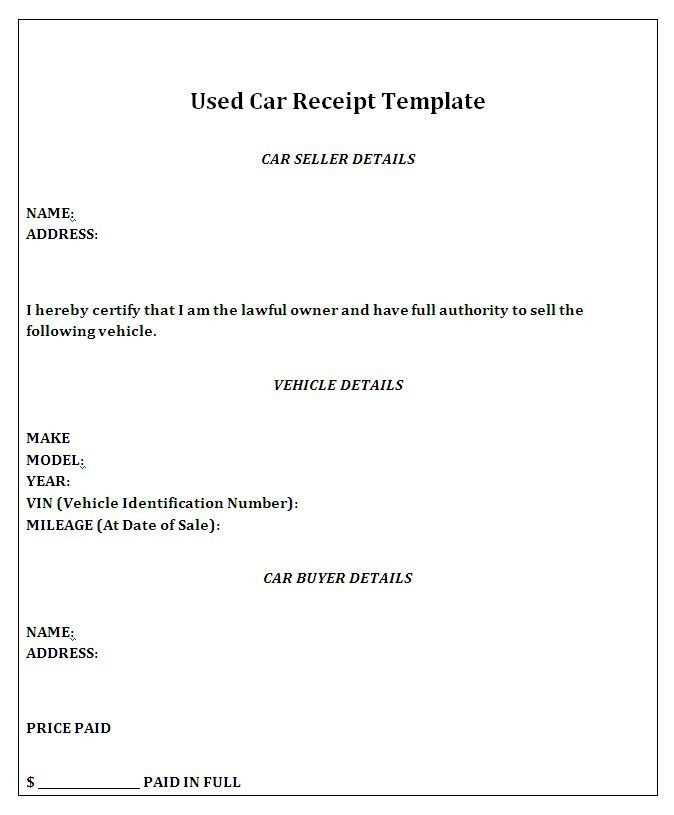

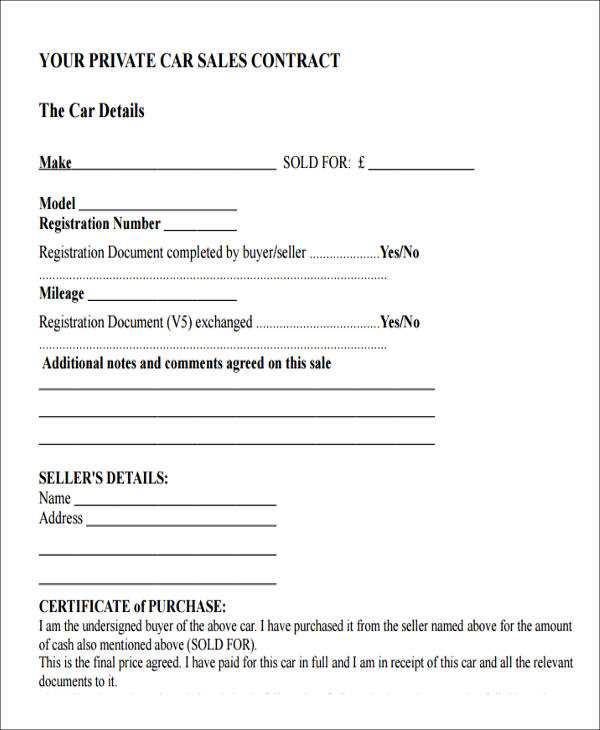

When selling a car in Australia, providing a properly structured sales receipt is essential. This document confirms the transaction, protects both parties, and serves as proof of purchase. A well-prepared receipt includes key details that ensure legal compliance and transparency.

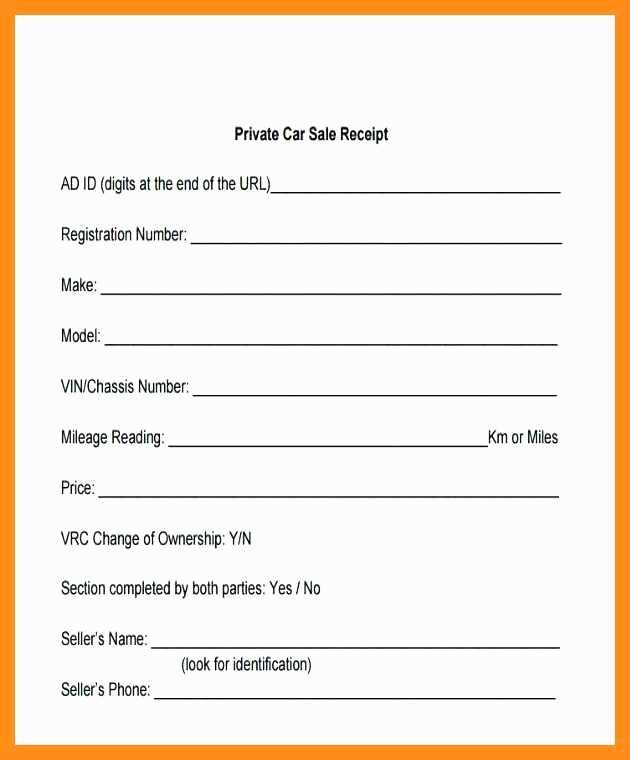

Every receipt should contain the buyer’s and seller’s full names, addresses, and contact details. The vehicle’s information–such as make, model, year, VIN (Vehicle Identification Number), and registration number–must be clearly stated. Additionally, the date of sale and the agreed price should be documented to avoid future disputes.

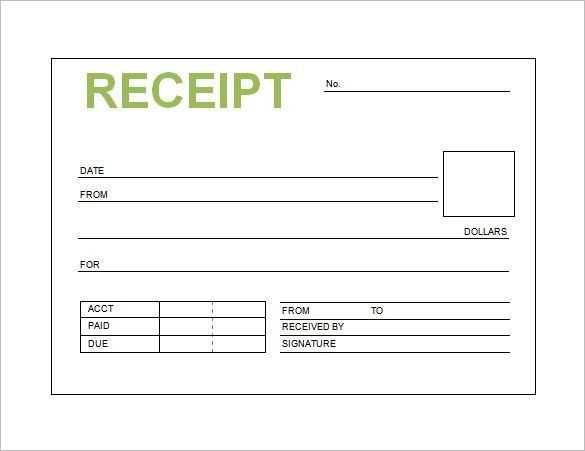

For added security, including a statement that the vehicle is sold “as-is” without warranty helps clarify the seller’s liability. Both parties should sign and keep a copy of the receipt for their records. Using a structured template simplifies the process and ensures all necessary details are included.

Customizable templates make it easy to create a legally sound receipt. Whether selling privately or through a dealership, having a clear, professional document ensures a smooth transaction. Downloading a pre-formatted template saves time and minimizes errors, making the sale process more straightforward.

Here’s a version without unnecessary repetitions:

For a streamlined car sales receipt, focus on the key details that both buyer and seller need. Avoid clutter and stick to the necessary components. Here’s what should be included:

| Field | Description |

|---|---|

| Seller’s Details | Name, address, contact information |

| Buyer’s Details | Name, address, contact information |

| Vehicle Information | Make, model, year, VIN, registration number |

| Transaction Date | Specific date of sale |

| Payment Method | Cash, check, bank transfer, etc. |

| Price | Total agreed amount |

| Warranty Information | If applicable, specify terms |

Keep the receipt clear and concise, avoiding redundant wording or additional commentary. By focusing on these essential points, you create a document that’s easy to understand and reference when needed.

- Vehicle Transaction Receipt Template Australia

When creating a vehicle transaction receipt in Australia, ensure all key details are included to make the document legally valid. The receipt must contain the full names and addresses of both the buyer and the seller. Specify the vehicle’s make, model, year of manufacture, Vehicle Identification Number (VIN), and odometer reading at the time of sale. Include the agreed-upon sale price and the payment method (cash, bank transfer, etc.).

For clarity, it’s important to also state whether the sale is for a new or used vehicle, as this can affect warranties or consumer rights. If the vehicle is sold “as is,” make this clear, as it will impact any future claims related to the vehicle’s condition. Both parties should sign the document to confirm the transaction. Keep a copy for your records, as it’s required for registration and potential future disputes.

In Australia, auto sales receipts must comply with several legal requirements to ensure transparency and protect both buyers and sellers. Here’s what you need to include:

- Seller Details: The receipt should clearly list the seller’s full name, business name (if applicable), address, and ABN (Australian Business Number).

- Buyer Information: Include the buyer’s name and address, which helps confirm the sale and prevents future disputes.

- Vehicle Details: The make, model, VIN (Vehicle Identification Number), and year of manufacture should be specified. This provides clear identification of the vehicle sold.

- Sale Price: The final sale price of the vehicle must be stated, including GST if applicable. This ensures that both parties agree on the financial terms of the transaction.

- Date of Sale: The receipt should clearly show the date of the sale to record the exact timing of the transaction.

- Warranty and Terms: If applicable, include any warranty information or terms regarding the condition of the vehicle at the time of sale. This protects both parties in case of future disputes.

- Signatures: Both the buyer and the seller should sign the receipt to acknowledge the transaction, making it legally binding.

Additional Requirements for Dealer Sales

If the sale is conducted by a dealer, additional details are required. The receipt should include the dealer’s license number and any other relevant documentation confirming their business status under Australian Consumer Law. This helps ensure that the transaction meets the standards set by the Australian Competition and Consumer Commission (ACCC).

Record Keeping and Reporting

Both parties must retain a copy of the receipt for their records. Dealers, in particular, are required to keep sales records for a minimum of five years for auditing purposes. This helps ensure compliance with tax and consumer protection regulations.

Ensure that the sales receipt includes the full business name and contact details, such as the address, phone number, and email. This gives clarity on where the transaction occurred and allows for easy follow-up.

Provide a unique receipt number to help identify and track the sale. This is vital for inventory management and auditing purposes.

List the date and time of the sale. This ensures that both parties have a reference for when the transaction occurred and can help resolve any disputes that may arise.

Clearly show the description of the car, including make, model, year, VIN (Vehicle Identification Number), and any other relevant details. This will help verify the item being sold and protect both buyer and seller.

Include a breakdown of the sale price and any additional fees, such as taxes or registration costs. It’s also recommended to highlight any discounts or trade-ins if applicable.

Ensure the payment method is noted (cash, credit card, etc.) along with the transaction details. This is important for both the buyer and seller to track payment history.

Incorporate a warranty or return policy, if applicable, with clear terms for the buyer to understand what is covered and for how long.

For car buyers in Australia, deciding between a printable or digital auto receipt depends on preferences and practical needs. Each option has distinct advantages and limitations.

- Printable Receipts:

- Provides a tangible record for easy access in case of disputes or future reference.

- Can be stored with other important paperwork, making it ideal for those who prefer physical copies.

- Suitable for situations where digital records may not be easily accessible or reliable.

- Digital Receipts:

- Offers easy storage and access on devices like smartphones or computers, saving physical space.

- Reduces the risk of losing documents and allows for instant sharing with others, like insurance providers.

- Typically more eco-friendly by cutting down on paper usage.

Choosing between the two depends on your priorities, such as the importance of having a hard copy versus the convenience of digital records. Both offer clear benefits based on your habits and needs.

Each Australian state has specific rules that govern the details required on a car sales receipt. These differences impact what information needs to be displayed, how taxes are calculated, and the specific consumer protection laws that apply.

Victoria

In Victoria, the sales receipt must include the Vehicle Identification Number (VIN) and the odometer reading at the time of sale. This is to comply with the Consumer Law of the state, ensuring transparency for both buyers and sellers. It’s also crucial for the seller to confirm the car’s compliance with Australian Design Rules (ADR) if the car is imported.

New South Wales

For sales in New South Wales, the receipt must clearly state whether the car is sold as-is or with a warranty. Additionally, it’s required to include the seller’s Australian Business Number (ABN) if applicable. This ensures that the transaction adheres to the state’s fair trading regulations, providing a layer of protection for both parties.

Be mindful of these specific requirements to ensure your sales receipt complies with state laws and avoids potential legal issues.

Begin by determining the basic elements you want to include. At a minimum, a vehicle transaction receipt should feature the buyer’s and seller’s names, contact details, and vehicle information such as make, model, VIN (Vehicle Identification Number), and year. Include the transaction date and price as well as any taxes or fees applied.

Ensure clear and accurate formatting. List each component of the transaction separately to avoid confusion, such as the cost of the vehicle, taxes, registration fees, and additional charges. This transparency will help both parties understand the breakdown of the payment.

Use a simple, clean layout that’s easy to read. Include headers for each section, such as “Vehicle Information,” “Payment Breakdown,” and “Seller Details,” to guide the reader through the receipt. Consistent font sizes and styles make it easier to read, ensuring that the receipt serves its purpose as a legal document.

Consider adding a receipt number for tracking purposes. This will help maintain records of the transaction, especially for future reference or in case of disputes.

If possible, include both digital and physical formats. For online transactions, provide a downloadable PDF version that mirrors the physical format, ensuring both buyer and seller have identical copies. For in-person transactions, print the receipt on durable paper for easy storage.

Lastly, review the receipt for accuracy. Errors in vehicle details, pricing, or contact information could cause issues down the line. Make sure all figures match the agreed-upon terms and that the receipt serves as a reliable document for both parties involved.

Ensure you include the correct date on the receipt. A common mistake is using an incorrect or outdated date, which can lead to confusion regarding the transaction’s timeline.

Missing or Incorrect Buyer Details

Verify that the buyer’s information is accurate, including full name and address. Incomplete or incorrect details can cause issues in the future if the buyer needs a copy or if disputes arise.

Inaccurate Item Descriptions or Pricing

List items clearly, specifying model numbers or key features. Errors in pricing, such as miscalculated taxes or incorrect totals, can create disputes. Double-check that the total amount reflects the correct sum, including applicable discounts and taxes.

Leave no ambiguity in the payment method section. If the payment method is not specified or wrongly noted, it can create confusion or challenges when referencing the payment transaction later.

For a smooth transaction, ensure your car sales receipt includes all the necessary details. This should include the buyer and seller’s names, the vehicle’s make, model, year, and VIN. Specify the agreed-upon price and any applicable taxes, along with payment method details. Don’t forget to include the date of the sale and signatures from both parties for validity.

Key components:

- Buyer and seller information (names and addresses)

- Vehicle details (make, model, year, VIN)

- Sale price and taxes

- Payment method (cash, bank transfer, etc.)

- Date of transaction

- Signatures of both parties

Always double-check that the details are correct before finalizing the document. Mistakes can lead to complications in ownership transfer or future disputes.