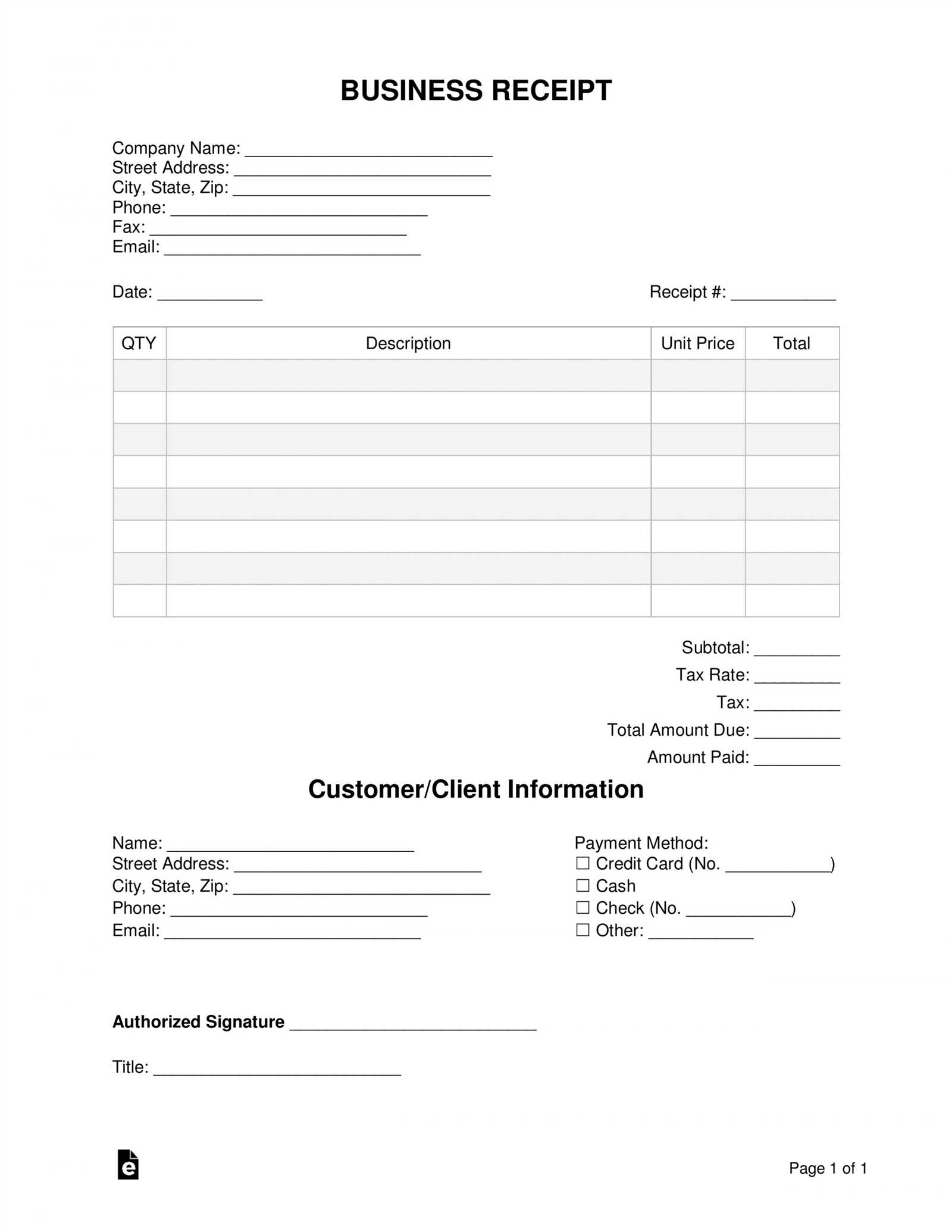

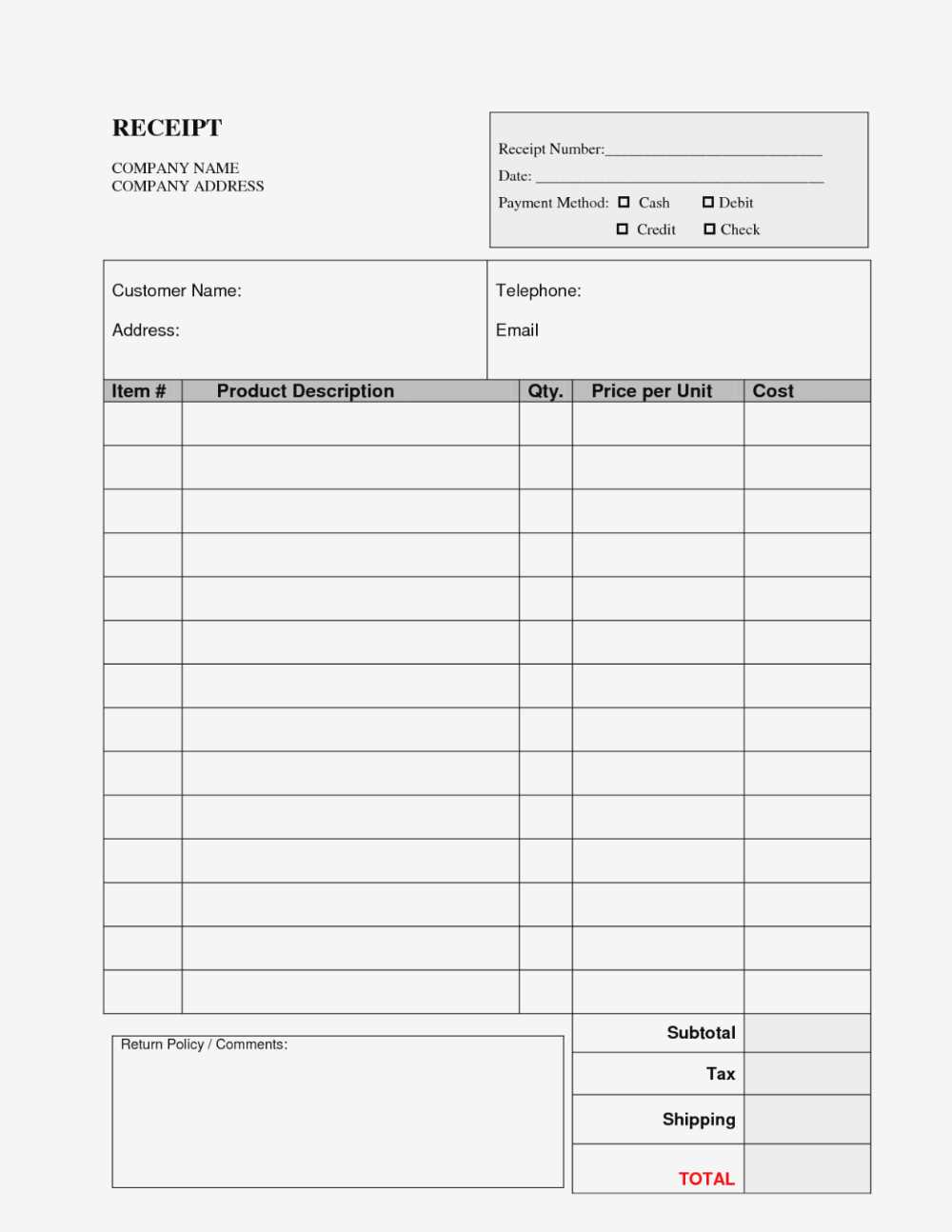

Using a structured form for equipment sales receipts helps streamline transactions and maintain clear records. A well-organized template ensures that all necessary details are captured, making it easier for both buyers and sellers to stay on the same page.

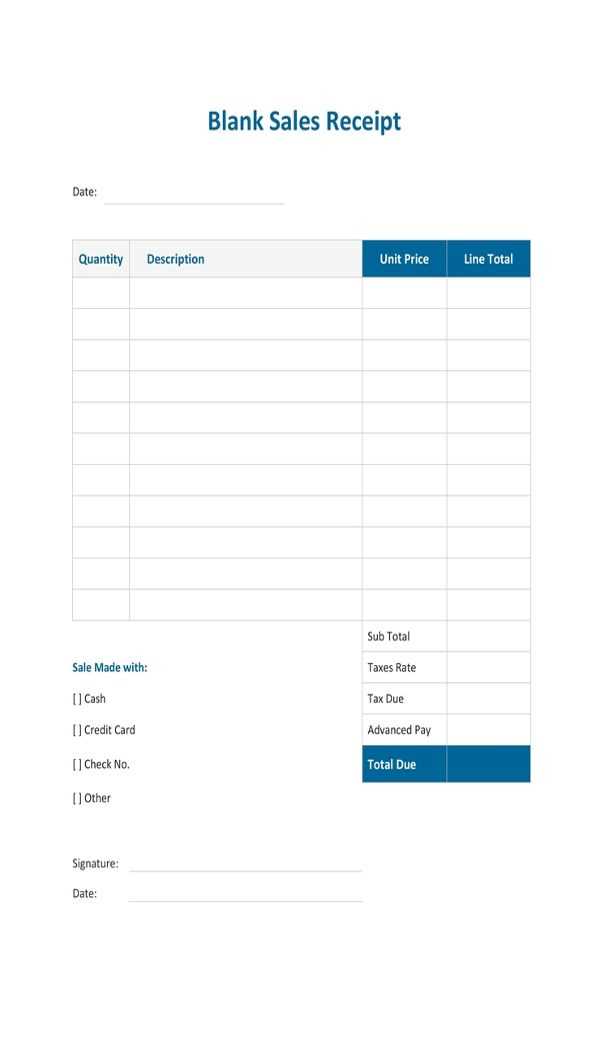

Include key fields like seller and buyer information, date of transaction, and equipment details. Clearly list the items sold, including quantities, unit prices, and any applicable taxes or discounts. This transparency reduces the chances of confusion and disputes.

Consider adding a section for payment terms, such as the method of payment and due date. This provides clarity on when and how payment is expected, avoiding potential misunderstandings.

Lastly, make sure there is space for both parties to sign the receipt. This serves as an acknowledgment of the terms and conditions, solidifying the transaction and preventing any future discrepancies.

Here’s the revised version:

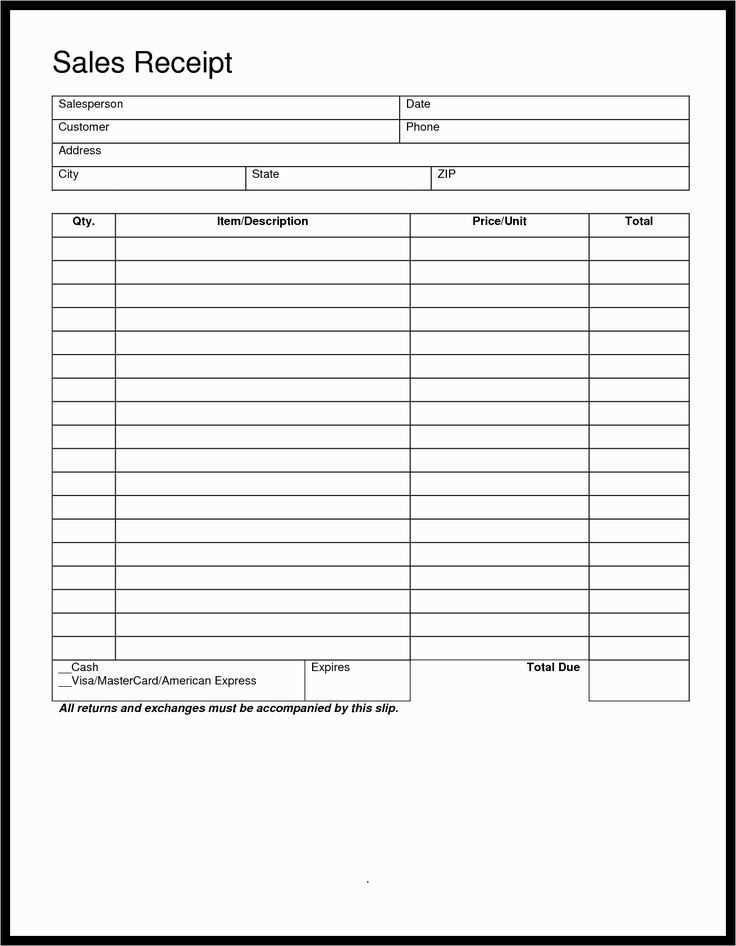

Ensure the receipt includes clear, labeled sections such as item descriptions, quantity, price per unit, and total cost. This will improve transparency and ease of understanding for both the seller and the buyer.

Header and Footer Placement

The header should feature the business name, contact information, and transaction date. Position this information at the top for easy access. Place the footer at the bottom, including payment method details and additional terms or disclaimers.

Itemized List Format

Provide a breakdown of each item sold, listing the product name, description, quantity, and price. Make sure these details are easy to read, with clear column separations. This structure prevents confusion during verification of the sale.

Equipment Sales Receipt Form Template

Defining Key Details for an Equipment Sales Receipt

Incorporating Payment Methods and Transaction Information

Customizing Receipt Design for Various Equipment Types

Ensuring Legal Compliance and Tax Reporting Obligations

How to Include Warranty and Return Policy Details

Best Practices for Digital vs. Paper Receipt Formats

Start by clearly listing the details of the equipment, including its name, model, serial number, and condition at the time of sale. This helps ensure that both the buyer and seller have a record of the exact product being transacted.

Incorporating Payment Methods and Transaction Information

Include payment information such as the method (credit card, cash, bank transfer, etc.), transaction ID, and the total amount paid. If applicable, note any financing or installment plans, including payment terms, so there is no ambiguity regarding the transaction.

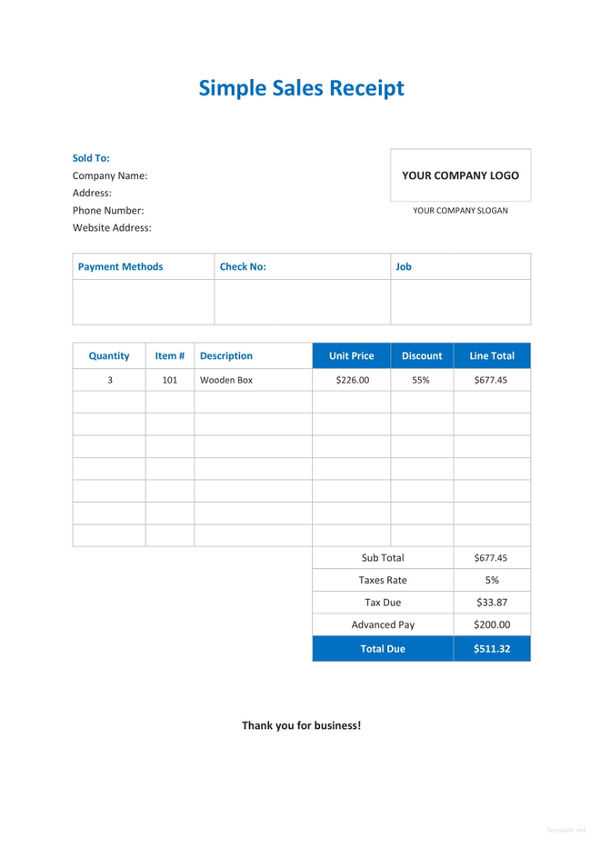

Customizing Receipt Design for Various Equipment Types

Tailor the design of your receipt to suit different equipment types. For high-value or specialized equipment, add more detailed information such as product specifications, warranties, and maintenance history. This adds clarity and enhances the buyer’s experience.

Always include legal compliance items such as applicable taxes, fees, and relevant business licenses. Tax reporting obligations, including sales tax or VAT, should be clearly listed on the receipt to prevent future disputes.

Incorporate warranty and return policy details on the receipt. State the warranty period, terms, and any exclusions. Include clear instructions on how the customer can initiate a return or claim warranty service, if applicable.

Consider the format of the receipt. Digital receipts are efficient, but ensure they are easy to read and store electronically. Paper receipts may still be preferred for some customers–use durable paper and ensure text clarity. Offer both formats when possible to cater to different preferences.