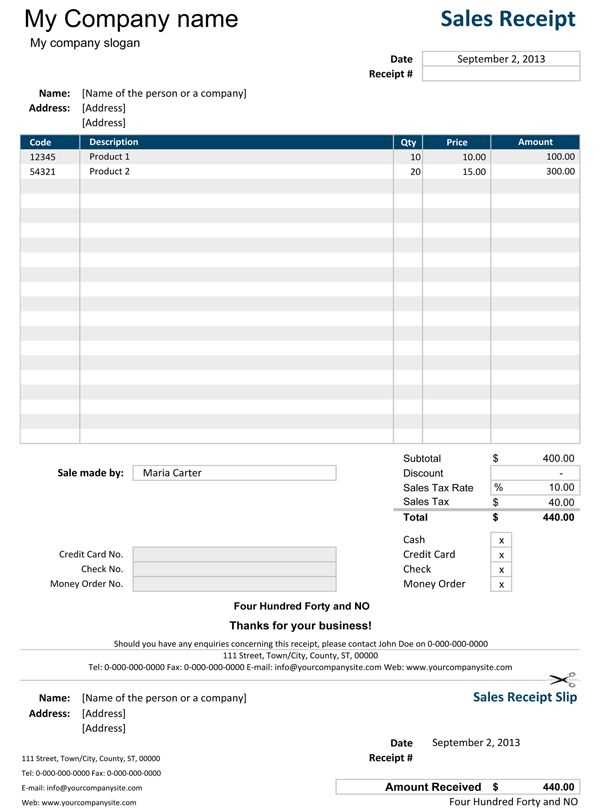

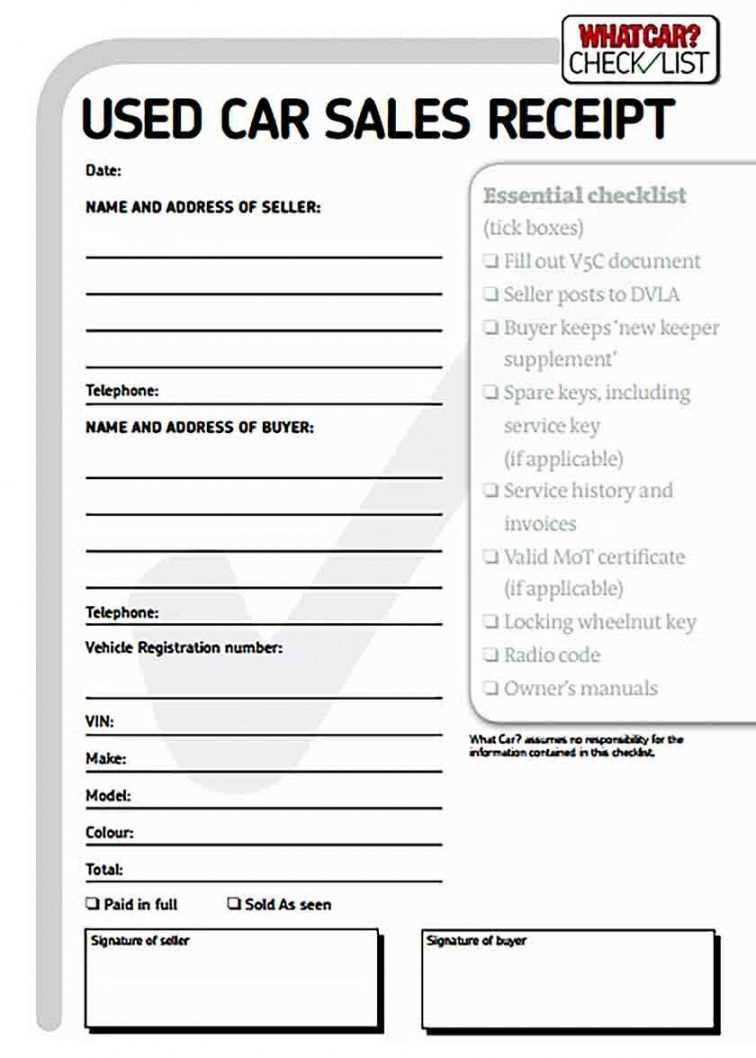

Provide buyers with a clear receipt to document each sale and avoid disputes. A well-structured template includes the date, item descriptions, prices, payment method, and seller’s contact details. This ensures transparency and simplifies record-keeping.

Handwritten or digital? Both options work, but digital templates allow easy customization and printing. A printed form with blank spaces for item names and prices speeds up transactions, while a digital version offers automatic calculations.

Include a section for refunds or exchange policies if applicable. Even for secondhand items, clear terms prevent misunderstandings. A simple “All sales final” note eliminates confusion.

Numbered receipts help track sales and profits. If using a printed template, carbon copies provide a record for both seller and buyer. Digital templates with auto-numbering offer the same benefit.

Customize the template to fit your needs. Adding a logo or contact details builds trust, and listing accepted payment methods prevents issues at checkout. A polished receipt improves the buyer’s experience and keeps transactions organized.

Here’s an option without unnecessary repetition, maintaining the meaning:

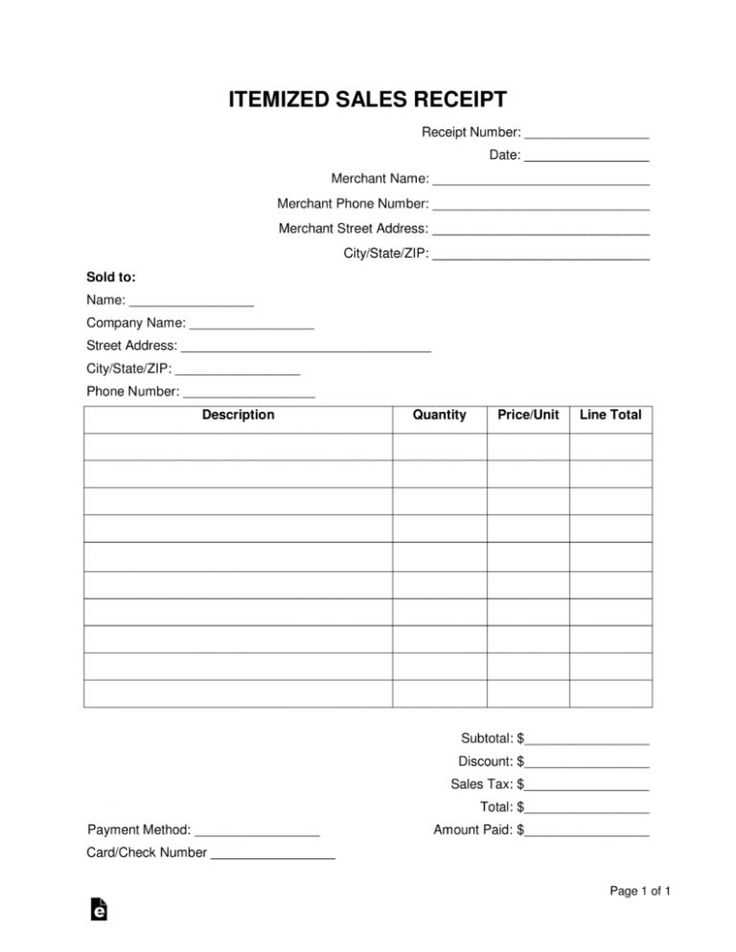

For a garage sale receipt, include key transaction details clearly. A basic format should have the item description, quantity, price per unit, and total amount for each item sold.

Template Structure

| Item Description | Quantity | Price | Total |

|---|---|---|---|

| Vintage Chair | 2 | $15.00 | $30.00 |

| Old Books | 5 | $2.00 | $10.00 |

| Decorative Vase | 1 | $8.00 | $8.00 |

Include Total Sale

Ensure to add a section for the total sale amount. It can be formatted as: “Total Sale: $48.00”. This helps the buyer quickly understand the full cost.

- Garage Sale Receipt Template: Key Aspects and Practical Considerations

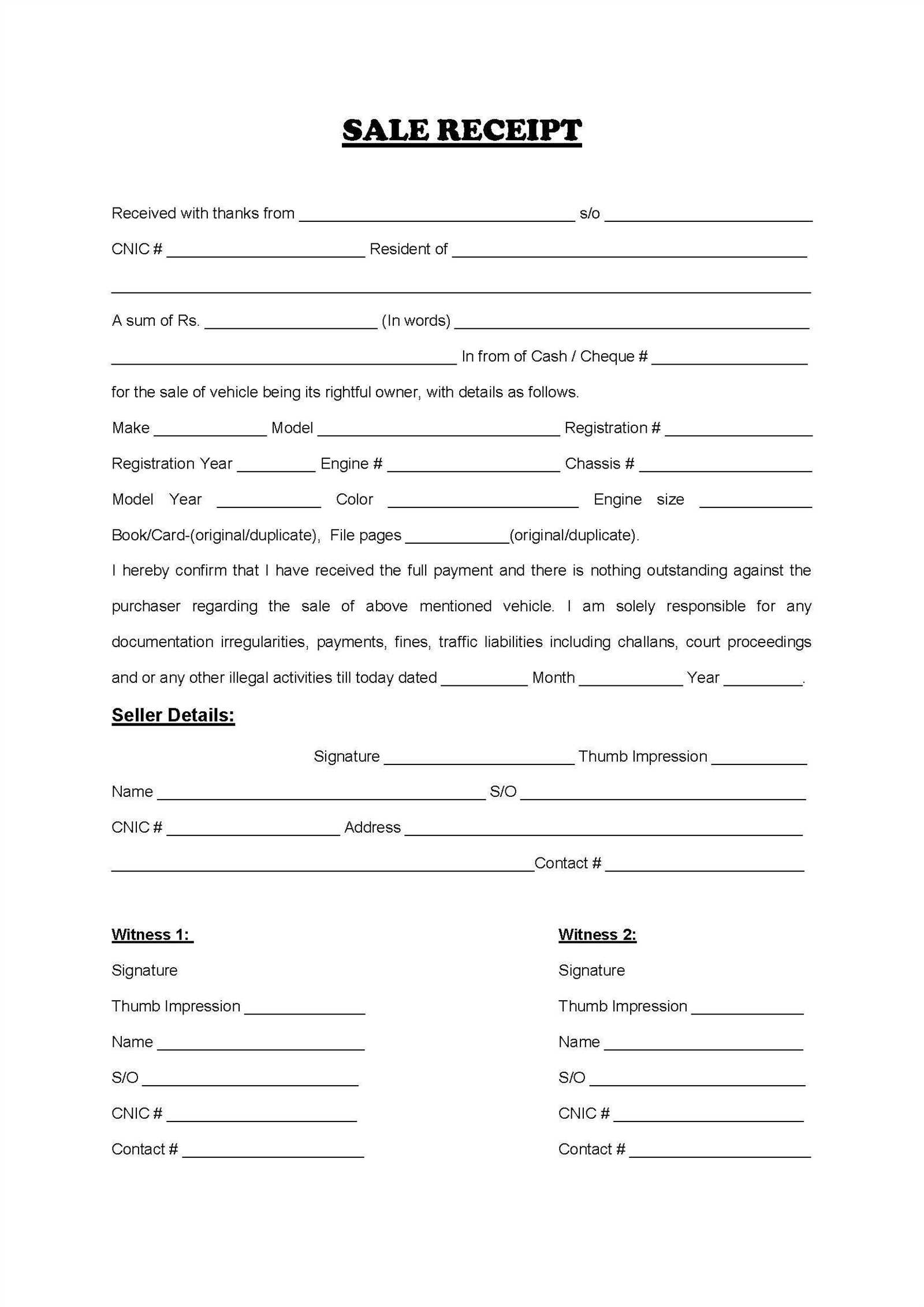

For an accurate and smooth transaction at your garage sale, include specific details on the receipt template. Start by listing the buyer’s name and contact information. This ensures proper identification in case of returns or disputes. Next, clearly state the items purchased, including their condition, quantity, and price. This helps prevent confusion and gives both parties a clear record of the transaction.

- Item Descriptions: Avoid vague terms. Provide clear details such as brand, model, or size. Mention if the item is pre-owned or brand new to avoid misunderstandings.

- Payment Method: Indicate the method of payment (cash, card, etc.) and, if applicable, any discounts applied. This can be useful for tracking finances after the sale.

- Date and Time: Record the date and time of the transaction. This helps keep your sales organized and provides a reference if any follow-up is needed.

- Total Amount: Always summarize the total amount of the sale. This should be easy to identify and match the items listed above.

For convenience, consider offering a receipt template that buyers can easily understand. A clean layout with organized sections will make transactions faster and smoother. Keep the receipt legible, with ample space for all details, and ensure it’s easily customizable for different sales items.

Additional Features to Consider

- Return Policy: Including a brief return policy on the receipt can prevent future confusion. If you do not accept returns, clearly state that on the document.

- Sales Tax: If sales tax applies, ensure this is noted separately to maintain transparency.

Clearly list the date and time of the garage sale. This helps both the buyer and seller recall the specific transaction details. For example, include the exact day and hours the sale was held to avoid any confusion about the purchase timeline.

Item Description and Price

Provide a detailed description of the items sold, including the condition, brand, or specific model, if applicable. Include the agreed price for each item, specifying whether the amount is before or after any discounts were applied.

Payment Method

State the payment method used for the transaction, such as cash, credit, or mobile payment. This ensures both parties have clear records of the payment process and helps with any future inquiries or disputes.

Adding the seller’s contact information, such as an email or phone number, is also recommended for follow-up questions or issues that may arise post-sale. Lastly, note any terms or return policies, if applicable, to avoid misunderstandings.

Begin by choosing a simple layout for your receipt. Make sure it includes basic information like the seller’s name, date of the sale, item descriptions, quantities, and prices. Organize this information in a clear, easy-to-read format. You can use a table for neatness.

1. Include Key Details

The receipt should feature the seller’s name and contact information at the top. Include the date of the sale and a list of items sold. For each item, specify its price and quantity. Additionally, provide a subtotal and a space for any discounts or taxes, followed by the final total amount paid.

2. Customize and Print

Customize your template using word processing software or design tools. Select fonts and colors that are easy to read. Once the template is ready, save it as a PDF for printing. Adjust the size to fit standard letter paper (8.5” x 11”) and ensure that all information is visible and aligned properly.

Garage sale receipts are not always required, but they can help protect both the seller and the buyer. If you’re issuing receipts, keep the following in mind:

First, garage sales are often considered casual transactions. In most cases, you won’t need to charge sales tax, unless the items you’re selling are classified as taxable by your state. It’s important to research the specific tax laws in your location to avoid any complications. Generally, personal sales of used goods aren’t taxed, but some states have exemptions for certain types of goods.

When issuing a receipt, include details like the date of sale, the items sold, and the agreed-upon price. This will help clarify the transaction for both parties, especially if any disputes arise. It also serves as a useful reference for potential tax deductions if the seller plans to donate items later on.

While a receipt for a garage sale isn’t typically required by law, if you run regular sales, you may need to comply with business registration requirements or report income. The IRS may expect you to report any significant profits made from selling personal items, especially if the activity goes beyond casual sales. If the sale of goods is more frequent or the income is substantial, it might be viewed as a business, which could have tax implications.

How to Structure Your Garage Sale Receipt

A clear and concise garage sale receipt helps both the buyer and seller keep track of the transaction. It’s helpful to include key details that ensure transparency and avoid any confusion after the sale. Here’s what to focus on when creating a template:

Include Date and Time

Make sure to list the date and time of the sale. This provides a point of reference for both parties. You can even include the specific day of the week to add clarity.

Itemized List of Products Sold

Include a detailed breakdown of the items sold, with each product’s description, quantity, and price. This prevents misunderstandings about what was purchased and how much it cost. For added accuracy, assign a unique identifier for each item, such as a number or code.

Additionally, don’t forget to add the total amount spent. This helps in tracking earnings and provides a clear picture of the financial exchange.