A well-structured sales receipt for a down payment ensures transparency and protects both parties. It serves as proof of the initial transaction, detailing the amount paid, remaining balance, and key terms of the agreement. A properly formatted template saves time and minimizes disputes.

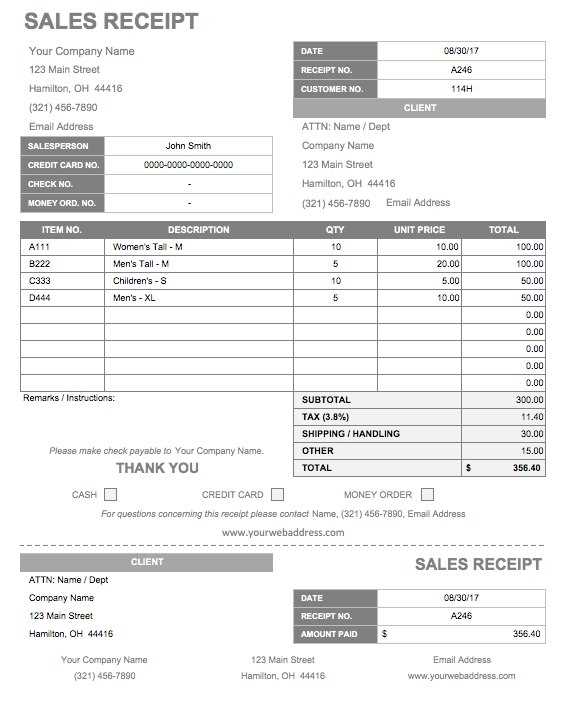

Include essential details such as: buyer and seller information, date of payment, description of the product or service, and a clear breakdown of costs. Specify whether the down payment is refundable or non-refundable to prevent misunderstandings. A unique receipt number helps track transactions efficiently.

For added clarity, outline payment methods accepted and any future installments required. Digital or printed copies should be stored securely for reference. Using a standardized template ensures consistency, making it easier to manage records and comply with tax regulations.

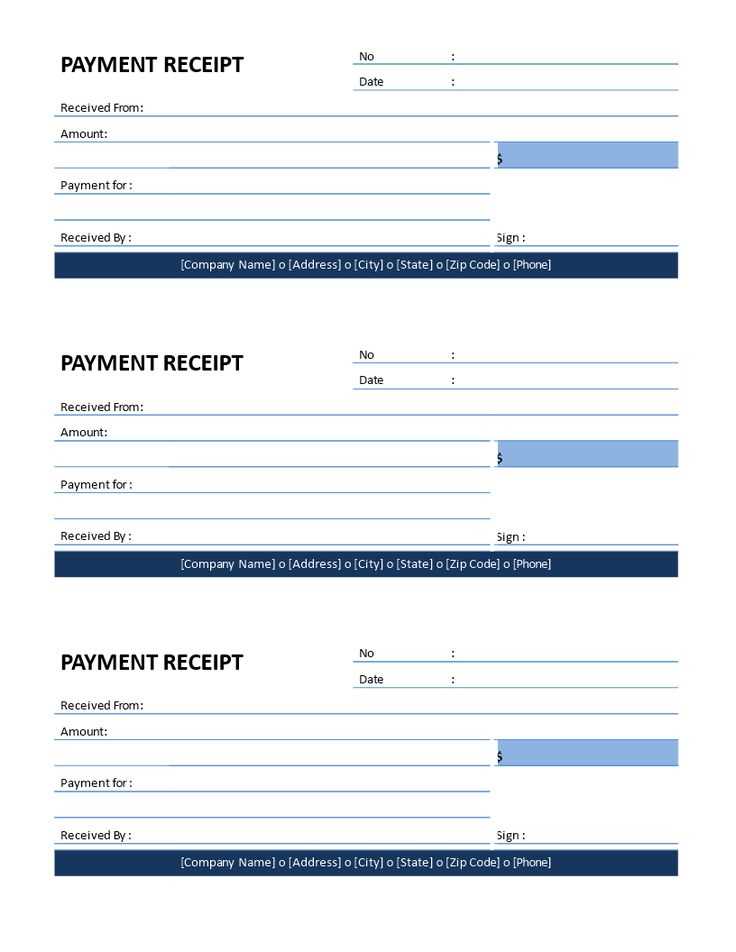

Down Payment Sales Receipt Template

Ensure all key details are included. The receipt must specify the buyer’s and seller’s names, contact information, payment date, and a unique receipt number. Clearly state the amount paid, remaining balance, and payment method.

Provide a detailed item description. List the purchased goods or services, including specifications, quantities, and any agreed terms. If the payment secures a future transaction, mention the conditions under which the remaining balance is due.

Include legal and refund terms. If the payment is non-refundable, state this explicitly. Any applicable warranties or conditions should also be outlined. A signature section for both parties ensures acknowledgment and prevents disputes.

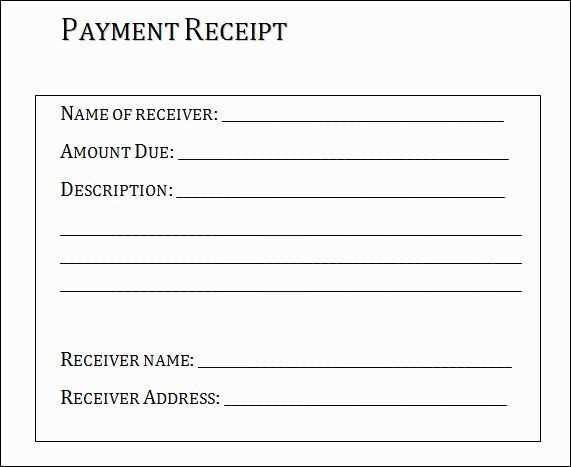

Key Elements to Include in a Sales Receipt for Partial Payments

Specify the amount received and the remaining balance clearly. A well-structured receipt prevents confusion and serves as proof of the transaction.

Essential Transaction Details

- Payment Date: Document when the partial payment was made to track progress.

- Customer and Seller Information: Include names, addresses, and contact details for record-keeping.

- Item or Service Description: List what was sold, including relevant specifications.

Financial Breakdown

- Amount Paid: Specify how much was received in numerical and written form.

- Remaining Balance: State the outstanding amount to avoid disputes.

- Payment Method: Indicate whether it was cash, check, card, or another form.

Adding a receipt number and authorized signature further strengthens the document’s credibility.

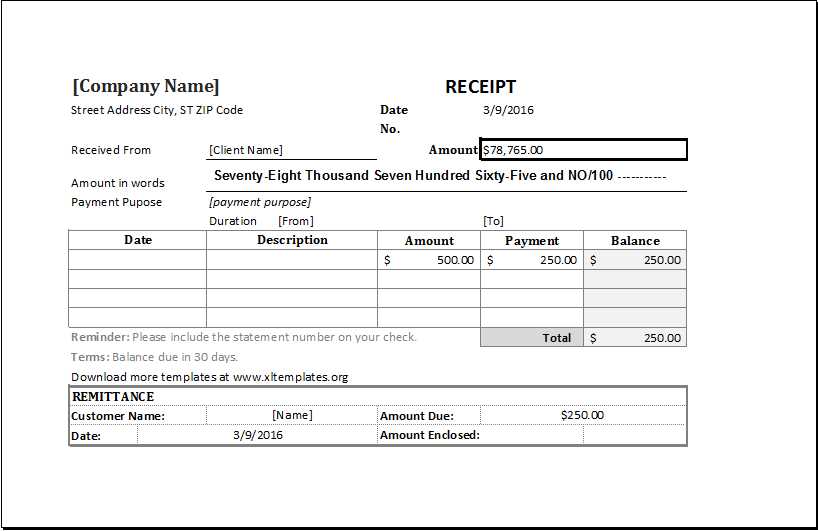

Formatting and Structuring a Clear Payment Record

Specify the date, amount, and payment method at the top to ensure immediate clarity. Use a structured layout with distinct sections for payer details, transaction description, and confirmation.

Key Elements for Clarity

List payer and recipient names, along with contact details, to prevent any misinterpretation. Break down the total amount, including any taxes or fees, to avoid disputes. If applicable, include an itemized summary for added transparency.

Confirmation and Authentication

Reserve space for an authorized signature or digital verification. A unique receipt number simplifies tracking and retrieval. If providing a printed copy, use high-quality paper with a watermark or logo to enhance authenticity.

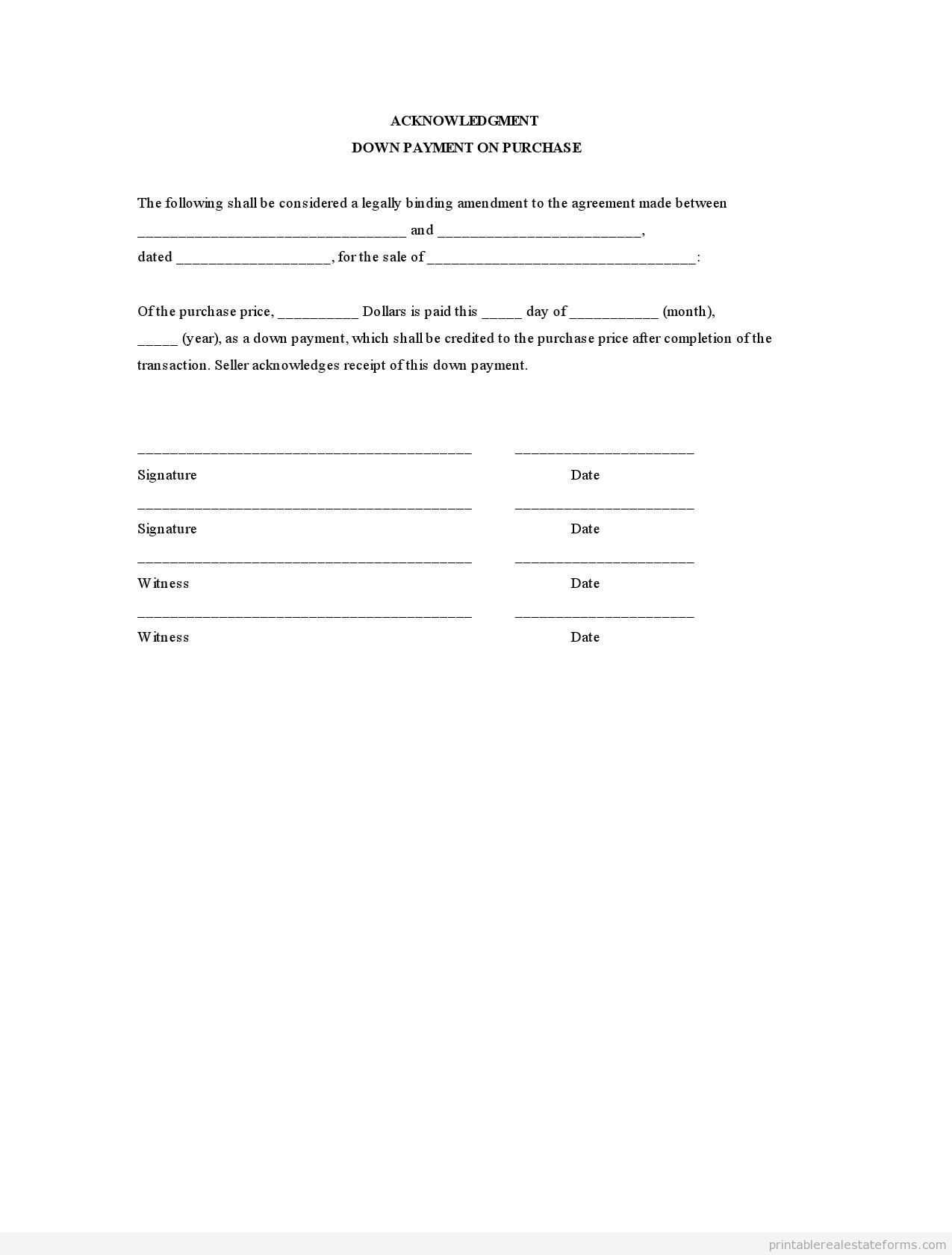

Legal Considerations When Issuing Receipts for Initial Payments

Specify the amount received and the payment method to prevent disputes. A well-documented receipt includes the payer’s name, date, transaction details, and a unique reference number for tracking.

Clearly state whether the amount is refundable or non-refundable. Ambiguity can lead to misunderstandings and legal complications. If conditions apply, outline them explicitly to ensure transparency.

Include the issuer’s name and contact details to establish credibility. Adding a signature or an official stamp reinforces authenticity, reducing the risk of fraudulent claims.