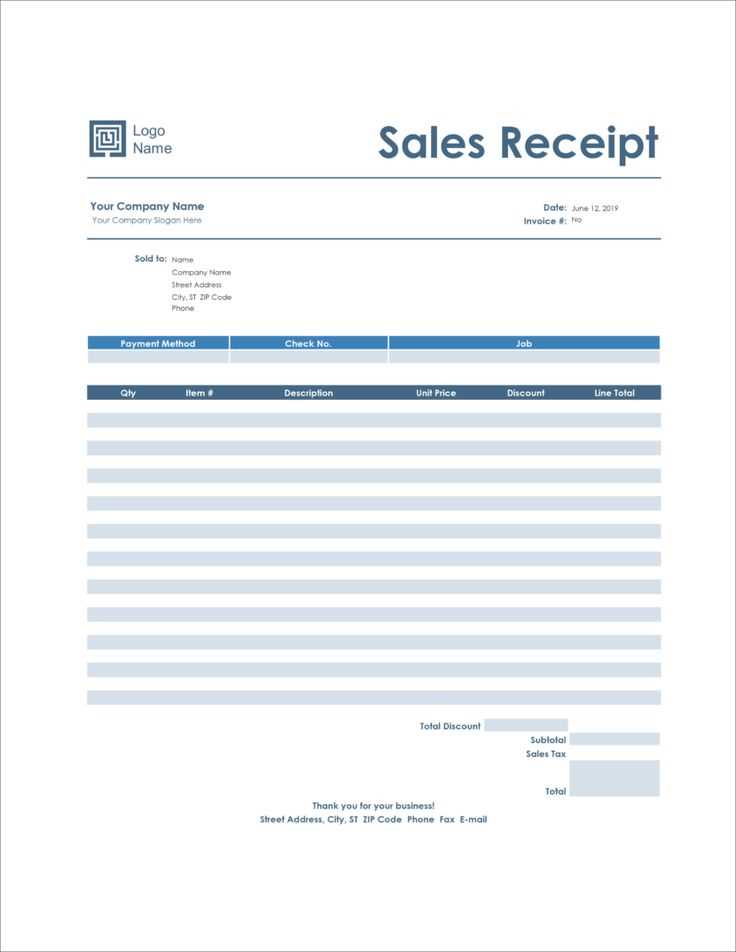

If you’re looking to streamline your transaction process, a computer sales receipt template can make your job easier. A well-organized receipt ensures that both the seller and buyer have a clear record of the sale, reducing confusion and helping with future references. This template can be customized to fit your business needs, whether you sell hardware, software, or accessories.

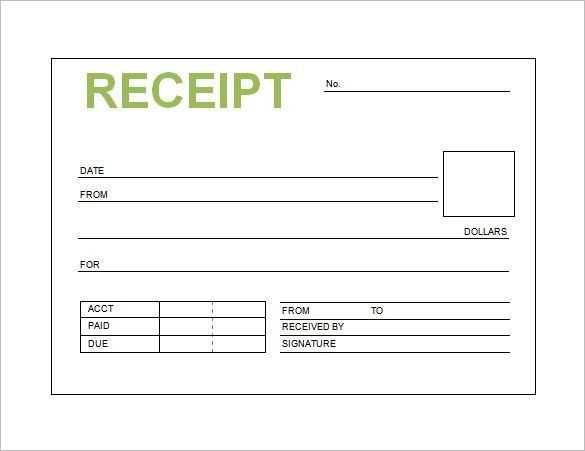

Start by including basic details such as the date, transaction number, and payment method. These pieces of information are crucial for both customer verification and business accounting. Ensure the itemized list includes a description of each product or service sold, along with the corresponding price and quantity.

Another key element is the tax information. Clearly outline the tax rate applied and the total tax amount for transparency. This can help customers understand how their final amount is calculated, especially in areas where sales tax rates vary.

Don’t forget to include contact details for both the seller and buyer, as well as any return or warranty policies. A template that has a professional layout can help reinforce your business’s credibility and build trust with your customers.

Here are the corrected lines, eliminating redundant repetitions:

Ensure each item is listed once with clear, concise descriptions. Avoid repeating product names or terms that don’t add new information. For example, instead of stating “Gaming Laptop, Gaming Laptop with high specs,” write simply “Gaming Laptop with high specs.” This helps keep the receipt clean and professional.

Review the quantities section. If an item appears multiple times but with the same quantity, list it just once with the total quantity. This reduces clutter and improves readability.

Use consistent terminology throughout. If you use “price” in one place, avoid switching to “cost” or “amount” in others. Keeping the language uniform prevents confusion and ensures clarity.

Finally, make sure the date and payment details appear only once, as repetition in these sections can create unnecessary visual noise. This keeps the receipt looking neat and easy to understand.

- Computer Sales Receipt Template

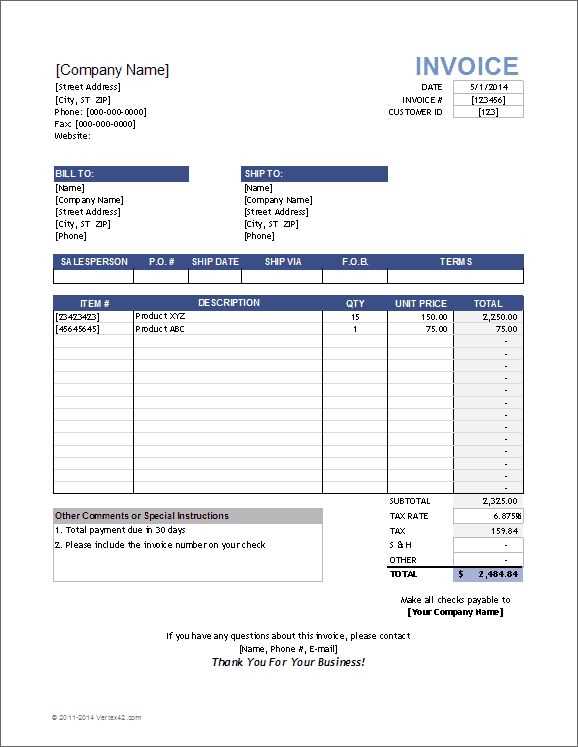

A well-structured computer sales receipt template helps provide clear documentation for both buyers and sellers. It should contain the necessary details to confirm the transaction, such as the computer model, price, payment method, and seller contact information. Start by including the buyer’s name and contact details along with the seller’s information. This ensures both parties have a point of reference if follow-up is needed.

For clarity, list the specific items sold, including their description, quantity, unit price, and total price. If the sale includes accessories, software, or warranties, make sure each item is listed separately. This eliminates confusion and ensures that everything is accounted for. Include any taxes or discounts that apply to the sale, along with the final amount due.

Additionally, include a payment section specifying the method of payment, whether it’s cash, credit card, or other options. Include a payment date, as it can be useful for record-keeping. Lastly, make sure there’s space for a signature or acknowledgment from both parties to finalize the sale.

Using a template not only saves time but also adds a level of professionalism to the transaction. Consider using simple and easy-to-read fonts, keeping the design clear and straightforward to ensure quick comprehension of the details.

Begin by including the business details. Make sure to list the company’s name, address, and contact number at the top of the receipt. This helps customers identify the source of their purchase quickly.

- Company Name: Include the full name of your business.

- Address: The location of the business where the transaction took place.

- Contact Information: A phone number or email address for customer support.

Next, add the customer’s information. While optional, providing customer details is useful for both parties. Include the customer’s name, address, and contact number if applicable.

- Customer Name: Full name of the purchaser.

- Customer Address: Include the address, if relevant.

- Phone Number or Email: To confirm the purchase or address any issues.

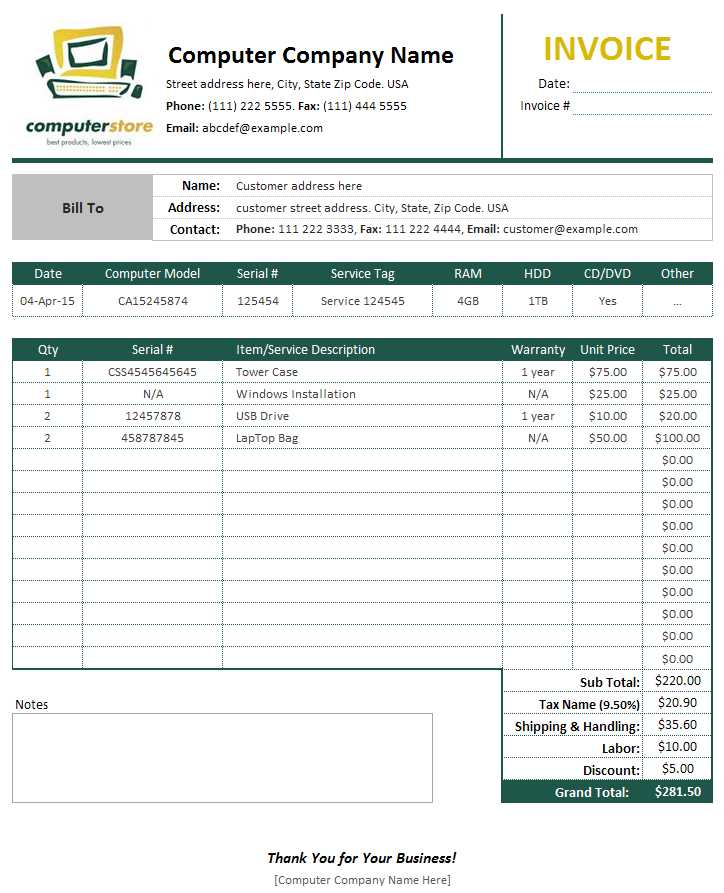

Now, include the product details. For each computer sold, list the model name, serial number, and quantity. Provide a brief description along with the price for each unit sold.

- Product Name: Identify the model or type of computer sold.

- Serial Number: A unique identifier for tracking purposes.

- Quantity: How many units were purchased.

- Price per Unit: The price of each computer sold.

After product details, calculate and list the totals. Show the subtotal before taxes, the tax rate applied, and the final total. Make sure the tax breakdown is clear to avoid confusion.

- Subtotal: The total cost of all products before taxes.

- Tax: Specify the applicable tax rate and amount.

- Total: The grand total after tax.

Lastly, include the payment method used for the transaction. This could be cash, credit card, or another form of payment. It’s also helpful to include any transaction ID or receipt number for future reference.

- Payment Method: Cash, credit card, etc.

- Transaction ID or Receipt Number: For record-keeping purposes.

Finish the receipt with a thank-you note. A simple acknowledgment of the purchase leaves a positive impression.

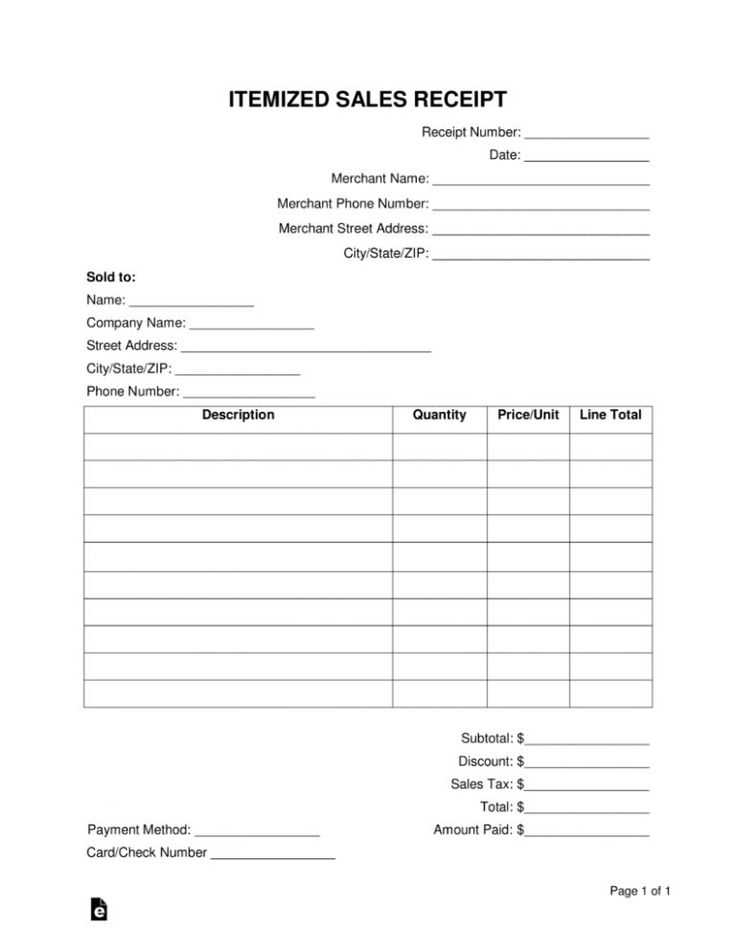

A sales receipt should include specific details to ensure clarity for both the buyer and seller. First, always include the seller’s contact information. This can be the store’s name, address, phone number, or email. Make sure the buyer knows where to reach out for any follow-up questions or concerns.

Transaction Details

Provide clear information about the transaction. This includes the transaction date and a unique receipt number. The receipt number helps track the sale in case of returns or issues. The payment method (credit card, cash, online transfer) should also be listed clearly, along with any relevant transaction identifiers, such as authorization or invoice numbers.

Purchased Items

List all items purchased with their descriptions, quantities, and prices. Each item should be clearly identified, along with the unit price and any applicable taxes. If there’s a discount or promotion, make sure to mention the discounted price, along with the original price for transparency.

| Item Description | Quantity | Price |

|---|---|---|

| Gaming Laptop | 1 | $1,299.99 |

| Wireless Mouse | 2 | $25.99 |

Finally, provide a total amount that summarizes the subtotal, tax, and final cost of the purchase. Include any return and refund policy information to clarify the terms under which the items can be returned or exchanged.

Choose a format that matches your business needs and makes it easy for both you and your customers to understand the transaction details. Use clear, structured layouts with distinct sections like product names, quantities, prices, and totals. Ensure all key details, such as date, receipt number, and payment method, are included for proper tracking and record-keeping.

If you’re printing receipts, ensure the format is compatible with your printer and provides enough space for necessary details without overcrowding. For digital receipts, opt for PDF or email formats, which can be easily accessed and stored on devices. Keep your layout simple and user-friendly, focusing on legibility with clear fonts and adequate spacing.

Consider including a section for return policies or warranty information if relevant, but keep it concise. A clean, professional format increases customer trust and makes it easier to resolve any future inquiries regarding the transaction.

To customize your receipt template for various products, start by adjusting the product details section. Include fields like product name, model, specifications, and serial number. For computers, consider adding extra fields for processor type, RAM size, storage capacity, and operating system. This helps create clear, informative receipts that match the product being sold.

Next, modify the pricing section to reflect product-specific pricing structures. For instance, a computer might have a base price with optional upgrades or warranties. Make sure your template includes clear breakdowns for each item or service added, such as software installation or extended support.

If you’re selling accessories or peripherals alongside computers, differentiate them in the itemized list. You can include specific categories or headers like “Accessories” or “Peripherals” to make the receipt easy to understand at a glance.

For bundled products, such as a computer with a mouse, keyboard, and monitor, create a grouped section that highlights the bundle price as well as individual item costs. This ensures customers understand the value of the package deal while keeping the receipt neat.

Finally, tailor the footer of the receipt to include product warranty details, return policies, and any relevant after-sales support information. For computers, customers often need these details, so make sure the information is clearly visible and relevant to the specific product.

Ensure the receipt clearly includes the seller’s name, business address, and contact details. This establishes the legal identity of the transaction and protects both parties in case of disputes.

- Accurate Description of Goods: List the specific details of the computer, such as make, model, and any included accessories. This provides clarity in case of returns or warranty claims.

- Sales Tax Compliance: Include the applicable sales tax amount, as tax regulations vary by region. This ensures compliance with local tax laws and provides a clear breakdown for the customer.

- Return Policy Disclosure: Explicitly mention the terms of the return or refund policy. Include time limits, conditions for returns, and whether restocking fees apply. This protects both the seller and the buyer.

- Warranty Information: If the computer comes with a warranty, specify its duration and the type of coverage. This is essential for both customer protection and legal clarity in case of faulty products.

- Payment Method and Amount: Record the exact payment method, including the full amount paid. This prevents future disputes regarding payment or payment discrepancies.

- Date of Sale: Clearly state the date of purchase. This serves as a reference point for the warranty period and any potential legal issues regarding the sale.

By including these details in a sales receipt, you ensure that all aspects of the transaction are transparent, reducing the likelihood of legal issues arising later.

To automate sales receipt generation, integrate a point-of-sale (POS) system with a receipt template generator. This allows the software to instantly generate receipts whenever a sale occurs. POS systems typically have built-in templates that can be customized with your business’s logo, address, and tax details. When a transaction is completed, the system can automatically populate the necessary fields, such as customer information, product details, and payment methods, reducing manual input.

Use a Receipt Generation API

Integrate a receipt generation API to streamline the process. APIs can generate digital receipts in various formats (PDF, HTML, etc.) based on the transaction data passed to them. APIs also allow for customization, ensuring the receipts match your business’s branding. With APIs, receipts are instantly created and sent to customers via email or text, without additional effort.

Set Up Automation Through Accounting Software

Many accounting platforms such as QuickBooks or Xero offer automated receipt generation. After a sale, these tools pull transaction details from your sales platform and generate a digital receipt automatically. This can help maintain accurate financial records and provide customers with receipts right away. Automation tools within these platforms can also send receipts via email or integrate with other customer communication tools.

By utilizing a POS system, API, or accounting software, automating sales receipt generation can save time, ensure accuracy, and provide a seamless experience for both you and your customers.

To create a computer sales receipt template, ensure it includes all necessary details. List the purchased items with accurate descriptions, including model names, quantities, and individual prices. Don’t forget to add any applicable sales tax and total amount due at the bottom.

Organize the template in clear sections: header, item list, taxes, and total. Make sure the store name, address, and contact information are easy to spot at the top. This helps customers recognize the receipt and contact you if needed.

For easy readability, use a simple font and format the text neatly. Align columns for the item details, such as price and quantity, so that the customer can quickly review their purchase. Ensure that the layout is consistent and professional.

Incorporating a space for the date and a unique receipt number allows for easy tracking and reference. This can help with returns, exchanges, or warranty claims in the future.

Lastly, consider adding a short return policy or instructions on how to contact customer support, providing your buyers with confidence in their purchase.