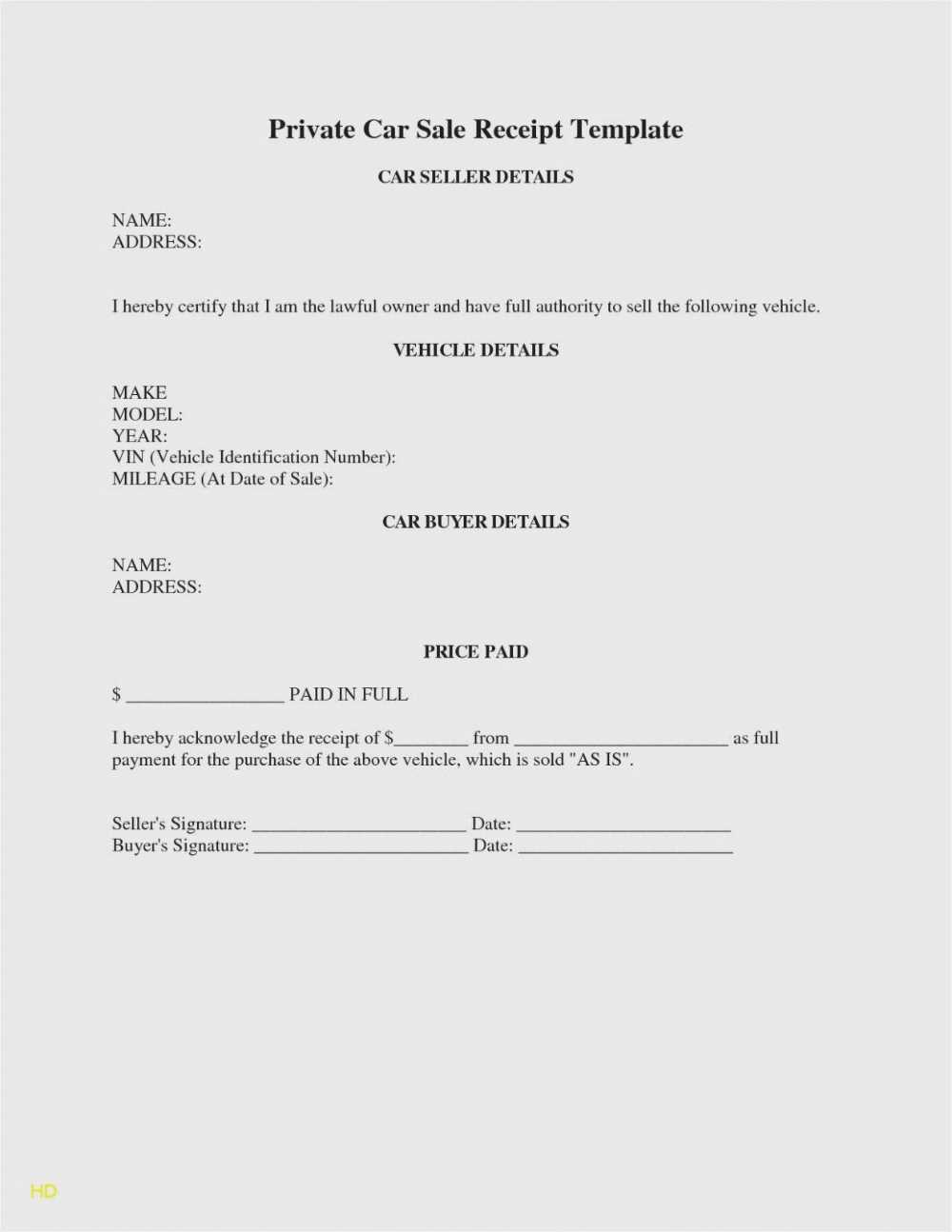

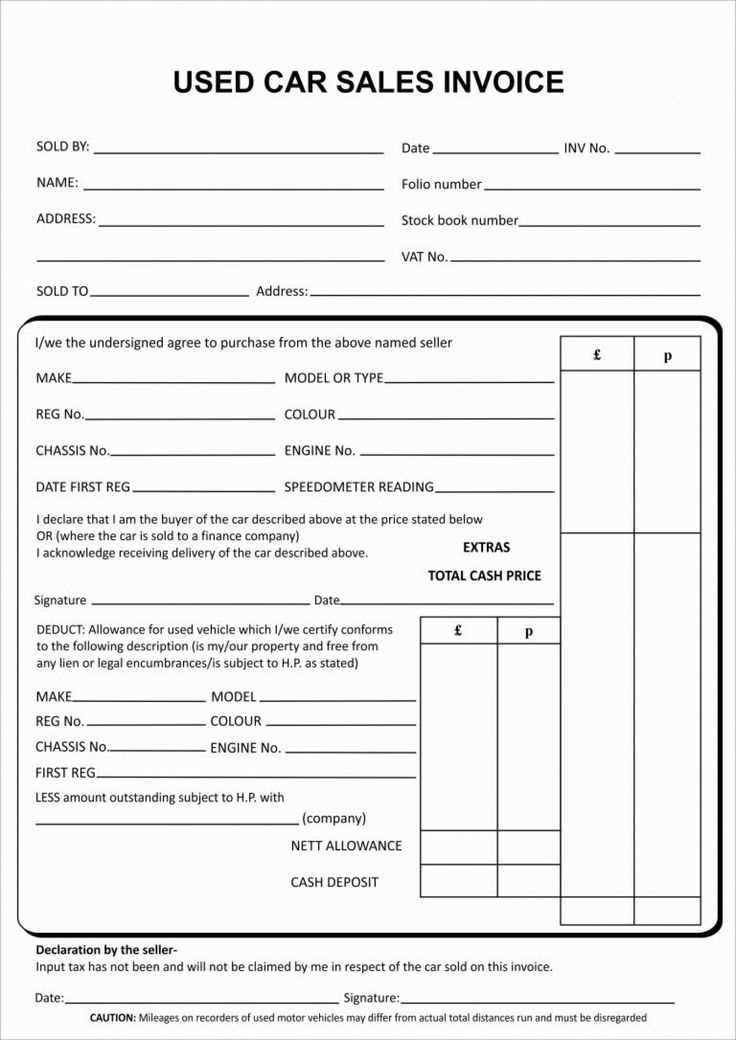

To create a car sales receipt in Ontario, ensure it includes all necessary details to comply with local regulations. The document must list the vehicle’s make, model, year, and Vehicle Identification Number (VIN), along with the buyer and seller’s full names and addresses. Include the date of the transaction and the agreed purchase price. Don’t forget to note the method of payment used, whether it’s cash, check, or financing.

It’s important to specify the condition of the vehicle at the time of sale, including any warranties or “as is” clauses. A clear statement about the transfer of ownership is required, ensuring both parties understand their responsibilities post-sale. Additionally, including any taxes or fees paid as part of the transaction ensures transparency and accuracy.

This template serves as a proof of purchase, so keeping a copy for your records is advised. Make sure all information is accurate, as mistakes could lead to complications down the road.

Car Sales Receipt Template in Ontario

To create a car sales receipt in Ontario, include key information to ensure a clear and legally valid document. The receipt should list both the seller’s and buyer’s details, the vehicle’s specifics, the agreed price, and any applicable taxes. Use the following elements in your template:

Required Information

Ensure the receipt contains the following details:

- Seller’s Information: Name, address, contact details.

- Buyer’s Information: Name, address, contact details.

- Vehicle Details: Make, model, year, Vehicle Identification Number (VIN), and odometer reading at the time of sale.

- Transaction Amount: The agreed purchase price and taxes applied.

- Date of Sale: The exact date the transaction took place.

Example Template

Here’s a simple format for a car sales receipt in Ontario:

| Field | Details |

|---|---|

| Seller’s Name | John Doe |

| Seller’s Address | 123 Main St, Toronto, ON |

| Buyer’s Name | Jane Smith |

| Buyer’s Address | 456 Elm St, Toronto, ON |

| Vehicle Make | Toyota |

| Vehicle Model | Corolla |

| Vehicle Year | 2015 |

| Vehicle VIN | 1HGBH41JXMN109186 |

| Odometer Reading | 120,000 km |

| Transaction Amount | $10,000 |

| Sales Tax | $1,300 |

| Total Amount Paid | $11,300 |

| Date of Sale | February 10, 2025 |

This template covers the required elements for clarity and compliance with Ontario’s regulations for car sales transactions. Ensure all information is accurate before finalizing the receipt.

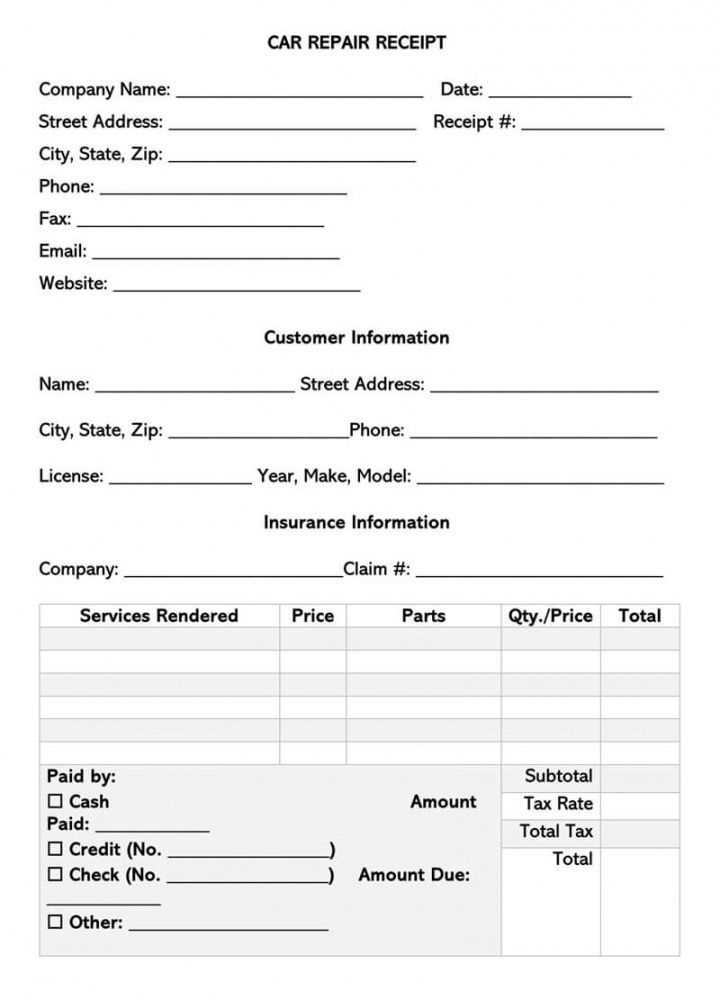

Understanding the Key Elements of a Sales Receipt

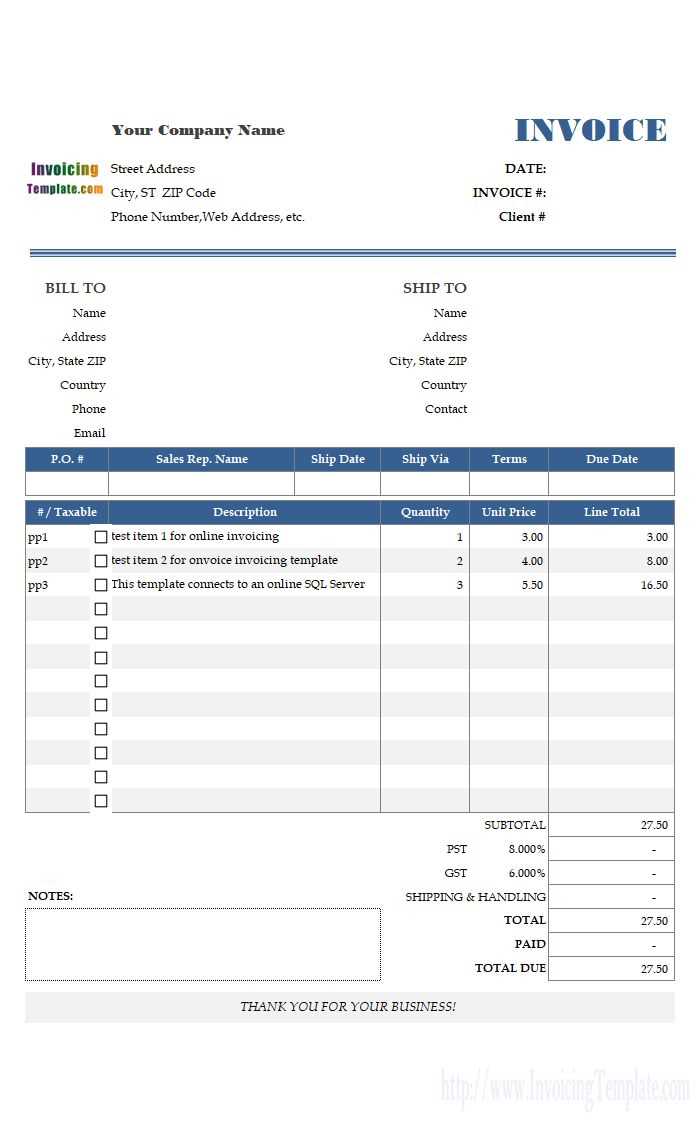

A sales receipt contains important details that provide transparency in transactions. It helps both the buyer and seller keep accurate records. Each element serves a specific purpose, ensuring both parties are on the same page about the sale. Here’s what to look for:

Seller Information

The receipt should clearly state the seller’s name, address, and contact details. This ensures that the buyer knows where the goods were purchased and who to contact in case of any issues with the product.

Transaction Details

Include the date and time of the transaction. This helps establish the timeline of the purchase and can be important for returns or warranty claims. The total amount paid, along with any taxes applied, must also be shown. A breakdown of the price for each item helps clarify the cost structure for the buyer.

In addition, any discounts or special offers applied should be listed to give the buyer a clear understanding of the final price. This transparency avoids confusion and potential disputes.

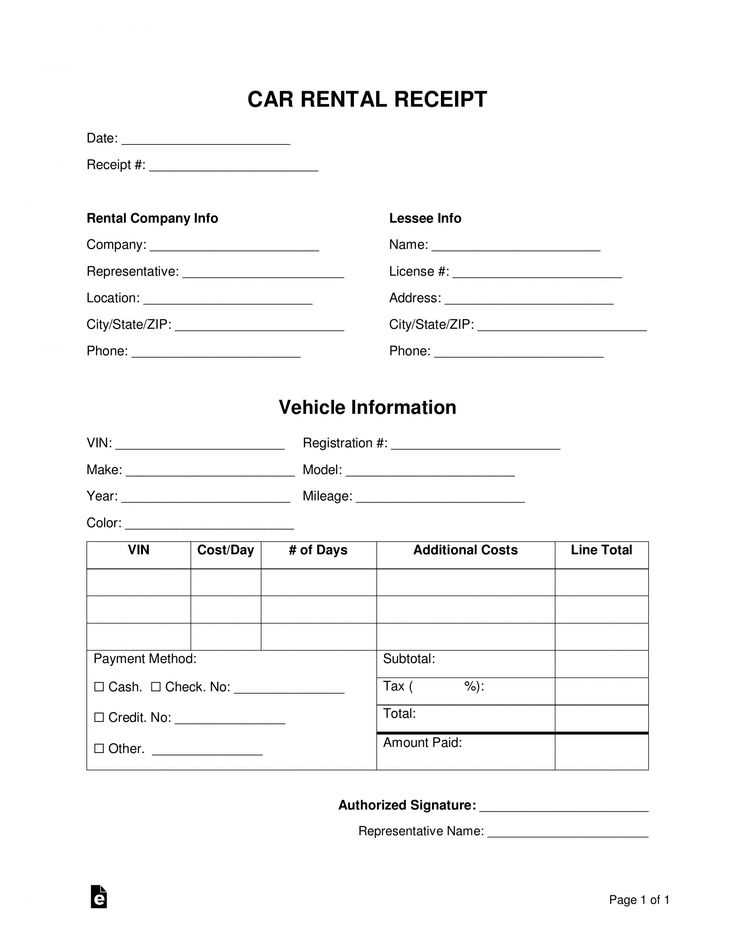

Customizing Your Template for Different Car Types

Adjust your template by adding sections specific to the car type, such as engine type, fuel efficiency, and vehicle history. For electric vehicles, include details like battery health and charging options. For luxury cars, emphasize premium features like interior materials and advanced technology.

Modify pricing fields based on the vehicle’s class. For example, high-end models might require more detailed pricing information, including the cost of special packages or accessories. This ensures the receipt reflects all aspects of the sale accurately.

Include additional information for specialized vehicles, such as off-road capability for SUVs or towing capacity for trucks. Highlight any unique warranties or service packages that apply to certain car types, helping customers understand their purchase better.

For used cars, add a section that tracks mileage and previous owners. This provides transparency and shows your commitment to clear communication, which can boost customer trust.

By tailoring your receipt template to the specific characteristics of each vehicle, you make the process smoother for both the buyer and the seller.

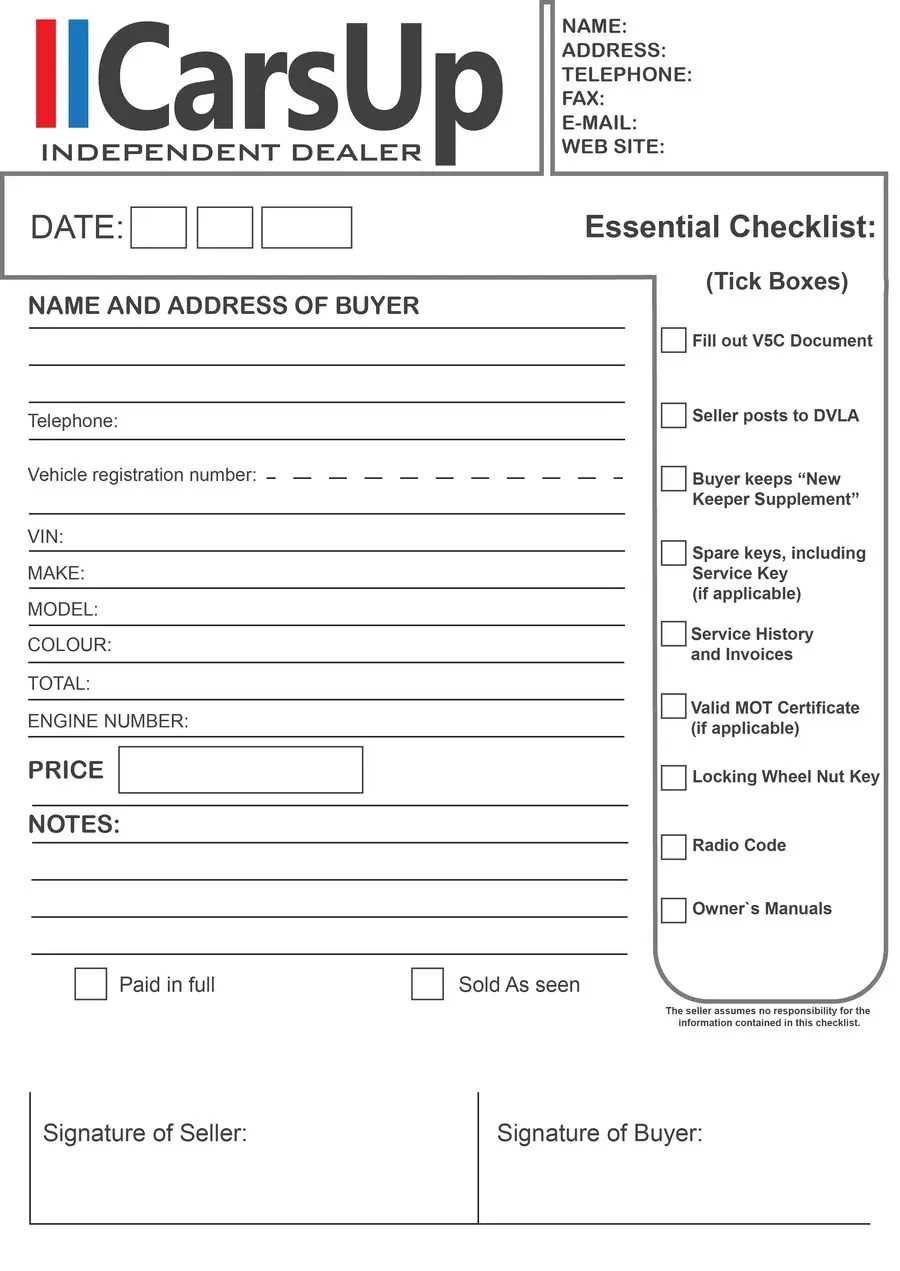

Legal Considerations for Car Sales in Ontario

Ensure your sale complies with the Ontario Motor Vehicle Dealers Act. If you are a dealer, register with the Ontario Motor Vehicle Industry Council (OMVIC) and follow the guidelines. Private sales also require proper documentation, including a bill of sale, proof of ownership, and a valid safety standards certificate for used vehicles.

Written Agreement and Disclosure

Always provide a written agreement detailing the sale terms. Disclose any known defects, past accidents, or title issues. Buyers must be informed of the vehicle’s condition, and sellers must disclose if the vehicle has been salvaged or previously written off.

Tax Implications

Sales tax must be collected on every sale. For private sales, the buyer is responsible for paying the tax when registering the vehicle with ServiceOntario. Ensure both parties understand the tax obligations involved in the transaction.

- For dealer sales, sales tax is added to the sale price.

- Private sales tax is calculated based on the vehicle’s value or the purchase price, whichever is higher.

Failure to follow these legal steps can result in fines or legal disputes. Ensure the buyer has a valid driver’s license and proof of insurance before finalizing the sale.