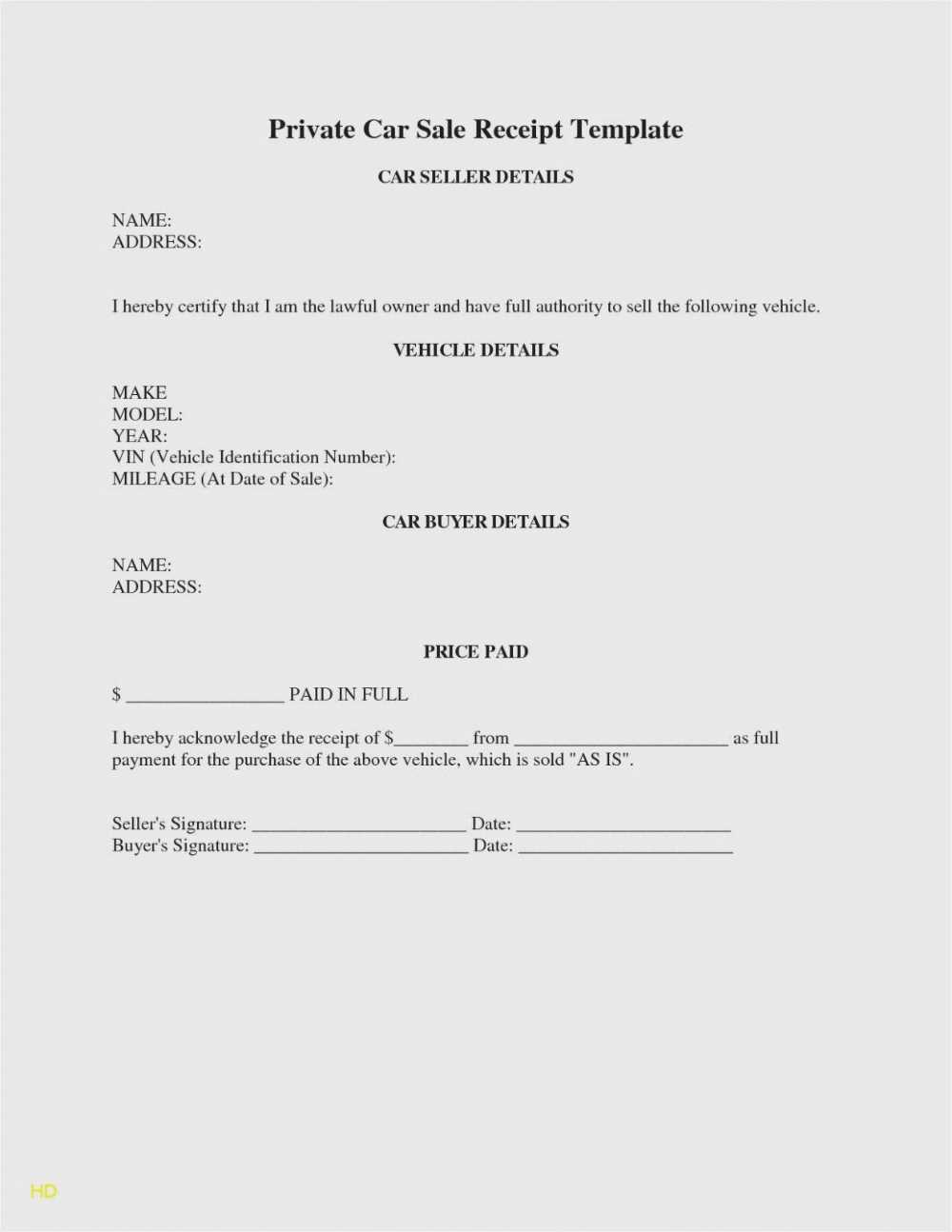

If you’re selling a car and need to create a professional receipt, the NRMA Car Sale Receipt Template is a simple and effective solution. This template helps you document the transaction accurately, ensuring both the buyer and seller have a clear record of the sale. It includes all necessary details like the vehicle’s make and model, the sale price, and both parties’ contact information.

Customize the template to suit your sale’s specifics. Be sure to include the vehicle identification number (VIN), odometer reading, and the date of sale. This will provide a thorough record in case of future disputes or for tax purposes. The template also offers space for any agreed-upon terms, such as warranty or “as is” conditions, which can help avoid misunderstandings later.

Once filled out, both parties should sign the receipt. Keeping a copy for your records is advisable, as it serves as proof of the transaction. With a few simple steps, the NRMA Car Sale Receipt Template ensures that the sale is legally sound and transparent for everyone involved.

Here’s the corrected text without repetitions:

To create an accurate and professional receipt for a car sale, follow a few simple steps. Start by clearly identifying the buyer and seller with their full names and contact details. Include the date of the sale and specify the vehicle’s make, model, year, VIN (Vehicle Identification Number), and any other relevant details like mileage or condition notes. List the sale price and any additional charges, such as taxes or fees. Clearly state the payment method, whether it’s cash, check, or financing, and outline any warranties or terms agreed upon. Finally, ensure both parties sign the receipt, acknowledging the transaction is complete.

By keeping the format clear and organized, both the seller and buyer can easily refer to the receipt in the future. Make sure each section is easy to understand and free from unnecessary information. Avoid adding non-essential details or repeating points that are already covered elsewhere in the document.

- NRMA Car Sale Receipt Template: A Practical Guide

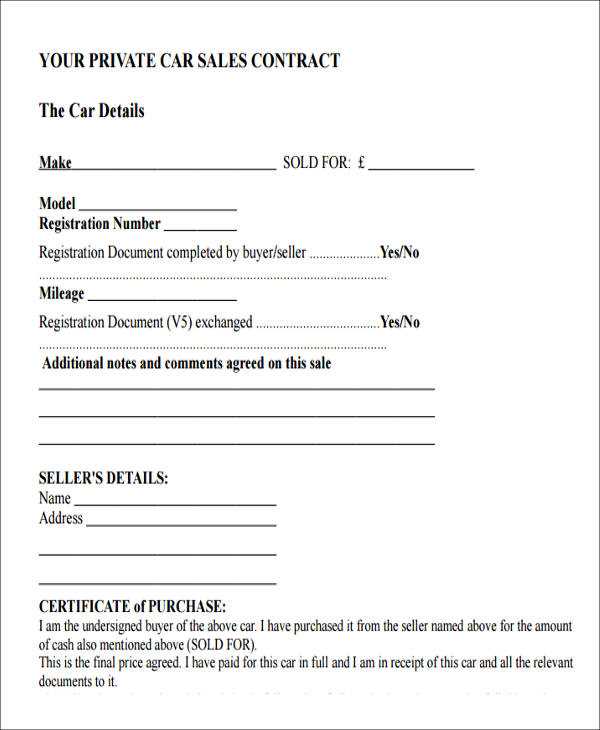

When selling a car through NRMA, providing a well-structured receipt ensures transparency and protects both the buyer and seller. Here’s what you need to include in your car sale receipt template:

Key Details to Include

- Seller Information: Include the full name, address, and contact details of the seller.

- Buyer Information: Include the full name, address, and contact details of the buyer.

- Vehicle Details: Make sure to specify the make, model, year, VIN (Vehicle Identification Number), and registration number of the car being sold.

- Date of Sale: Clearly state the date the transaction took place.

- Sale Price: Mention the agreed-upon price for the vehicle. Include the currency (AUD) for clarity.

- Payment Method: Indicate whether the payment was made via bank transfer, cheque, cash, or another method.

- Condition of Vehicle: Include a statement about the car’s condition at the time of sale (e.g., sold “as is” or with warranties).

- Signatures: Both the buyer and seller should sign the receipt to confirm the sale.

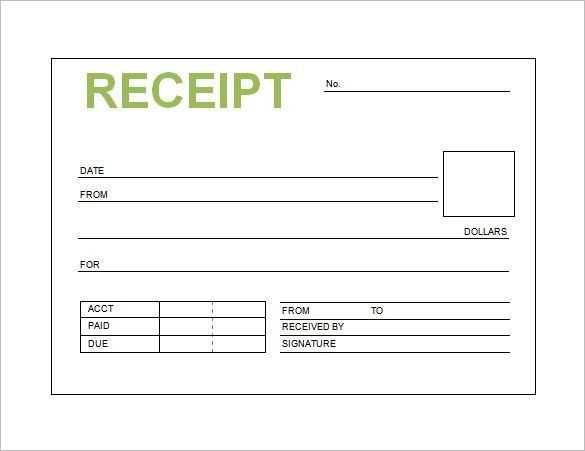

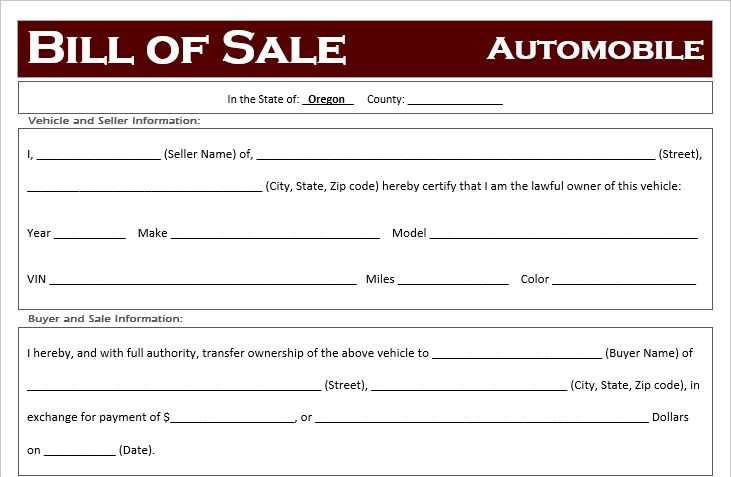

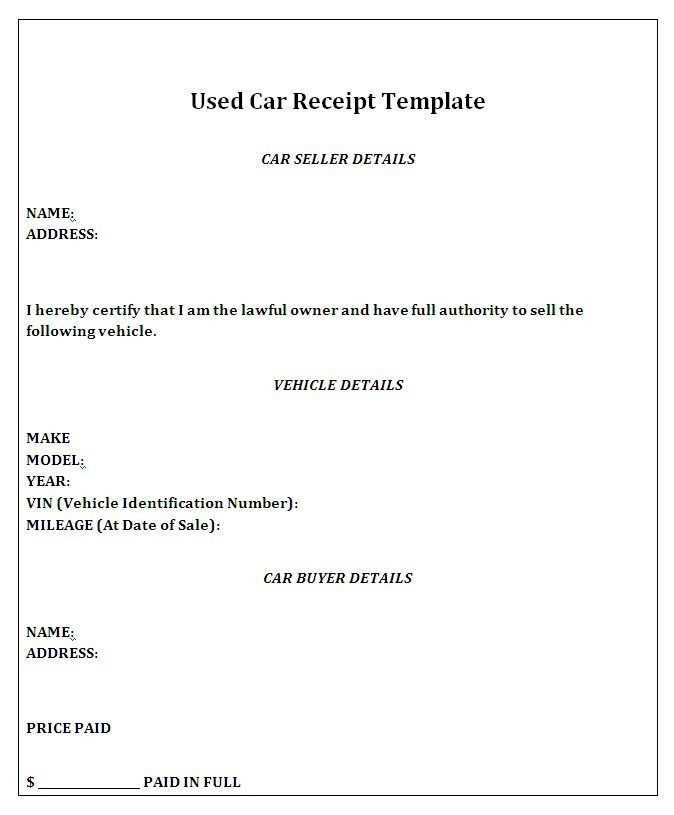

Template Example

Here’s a simple layout for your NRMA car sale receipt:

Seller Name: [Seller's Name] Seller Address: [Seller's Address] Seller Contact: [Seller's Phone Number] Buyer Name: [Buyer's Name] Buyer Address: [Buyer's Address] Buyer Contact: [Buyer's Phone Number] Vehicle Details: - Make and Model: [Car Make, Model] - Year: [Year] - VIN: [Vehicle Identification Number] - Registration Number: [Registration Number] Date of Sale: [DD/MM/YYYY] Sale Price: [Price in AUD] Payment Method: [Cash, Bank Transfer, etc.] Condition of Vehicle: [Condition, e.g., "As is, no warranty"] Both Buyer and Seller agree to the sale as outlined above. Seller Signature: ____________________ Buyer Signature: ____________________ Date: ____________________

This receipt acts as proof of transaction and can be used in case of disputes. Make sure both parties keep a copy for their records.

Begin by editing the receipt template to accurately reflect the details of your specific transaction. Replace any placeholder text with the buyer’s and seller’s full names, addresses, and contact information. Ensure the car details are precise, including make, model, year, VIN, and odometer reading at the time of sale.

Next, update the sale price and payment method. If you received a deposit, specify the amount and date paid, along with the remaining balance. For any trade-in vehicles, include their value and ensure the amounts are correctly deducted from the total sale price.

If applicable, add any warranties or guarantees that were agreed upon. Clearly outline the terms of the sale, including any “as-is” clauses, to avoid misunderstandings later. You may also want to list any additional items sold with the vehicle, like keys, manuals, or accessories.

Finally, ensure that both parties sign and date the receipt at the bottom. You may want to include a note about the transaction’s completion, confirming that the car has been transferred and all necessary paperwork has been provided. Adjust the format to make it readable and straightforward for both the buyer and seller.

Step-by-Step Guide to Filling Out Buyer and Seller Information in the NRMA Template

Accurate completion of buyer and seller details is vital to avoid complications. Follow these simple steps to ensure you enter the necessary information correctly:

1. Seller Information

Start by entering the seller’s full name, address, and contact details. Make sure the details match the identification documents to prevent any confusion later. Double-check the spelling of the name and the address to ensure accuracy. If the seller is a company, include the company’s registered name and ACN (Australian Company Number).

2. Buyer Information

Next, provide the buyer’s full name, address, and contact details. Similar to the seller’s information, ensure everything is correct. If the buyer is a company, include the relevant details like the company name and ACN. It’s crucial that both parties provide correct and up-to-date contact information for smooth communication post-sale.

| Field | Seller’s Information | Buyer’s Information |

|---|---|---|

| Full Name | Enter full name as per ID | Enter full name as per ID |

| Address | Provide complete address | Provide complete address |

| Contact Number | Enter a valid phone number | Enter a valid phone number |

| Email (if applicable) | Enter valid email | Enter valid email |

Ensure the information matches official documents for both parties to avoid errors during the sale process. After completing these sections, verify everything for consistency and accuracy.

Accurate vehicle details are critical in a car sale receipt. Here’s how to include them correctly:

1. Vehicle Identification Number (VIN)

- Ensure the VIN is entered exactly as it appears on the car registration and other legal documents.

- Double-check the VIN for accuracy to avoid potential issues with the sale or transfer of ownership.

2. Make, Model, and Year

- List the exact make, model, and year of the vehicle. This prevents confusion or disputes in the future.

- If there are any variations within the model (e.g., trim levels), note them as well.

3. Odometer Reading

- Record the current mileage on the vehicle, as stated on the odometer.

- Ensure the reading is clearly visible and legible to avoid misunderstandings.

4. Color and Body Type

- Include the vehicle’s color and body type, such as sedan, SUV, or coupe. This helps provide a clearer description.

- Verify these details from the vehicle’s registration certificate or official documentation.

5. Registration Details

- Include the vehicle’s registration number and expiry date as listed on the registration certificate.

- Confirm the registration status before completing the sale receipt.

Accurate and complete vehicle details are essential for ensuring a smooth and legally compliant transaction. Verify all information before finalizing the receipt to protect both the buyer and the seller.

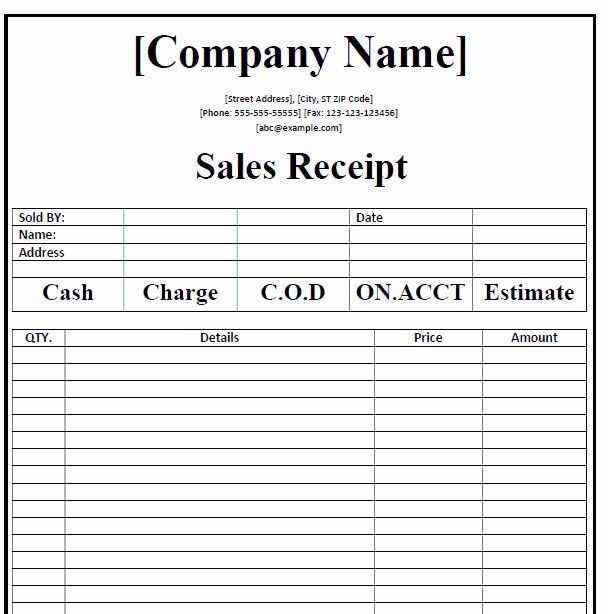

When reviewing an NRMA car sale receipt, focus on the payment section to ensure clarity and accuracy. This section typically breaks down the total amount paid, showing individual components like taxes, fees, and any applicable discounts. Pay attention to how the amounts are listed to avoid confusion or discrepancies.

Key Elements of the Payment Section

The payment section of the NRMA receipt will clearly display the final sale price, along with a breakdown of charges. Look for specific categories, such as the vehicle cost, registration fees, and additional services. A detailed layout ensures that you can trace each charge to understand the overall cost.

How to Spot Any Errors

Double-check the figures listed in this section to confirm accuracy. For example, verify the amounts for taxes and any optional fees included in the sale. Mistakes can sometimes occur, so ensure that each payment matches your expectations based on the original sale agreement.

Use the NRMA car sale receipt template to handle GST and taxation with ease by following a few simple steps. The template includes clear fields to track tax details, ensuring you comply with Australian tax regulations when selling a car.

Ensure the correct GST rate of 10% is applied to the sale price if the transaction involves a business. This can be easily reflected in the NRMA template by filling in the GST-exclusive amount in the designated field. If you’re a private seller, you generally don’t need to worry about GST, but it’s good to know how to manage it if you later operate as a business.

Here’s a breakdown of the key taxation components on the car sale receipt:

| Item | Tax Details |

|---|---|

| Sale Price | Include the full sale amount excluding GST for business sales. |

| GST (10%) | Apply 10% GST to the sale price if applicable. |

| Final Price | Sum the sale price and GST for the total amount due. |

Keep a copy of each transaction for your records. It’s important to retain this information for potential future audits. The NRMA template allows easy storage and referencing, which simplifies tax reporting and payments when tax season comes around.

For private car sales, the NRMA template also helps track potential capital gains tax if the vehicle’s sale results in a profit. If you made a capital gain, include the vehicle’s original purchase price and any costs related to improvements or modifications. These figures will be necessary for accurate tax reporting.

By using the NRMA car sale receipt template, you can confidently manage GST and tax details, whether you’re selling as a business or as an individual. This ensures full compliance and minimizes the risk of errors when reporting your income or tax obligations.

Store your finalized NRMA car sale receipt in multiple formats to ensure accessibility. Keep both physical and digital copies. A well-organized folder system on your computer or cloud storage will make it easy to retrieve when needed.

1. Keep a Backup in Cloud Storage

- Upload the receipt to a reliable cloud service such as Google Drive or Dropbox for secure access from any device.

- Ensure you set the proper permissions to control who can view or share the receipt.

- Organize receipts in clearly named folders to help with future retrieval.

2. Share Securely with Relevant Parties

- When sharing, use secure file-sharing platforms to protect sensitive information.

- For email, send the receipt as a PDF attachment with a password for added security.

- Include clear instructions in the message to avoid confusion.

Removing Redundancies While Keeping Meaning Intact

Start by simplifying your text. Eliminate any repetitive phrases or words that don’t add new information. Focus on the core message, keeping only the necessary elements that directly contribute to the meaning.

How to Identify Redundancies

Look for phrases where the same idea is repeated in different ways. For example, “in order to” and “to” often serve the same purpose. “Begin to” can often be shortened to “begin.” Remove these without losing clarity.

Refining Your Text

After identifying unnecessary repetitions, read through the content again. Ensure that every sentence flows naturally while maintaining its meaning. Keep your language straightforward and precise. This keeps your audience engaged and avoids unnecessary clutter.