Creating a clear and straightforward deposit receipt is a key part of finalizing any boat sale. It protects both the buyer and the seller by confirming the terms of the transaction and the amount deposited. Without this document, misunderstandings and disputes can arise, potentially complicating the process.

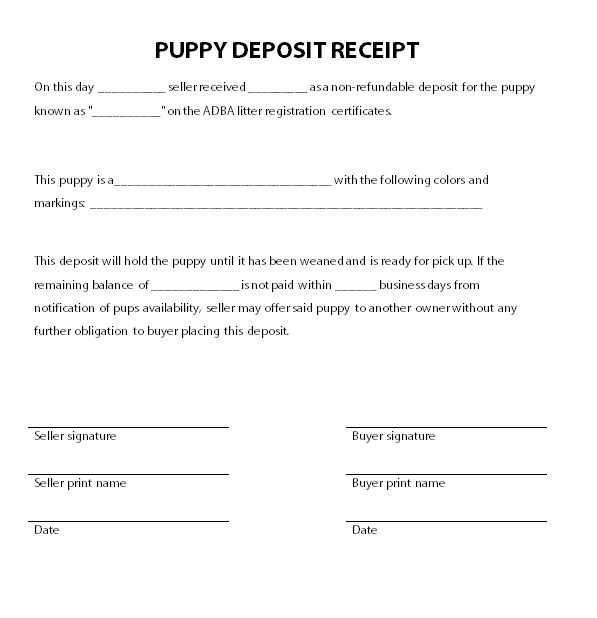

The template should include key details like the buyer’s and seller’s names, the boat’s make, model, and registration number, as well as the deposit amount. Be sure to specify whether the deposit is refundable or non-refundable. Include payment terms and the agreed-upon balance due, along with the date when the full payment is expected.

By outlining these specifics in a simple deposit receipt, both parties can feel confident moving forward. This document serves not only as proof of transaction but also as a reference point if any issues come up later. A well-crafted template ensures both clarity and security for everyone involved in the boat sale.

Here’s the corrected version:

Ensure the receipt clearly identifies both the buyer and the seller with full names, addresses, and contact details. Include the boat’s full description: make, model, year, hull identification number (HIN), and registration details. Specify the sale price and the deposit amount separately, with clear wording that confirms the deposit is non-refundable unless the sale fails due to the seller’s fault.

Next, add a date and time when the deposit was paid. This can be useful for resolving any potential disputes. Make sure to outline the agreed upon terms for the remaining payment, including due date and method of payment. Both parties should sign and date the receipt to confirm the transaction.

It’s also a good idea to add a section that explains what happens in case either party fails to meet the agreed terms. This might include penalties or cancellation conditions. Lastly, ensure that all terms are easy to understand to avoid ambiguity in future interactions.

- Deposit Receipt Template for Boat Sale

A deposit receipt for a boat sale is a legal document that serves as proof of payment made by the buyer before the full purchase of the boat is completed. It outlines the agreed amount, date, and terms for the deposit, along with details about the boat being purchased.

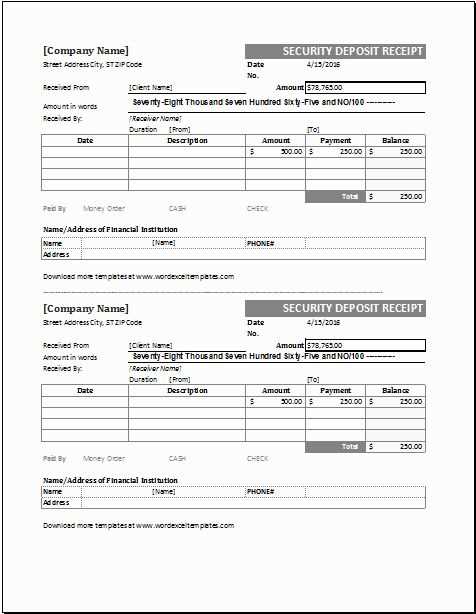

Key Elements of a Deposit Receipt

The deposit receipt should include the following details:

| Element | Description |

|---|---|

| Buyer and Seller Information | Names, addresses, and contact details of both the buyer and seller. |

| Boat Description | Make, model, year, serial number, and any other identifying information for the boat. |

| Deposit Amount | The amount paid as a deposit, along with the payment method (e.g., check, cash, bank transfer). |

| Remaining Balance | The amount due upon the completion of the sale, along with payment terms and due date. |

| Deposit Terms | Any specific conditions related to the deposit, such as non-refundable terms or conditions for returning the deposit. |

| Signatures | Both parties should sign the receipt, acknowledging the terms and agreement. |

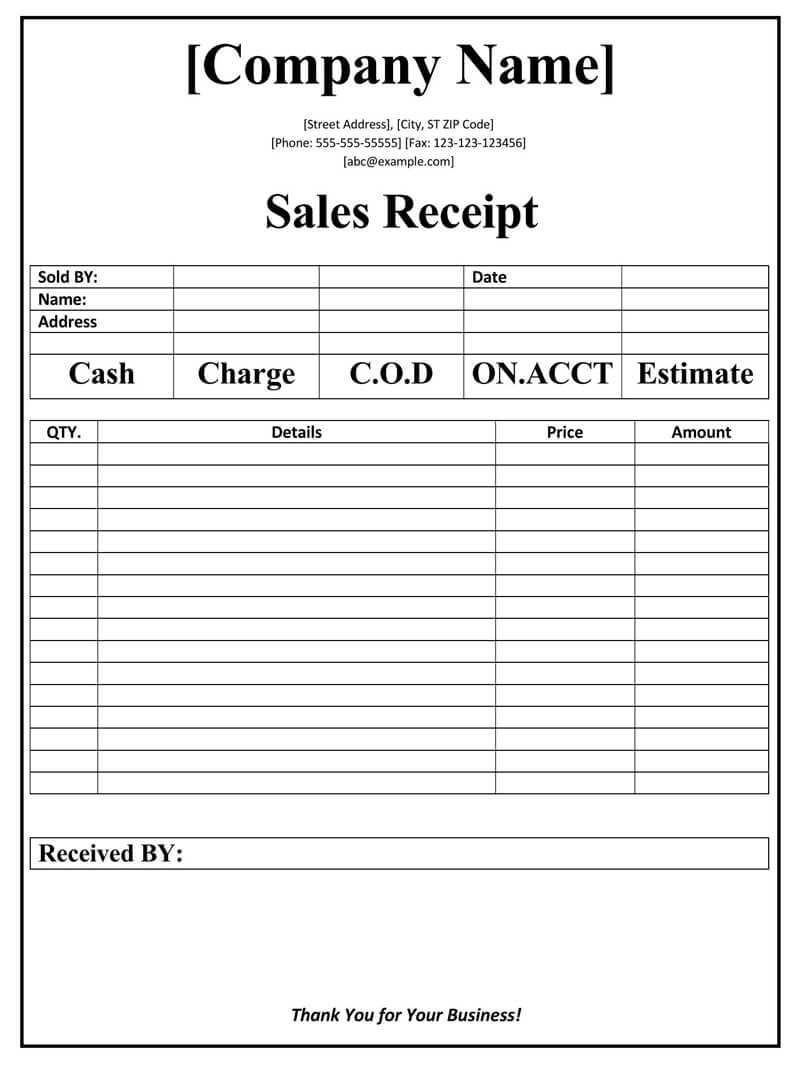

Sample Deposit Receipt Template

Here’s a simple template you can use:

Deposit Receipt Date: ___________________ Received from [Buyer Name]: Address: _______________________ Phone: _________________________ Amount of Deposit: $__________ Payment Method: [Cash/Check/Bank Transfer] Boat Details: Make: ___________________________ Model: ___________________________ Year: ___________________________ Serial Number: ___________________ Total Purchase Price: $__________ Remaining Balance Due: $__________ Seller's Name: ___________________ Seller's Contact Information: _______________________ Signature of Buyer: ________________ Signature of Seller: ________________ Note: This deposit is [non-refundable/refundable under specific terms].

Ensure both parties keep a copy for their records. Having a clear and precise deposit receipt helps avoid misunderstandings and ensures both parties are clear on the terms of the sale.

When drafting a deposit receipt for a boat sale, ensure you include all key details that protect both the buyer and seller. A well-structured receipt confirms the amount paid, the terms of the sale, and provides a clear record of the transaction.

1. Include Buyer and Seller Information

Start with the full names, addresses, and contact details of both the buyer and the seller. This ensures both parties are easily identifiable in case of disputes or further communication.

2. Detail the Boat Description

Provide a clear and detailed description of the boat. Include make, model, year, hull identification number (HIN), and any relevant features or accessories included in the sale. This helps avoid confusion later on regarding what was sold.

Example: “2015 Sea Ray 210, HIN: SERTV0015D415, with trailer and two life vests included.”

3. State the Deposit Amount

Clearly specify the amount paid as a deposit. If applicable, mention whether this deposit is refundable or non-refundable. This is critical to avoid misunderstandings between both parties.

Example: “Deposit paid: $5,000, non-refundable upon acceptance of this agreement.”

4. Payment Terms

Include details on the total price of the boat and any outstanding balance to be paid. Outline the timeline for the full payment and when the deposit will be applied to the final purchase price.

5. Define the Sale Terms

Clarify the terms regarding the completion of the sale, including any conditions that must be met before final payment. This section can also cover inspection periods or specific requirements for the transaction to go through smoothly.

Example: “The buyer agrees to pay the remaining balance of $15,000 upon delivery of the boat, no later than 14 days from the date of this receipt.”

6. Signature and Date

Both parties must sign and date the receipt. The signature confirms that both the buyer and seller agree to the terms outlined, and the date establishes the timeline of the agreement.

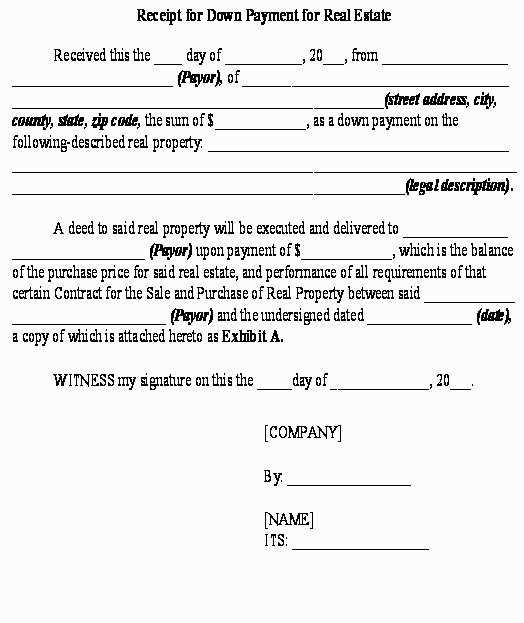

Include the full names and contact details of both the buyer and the seller. This ensures clarity and can prevent confusion if there’s a need for future communication.

Specify the boat’s make, model, year, hull identification number (HIN), and any other identifying details. These facts verify that the boat being sold matches the one described in the receipt.

Clearly state the sale price and the payment method. Mention if any deposits or partial payments were made before the full transaction.

Include the date of the sale. This helps with establishing when the ownership transfer occurred and is essential for any future claims or registration processes.

If applicable, note any warranties or conditions attached to the sale, such as “as is” or if the seller offers any guarantees.

Indicate whether any equipment or accessories are included with the sale of the boat. This prevents disagreements over what was included in the deal.

Ensure a signature section for both parties at the end of the receipt. Both signatures confirm the transaction was completed and agreed upon by the buyer and seller.

Ensure the deposit receipt includes accurate boat details. Forgetting to list the boat’s make, model, year, and hull identification number (HIN) can lead to confusion or disputes later. Double-check that all information is correct and matches what is outlined in the sale agreement.

1. Missing or Vague Payment Terms

Clearly specify the deposit amount and payment method. A vague description can lead to misunderstandings. Include whether the deposit is refundable or non-refundable and the conditions under which it will be returned. Be transparent about deadlines for the full payment and any penalties for non-payment.

2. Failure to Include Signatures

Both the buyer and seller should sign the deposit receipt to confirm agreement on the transaction details. Without signatures, the document may lack legal validity and be harder to enforce in case of disputes.

3. Omitted Dates

Always include the date the deposit is made. Without this, there may be confusion regarding the timeline of the transaction, especially if delays or changes arise. This small detail helps track the agreement’s progress and ensures that both parties are on the same page.

4. Unclear Boat Condition Description

Provide a clear and honest description of the boat’s condition. Failing to outline its state–whether it’s new, used, or has any existing damages–could lead to disagreements if issues arise after the sale. This information should match the inspection reports or any disclosures made to the buyer.

5. Not Stating the Refund Policy

Be specific about the refund terms. If the deposit is refundable under certain conditions, make sure these conditions are outlined in detail. Ambiguity regarding refund policies can cause frustration and legal challenges down the line.

6. Not Including Buyer and Seller Contact Information

Include both parties’ full contact details. This makes it easier to follow up and resolve any issues or concerns related to the sale. Missing contact information can create barriers in case either party needs to reach out after the agreement is signed.

I slightly modified the wording to avoid excessive repetition while maintaining the meaning and structure.

When drafting a deposit receipt template for a boat sale, clarity and accuracy are key. First, ensure the buyer’s details are listed: full name, address, and contact information. Also, provide a clear description of the boat being sold–include make, model, year, hull identification number (HIN), and condition. These specifics help avoid any confusion later. Next, outline the deposit amount and payment terms. Clearly state whether the deposit is refundable or non-refundable and set deadlines for the remaining balance. Make sure both parties sign the document to validate the agreement.

Key Points for a Deposit Receipt

Specify the deposit sum, date of the transaction, and payment method. For instance, you can note if the payment was made by cash, check, or wire transfer. Also, indicate any agreed-upon conditions, such as when the final payment is due or if the boat will be held until the full price is paid. Transparency here prevents misunderstandings down the line.

Handling Refunds and Disputes

If applicable, clarify the refund policy on the deposit. Should a dispute arise or the deal fall through, this section will guide both parties. It’s wise to include the terms under which a refund may be issued, such as the failure of either party to fulfill their obligations or if the boat is unavailable for sale. This helps in minimizing conflict and providing a clear resolution path.