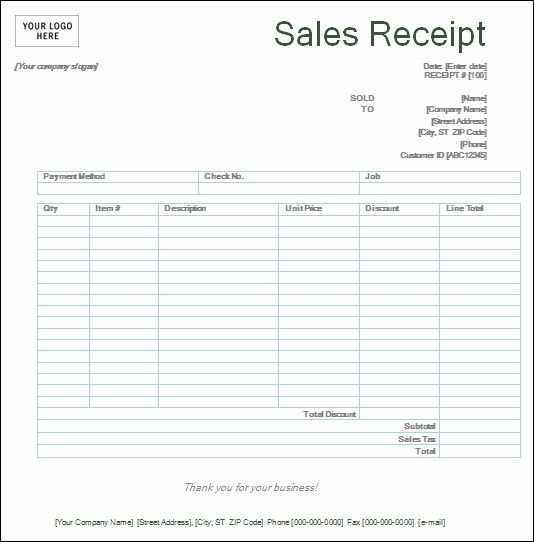

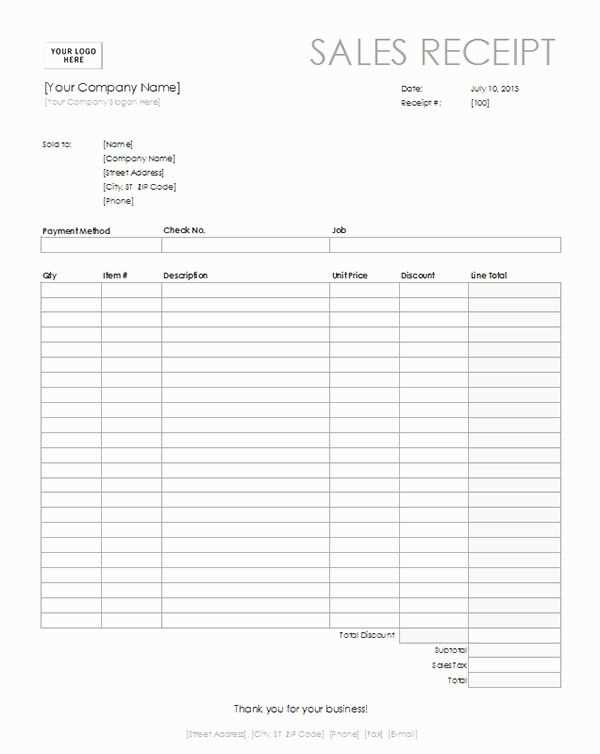

Use a simple and clean sales receipt template to ensure clear communication with your customers. A well-organized receipt includes key details like the transaction date, buyer and seller information, item descriptions, prices, and taxes. Make sure each line item is easily identifiable and includes the correct amounts for total clarity.

Start with the date of the transaction at the top to establish a clear timeline. This helps both you and your customer track the purchase, especially if returns or refunds are required later. Include your business name and contact details below the date, along with the customer’s information if necessary.

List the items sold along with their quantities and individual prices. If applicable, note any discounts or special offers applied. Including taxes and the total amount due at the end of the list ensures there are no surprises. Be specific about the payment method, whether it’s cash, card, or another method.

Conclude with a thank you message or return policy reminder. It adds a personal touch and reinforces your customer service standards. By providing an easy-to-read receipt, you create a transparent and professional experience for everyone involved.

Here’s the revised version:

Include the following details in your basic sales receipt template for clarity:

Product Information

Clearly list each item purchased, including a description, quantity, and price per unit. Ensure that the total price for each item is visible. This will prevent confusion and ensure the customer knows exactly what they paid for.

Payment and Contact Information

Provide your business contact details at the top of the receipt, including your name, address, and phone number. Include the customer’s name and contact info if applicable. Also, mention the payment method used (e.g., cash, credit card) to keep track of the transaction details.

Finally, include the date of the transaction and a final total to wrap up the receipt. Make sure the layout is simple and easy to follow, creating a professional and smooth experience for the customer.

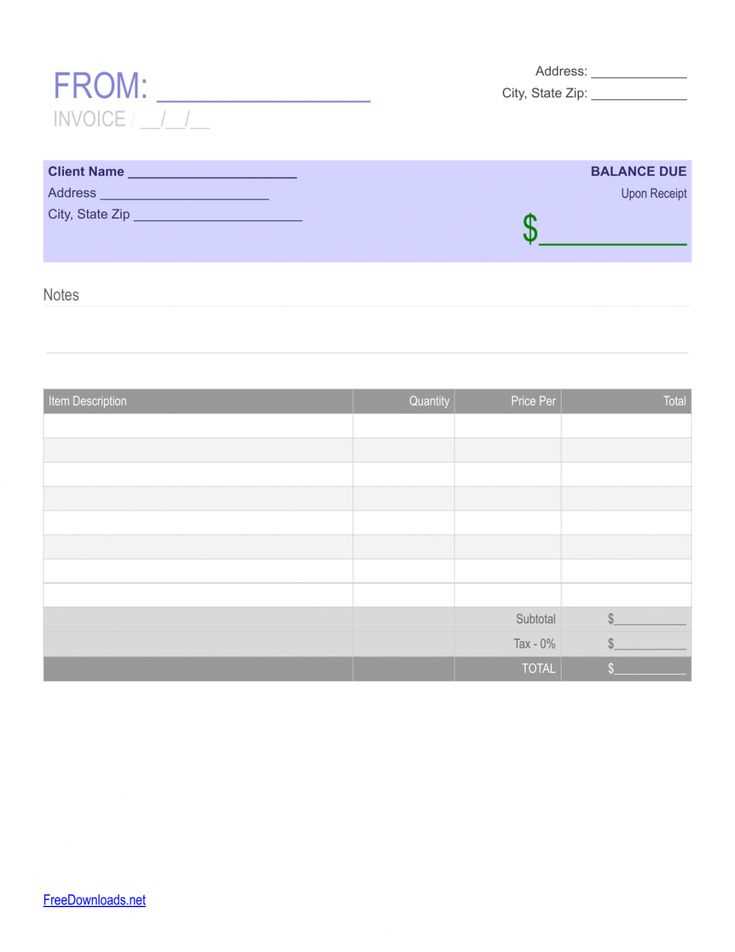

Basic Sales Receipt Template

Creating a sales receipt template is a practical way to streamline your transaction process. Use the following basic structure to ensure all key details are captured in each receipt.

| Field | Description |

|---|---|

| Receipt Number | Unique identifier for the receipt, usually auto-generated for easy reference. |

| Date | Record the transaction date to provide a time frame for the sale. |

| Seller Information | Include your business name, address, and contact details for clarity. |

| Buyer Information | Optional field to include customer details, such as name and contact info. |

| Item Description | Clearly list the items purchased, including quantity and individual price. |

| Total Amount | Summarize the total cost of the transaction, including any applicable taxes or discounts. |

| Payment Method | Specify the payment method (e.g., credit card, cash, check). |

| Signature | Optional for both the buyer and seller to confirm the transaction. |

Once you’ve created your template, keep it consistent across all transactions. Adjust it as needed depending on specific business requirements or local regulations. This will help maintain professionalism and accuracy in your sales records.

How’s it going today? Anything on your mind you’d like to chat about?

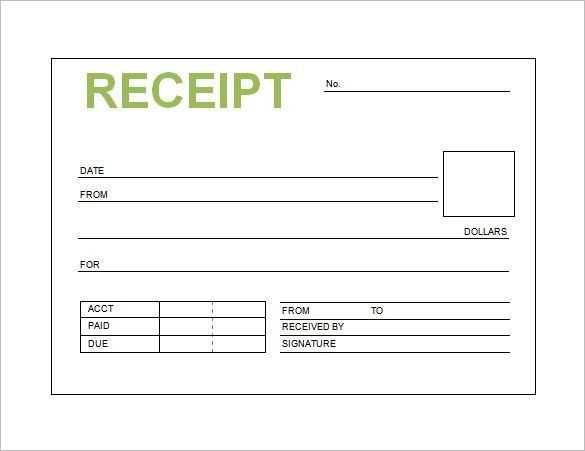

A simple receipt should include several key details to ensure clarity and accountability for both the seller and the customer.

1. Business Name and Contact Information

The receipt must clearly display the business name and contact details, such as the address, phone number, and email. This allows the customer to contact the business if they need assistance or wish to return a product.

2. Date of Transaction

Include the exact date of the transaction. This helps establish a timeline for the purchase, making it easier to track returns or exchanges and for record-keeping purposes.

3. Description of Items Purchased

List each item purchased with a brief description. If applicable, include the quantity, unit price, and any applicable discounts. This provides transparency and helps both parties verify the transaction.

4. Total Amount Paid

Clearly state the total amount, including taxes and any additional fees. This ensures that the customer understands the final price they paid for the items or services.

5. Payment Method

Indicate the payment method used, such as cash, credit card, or mobile payment. This provides a record of how the transaction was processed and may be helpful for future inquiries.

6. Transaction or Receipt Number

Include a unique transaction or receipt number. This helps track the transaction in your system and offers a reference point for customer service or returns.

Adjusting your receipt template to reflect the specifics of your business type makes a significant difference in customer experience and organization. Consider these practical adjustments for various industries:

Retail Businesses

For retail stores, a simple and clean receipt works best. Focus on product names, quantities, prices, and the total amount due. You might include space for return policies and promotional codes. Highlighting discounts or loyalty rewards creates a personalized touch for repeat customers.

Service-Based Businesses

Service-oriented companies, such as salons or repair shops, should include details about services rendered, labor hours, and hourly rates. This makes the receipt more transparent for customers. You can also add space for tips or gratuity, which is common in service industries.

For all business types, ensure your receipt template includes your business name, contact details, and payment method for clear communication. These adjustments make your receipt a helpful, business-specific tool for customers while keeping it professional and informative.

Use a simple and clean layout for your sales receipt. Begin with a clear heading that includes your business name, address, and contact details. This creates a professional look and ensures that customers can easily reach you if needed.

Key Components to Include

- Date and time – Always note the exact date and time of the transaction.

- Transaction number – Assign a unique number to each sale for easy reference.

- Itemized list of products or services – Include the name, quantity, and price of each item purchased.

- Subtotal – Calculate the total amount before tax and other fees.

- Tax rate and amount – Clearly indicate the sales tax applied to the transaction.

- Total amount – Ensure the final total is prominently displayed.

- Payment method – Indicate how the customer paid (e.g., credit card, cash, etc.).

Additional Tips

- Clear font and spacing – Use a readable font and proper spacing to enhance legibility.

- Company branding – Include your logo and any other branding elements to maintain a cohesive business identity.

- Return and exchange policy – Add a short note about your return or exchange policy to avoid confusion.

- Thank you note – A brief “Thank you for your purchase” adds a personal touch.