Use a handwritten sales receipt to provide clear documentation of a transaction while maintaining a personal touch. A well-structured receipt ensures both the buyer and seller have a record of the sale, reducing the risk of disputes.

Include essential details such as the date of purchase, seller and buyer names, description of goods or services, amount paid, and payment method. Numbering receipts sequentially improves organization, while signatures from both parties enhance authenticity.

Choose a clean, legible format with enough space for writing. A lined template helps maintain neatness, and using carbon copies or scanning receipts ensures backup records. Keep completed receipts in a secure location for future reference.

A simple, structured template makes transactions smoother and more professional. Whether selling products, providing services, or issuing invoices, a handwritten receipt remains a reliable method for documenting financial exchanges.

Here’s a revised version with fewer repeated words while keeping the meaning:

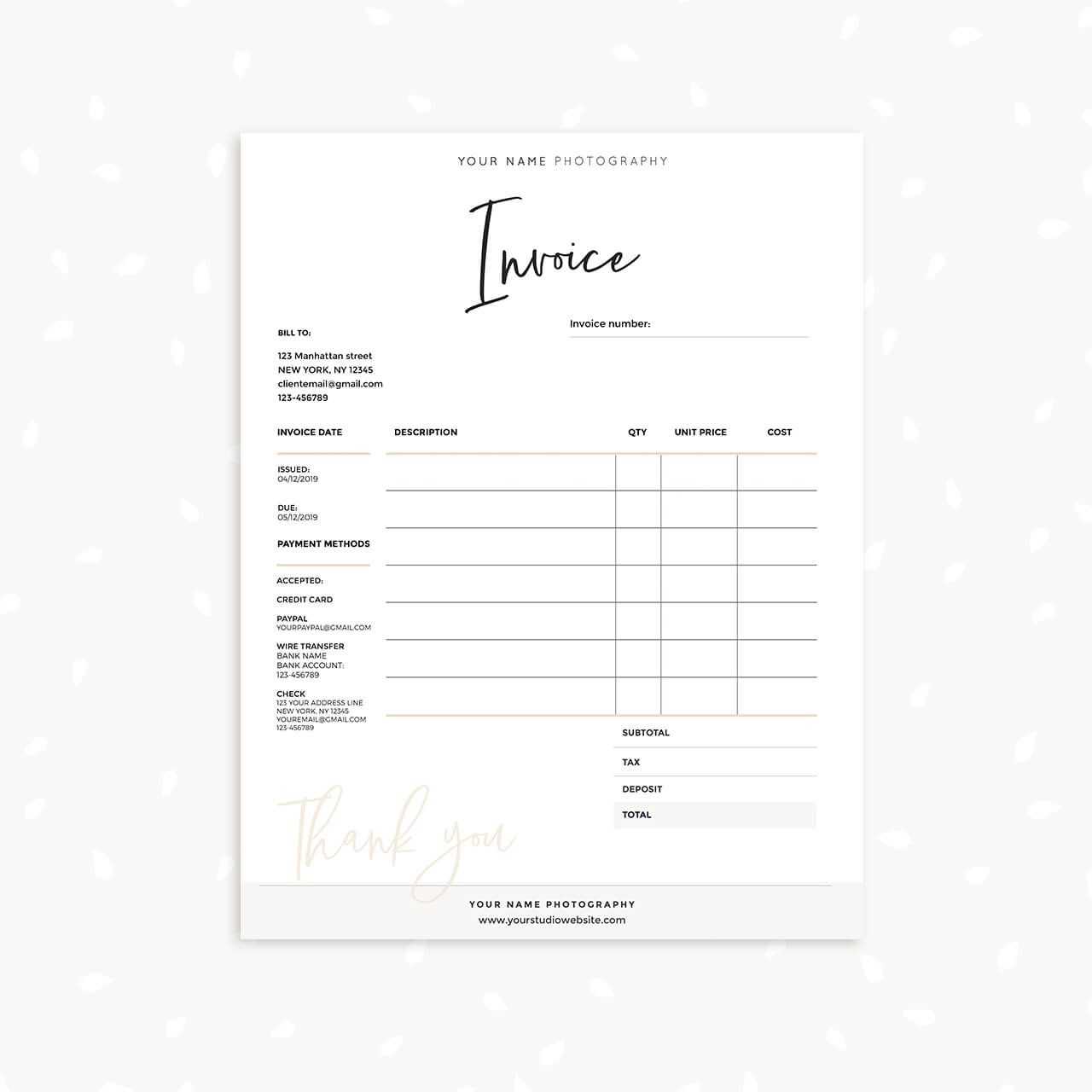

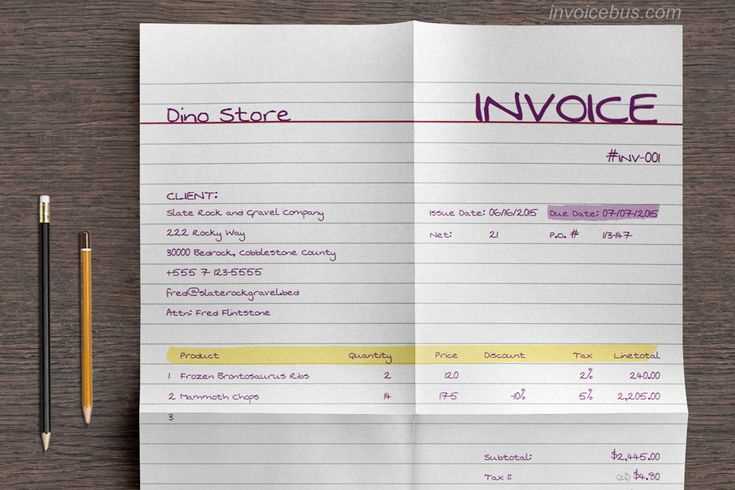

Use a structured layout for clarity. Start with the seller’s name, address, and contact details at the top. Below, include the date of the transaction and a unique receipt number. Clearly list each item or service, specifying quantity, unit price, and total cost. Sum the amounts and indicate any applicable taxes separately. Add a final total at the bottom. For verification, include a signature line for the seller and an optional space for the buyer’s acknowledgment. Keep a copy for records to ensure accuracy and future reference.

- Handwritten Sales Receipt Template

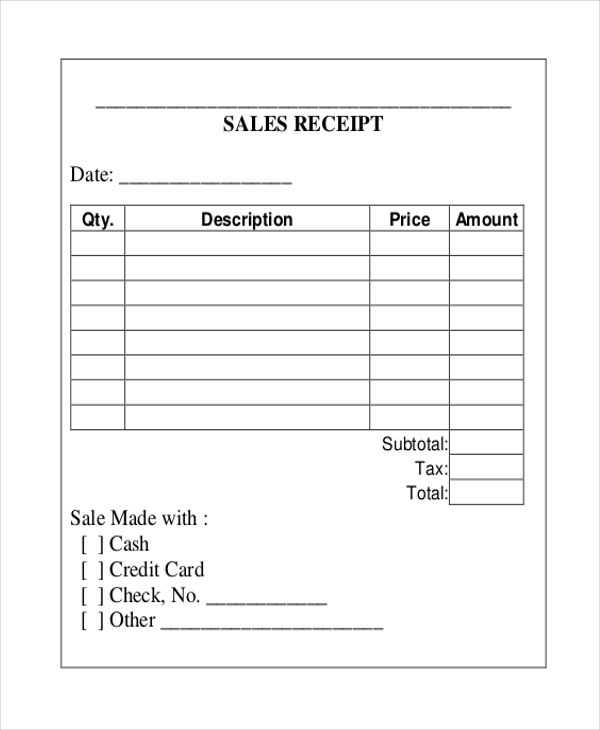

Use a structured format to ensure clarity and accuracy in handwritten sales receipts. Always include the following key elements:

- Header: Write “Sales Receipt” at the top, followed by the date of the transaction.

- Seller Information: Include the business or individual’s name, address, and contact details.

- Buyer Information: Record the customer’s name and contact details if applicable.

- Itemized List: Clearly list each product or service, including quantity, unit price, and total cost.

- Subtotal and Taxes: Calculate the total before tax, add applicable taxes, and provide a final total.

- Payment Method: Indicate whether the payment was made in cash, check, or another form.

- Signature: Have both the seller and buyer sign if necessary for record-keeping.

Use a carbon copy or duplicate receipt book to maintain records. Ensure legibility by writing clearly and using a standard format for consistency.

Include the date and time of the transaction at the top to track when the sale occurred. Clearly state the seller’s name or business name along with contact details for reference. List the items sold with a brief description, including quantities and unit prices for transparency. The total amount due should be prominent, along with any applicable taxes. For accurate record-keeping, provide the payment method used (cash, credit, etc.) and the amount received. Finally, add a unique receipt number to prevent confusion in case of returns or disputes.

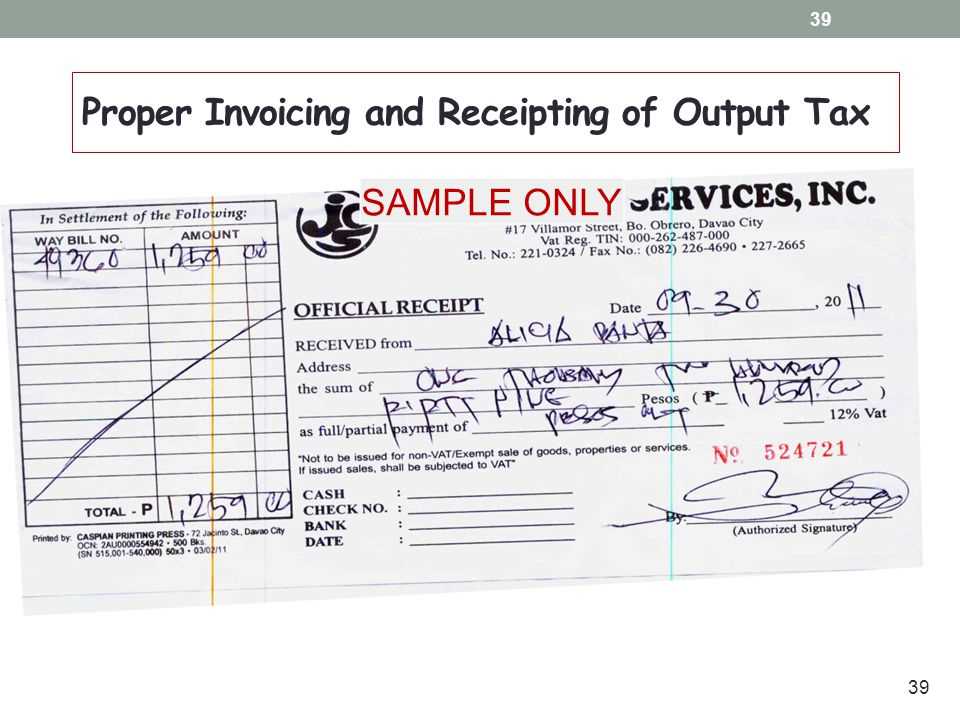

Legal Considerations and Compliance Guidelines

Ensure your handwritten sales receipts comply with local tax and business regulations. It’s crucial to include key details such as the date of transaction, the names of the buyer and seller, and the products or services sold. Missing or incorrect information could lead to disputes or legal consequences.

Tax Reporting and Documentation

Sales receipts must include accurate tax information, like the sales tax amount, if applicable. This is necessary for reporting taxes to local authorities. You may also need to provide additional documentation for large transactions or specific business sectors, depending on the jurisdiction.

Consumer Protection Laws

Make sure the sales receipt meets consumer protection laws by clearly outlining refund, return, and warranty policies. This ensures transparency and helps build trust with customers. Always store copies of receipts for a reasonable period, as some regions require businesses to retain transaction records for auditing purposes.

Choose paper with a smooth surface that prevents ink from smudging. Opt for a weight of 80-100 gsm for optimal writing experience. Heavier paper adds durability but can feel bulky. Consider using standard white or lightly textured paper for a professional look, ensuring clarity in each detail.

Paper Type and Quality

For handwritten sales receipts, select acid-free paper to prevent yellowing over time. If using carbon paper for multiple copies, ensure the primary sheet has enough thickness to handle the pressure without bleeding through.

Writing Instruments

Ballpoint pens are ideal, as they offer consistent ink flow and quick drying. Avoid gel pens, as they may smudge or take longer to dry. For a more sophisticated appearance, consider using a fine-liner or fountain pen, but ensure the ink won’t smudge on the selected paper. Always test your writing tools before committing to the final receipt to avoid issues with legibility.

Ensure clear separation between sections using spacing. Leave enough room between the header, itemized list, and totals for easy reading. Use consistent indentation and line breaks to make the document feel organized.

- Use legible handwriting: Opt for large, clear lettering that anyone can read easily. Avoid cursive or overly stylized fonts that can confuse the reader.

- Break information into sections: Label the header with “Receipt” at the top, followed by sections such as “Date,” “Items Purchased,” and “Total.” This structure helps the reader focus on key information quickly.

- Align columns: Keep prices, quantities, and item names aligned in columns to improve flow. This will prevent the document from feeling cluttered and enhance comprehension.

- Group related items: Group similar items or services together, separated by lines or extra space, to make the document easy to scan. This will allow the reader to quickly identify product categories and totals.

- Consistent punctuation: Use uniform punctuation, such as commas or periods, to separate different pieces of information. This reduces confusion and gives the receipt a polished look.

These adjustments will not only improve legibility but also make the receipt look more professional, ensuring that the recipient can quickly find the details they need without effort.

Ensure all the details are legible. Avoid using illegible handwriting or unclear fonts that might cause confusion. Clear writing can prevent costly mistakes and misunderstandings.

Incomplete Customer Information

Always include full customer details, such as the name, address, and contact number. Missing or incorrect information can delay deliveries or even cause legal disputes later. Make it a habit to double-check the data before finalizing any transaction.

Wrong Product Descriptions or Pricing

Accurately describe the products being sold, including any specifics like color, size, or model. Avoid vague descriptions that could lead to returns or disputes. Also, double-check that the prices are correct and match the agreed-upon amount to prevent confusion.

Lastly, always ensure that both the buyer and seller sign the receipt, confirming the details. Missing signatures can lead to claims of fraud or disputes that could be avoided with proper documentation.

Store handwritten sales receipts in a safe, organized manner. Use labeled folders or filing cabinets to categorize receipts by date, customer, or transaction type. This makes it easier to retrieve any document when needed.

Consider scanning and digitizing receipts for backup. Digital copies should be stored in a secure cloud service or external storage device. This protects records from potential damage while ensuring they remain easily accessible.

Set up a clear, consistent naming system for files. For example, use formats like “YYYY-MM-DD_CustomerName_ReceiptNumber” to maintain clarity and avoid confusion in your record-keeping system.

Review your storage method regularly to ensure receipts are organized and retrievable. Dedicate a specific day each month to clean up and update your filing system.

| Storage Method | Advantages | Disadvantages |

|---|---|---|

| Physical Filing | Easy to access without tech requirements | Prone to damage or loss over time |

| Digital Storage | Convenient and secure, can be backed up | Requires tech skills and proper device maintenance |

Proper record-keeping should include a backup process for digital copies. Regularly back up files to avoid the risk of data loss from system failures or theft.

Use clear and simple formatting to create a handwritten sales receipt. This will make it easier for both the seller and the buyer to read and understand the transaction details. Start with the business name and contact information at the top. Include a space for the receipt number and date to ensure proper record-keeping.

Details to Include

Each receipt should include the buyer’s name, a description of the items purchased, quantities, unit prices, and the total amount due. Always calculate taxes separately to maintain transparency in pricing. If discounts or special offers apply, make sure to clearly show the original price and the discounted rate.

Formatting Tips

Write neatly to avoid confusion. Use a consistent format for item listings and totals. A simple bullet list for items or a table format helps organize the information clearly. Leave space between sections to separate different parts of the receipt, like items and totals, for better readability.