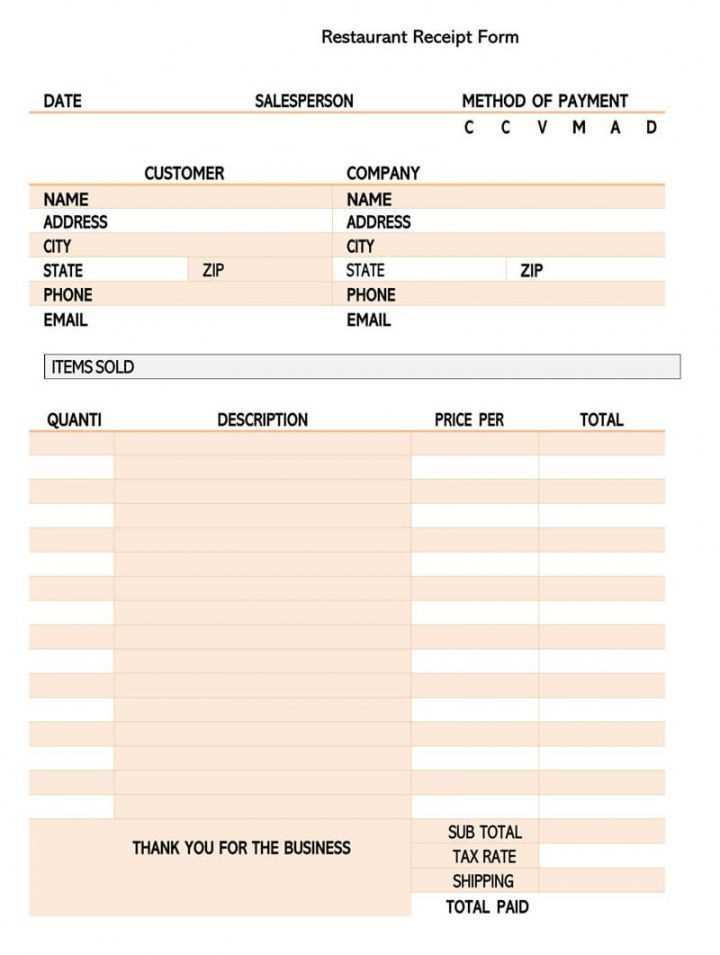

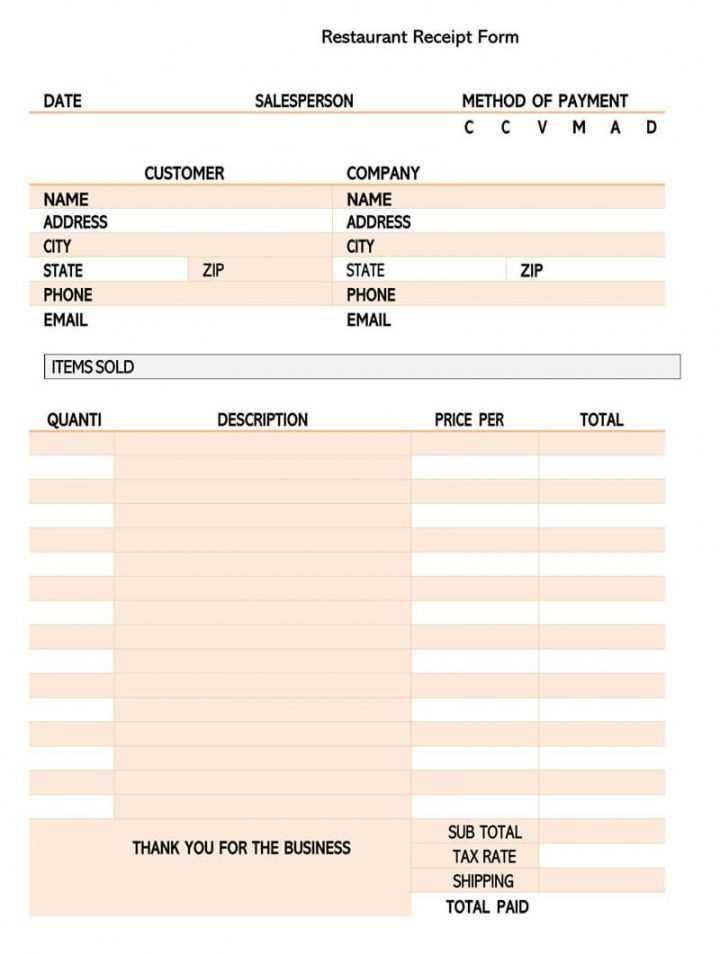

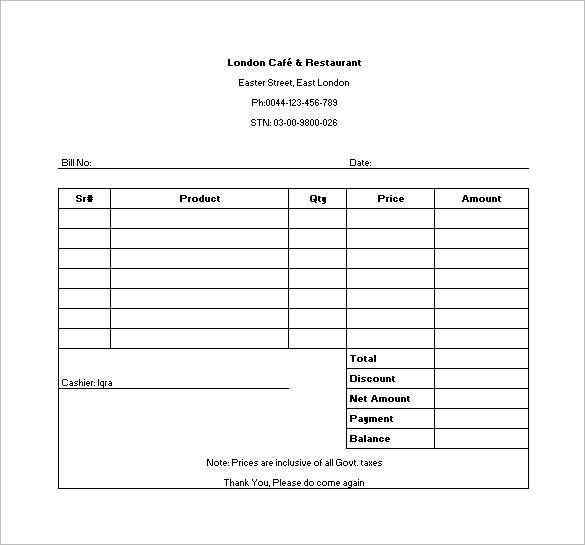

Creating a restaurant receipt for company use requires clarity and professionalism. A well-designed template not only helps in maintaining accurate financial records but also simplifies the reimbursement process. To get started, include the restaurant name, address, and contact details at the top. This ensures that the receipt is identifiable and provides necessary business information for accounting purposes.

The next step is including the list of items purchased. Make sure to detail each item clearly, along with its price. If the company reimburses based on specific items or categories, this section should be organized accordingly. Grouping similar items together will help both the company and the employee quickly review and verify the charges.

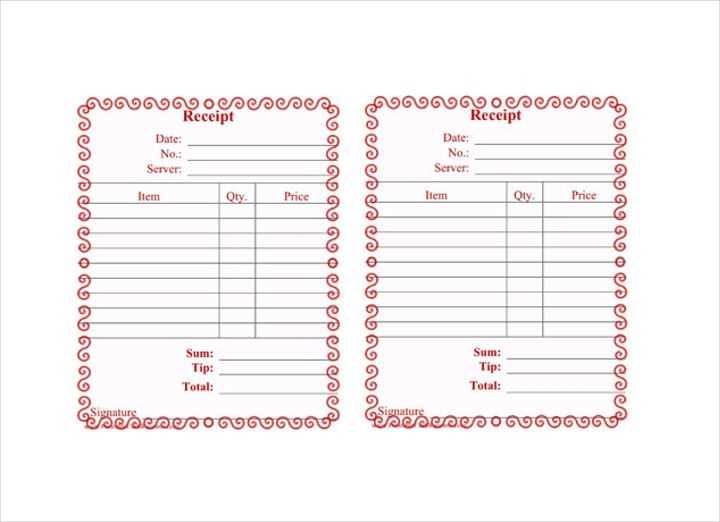

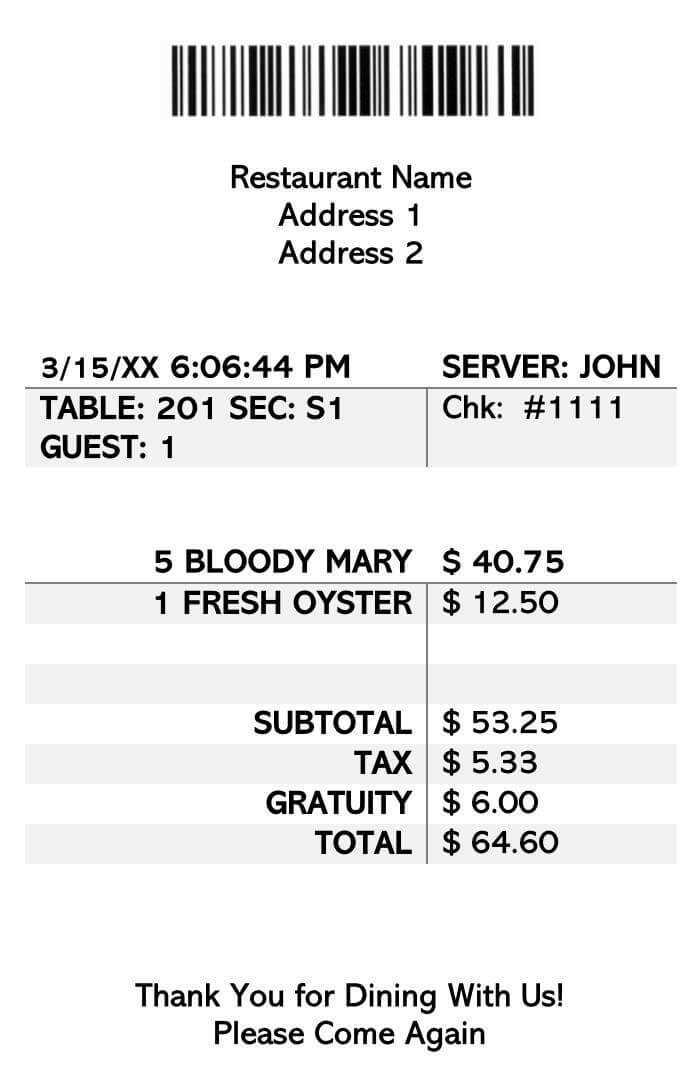

Don’t forget to add the total amount, including taxes and tips. A breakdown of these charges can be helpful for transparency and clarity. In cases where a tip is calculated as a percentage of the total bill, clearly specify that calculation. Make sure that the receipt includes the date and time of the transaction for easy reference in case of audits or expense claims.

Finally, a section for payment details is useful, whether the bill was paid via card, cash, or another method. This can also be included in a footer to enhance the overall layout of the receipt. When creating a template, consistency is key, so ensure that the design and structure stay uniform for all company-related receipts.

Here are the corrected lines:

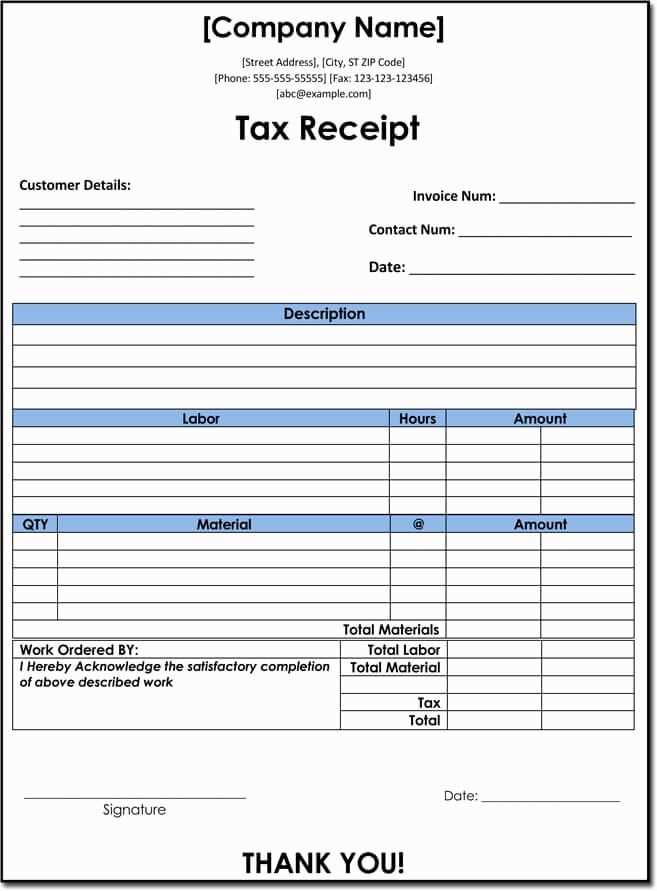

Adjust the “company name” section to reflect the official business name exactly as it appears in the registration documents.

Ensure that the tax identification number (TIN) is clearly visible and correctly formatted for compliance purposes.

Clarify the itemized list by breaking down each charge, ensuring the description is brief but specific enough for the client to understand the cost.

Update the date format to match the local convention, whether it’s DD/MM/YYYY or MM/DD/YYYY, depending on the region.

Make sure the payment terms are stated clearly, including due dates and any late fees, to avoid confusion later.

Verify that the total amount is correct, double-checking both the subtotal and any added taxes or discounts before finalizing the receipt.

Consider adding a footer with your company’s contact information and website for easy reference.

- Restaurant Receipt for Company Template

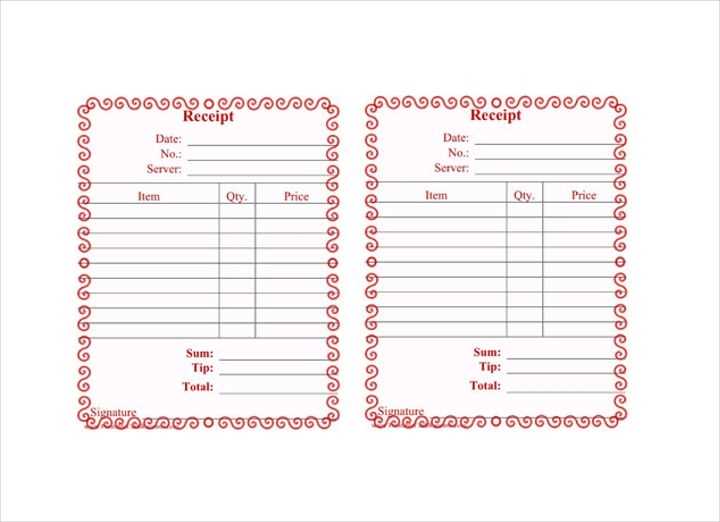

To ensure clarity and proper documentation of business expenses, use a well-organized restaurant receipt template. Here’s what to include:

Required Information

- Restaurant Name and Contact: Ensure the restaurant’s name, address, and phone number are included for verification purposes.

- Date and Time: Include the specific date and time of the meal to accurately align with business-related activities.

- Itemized List: List each item purchased along with its price. This detail helps to track each purchase and provides transparency.

- Subtotal, Taxes, and Tips: Make sure the subtotal, taxes, and any tips are clearly shown. This ensures accurate expense reporting.

- Payment Method: Clearly indicate how the bill was paid, such as via company credit card, cash, or another method.

Design Considerations

- Easy-to-Read Layout: Organize the receipt for simple comprehension with clear sections for each detail.

- Include Your Company Logo: Add the company’s logo at the top for a professional and branded appearance.

- Customizable Fields: Provide space for additional details, such as names of attendees or the purpose of the meal, which may be useful for internal tracking or reporting.

Using this template allows for easy documentation of business meals, aiding both expense reporting and financial auditing.

Begin by including your restaurant’s branding–such as the logo, name, and contact information–at the top of the receipt. This creates a professional image and helps customers remember your business. Next, adjust the layout to highlight the most relevant information for your business, such as itemized food and beverage prices, taxes, and tips. A clear breakdown aids in customer transparency and can support accounting tasks.

Consider adding specific details that suit your needs. For example, include the server’s name, the date and time of the transaction, or a reference number for easy tracking. This helps with customer service and internal record-keeping. If you offer loyalty programs, include a space for points or rewards earned during the visit.

For businesses that cater to different customer types, you can include options for customizing the receipt based on the payment method, whether it’s cash, card, or digital payment. This customization ensures that each receipt provides the necessary information in an accessible format for both customers and your team.

Finally, integrate your receipt system with your accounting software to reduce manual entry errors. This integration saves time and ensures that you maintain accurate records without extra effort. Adjust your receipt template as your business evolves to make sure it remains efficient and tailored to your specific needs.

Include the following details for clarity and compliance in a restaurant receipt for company use:

1. Restaurant Details

Clearly display the restaurant’s name, address, and contact information. This ensures transparency and enables easy follow-up if necessary.

2. Transaction Breakdown

Provide an itemized list of all purchased items. Include the price of each item, the quantity, and any applicable discounts. This helps with expense tracking and audit purposes.

3. Total Amount and Tax Information

Make sure to include the total amount paid and break down the taxes separately. This allows for accurate reporting in financial statements.

4. Date and Time

The date and time of the transaction should be included for reference and reporting purposes.

5. Payment Method

Specify the payment method used (e.g., credit card, cash, or company account). This will help in tracking expenses and managing reimbursements effectively.

6. Receipt Number or Transaction ID

Each receipt should have a unique number or transaction ID. This aids in organizing records and preventing confusion in case of disputes.

7. Tips and Gratuity

If applicable, list the tip amount separately. This ensures transparency for both the company and the restaurant staff.

8. Company Information (Optional)

Optionally, include the company name and address, especially if the receipt will be used for expense reimbursement or tax deductions.

| Details | Example |

|---|---|

| Restaurant Name | Sample Bistro |

| Address | 123 Main Street, City, State, 12345 |

| Transaction Date | February 11, 2025 |

| Itemized List | 2x Salad, 3x Burger |

| Total | $50.00 |

| Tax | $5.00 |

| Payment Method | Company Credit Card |

| Tip | $7.00 |

Ensure your restaurant receipts comply with local tax laws to avoid penalties. A valid receipt should contain specific details, such as the business name, tax ID, date of purchase, and a breakdown of goods or services provided. This information is necessary for accurate reporting and tax filing.

For businesses claiming meal expenses, retaining receipts is vital for deductions. The IRS, for example, requires proof of business-related meals for tax benefits. Ensure the receipt shows the business purpose, attendees, and the amount spent to qualify for tax exemptions or deductions.

Businesses should also stay informed about local sales tax regulations. Depending on the region, certain meals or services may be exempt from tax, while others may include specific sales tax rates. Incorrectly categorizing these items could lead to costly mistakes during tax audits.

For proper documentation, keep receipts in an organized manner. Consider using digital tools that allow easy storage and retrieval of receipts. This not only helps in staying compliant but also streamlines the audit process.

If you are unsure about how to handle meal receipts for tax purposes, consulting with a tax professional is a wise step. They can provide guidance specific to your business type and location, ensuring accurate deductions and compliance with tax regulations.

For a company, creating a restaurant receipt template is straightforward. Follow these key points:

- Include Company Details: Make sure the receipt has your company’s name, address, contact information, and tax identification number. These should be clearly visible at the top.

- List Items Accurately: Each item purchased should have a description, quantity, and price. Include any applicable discounts or promotions.

- Specify Date and Time: Add the exact date and time of the transaction to avoid confusion in case of disputes or for record-keeping purposes.

- Provide Total Amount: The total should be clearly stated, showing both subtotal and taxes. If applicable, list tips separately.

- Payment Method: Indicate whether the payment was made via cash, card, or another method. This helps for tracking payments.

- Include a Unique Receipt Number: Assign a unique identifier to each receipt for easier referencing and auditing.

- Tax Information: List the applicable tax rate and the total tax amount charged to ensure transparency.

By following these guidelines, you can create a practical and professional receipt template for your business.