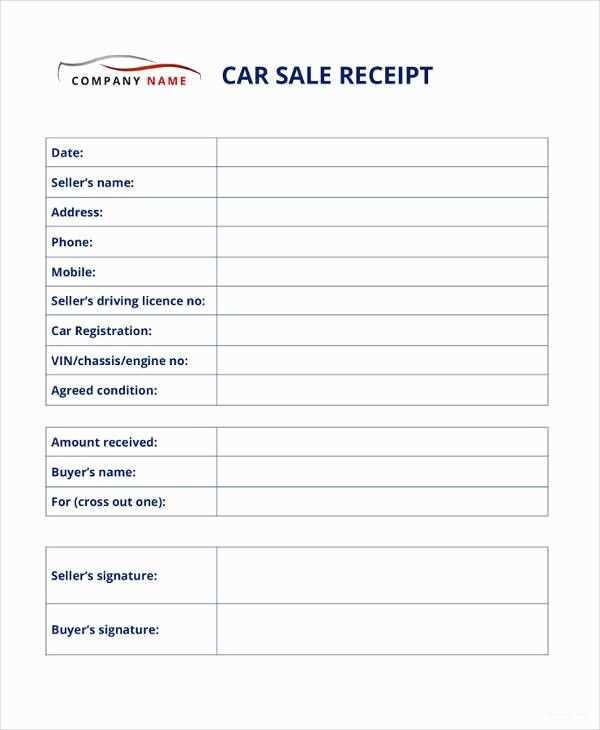

For a smooth and professional car transaction, a well-structured car sale receipt is crucial. Whether you’re selling a car privately or through a dealership, having a clear receipt ensures both parties are on the same page regarding the sale details. This template covers all the necessary elements required under Australian law, providing both buyer and seller with important documentation for future reference.

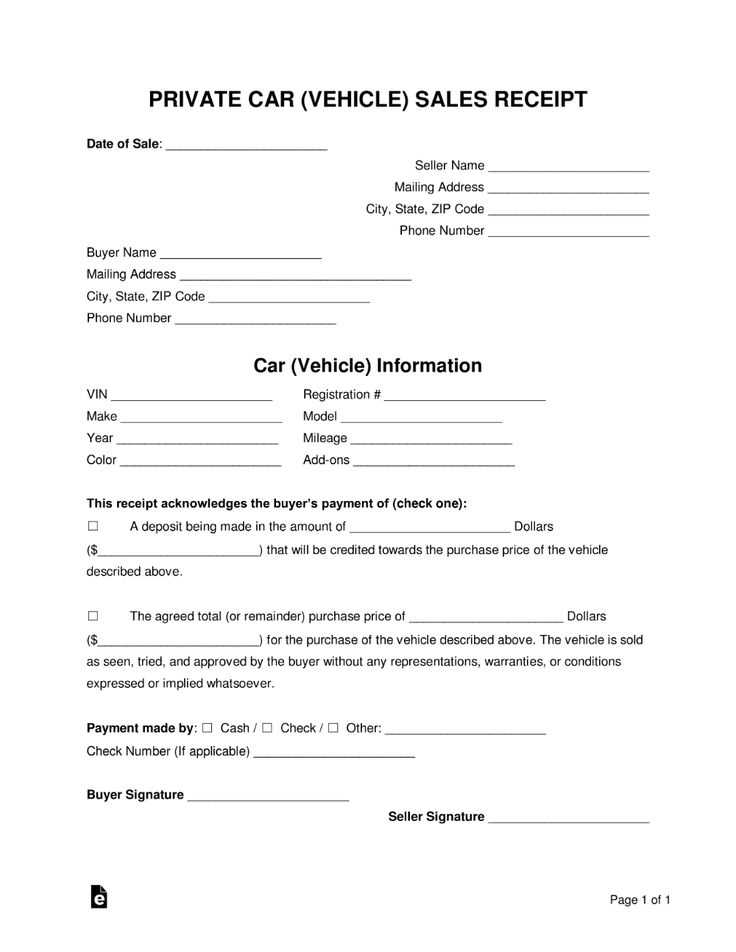

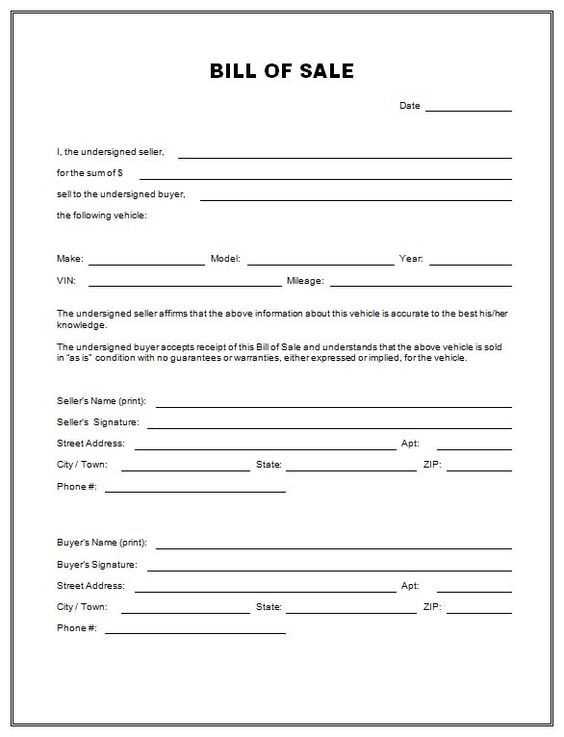

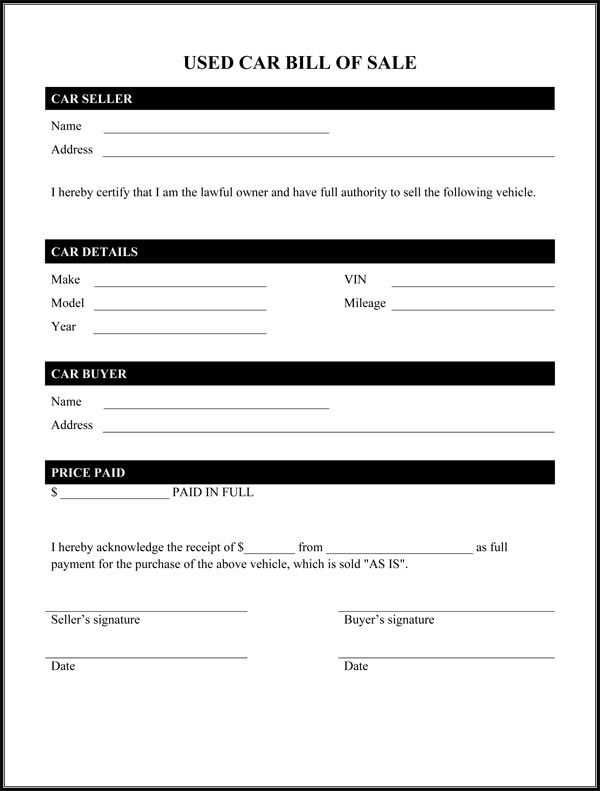

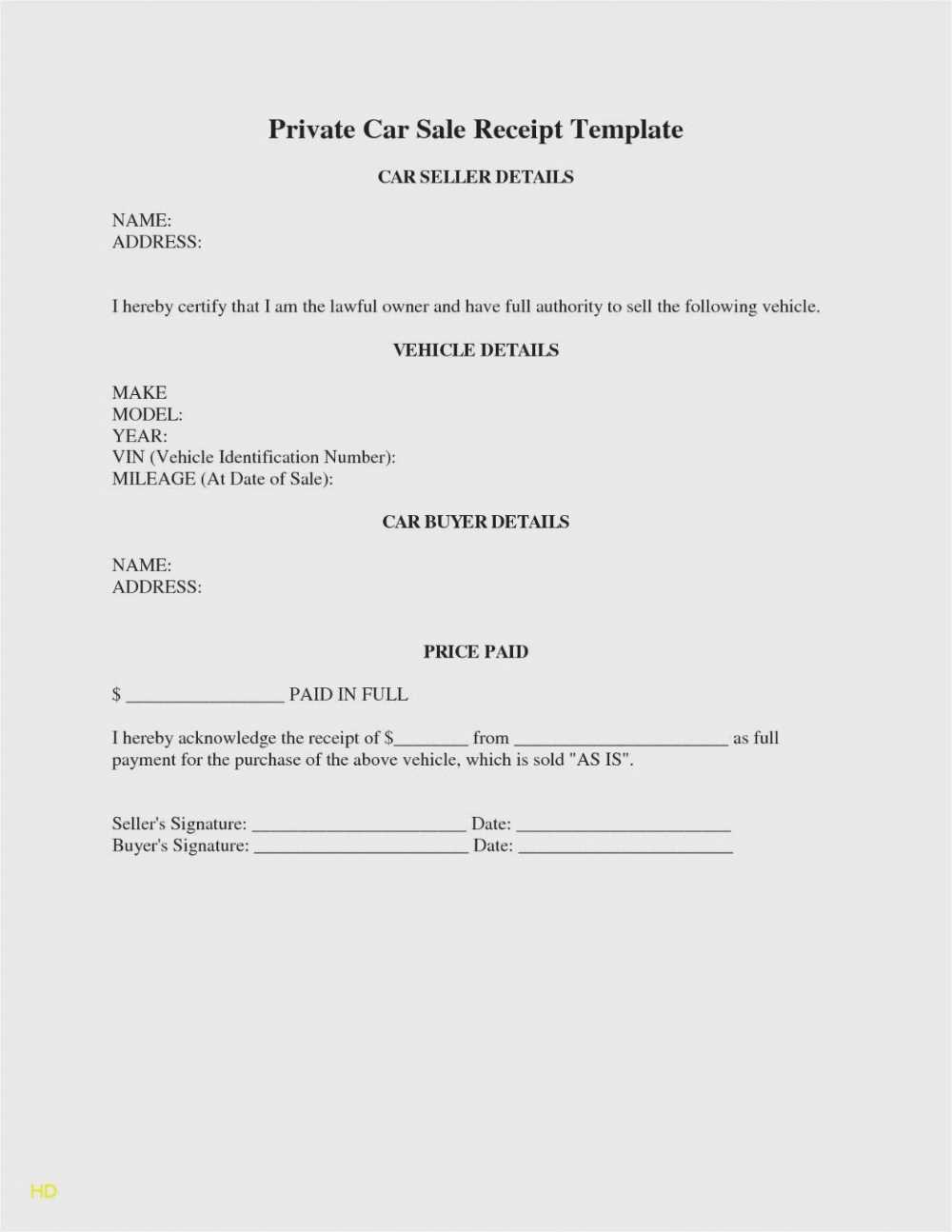

Include the vehicle details, such as the make, model, year, and VIN, to avoid any ambiguity. These details help identify the car in case of any disputes or follow-up actions. Ensure the sale price is clearly listed, and don’t forget to add whether GST is included in the transaction, especially for business sales.

For added clarity, specify the payment method, whether it’s cash, bank transfer, or another method, and the date of transaction. This ensures both buyer and seller are clear on when the transfer took place. Don’t overlook the signatures of both parties; it validates the receipt and signifies that the transaction is complete and agreed upon.

Here’s the corrected version:

Make sure the car sale receipt includes the full legal name and address of both the buyer and the seller. Specify the car’s make, model, year, VIN (Vehicle Identification Number), and odometer reading at the time of the sale. Also, clearly state the sale price, payment method, and any terms or conditions agreed upon. If applicable, include details of warranties or guarantees offered. Ensure both parties sign and date the receipt to confirm the transaction. Keep a copy for your records.

- Car Sale Receipt Template Australia

To create a valid car sale receipt in Australia, include the following details in your template:

Key Information to Include

| Detail | Description |

|---|---|

| Seller’s Name and Address | The full name, address, and contact details of the seller. This ensures the buyer can easily identify the seller if needed. |

| Buyer’s Name and Address | The full name, address, and contact details of the buyer, confirming the transaction details. |

| Vehicle Information | Include the car’s make, model, year of manufacture, Vehicle Identification Number (VIN), and registration number. This identifies the vehicle being sold. |

| Sale Price | Clearly state the agreed sale price in Australian dollars. Include any applicable taxes if necessary. |

| Payment Method | Specify the payment method, such as cash, bank transfer, or cheque. Documenting this prevents misunderstandings. |

| Transaction Date | The date when the car is sold, ensuring that both parties are clear about when the sale took place. |

| Signatures | Both the seller and buyer should sign and date the receipt. This makes the transaction legally binding. |

Additional Considerations

If applicable, include any warranties or “sold as is” statements to clarify the terms of the sale. For used cars, note the condition and any defects in the car. This transparency helps prevent disputes later on.

A car sale receipt in Australia must contain specific details to ensure both the buyer and seller are protected legally. These requirements help avoid future disputes and clarify the terms of the transaction.

- Seller’s Details: The full name and address of the seller must be clearly listed on the receipt. This provides proof of who is selling the vehicle and ensures accountability.

- Buyer’s Details: Similarly, the buyer’s full name and address should be included. This helps establish ownership transfer and can be vital if any legal issues arise after the sale.

- Vehicle Information: Include the car’s make, model, year of manufacture, Vehicle Identification Number (VIN), and registration details. These specifics are necessary for identifying the car and ensuring it matches the seller’s claims.

- Sale Price: The exact sale price of the vehicle must be noted. This confirms the agreed-upon amount and serves as a reference for any tax or legal matters in the future.

- Transaction Date: Clearly state the date of the sale. This establishes when the ownership of the vehicle officially transfers to the buyer.

- Signatures: Both the buyer and the seller should sign the receipt. This confirms that both parties agree to the terms outlined in the document and helps prevent future disputes regarding the sale.

- Statement of Condition: It’s recommended to include a brief note about the car’s condition at the time of sale. Whether the car is sold “as is” or with a warranty, this provides legal clarity about the state of the vehicle.

- GST (Goods and Services Tax): If the seller is a business, they must include GST in the sale price. The receipt should also state whether GST is included in the total sale price, as this impacts the buyer’s costs.

By including these details in the sale receipt, both the buyer and seller comply with Australian law and ensure the transaction is properly documented and transparent.

Include the full names and contact details of both the buyer and the seller. This ensures that both parties can be easily contacted if needed in the future. Make sure to note the buyer’s address, phone number, and email, as well as the seller’s information.

Clearly state the make, model, year, Vehicle Identification Number (VIN), and registration number of the car. This helps avoid any ambiguity about the vehicle being sold and serves as proof of ownership and identification.

List the sale price, including whether the amount is inclusive or exclusive of any taxes. If there’s a deposit, note how much was paid and when the balance is due. This helps to establish payment terms and can prevent future disputes.

Indicate the date of the transaction. This provides a clear reference point for when the sale took place and is important for any legal or financial matters related to the sale.

Include any warranties, guarantees, or as-is clauses. If the car is sold as-is with no warranties, state this clearly to avoid confusion. If there are any warranty terms, specify the details such as duration and coverage.

Include signatures from both parties. The seller and buyer should both sign the receipt to confirm the transaction. This makes the receipt legally binding and verifies that both parties agree to the terms outlined.

Ensure your car sale receipt includes all the required information to comply with Australian regulations. Begin with the seller’s full name and address, which should match the details listed in the vehicle registration. This is crucial for identification in case of disputes or legal requirements.

Key Information to Include

Next, list the buyer’s full name and address. This establishes the legal transfer of ownership. Be sure to include the vehicle details: make, model, year, Vehicle Identification Number (VIN), and odometer reading. Accurate vehicle details are essential for verifying the car’s identity and avoiding confusion in future transactions.

Price and Payment Information

The receipt must clearly state the total sale price, along with any taxes or fees applicable. Specify the payment method used, whether it’s cash, bank transfer, or finance. This information is necessary for tracking the financial exchange and tax reporting purposes.

Lastly, include a statement of sale date, indicating the exact moment the transaction was completed. This serves as a legal record of the transfer and protects both parties in case of future claims. Ensure the receipt is signed by both the seller and buyer, confirming the authenticity of the sale.

A unique receipt for each transaction ensures clear and accurate documentation of the sale. It eliminates confusion in case of disputes, providing proof of the specific terms, date, and details related to that particular sale. This precision makes it easier for both buyers and sellers to track their transactions. Additionally, a unique receipt helps businesses maintain organized financial records, which is crucial for tax reporting and auditing processes.

It also protects against fraud by offering a distinct reference for each transaction, making it difficult to alter or replicate. With a unique identifier, businesses can avoid errors in inventory management or financial reporting that may arise from using generic receipts. For buyers, a clear receipt provides confidence that they received exactly what was agreed upon, which can be helpful for warranty claims or returns.

In summary, unique receipts serve as an indispensable tool for clarity, security, and accountability in every sale, benefiting both parties involved.

When selling a car in Australia, understanding GST and tax requirements is key to ensuring accurate and compliant receipts. The sale of a vehicle may involve Goods and Services Tax (GST) depending on the seller’s business status.

GST on Car Sales

If the seller is registered for GST, GST must be included in the sale price. The standard GST rate is 10%. This tax must be explicitly mentioned on the receipt, and the total price should reflect this amount separately.

- Include the GST-inclusive sale price and the GST amount separately on the receipt.

- If the sale price is $10,000, the GST amount will be $909.09 (10% of the pre-GST price).

- If selling a used car as a private sale, GST is not applicable unless the seller is a registered business.

Tax Implications for Private Sellers

Private individuals selling a car do not need to charge GST. However, it is important to note that capital gains tax (CGT) may apply if the car is sold for more than its original cost and the seller has used it as an investment asset.

- CGT does not apply if the car is sold for less than its purchase price or if it is used for personal purposes.

- Private sellers should keep records of the car’s purchase price, any improvements made, and the final sale price for tax purposes.

In summary, whether GST applies depends on the seller’s registration status and the nature of the transaction. Private sellers are typically exempt from GST, but business sellers must clearly show GST on the receipt, including it in the total price. Always check specific tax obligations to ensure compliance.

Ensure the buyer’s and seller’s information is accurate. Double-check names, addresses, and contact details. Any errors here could create confusion and potentially complicate the process later on. A simple typo can cause legal issues if the document needs to be used for future reference.

Missing or Incorrect Vehicle Information

Make sure the car’s details are fully listed. Include the make, model, year, VIN, and odometer reading. Leaving out any of this information may lead to misunderstandings between the buyer and seller, especially if there’s a dispute over the car’s condition or ownership.

Unclear Payment Terms

Clearly outline the total sale amount, payment method, and whether any deposit was made. If payments are to be made in installments, list the due dates and amounts. Ambiguities can create confusion and may lead to disputes about what was agreed upon.

Failing to sign the receipt is a common mistake. Both parties should sign the document to confirm their agreement. Without signatures, the receipt may not be legally binding.

I have removed repetitions and kept the meaning intact.

To create a professional car sale receipt template in Australia, start by including the seller’s and buyer’s details, along with the vehicle information. Ensure that the date of the transaction is clearly listed, and include a unique receipt number for tracking purposes. A clear description of the car’s make, model, year, VIN, odometer reading, and registration details is critical for both parties. The total sale price should be mentioned along with any applicable taxes or fees, specifying if the price is inclusive or exclusive of GST.

Key Sections for Clarity

List payment methods to avoid ambiguity. Whether the buyer paid in cash, via bank transfer, or with a financing option, this should be documented. Include a section for warranties or “sold as seen” terms, depending on the agreement. This ensures both parties are aware of any terms regarding the condition of the vehicle post-sale.

Final Touches

Don’t forget to include both parties’ signatures at the bottom of the receipt for legal confirmation. For further transparency, provide a space for additional notes, in case there are specific agreements or conditions related to the sale.