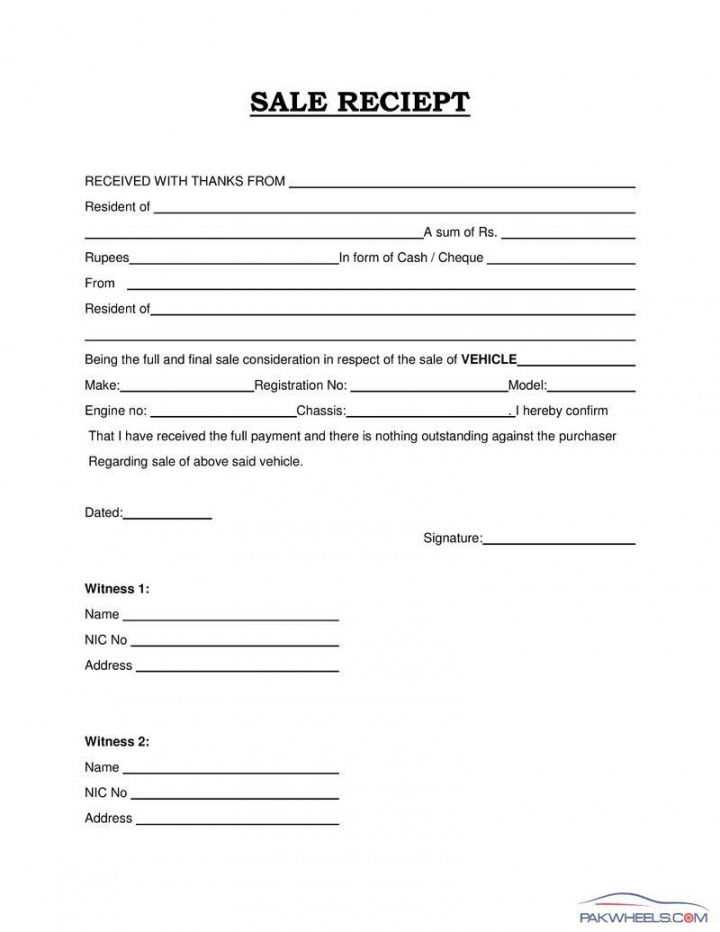

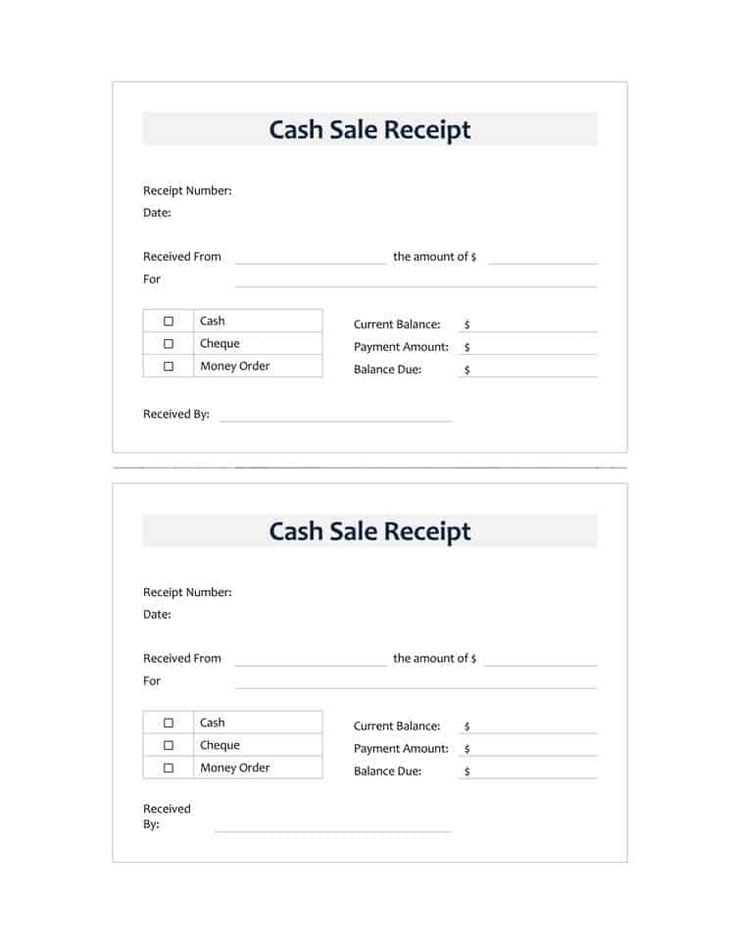

A well-structured sales receipt simplifies transactions and ensures clear record-keeping. It should include key details such as the seller’s and buyer’s names, the date of sale, a description of the goods or services, the total amount, and payment method. A properly formatted receipt protects both parties and helps with tax reporting.

Clarity and consistency are essential when designing a receipt. Use a simple layout with clearly labeled sections. A receipt should always include a unique transaction number for tracking and reference. If applicable, add tax details and any warranties or return policies to prevent future disputes.

Many businesses benefit from digital templates, which allow for quick customization. A reusable format speeds up invoicing and reduces errors. Whether using a spreadsheet, word processor, or specialized software, ensure the template is easy to update and compatible with your accounting system.

For small businesses, a printable PDF template is a practical option. It provides a professional appearance without the need for advanced software. Larger organizations may prefer automated receipts integrated with their payment systems, ensuring seamless processing and digital storage.

Choosing the right template depends on business needs, but the core elements remain the same: accuracy, readability, and compliance with legal requirements. A well-designed sales receipt not only records a transaction but also reinforces professionalism and trust with customers.

Here’s the corrected version with reduced repetition:

To make your sales receipt more streamlined, focus on using clear and concise wording. Avoid excessive details that might clutter the format. Start by listing the items sold with quantities and prices, followed by the total amount due. This simple structure keeps everything easy to follow.

Streamlining Item Information

For each item, include the name, quantity, unit price, and total price. Avoid redundant descriptions. For instance, “2 x Item A” is sufficient rather than “Two pieces of Item A”.

Clear Total Calculation

Include only the subtotal, taxes, and final total. Remove unnecessary breakdowns unless required for specific purposes. This keeps the focus on the core numbers that the customer needs.

By limiting excess wording and focusing on essential details, your receipt will be more effective and easier to read.

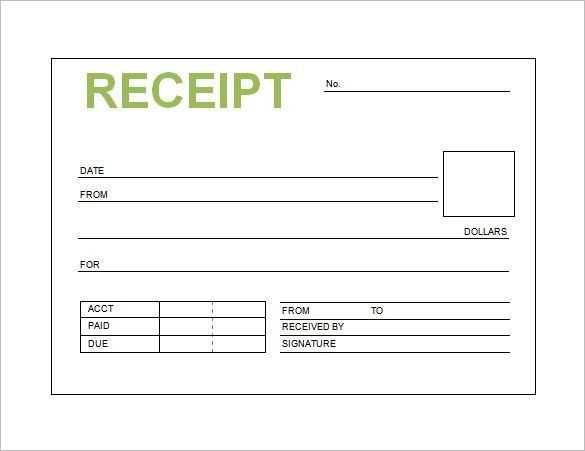

- General Sales Receipt Template

Creating a clear and concise sales receipt is critical for documenting transactions. A general sales receipt template should include specific sections for both the seller and buyer details, as well as the product or service information.

Key Elements to Include

- Seller Information: Company name, address, and contact details.

- Buyer Information: Customer’s name, address, and contact details (optional depending on the transaction).

- Transaction Date: The exact date of the transaction.

- Itemized List: A breakdown of products or services provided, including quantity, unit price, and total cost for each item.

- Subtotal: The total cost of all items before taxes and discounts.

- Tax Information: The applicable sales tax rate and total tax amount.

- Total Amount: The total amount due after including taxes and discounts.

- Payment Method: Indicate whether the transaction was completed with cash, credit, debit, or another payment method.

Design Tips for Clarity

- Readable Fonts: Use legible fonts with appropriate size for easy reading.

- Clear Layout: Keep the receipt layout simple and organized. Group related information together and separate sections for easier navigation.

- Space for Additional Notes: Include a section for extra details or messages, such as a thank-you note or return policy.

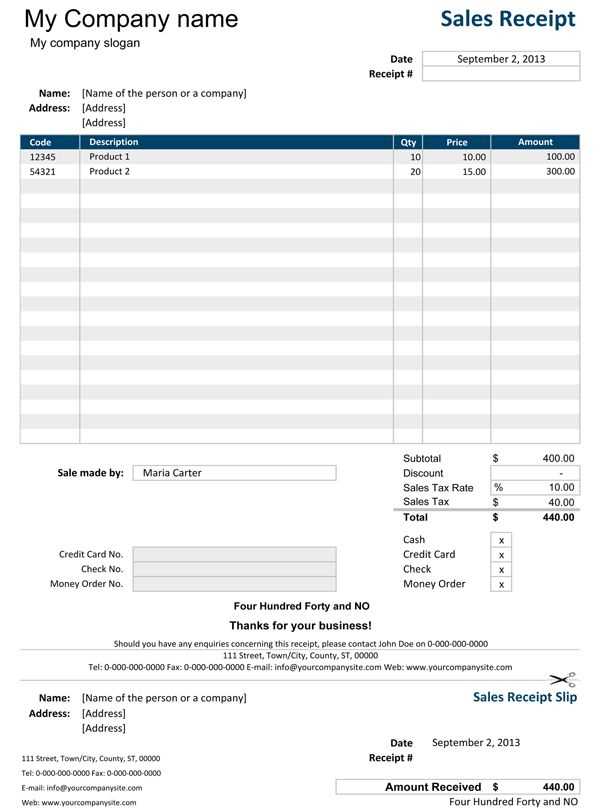

When creating a purchase receipt, focus on including specific details that provide clarity and transparency to both the buyer and the seller. Start with the receipt’s header, which should include the business name and contact information. This helps customers quickly identify the source of the transaction. Be sure to include the transaction date and a unique receipt number for tracking purposes.

Transaction Details

List each item or service purchased, along with its description, quantity, and price. This allows customers to verify what they paid for and ensures that all items are accounted for. Adding applicable taxes and the total amount is crucial for completeness.

Payment Information

Include the payment method used (e.g., credit card, cash, digital wallet) and the total amount paid. If any discounts were applied, clearly show the reduction to ensure transparency in the final amount.

| Element | Details |

|---|---|

| Business Name | Company name and contact information |

| Transaction Date | Date of purchase |

| Item Description | Product or service purchased |

| Quantity | Number of items purchased |

| Price | Price of each item |

| Taxes | Sales tax amount |

| Total Amount | Overall cost after tax |

| Payment Method | Type of payment used |

For accurate record-keeping and customer satisfaction, a well-structured receipt helps avoid misunderstandings and makes the process of returns or exchanges easier.

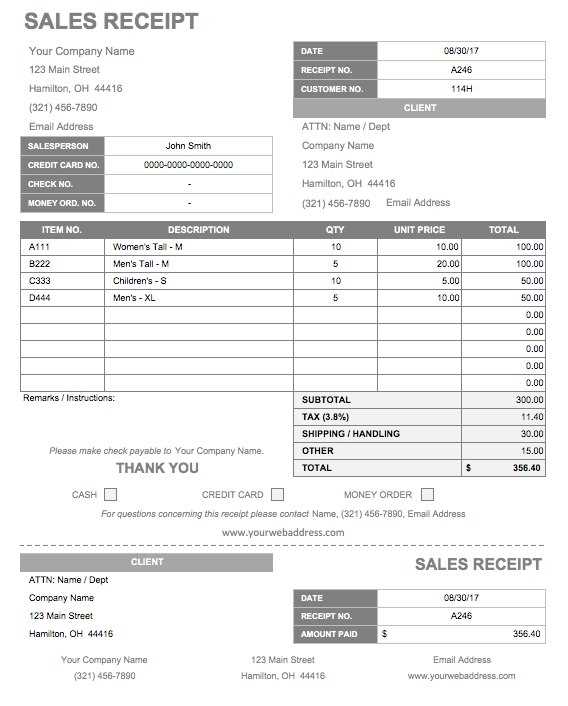

To format a transaction slip correctly, include all relevant details clearly and concisely. Begin with the header, which should feature the name and contact information of the business or service provider. Ensure that the transaction date and time are prominently displayed.

- Business Details: Include the name, address, phone number, and email address. This allows customers to contact the business if needed.

- Transaction Date and Time: Display the date and time in a readable format. It helps keep records organized for future reference.

- Receipt Number: Assign a unique transaction ID or number for tracking purposes. This helps in identifying the transaction in case of any discrepancies.

- Itemized List: Break down the purchased items or services. For each item, list the description, quantity, and price.

- Tax and Discounts: Include applicable taxes and any discounts applied. Clearly show the amounts to avoid confusion.

- Total Amount: State the final amount after all calculations, including taxes and discounts. Make it clear for easy understanding.

Position these elements logically to create a clean, organized layout. Ensure all figures are accurate and readable, using bold text or different font sizes for emphasis where necessary. Avoid clutter, keeping the design simple but informative.

Always include key details on payment proofs to ensure they meet legal standards. A receipt must clearly state the transaction amount, date, and method of payment. Ensure that both the seller’s and buyer’s information are included, such as names or business identifiers. A legal payment proof must also provide an itemized list of products or services, reflecting the agreed-upon transaction. Additionally, specific tax information, such as VAT numbers, should be included when applicable.

By law, businesses may also be required to keep copies of receipts for a set period for tax and auditing purposes. Check local regulations to understand retention periods and other jurisdiction-specific requirements. Proper documentation of payment proofs helps avoid disputes and strengthens the credibility of business transactions.

Opt for digital records when speed, organization, and accessibility matter. Digital transaction logs can be easily stored, retrieved, and shared across multiple devices, allowing for immediate access and a higher degree of security. They also reduce the risk of physical damage, such as wear and tear or loss in case of a disaster.

Benefits of Digital Records

Digital records provide easier management, allowing users to sort, search, and retrieve transactions quickly with the help of automated systems. Cloud storage options ensure that data is not only safe but also retrievable from anywhere, eliminating the need for physical storage space. Additionally, digital receipts can be linked to bank statements or accounting software for streamlined financial management.

Challenges of Paper Records

Paper records, though tangible, require more storage space and can be cumbersome to organize, especially over time. They also increase the risk of loss, theft, or damage from environmental factors such as fire or water. In addition, paper-based transactions make it harder to quickly reconcile or verify past activities, especially when dealing with large volumes of receipts.

Include your business name, logo, and contact details prominently at the top of the receipt. This helps establish brand recognition and provides customers with an easy way to reach you if needed.

Choose the right font style and size to ensure readability. A clean, professional look is key to making a lasting impression.

Incorporate specific details like tax rates, service fees, or discounts, clearly separating them from the total amount. This transparency helps prevent confusion and builds trust with your customers.

Offer optional fields for additional customer information, such as loyalty program numbers or promotional codes. This can encourage repeat business and track customer preferences over time.

Include a clear return or exchange policy at the bottom. This section protects both the customer and the business in case of issues with the purchase.

Make sure to include a unique transaction number and date for reference. This helps with accounting and ensures each receipt can be traced back to a specific sale.

Consider offering digital receipts as an alternative. This option reduces paper waste and provides an eco-friendly solution while still offering the necessary details to your customers.

Always double-check the transaction details before issuing a receipt. Common mistakes often stem from incorrect amounts or missing items. Ensure all products or services are accurately listed with the correct pricing. A small error can lead to confusion for both the customer and your accounting system.

Incorrect Tax Calculations

Double-check tax rates applied to items. Sometimes receipts reflect outdated or wrong tax rates, leading to undercharging or overcharging. Regular updates to your system can help avoid this issue.

Missing Contact Information

Ensure the business name, address, and contact details are clearly visible on every receipt. This not only makes the receipt valid for warranty or return purposes but also improves professionalism. Missing this information can make a receipt seem incomplete or unprofessional.

Another mistake is issuing receipts without clear payment method details. Whether it’s cash, card, or other methods, the receipt should indicate how the customer paid. This helps resolve any future payment disputes.

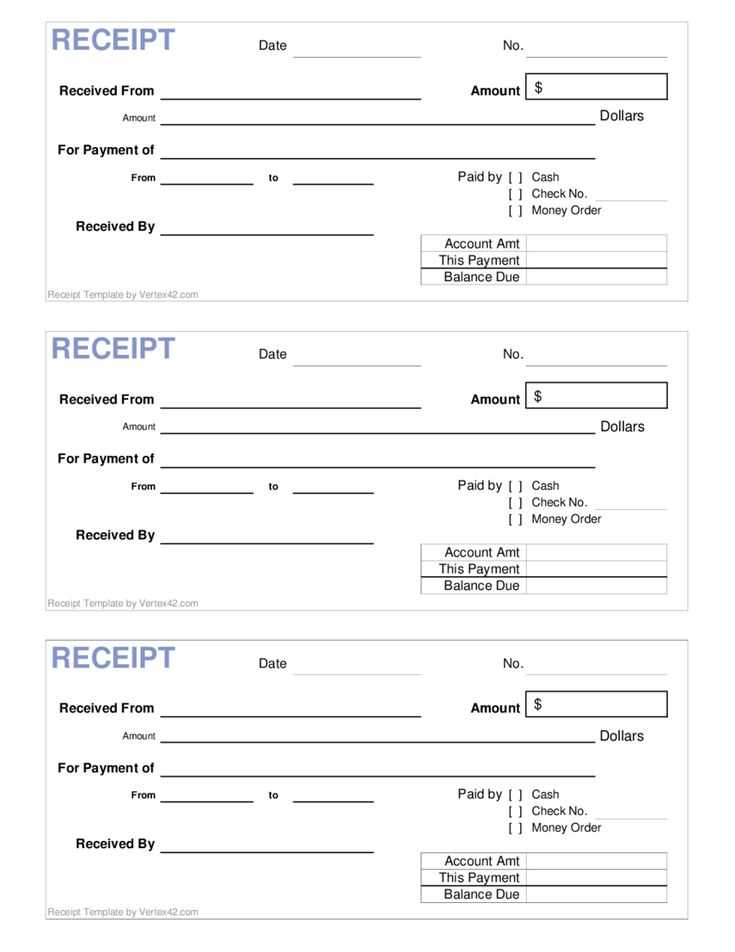

Use a clear and simple structure to create a sales receipt template. This makes it easier for both you and the customer to understand the details of the transaction. Begin by clearly listing the business name, contact information, and a receipt number for tracking purposes. Include the date of the transaction, the items purchased, and the price for each item.

Itemized List

Provide an itemized list of products or services sold. Each entry should have a description, quantity, price per unit, and total price. This helps ensure transparency in the sale process and reduces the risk of confusion or disputes.

Additional Charges

If applicable, add any extra charges such as taxes, discounts, or shipping fees at the bottom of the itemized list. This section should be clearly marked, so customers know exactly what they are being charged for.

Lastly, include a total amount due, both before and after any discounts or taxes. A clear breakdown of costs will ensure your sales receipt serves its purpose in tracking and confirming transactions.