A well-structured restaurant receipt simplifies transactions and enhances customer satisfaction. Whether you manage a small café or a large dining establishment, having a clear and professional receipt layout is essential. It ensures accurate record-keeping, prevents disputes, and strengthens your brand identity.

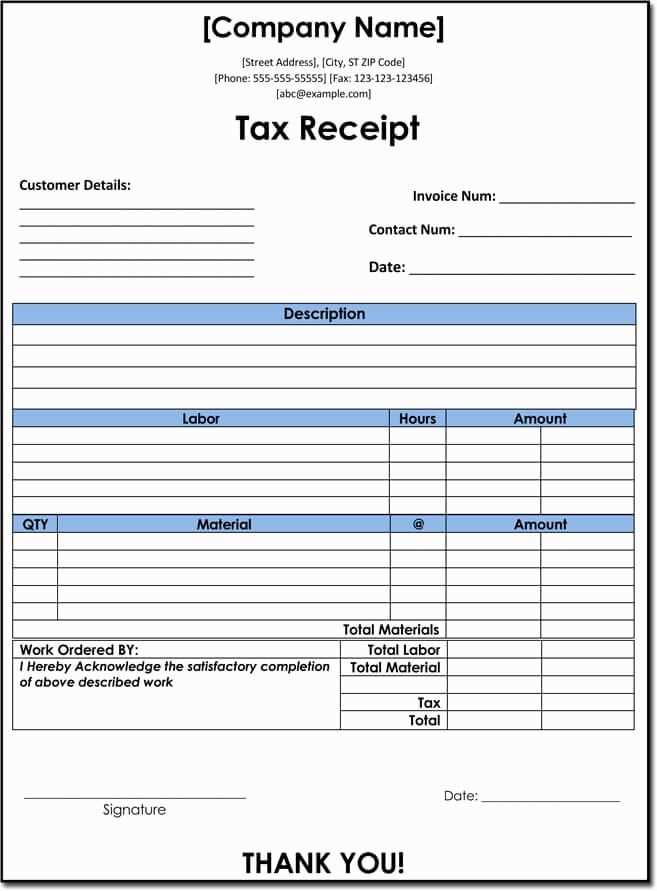

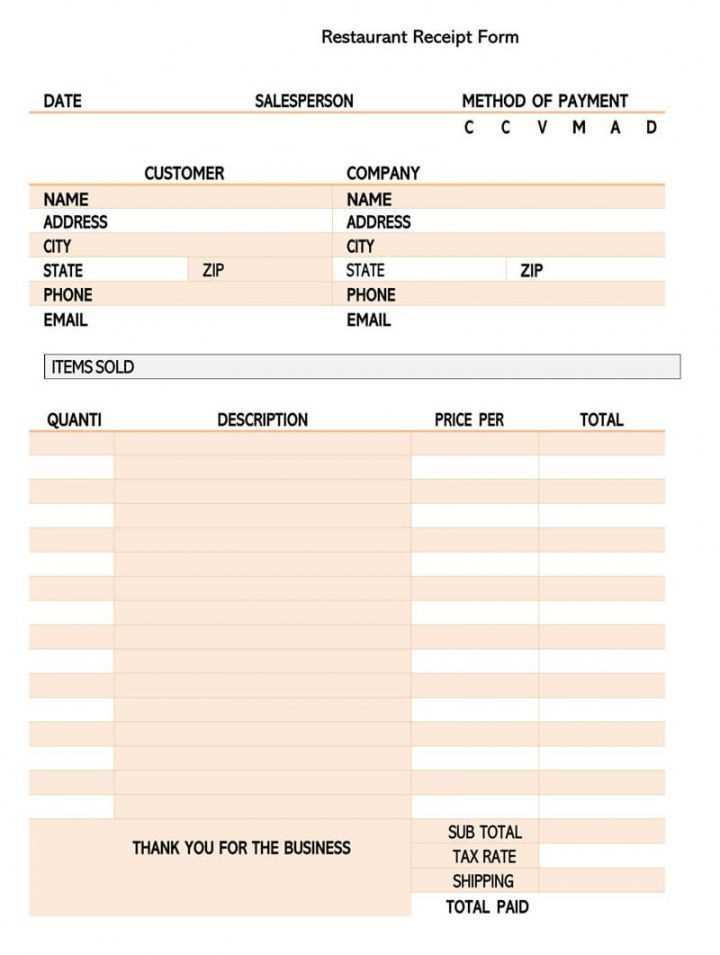

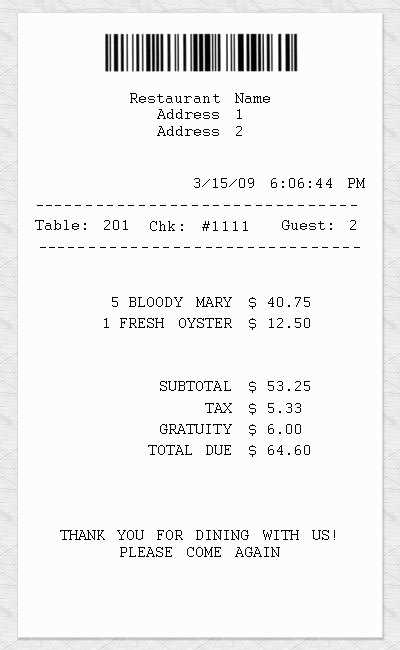

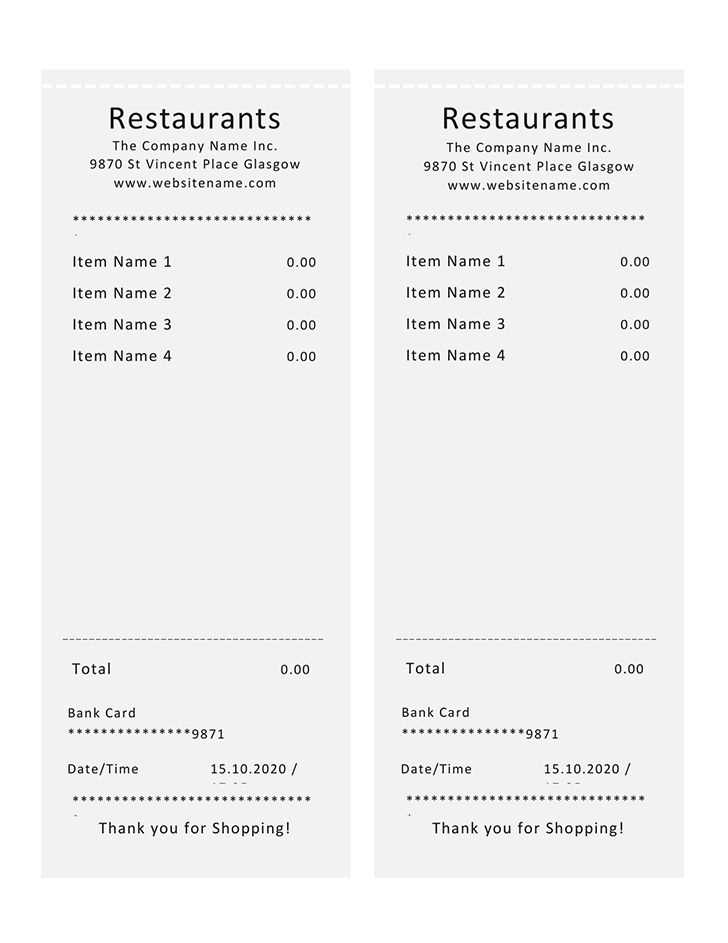

Every receipt should include key details such as the restaurant’s name, contact information, date, order breakdown, subtotal, tax, and total amount. Adding a unique order number helps with tracking, while a short thank-you note or promotional message encourages repeat business.

Digital and printed receipts each have their advantages. While printed versions remain standard, digital receipts reduce paper waste and provide customers with easy access to their purchase history. Many modern point-of-sale (POS) systems offer customizable receipt templates, allowing you to tailor the design to match your branding.

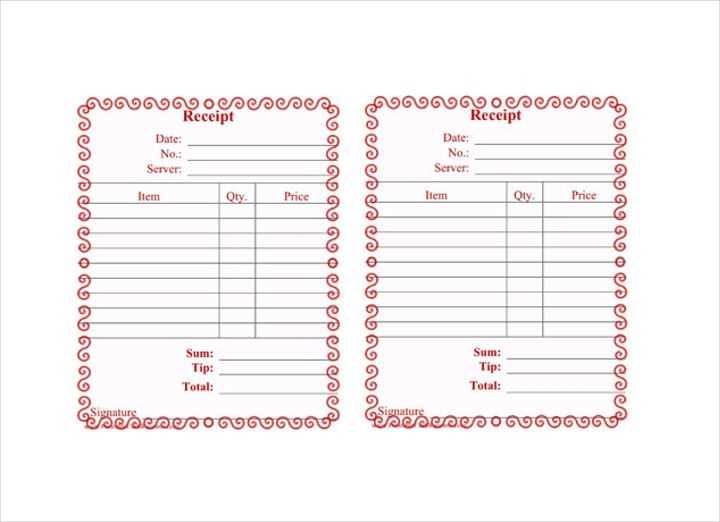

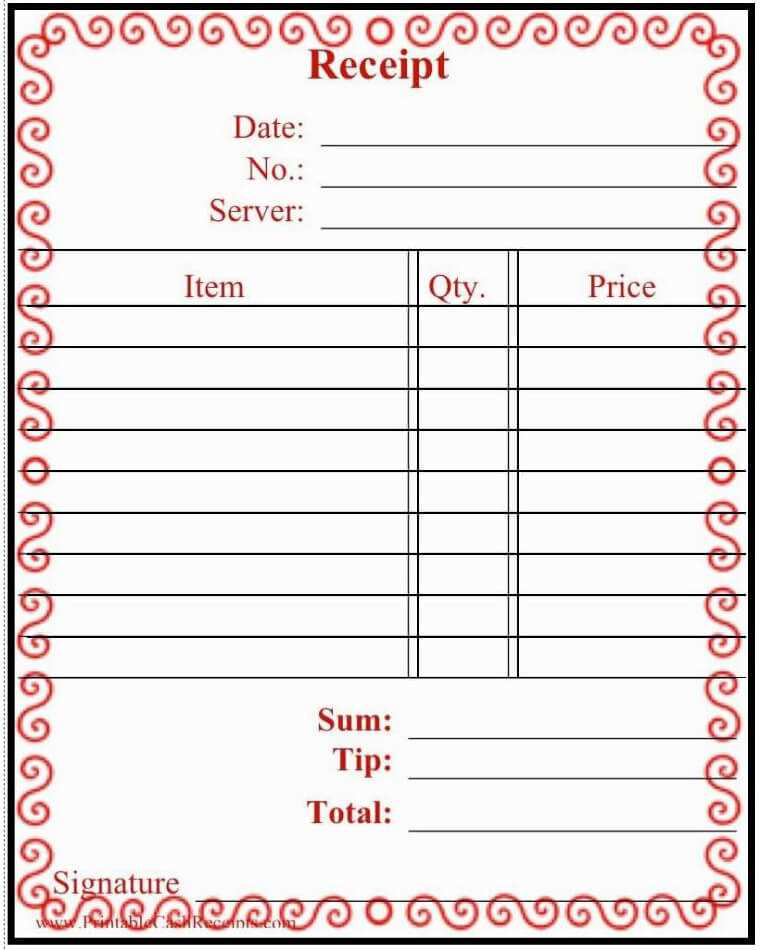

Formatting also plays a crucial role. A clean layout with clear font choices improves readability. Bold or italicized text can highlight important sections, such as the total amount or special discounts. If your business accepts tips, consider adding a suggested gratuity section to streamline the process for customers.

Choosing the right template depends on your business needs. Simple layouts work best for quick-service restaurants, while upscale dining establishments may prefer elegant designs with custom branding. Regardless of style, consistency and clarity should always be the priority.

Here’s the corrected version without unnecessary word repetitions:

Focus on a clean layout for your restaurant receipt template. Include only the necessary information such as the restaurant name, address, date, items ordered, quantity, price, and total amount. Avoid excessive details that might clutter the receipt, like extra design elements or redundant notes.

Ensure clear itemization. Each item should be listed with its price, and any applicable taxes should be shown separately to maintain transparency. Group similar items under appropriate headings to make the receipt easier to follow.

Use legible fonts, and make sure the important data, like total amount, is easily distinguishable. Avoid small or overly stylized fonts that may make it difficult for customers to read their receipts at a glance.

Consider adding a section for tips or service charges, if applicable. Make sure it is clearly labeled and easily understood by the customer.

- Template Restaurant Receipt: Key Aspects and Customization

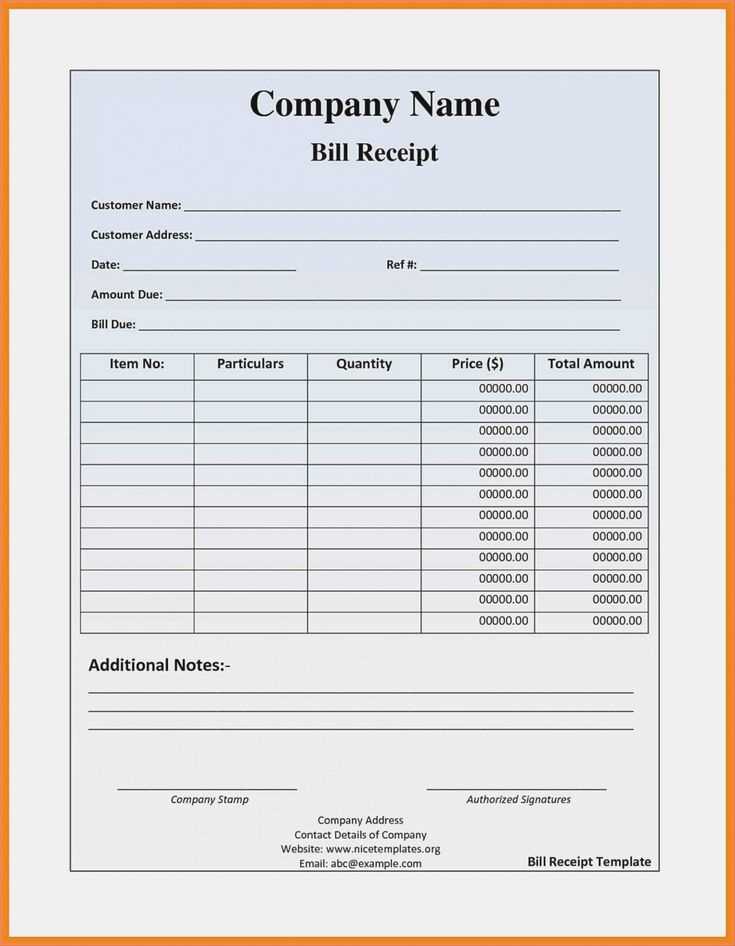

Customize your restaurant receipt template to suit your business needs. A well-designed template enhances both customer experience and record-keeping. Focus on the following aspects:

Layout and Structure

- Header: Include your restaurant’s name, logo, and contact information at the top for branding and customer reference.

- Date and Time: Ensure the receipt shows the transaction date and time for easy tracking and future reference.

- Itemized List: Clearly list all items purchased with individual prices. This transparency avoids confusion and builds trust with customers.

- Subtotal, Taxes, and Total: Include a breakdown of charges, showing both subtotal and taxes, along with the final amount due.

Customization Options

- Fonts and Colors: Use consistent fonts and colors that match your restaurant’s branding. Avoid clutter and keep it readable.

- Payment Methods: Clearly specify the payment method used (cash, credit, or digital) to keep accurate records.

- Tips: Provide a space for customers to add tips if necessary. Make sure the tip is separate from the total bill to avoid confusion.

- Footer: Add any disclaimers, such as refund policies, or a thank you note for added customer engagement.

Each dining receipt should clearly list the date and time of the transaction. This ensures transparency and helps both the customer and restaurant track the purchase.

Include the restaurant’s name and contact details, such as address and phone number. This allows customers to quickly reach out in case of inquiries or issues.

Provide a breakdown of the items purchased, including the name, quantity, and price of each. This detail helps avoid confusion about what was ordered and charges applied.

Include tax and service charge details separately. Highlighting these charges helps customers understand their total cost and prevents misunderstandings regarding the final amount.

A clear total amount should be listed at the bottom, showing the sum of all items, taxes, and additional fees. This gives customers a concise final figure for their payment.

Consider including a payment method section. Whether paid by cash, credit card, or digital wallet, this records how the transaction was completed for both parties’ reference.

Finally, add any relevant tips or feedback instructions. This encourages customer interaction and can provide valuable insights into their dining experience.

Choose a bill format that fits the style of your restaurant while ensuring clarity for customers. The structure should prioritize ease of reading, with clear sections that distinguish between items, taxes, and tips. A simple, clean layout works best to avoid confusion.

Key Elements for an Effective Bill

Include essential components such as the item name, quantity, price per unit, subtotal, taxes, and the total amount. Organize these in a way that customers can quickly check individual charges. The inclusion of a space for gratuities, if applicable, helps to avoid ambiguity.

Format Options: Digital vs. Paper

Consider whether to issue paper or digital receipts. Paper receipts are more traditional, but digital receipts can be more efficient and environmentally friendly. Make sure the format you choose aligns with your customers’ preferences and your restaurant’s branding.

| Item | Quantity | Unit Price | Total |

|---|---|---|---|

| Cheeseburger | 1 | $5.00 | $5.00 |

| Fries | 1 | $2.50 | $2.50 |

| Tax (8%) | – | – | $0.60 |

| Total | – | – | $8.10 |

Adjust your receipt’s branding elements to reflect your restaurant’s unique identity. Start with your logo placement; positioning it prominently at the top of the check ensures it’s the first thing customers see. Use high-quality graphics to keep the logo sharp and clear, even on smaller receipts.

Font Choices

Select fonts that align with your restaurant’s ambiance. For a modern feel, opt for sleek, sans-serif fonts. For a classic or vintage vibe, go for serif fonts. Make sure the font size is legible, but avoid overwhelming the receipt with overly large text. Stick to a maximum of two different fonts for a clean, professional appearance.

Color Palette

Pick colors that align with your brand’s theme and atmosphere. Using your primary brand colors for the header, footers, and subtotal sections makes the receipt instantly recognizable. Make sure the text contrasts with the background for easy readability. Avoid using too many colors to prevent the receipt from looking cluttered.

Ensure that the branding elements like your address, website, or social media handles are easily noticeable. These details can be placed in the footer section in smaller fonts to keep them accessible but not distracting.

Ensure your invoices meet tax and legal standards by including mandatory elements like business name, tax ID number, and clear itemization of services. This transparency not only protects your restaurant but also helps maintain trust with your customers.

Accurate Tax Breakdown

Clearly separate taxes from the total amount. For example, itemize the VAT (Value Added Tax) separately so customers can identify it easily. This ensures compliance with tax authorities and avoids potential penalties. Always update the tax rate based on the latest regulations in your region.

Invoice Record-Keeping

Keep a detailed record of all invoices, including receipts for meals and drinks, for the required retention period as defined by local tax laws. This will be vital for audits or disputes. Implement a systematic approach to organizing and storing invoices digitally or physically.

Failure to comply with legal and tax regulations can result in fines, so it’s essential to stay informed about changes in tax laws and invoice requirements. A properly formatted receipt will safeguard your restaurant from unnecessary complications and build credibility. Always seek legal or tax advice if you’re unsure about any aspect of invoicing.

Digital receipts offer several advantages, including immediate access and easy storage. They eliminate the need for paper, reducing physical clutter. Customers can retrieve their receipts anytime through emails or apps, making them a convenient choice for tracking expenses. They also save on printing costs for businesses.

However, there are limitations. Not everyone is comfortable with digital formats, especially older customers who prefer paper. There’s also the issue of device dependency; accessing digital receipts requires a smartphone or computer, which can be inconvenient in certain situations.

Printed receipts are tangible and widely accepted. They don’t rely on technology, ensuring accessibility for everyone. Businesses can provide instant proof of purchase without relying on email servers or apps. This is particularly useful for customers who don’t own smartphones or prefer hard copies for record-keeping.

On the flip side, printed receipts create waste and incur paper and ink costs. They also require physical storage space, which can be a challenge for both customers and businesses.

Choosing between digital and printed receipts depends on your business model and customer base. Consider offering both options to cater to different preferences and environmental goals.

Avoid cluttered designs that overwhelm the viewer. Prioritize a clean layout with ample white space to make the receipt easy to read.

1. Poor Font Selection

- Choose legible fonts that are easy to read in different sizes. Avoid decorative fonts for important details like totals and taxes.

- Ensure the font size contrasts enough with the background, especially for critical information like the total bill.

2. Lack of Clear Hierarchy

- Organize content logically by grouping related items together. This makes scanning through the receipt easier and more intuitive.

- Use different font weights, sizes, or colors to separate sections such as items, taxes, and total price.

3. Inconsistent Alignment

- Align text consistently to avoid a disorganized appearance. For example, prices should align right, and item names should align left.

- Ensure all elements are spaced appropriately to prevent the design from feeling cramped or uneven.

4. Overcomplicated Layout

- Keep the layout simple and straightforward. Too many columns or excessive use of graphics can distract from the key information.

- Ensure the design is user-friendly, with elements placed in a predictable order that the customer can easily follow.

5. Inaccurate or Missing Information

- Double-check that all necessary details are included, such as the restaurant’s contact info, date, and itemized list of purchases.

- Ensure accurate tax calculations and totals to avoid confusion or errors that could frustrate customers.

How to avoid redundancy in “receipt” and “restaurant” terms

To maintain clarity and natural flow, it’s beneficial to use abbreviations or different phrasing when referring to restaurant receipts. For instance, instead of repeating “restaurant receipt” multiple times, use alternatives like “bill,” “tab,” or “invoice” based on context. This not only keeps the language fresh but also prevents unnecessary repetition.

Abbreviating where appropriate

For digital or template-based formats, consider shortening phrases like “restaurant receipt” to simply “receipt” when the context clearly indicates it refers to a dining establishment. This works well in templates where it’s understood that the receipt is related to a restaurant, keeping the document concise without losing meaning.

Context-driven usage

In situations where the term needs to be more specific, such as in a multi-purpose receipt template, you can use terms like “food receipt” or “dining receipt.” This offers more context without repeating the same words. The key is to adjust according to the purpose and audience of the template.