A bill of sale and receipt are key documents in any transaction, serving as proof of ownership transfer. Both offer clear evidence of a sale, and it’s important to have them filled out properly to avoid potential misunderstandings. A bill of sale outlines the details of the item or service being sold, while a receipt confirms that payment has been received. Both documents should include specific information such as the buyer and seller’s details, item description, purchase price, and transaction date.

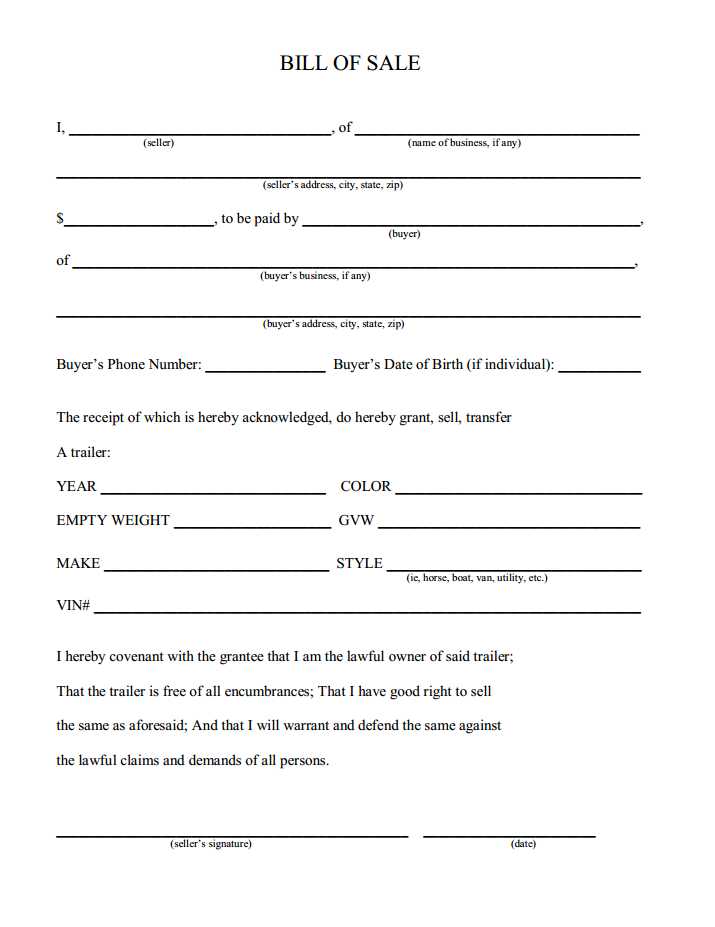

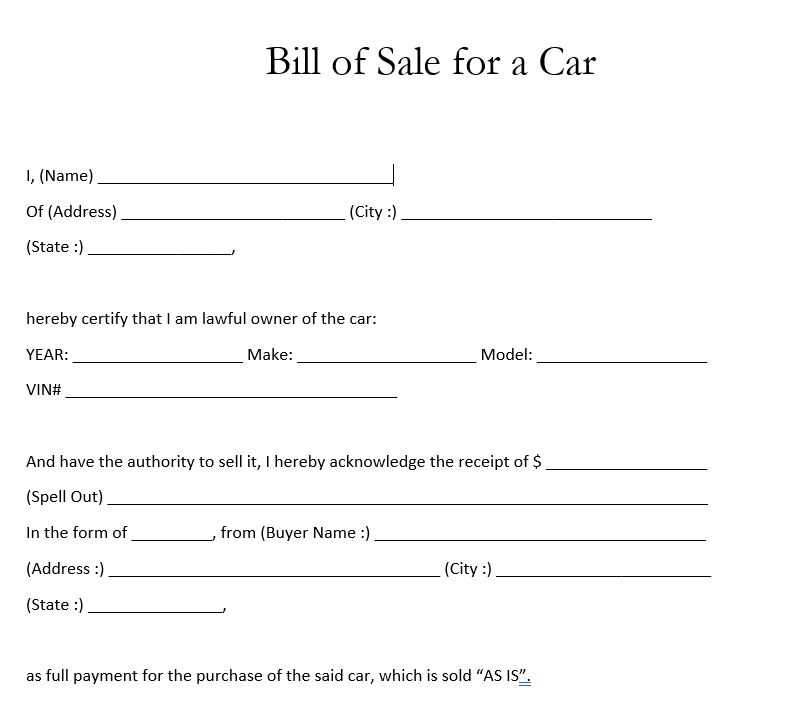

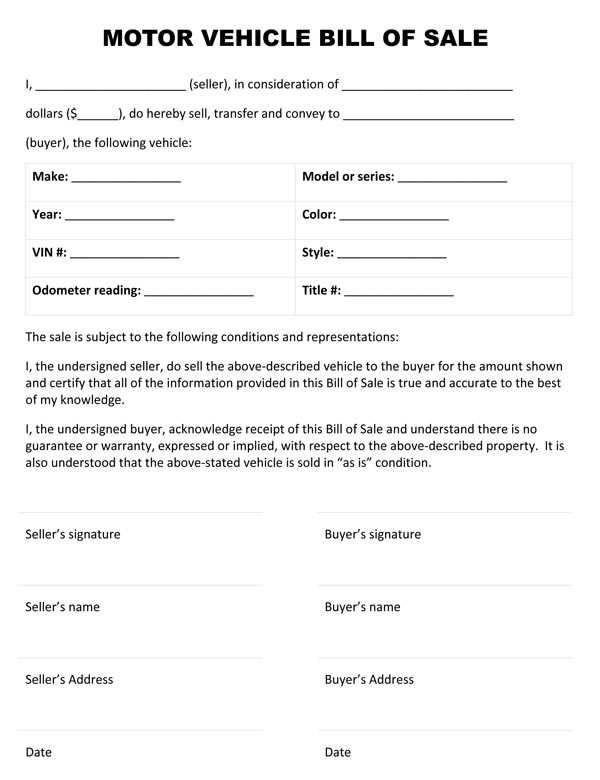

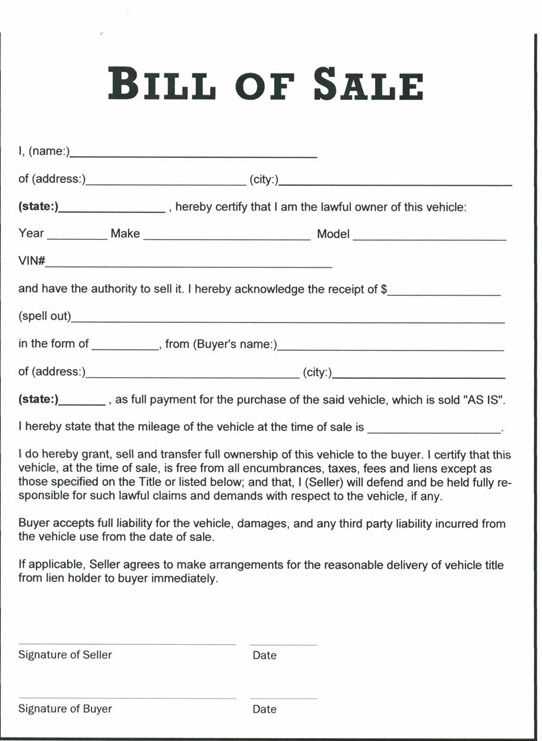

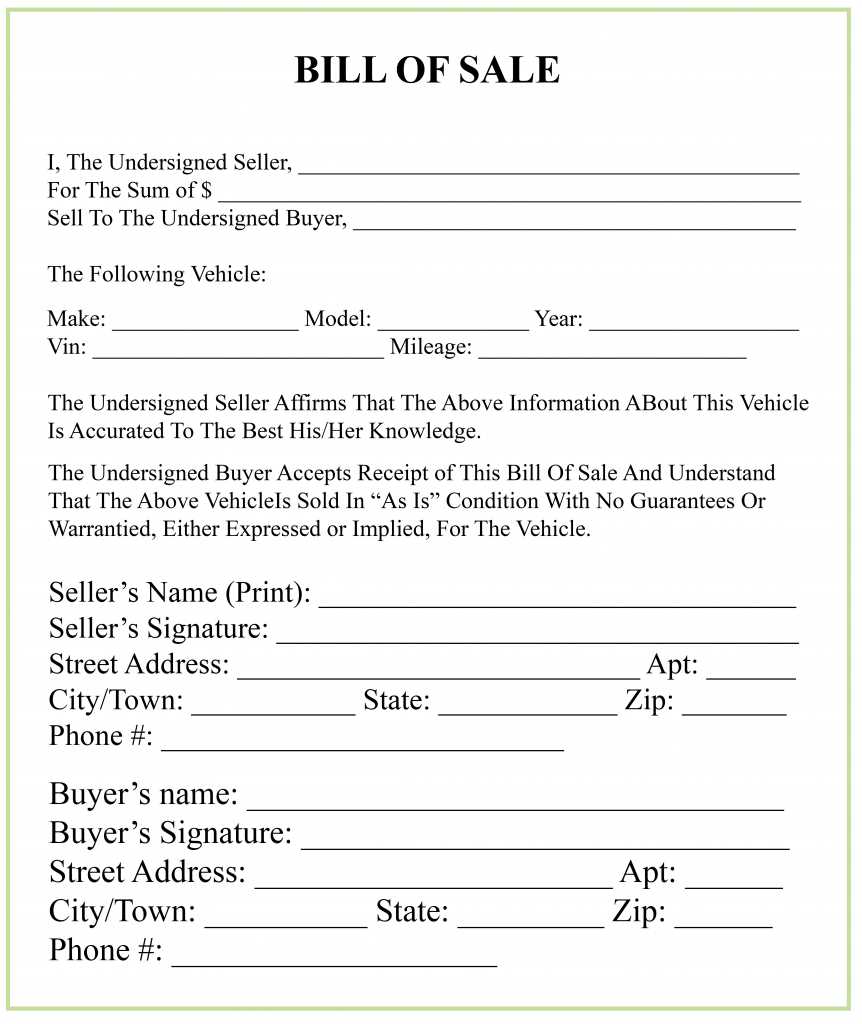

When creating a bill of sale template, focus on simplicity and clarity. Include fields for the buyer’s and seller’s full names, contact information, and addresses. It should also feature a section for item identification, which could be a vehicle, equipment, or personal property. This ensures both parties are clear on what’s being sold. Including a space for signatures solidifies the document’s validity.

On the other hand, a receipt confirms the payment made during the transaction. This is often a simpler document but still needs to list the transaction date, amount paid, and payment method. Adding a transaction ID or receipt number can help track payments, making it easier for both parties to keep records. Keep these documents organized and accessible for future reference.

Here’s the corrected version:

Use a clear structure in your bill of sale template. Include the full names of the buyer and seller, along with their contact information. Be specific about the item being sold: describe it, including make, model, and any distinguishing features. Provide the sale price and mention if any payments are pending or have been completed. Add the date of the transaction and a statement confirming that the item is sold as-is, with no warranties unless stated otherwise.

Make sure the template includes a space for signatures. Both the buyer and seller should sign and date the document, confirming their agreement to the terms. If needed, leave room for a witness or notary signature. This adds an extra layer of validity to the sale.

For receipts, ensure they reflect the transaction accurately. They should clearly state the date, sale price, and any taxes applied. Include the method of payment, whether by cash, check, or credit. For added clarity, you may want to include a note confirming that the buyer has received the item in good condition, if applicable.

Bill of Sale Template and Receipt: Practical Guide

How to Draft a Bill of Sale Template for Personal Transactions

Creating a clear and concise Bill of Sale (BOS) template ensures both parties understand the terms of the transaction. The template should include basic transaction details such as the buyer’s and seller’s full names, addresses, and contact information. List the item or service being sold, including a clear description and any relevant serial numbers or identifying marks. Mention the purchase price, payment method, and the date of the sale. It’s also helpful to include a statement that the item is sold “as-is” if there are no warranties or guarantees attached.

Include space for both parties to sign, confirming the terms. If the transaction involves a vehicle, additional details like the Vehicle Identification Number (VIN) should be noted. Be specific about the condition of the item and note any pre-existing damages if applicable. This ensures transparency and protects both buyer and seller from future disputes.

Key Elements to Include in a Receipt for a Successful Transaction Record

A receipt should provide a written record that confirms the buyer has made a payment and that the seller has transferred the item or service. Include the transaction date, the amount paid, and the payment method (e.g., cash, credit, or bank transfer). The receipt should list the same item or service mentioned in the Bill of Sale, along with any specific identification numbers or distinguishing features.

Also, note any taxes or fees that were included in the transaction, especially for larger purchases or sales involving goods subject to tax. Have the seller sign the receipt, and if possible, provide a duplicate copy for the buyer. A signed receipt serves as a legally binding document that confirms the buyer’s rights to the purchased item.

Understanding Legal Implications of Bill of Sale and Receipt for Both Parties

The Bill of Sale and receipt are both legally binding documents, ensuring that both parties uphold their end of the deal. A Bill of Sale acts as proof of transfer of ownership and can be critical if a dispute arises or if the buyer needs to prove ownership for registration purposes. Without a properly drafted BOS, a seller may face challenges proving the transaction in court if issues arise in the future.

For the buyer, having a receipt protects their investment by confirming the transaction and ensuring there’s a record of payment made. It also serves as a reference in case they need to return or exchange the item. A receipt further prevents claims that the item was never paid for, reducing the risk of fraud.

Now words do not repeat excessively, maintaining clarity and accuracy.

To avoid unnecessary repetition, focus on using synonyms or rephrasing when a term appears frequently. This creates a natural flow and improves readability. For example, instead of repeating “vehicle” multiple times, alternate with “car,” “auto,” or “motor vehicle” depending on context.

Use of Active Voice

Active voice encourages clear, direct communication. For instance, instead of “The document was signed by the buyer,” use “The buyer signed the document.” This simple shift eliminates passive constructions and reduces wordiness.

Avoid Redundancy

Repetitive phrases add no new information. For example, instead of writing “A receipt should be issued to the buyer after payment has been made,” simply state, “A receipt is issued to the buyer after payment.” Shortening such statements increases precision and efficiency.