overview

A simple and direct format will help tenants and landlords verify payments. A well-organized receipt can also serve as proof of payment for tax or legal purposes.

| Field | Description |

|---|---|

| Tenant Name | The full name of the tenant |

| Rental Period | The date range for which the payment was made (e.g., January 1 – December 31) |

| Payment Amount | The total amount paid for the period |

| Landlord Name | Name of the landlord or property management company |

| Property Address | The address of the rented property |

| Payment Date | The date when the payment was made |

| Payment Method | Method of payment (e.g., bank transfer, check, cash) |

| Signature | Landlord or property manager’s signature for verification |