Need a clear and professional way to document payments? A well-structured deposit slip template in Excel ensures accuracy and saves time when managing transactions. Whether you’re handling daily deposits for a business or tracking personal finances, an Excel-based format provides flexibility, automatic calculations, and easy record-keeping.

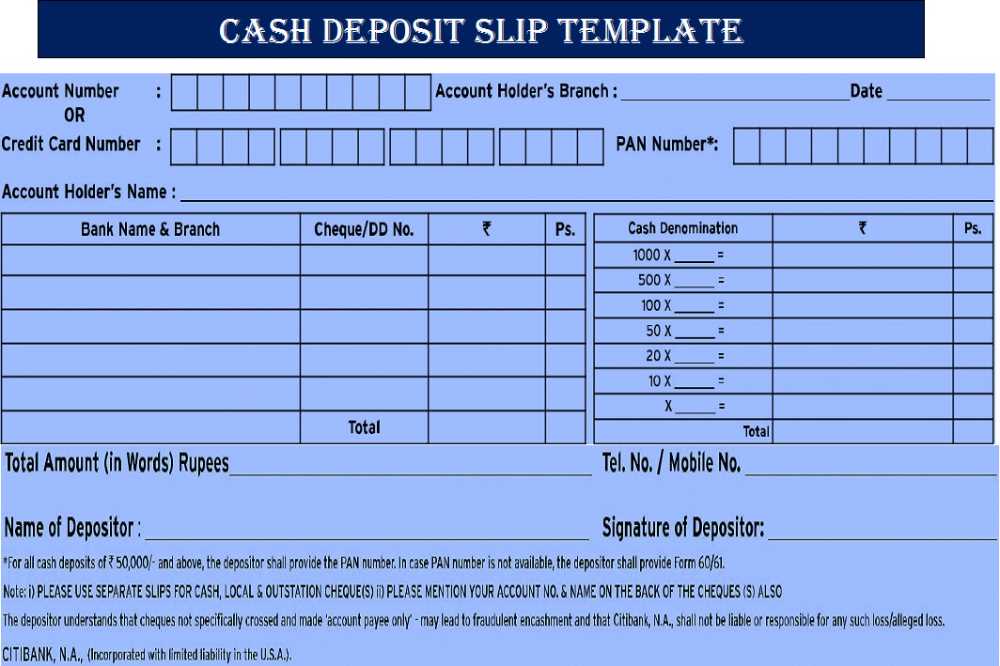

Unlike generic templates, a custom-designed deposit slip includes fields tailored to your needs, such as payer details, payment methods, reference numbers, and total amounts. With built-in formulas, Excel templates can automatically sum up multiple payments, reducing manual errors and improving efficiency.

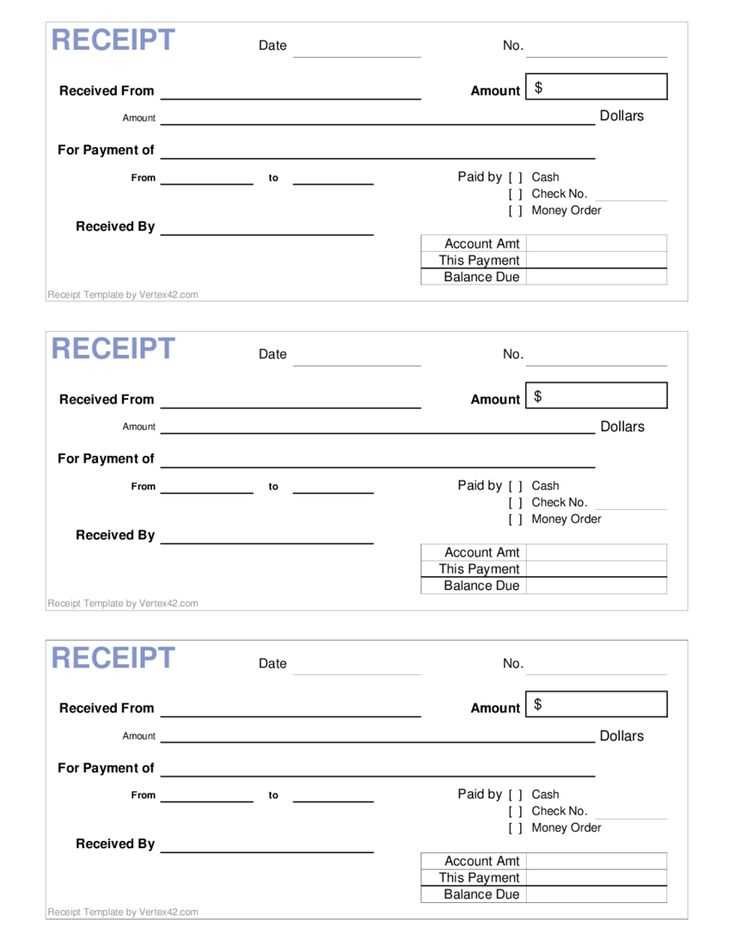

Pairing a deposit slip with a unique sales receipt template enhances financial tracking. A sales receipt confirms a transaction, while a deposit slip records the funds added to an account. By using Excel, you can create both templates in one file, ensuring seamless integration and quick access to past transactions.

Customizing an Excel deposit slip template is simple. You can adjust column widths, add drop-down lists for payment types, and use conditional formatting to highlight specific entries. Printing directly from Excel ensures a clean, professional appearance, while digital storage allows for easy archiving and retrieval.

Ready to simplify payment tracking? A structured deposit slip template keeps records organized and ensures smooth financial operations, whether for personal use or business transactions.

Deposit Slip Template Excel Unique Sales Receipt

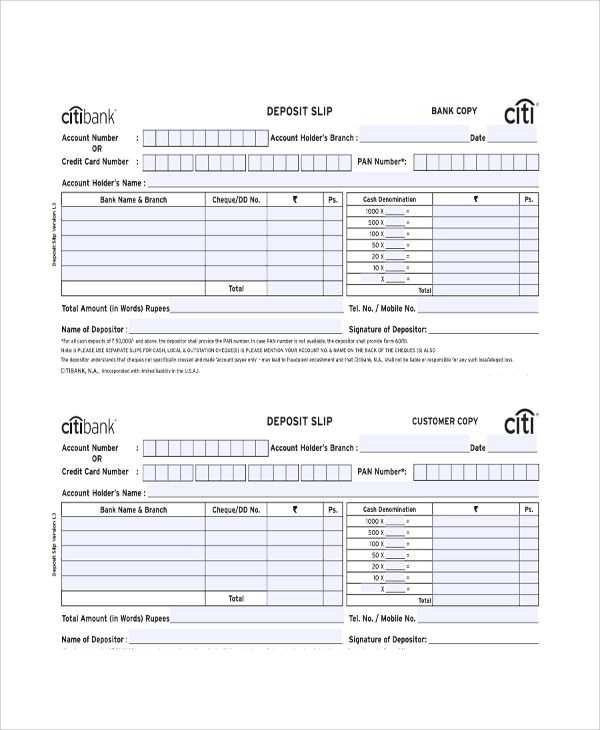

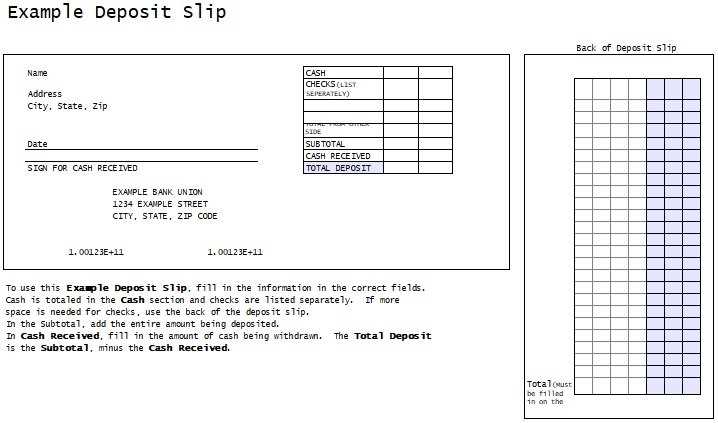

For seamless record-keeping and transactions, creating a deposit slip template in Excel is a practical way to ensure consistency and accuracy. Customizing the template to fit unique sales receipt details allows you to track and document payments effectively. Start by organizing the template with fields for the date, deposit amount, account number, and description of the sale. Customize it further by including customer names and sales items for detailed tracking.

Ensure the template has cells that automatically calculate totals. This helps avoid errors in manual calculations and saves time. Integrate formulas to calculate sales tax, discounts, and final amounts. Make use of Excel’s conditional formatting to highlight discrepancies or unusual values, ensuring any issues stand out immediately.

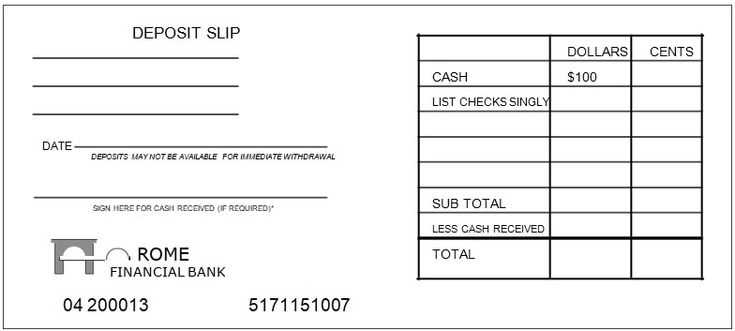

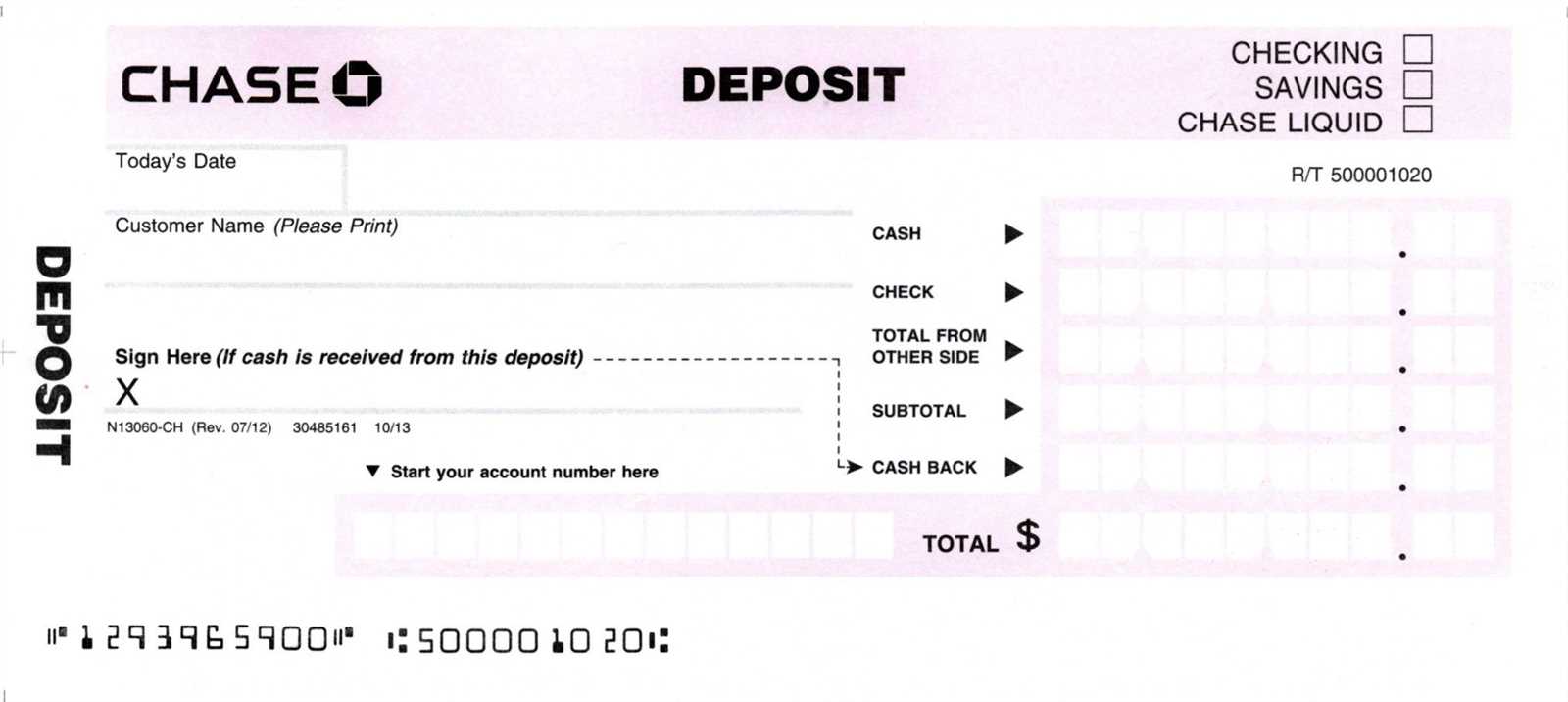

For improved organization, categorize deposits by payment method, such as cash, check, or card. This enables quicker reconciliation of bank statements with your sales records. Keep your Excel template structured and easy to update by setting it up to auto-fill recurring sales or deposit information. Customization options also include dropdown menus for quick entry of commonly used data.

Finally, consider saving the template as a reusable document, allowing for quick adjustments when needed. Keeping the layout clear and simple ensures that even users unfamiliar with Excel can use it efficiently. This approach streamlines financial tracking and reduces the potential for mistakes, making it a helpful tool for businesses looking to manage deposits and sales receipts effortlessly.

How to Structure a Deposit Slip Template in Excel for Accurate Record-Keeping

Create a deposit slip template that is clear and organized for efficient tracking of transactions. Begin by setting up columns to capture all relevant information. These typically include the deposit date, account number, depositor’s name, check numbers (if applicable), and the deposit amount. Each row should represent a single deposit entry, making it easy to track individual items.

Columns to Include

Design the following columns for a streamlined deposit slip template:

- Deposit Date: Use a date format for easy sorting (e.g., MM/DD/YYYY).

- Depositor Name: Ensure this column clearly identifies the person or entity making the deposit.

- Account Number: Include the number associated with the deposit for reference.

- Check Number: If applicable, list the check number or identifier.

- Deposit Amount: List the amount deposited, and format it as currency for clarity.

- Deposit Method: Indicate whether the deposit is made by cash, check, or transfer.

Advanced Features for Better Tracking

For more detailed tracking, incorporate calculations to automatically total deposits. Use Excel formulas to sum up amounts deposited in different categories or dates. Set up conditional formatting to highlight any discrepancies, such as missing fields or unusually high amounts. This allows for quick checks on accuracy and consistency.

By structuring the template this way, you’ll be able to easily monitor and verify deposits, reducing the chances of errors and ensuring precise record-keeping.

Customizing a Sales Receipt Format to Match Business Requirements

Adjust the sales receipt layout to highlight critical information specific to your business. Start by including your company logo, name, and contact details at the top of the receipt. This builds brand consistency and makes it easy for customers to get in touch with you for inquiries.

Next, set up a clear section for the transaction details, including the date, time, and a unique receipt number. A well-structured table for itemized products or services, along with their quantities and prices, allows customers to review their purchase easily. Incorporate tax calculations and any applicable discounts clearly to avoid confusion.

Customize for Legal and Regulatory Needs

Ensure that the receipt includes fields required by law, such as tax identification numbers and any specific information mandated by local regulations. Include refund policies, warranty details, and other legal disclaimers relevant to your industry.

Adding Additional Features

For businesses that offer loyalty programs or special offers, include a section for loyalty points or coupon redemption. A space for personalized messages, like “Thank you for your purchase!” or special event promotions, adds a personal touch. Streamline the design so it remains clean and professional while fitting all necessary data.

Once your template is tailored to your needs, save it as an Excel file for easy editing and future use. Adjust columns and rows to fit the content without overcrowding, and ensure your template remains functional across different devices.

Integrating Automated Calculations in an Excel Deposit Slip for Error Reduction

Automating calculations in your Excel deposit slip can significantly reduce human error and streamline your financial processes. Here are steps to integrate automated calculations directly into your template:

1. Use Excel Formulas for Totals

Start by adding basic formulas that sum the values in your deposit slip. For example, use the SUM function to automatically calculate the total deposit amount. In the “Amount” column, input this formula:

=SUM(B2:B10)

This will automatically total all the amounts entered in cells B2 through B10. This reduces the chances of manual calculation mistakes.

2. Apply Conditional Formatting for Accuracy

Use conditional formatting to highlight discrepancies or errors in the deposit slip. Set up a rule that flags any negative or unusually high values in the “Amount” column. This way, you’ll spot errors like double entries or miscalculations immediately.

- Go to Home > Conditional Formatting > New Rule.

- Select “Format cells that contain” and choose “Cell Value” for the condition.

- Set the rule to format cells where the value is less than 0 (negative amounts) or exceeds a certain threshold.

3. Automate Date Entry with TODAY Function

Instead of manually entering the date each time, use the TODAY function. This automatically inserts the current date when you open the document, ensuring consistency and reducing the chance of entering the wrong date.

=TODAY()

4. Set Up Data Validation for Consistency

Prevent input errors by using Excel’s Data Validation feature. Set limits on acceptable values in certain cells, such as ensuring that the “Deposit Number” field only accepts numeric entries. This ensures the integrity of your data right from the start.

- Select the cell where you want to restrict input.

- Go to Data > Data Validation.

- Choose “Whole Number” or “Decimal” as appropriate.

- Set minimum and maximum values if necessary.

5. Integrate Automated Bank Account Balance Calculations

Link your deposit slip to an account balance tracker within the same Excel file. Use formulas that deduct the deposit amount from the current balance, updating automatically as new deposits are entered. This eliminates manual calculations and ensures real-time balance updates.

By setting up these automated features, you minimize the risk of errors in your deposit slip and create a more efficient workflow.