For a smooth transaction in private vehicle sales in Australia, ensure your receipt template is clear and legally sound. The receipt should outline the key details of the sale, providing a transparent record for both the buyer and seller. Include the buyer and seller’s full names, addresses, and contact information. Document the vehicle’s make, model, year, VIN (Vehicle Identification Number), and registration details. Also, specify the agreed sale price, along with the payment method used, and the date of the transaction.

Include a clear statement of the transaction. Make sure the receipt reflects that the vehicle is sold “as is,” unless other conditions apply. Acknowledge any warranties or guarantees if applicable. This helps avoid any misunderstandings post-sale. It’s also a good practice to include a section for signatures from both the buyer and seller, confirming the completion of the sale.

Don’t forget to keep a copy of the signed receipt for your records. It serves as proof of the transaction and can be crucial in case of any future disputes. Providing a well-structured receipt makes the sale process smoother and helps ensure both parties are protected legally.

Australian Private Vehicle Sales Receipt Template

For a smooth private vehicle sale in Australia, make sure to include the following details in your receipt template:

1. Seller and Buyer Information: Include full names, addresses, and contact details of both parties. This ensures clear identification in case of future disputes.

2. Vehicle Details: List the make, model, year, VIN (Vehicle Identification Number), registration number, and odometer reading at the time of sale.

3. Sale Price: Clearly state the agreed-upon price of the vehicle, and indicate the payment method (e.g., bank transfer, cash). Both parties should sign to confirm the sale price.

4. Date of Sale: Specify the exact date when the sale occurred. This is important for the legal transfer of ownership and any warranty-related issues.

5. Condition of the Vehicle: A brief statement about the vehicle’s condition at the time of sale, including whether it was sold as is or with any warranties, should be noted. Any defects or repairs made to the vehicle should also be mentioned.

6. Signatures: Both the buyer and seller should sign the receipt. This verifies that both parties agree to the terms of the sale.

7. Acknowledgement of Ownership Transfer: A section confirming the buyer has received full ownership of the vehicle after payment has been made.

By including these key elements, the transaction will be well-documented, providing legal clarity for both parties.

What Information Should Be Included in the Receipt?

The receipt for the sale of a private vehicle should contain the following key details to ensure transparency and legal clarity:

- Seller’s Information: Full name, address, and contact details of the seller should be listed. This confirms the identity of the person selling the vehicle.

- Buyer’s Information: Full name, address, and contact details of the buyer, confirming the individual acquiring the vehicle.

- Vehicle Details: Make, model, year, VIN (Vehicle Identification Number), color, and odometer reading. These specifics identify the exact vehicle being sold.

- Sale Price: The total agreed-upon price for the vehicle, including any applicable taxes or fees. This amount must match the agreed terms between both parties.

- Payment Method: Specify the method of payment used, whether it is cash, bank transfer, or another form of payment.

- Date of Sale: The exact date the transaction took place. This ensures clarity regarding the timeline of the sale.

- Signatures: Both the seller and the buyer should sign the receipt to confirm the authenticity of the transaction and their agreement to the terms.

Additional Notes

- Warranty Information: If any warranties are included, they should be clearly noted, along with their terms and duration.

- Disclosure of Condition: Include any known issues or defects with the vehicle. Both parties should acknowledge these details.

How to Format the Receipt for Legal Compliance?

Ensure your vehicle sales receipt includes all required details for legal validity. Clearly state the full names and addresses of both the buyer and the seller. Specify the vehicle’s make, model, year, VIN (Vehicle Identification Number), and registration details. This helps in verifying the vehicle’s identity and ownership.

Clearly mention the transaction amount, breaking it down into the sale price and any applicable taxes. Include the payment method, whether it’s a bank transfer, cheque, or cash. Specify any deposits or down payments made, along with the final balance paid.

Include the date of the transaction and ensure both parties sign the receipt. This serves as proof of agreement and confirms the transaction took place. You should also note any warranties or conditions attached to the sale.

Lastly, provide space for any additional remarks or notes that may be relevant, such as vehicle condition or special agreements. This keeps all parties informed and helps avoid disputes later on.

Examples of Commonly Used Receipt Templates

For Australian private vehicle sales, receipts are an important part of the transaction process. Below are some common templates used in the industry.

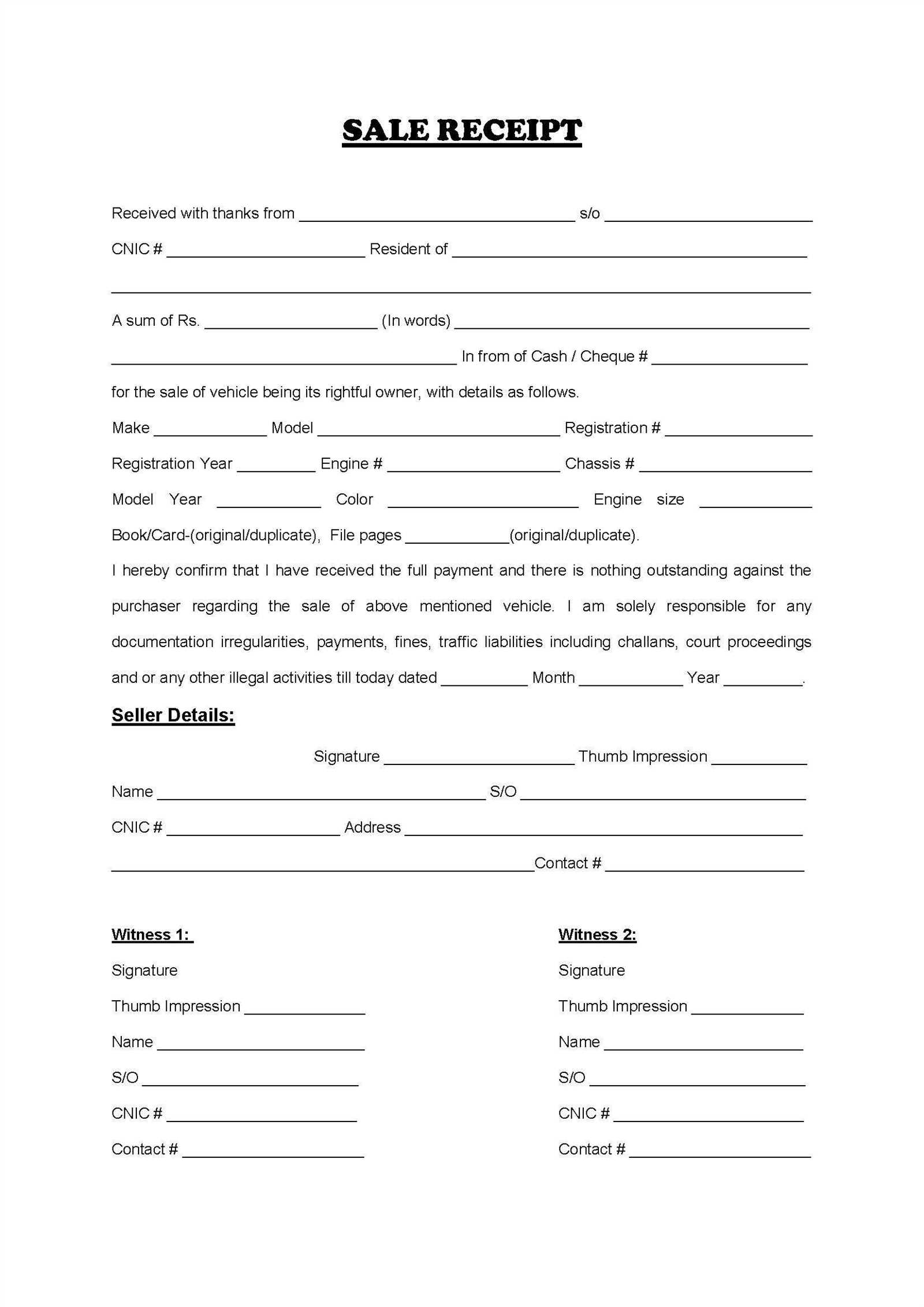

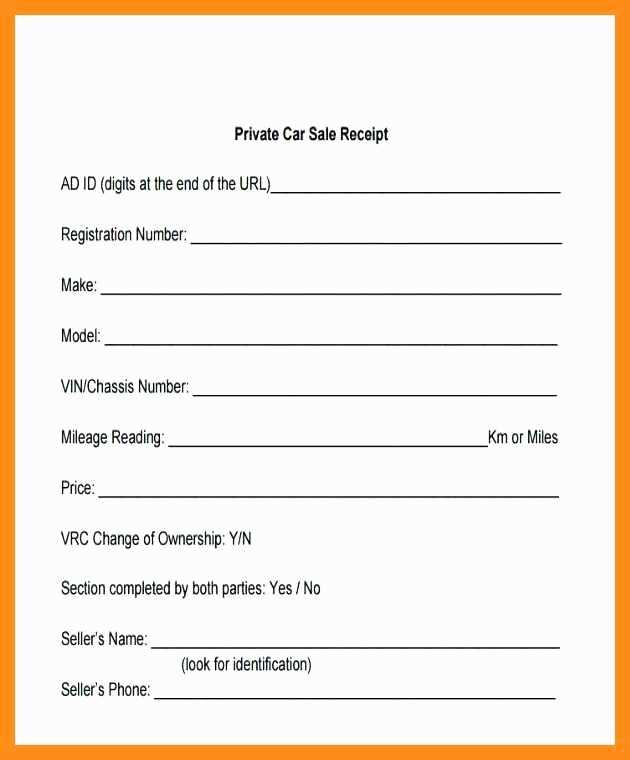

Basic Sale Receipt

This template is straightforward, listing essential details such as the vehicle’s make and model, VIN number, date of sale, buyer and seller information, and the amount paid. It includes a simple breakdown of the transaction and a signature line for both parties. This format is ideal for smaller transactions where only the core details need to be recorded.

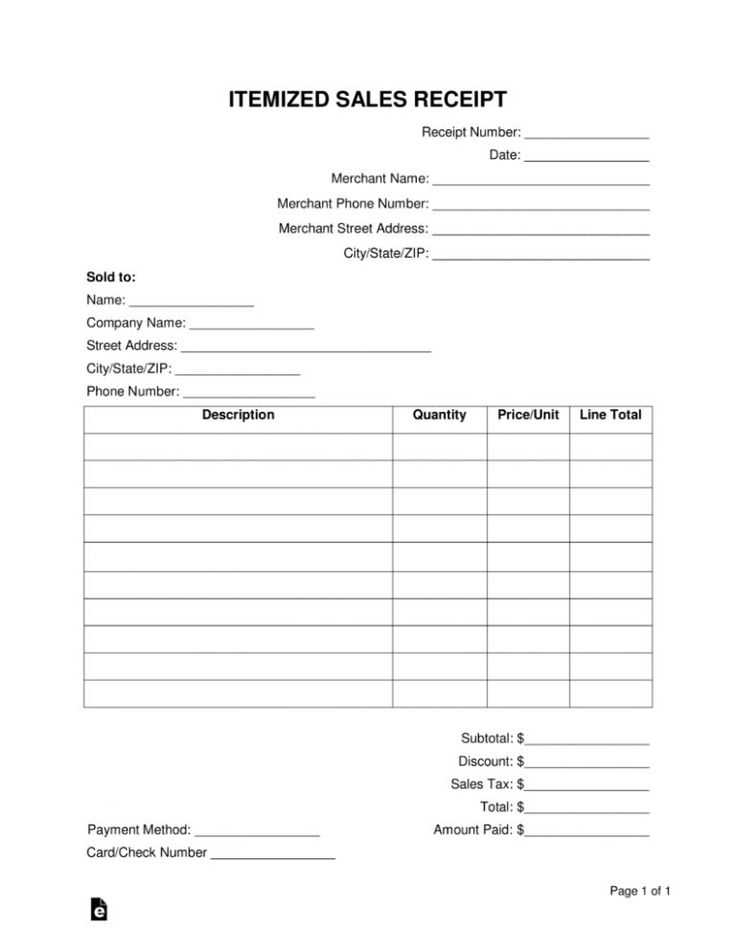

Detailed Transaction Receipt

A more comprehensive template includes not only the basic sale information but also additional fields for taxes, fees, warranties, and payment methods. This format provides a clear record of any extras or conditions tied to the sale, offering greater transparency for both parties. It’s commonly used in dealership transactions or for sales that involve financing.