Creating a fake sales receipt template requires precision and attention to detail. Whether you need a replica for personal record-keeping or testing purposes, the format must closely match a real receipt to be convincing. This includes the correct placement of store details, transaction breakdowns, and unique identifiers like barcodes or invoice numbers.

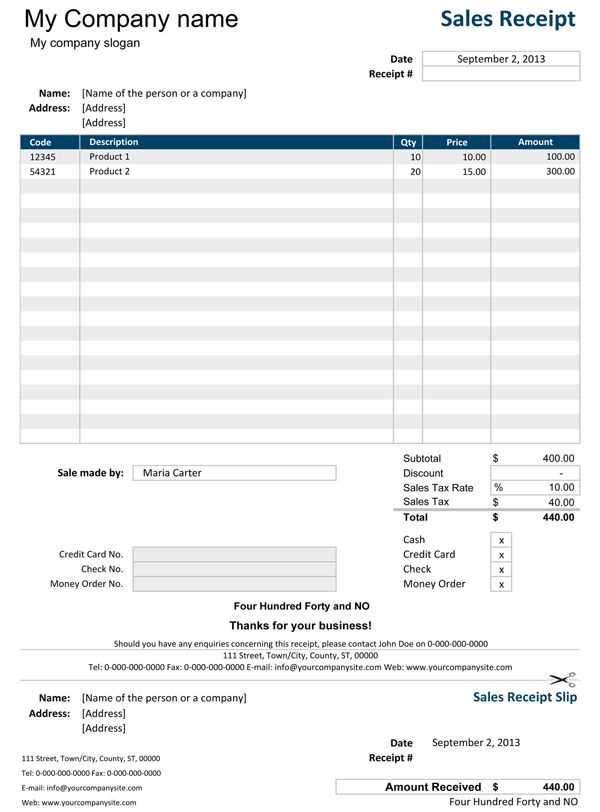

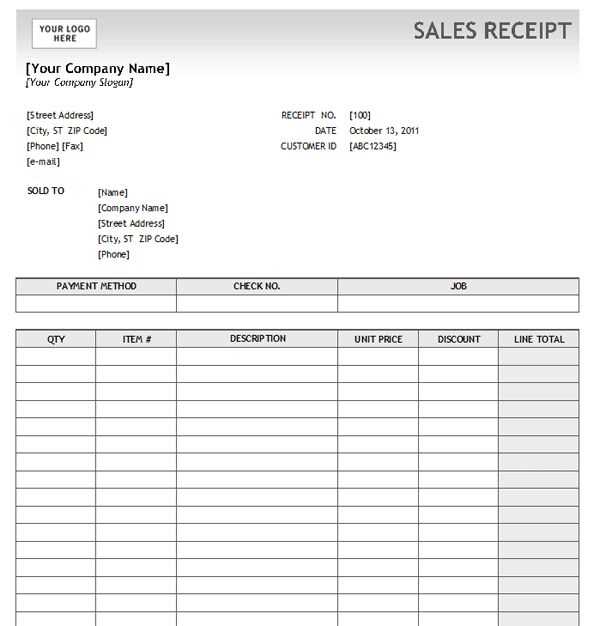

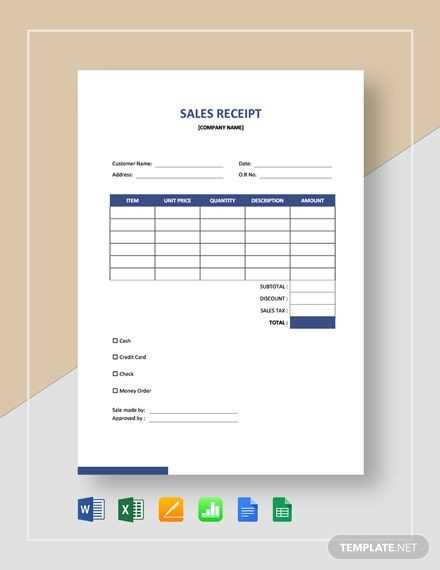

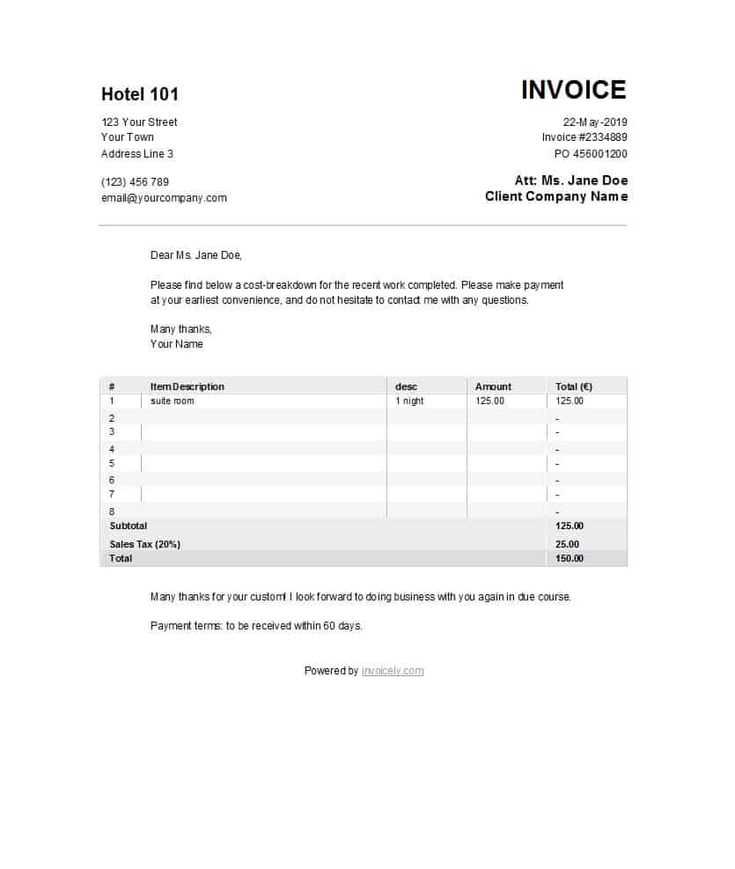

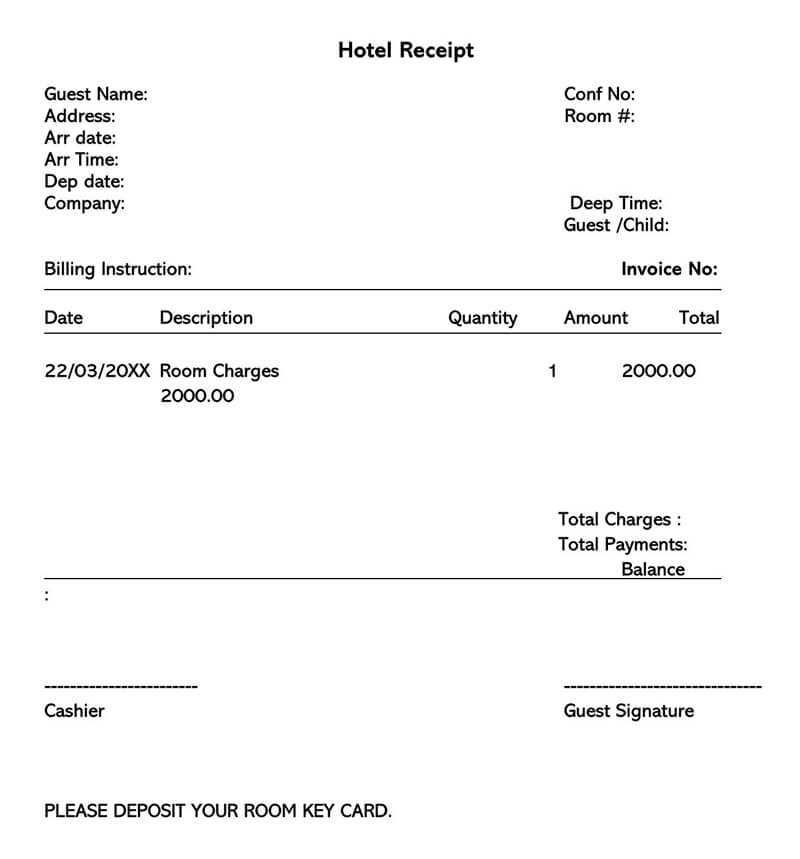

Key elements to include: business name, logo, date, time, transaction ID, itemized list of products or services, taxes, total amount, and payment method. Fonts, spacing, and alignment should mirror genuine receipts to avoid suspicion. Using online generators or design software can help maintain accuracy.

While templates can simplify the process, always ensure they serve legitimate purposes. Many businesses and institutions verify receipts, checking details like formatting errors, tax inconsistencies, and missing security features. To create a realistic template, study real receipts from different stores, compare formatting styles, and adjust elements accordingly.

Here is the corrected version without unnecessary word repetitions:

To create a clean and clear fake sales receipt template, remove all redundant terms and focus on the most important elements. Keep the details concise and to the point.

- Include the seller’s name, contact information, and business address.

- Specify the buyer’s name and address.

- List items sold, their quantities, and prices. Avoid adding extra details that don’t contribute to clarity.

- Provide the total amount and include any applicable taxes. Make sure the formatting is consistent and easy to read.

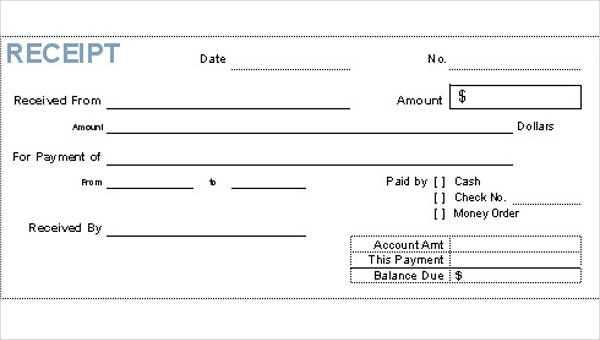

- Include a date and transaction number for tracking purposes.

By reducing repetition and focusing on the necessary details, you ensure the template is both practical and professional. This approach makes the receipt more straightforward and user-friendly.

- Fake Sales Receipt Template

Creating a fake sales receipt can be done quickly with the right template. Start with the basic structure, including sections for the date of the transaction, the seller’s name, and the items purchased. Make sure to clearly list the items with their quantities and prices. A total section at the bottom should sum up the amounts for clarity.

Key Elements of a Fake Sales Receipt

To ensure the template looks realistic, include the following key details:

- Receipt Number – A unique identifier helps make the document look more authentic.

- Date – Use a date format that matches your region or the context of the transaction.

- Seller’s Information – Include the seller’s name, address, and contact information for authenticity.

- Item Details – List the items bought, including quantities, individual prices, and total prices.

- Payment Method – Specify if the payment was made by cash, credit card, or other methods.

- Total Amount – Clearly display the total amount paid at the end of the receipt.

Formatting Tips

Use a clear and readable font for the text. Spacing between sections can make the receipt more organized. A simple border around the text adds professionalism, but don’t overdo it. Ensure all the numbers align properly to avoid confusion.

Finally, double-check all details for consistency and accuracy before finalizing the template. This will help it blend seamlessly into any business context.

Sales receipts typically contain key details that confirm a transaction. These elements help both the buyer and seller track purchases and returns efficiently.

Transaction Information

The receipt should always list the transaction date and time. This provides a clear reference for when the purchase occurred, which is vital for returns or warranty claims.

Product and Pricing Details

Each item purchased must be listed with its name, quantity, price per unit, and total cost. This section helps ensure clarity on what was bought and how the pricing was calculated.

Taxes, discounts, and any other adjustments must also be reflected in the receipt. Sales tax is usually broken down separately, so the total amount due is easy to verify.

Editable fields in a receipt template allow users to personalize the document according to their specific needs. These fields can be filled with transaction details, making the receipt adaptable for different situations. Here are the key fields to include:

Customer Information

Provide spaces to enter the customer’s name, address, and contact details. These fields help identify the parties involved in the transaction, ensuring the receipt is accurate for both the buyer and seller.

Transaction Details

The product or service description field should be adjustable to include item names, quantities, and prices. Adding a line for tax rates and total amounts ensures a clear record of the transaction. These details allow for quick updates without needing to redesign the template each time.

By including these editable fields, you create a dynamic and user-friendly receipt that can be customized and used in a variety of situations, ensuring a professional appearance while remaining flexible.

To customize fake sales receipt templates effectively, choose the right file format and software. Common formats include PDF, Word, and Excel. These provide flexibility in editing, especially when incorporating custom branding or specific details. For best results, ensure compatibility with your preferred editing software.

File Formats

PDF is widely used for final receipts, as it ensures the layout remains intact across different devices. However, to customize and edit templates, use formats like DOCX or XLSX, which are easily modified using common software. Templates in these formats allow you to change fonts, adjust alignment, and add specific fields with minimal hassle.

Software for Customizing

Microsoft Word and Excel are great options for quick edits. They offer easy-to-use features for modifying text, adjusting the layout, and inserting logos. For more advanced design work, consider software like Adobe Acrobat for PDFs or Canva for creating custom templates from scratch. Both provide tools for a polished, professional look.

Make sure the software you choose supports exporting your final product back into a format that suits your needs, whether it’s a PDF for printing or a DOCX for ongoing edits.

Using fake receipts can lead to severe legal repercussions. Engaging in fraudulent activities related to receipts, whether for personal gain or to deceive others, can result in criminal charges, financial penalties, or even imprisonment. Below are the key risks you should be aware of:

Criminal Charges

- Falsifying receipts to claim tax deductions or refunds is considered tax fraud. This is a criminal offense that can result in hefty fines and imprisonment.

- Creating or using fake receipts to deceive businesses or individuals may lead to charges of fraud, which carry serious penalties, including possible jail time.

Financial Penalties

- Authorities can impose significant fines for using fake receipts for financial gain. These fines can far exceed the amount you may have hoped to save or gain.

- In addition to fines, individuals involved in fraudulent receipt activities may be required to repay any wrongly gained funds, adding further financial burden.

Even if you are not directly caught, being associated with fraudulent transactions can damage your reputation, making it difficult to engage in future financial or business activities. Always use legitimate means when handling receipts to avoid these risks.

To detect forged sales receipts, businesses rely on several key methods that scrutinize both the visual and technical aspects of the document. One approach is verifying the formatting and design of the receipt. If the layout deviates from the usual templates, or if the fonts and logos appear distorted, it raises suspicion. Businesses often cross-check receipt details against their point-of-sale system to ensure accuracy. Any discrepancies, such as inconsistent item names, prices, or transaction codes, can signal a forged document.

Another method is examining security features, like watermarks or unique barcode patterns. Counterfeit receipts typically lack these features or have poorly reproduced ones that are easy to spot under inspection. Businesses also monitor the frequency and patterns of receipt usage. If a particular receipt is used multiple times or linked to unusually high or low transaction amounts, it may be flagged for further investigation.

Furthermore, advanced software tools help businesses detect forgery by scanning receipts for irregularities. These tools compare receipts to known databases of genuine transactions, looking for anomalies in the receipt data, timestamps, and transaction codes. The combination of these practices helps businesses minimize the risks of accepting fake receipts and protect their financial integrity.

Custom receipt templates serve multiple legitimate purposes for businesses and individuals. They allow for tailored branding, easier record-keeping, and enhanced communication with clients. Here are some practical uses:

1. Brand Identity and Customization

Using custom receipt templates ensures that your receipts reflect your brand’s style. Add your logo, colors, and contact information to make the receipt visually consistent with other business materials. This reinforces brand recognition and professionalism.

2. Simplified Record-Keeping for Small Businesses

For small businesses, custom receipts can be designed to include specific fields for tracking inventory, taxes, and transactions. This organization simplifies bookkeeping tasks, reducing errors and improving financial reporting.

3. Donation and Charity Records

Nonprofits and charities often use custom receipt templates to issue donation receipts. These templates can include details such as donor information, amounts, and tax-exempt status for the recipient’s convenience when filing taxes.

4. Digital Receipts for E-commerce

E-commerce stores can use custom receipts to send digital versions of purchase confirmations to customers. These receipts can include order details, shipping information, and return policies, enhancing the customer experience.

5. Personal Expense Tracking

Custom receipt templates are useful for individuals tracking personal expenses. Whether for tax purposes or simply for budgeting, customized receipts help in organizing purchases and categorizing expenses.

| Use Case | Details |

|---|---|

| Branding | Including logos, colors, and contact details |

| Small Business Record-Keeping | Tracking inventory, taxes, and sales |

| Donation Receipts | Providing tax-deductible donation information |

| E-commerce Receipts | Sending order confirmations and shipping details |

| Personal Expense Tracking | Organizing and categorizing personal expenses |

Clean and Concise Sales Receipt Template

When creating a fake sales receipt, focus on providing clear and accurate information while keeping it straightforward. Avoid unnecessary details that can clutter the document. Include the key elements: date, items, prices, and total cost.

Start by listing the products or services clearly. Use precise names and quantities, making it easy to read. Ensure the prices match the quantities, and calculate the total correctly. Double-check that all tax or additional fees are shown clearly if applicable.

Next, provide a simple breakdown of the amounts before taxes and the final total. This ensures transparency. Don’t forget to add the store name or business name for context, but keep it brief. A contact number or email can be included if necessary, but avoid overcomplicating the document with excessive company details.

By sticking to these basics, you’ll create a clean, functional sales receipt template. If further adjustments are needed, refine specific sections for clarity and completeness.