If you need a quick and professional way to issue receipts for your online sales, a template can save you time and effort. It simplifies the process of recording and tracking transactions, ensuring you maintain accurate records. By using a ready-made template, you can avoid the hassle of creating one from scratch every time you complete a sale.

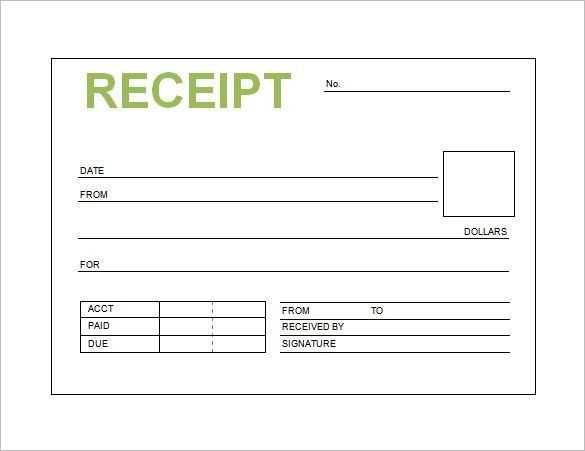

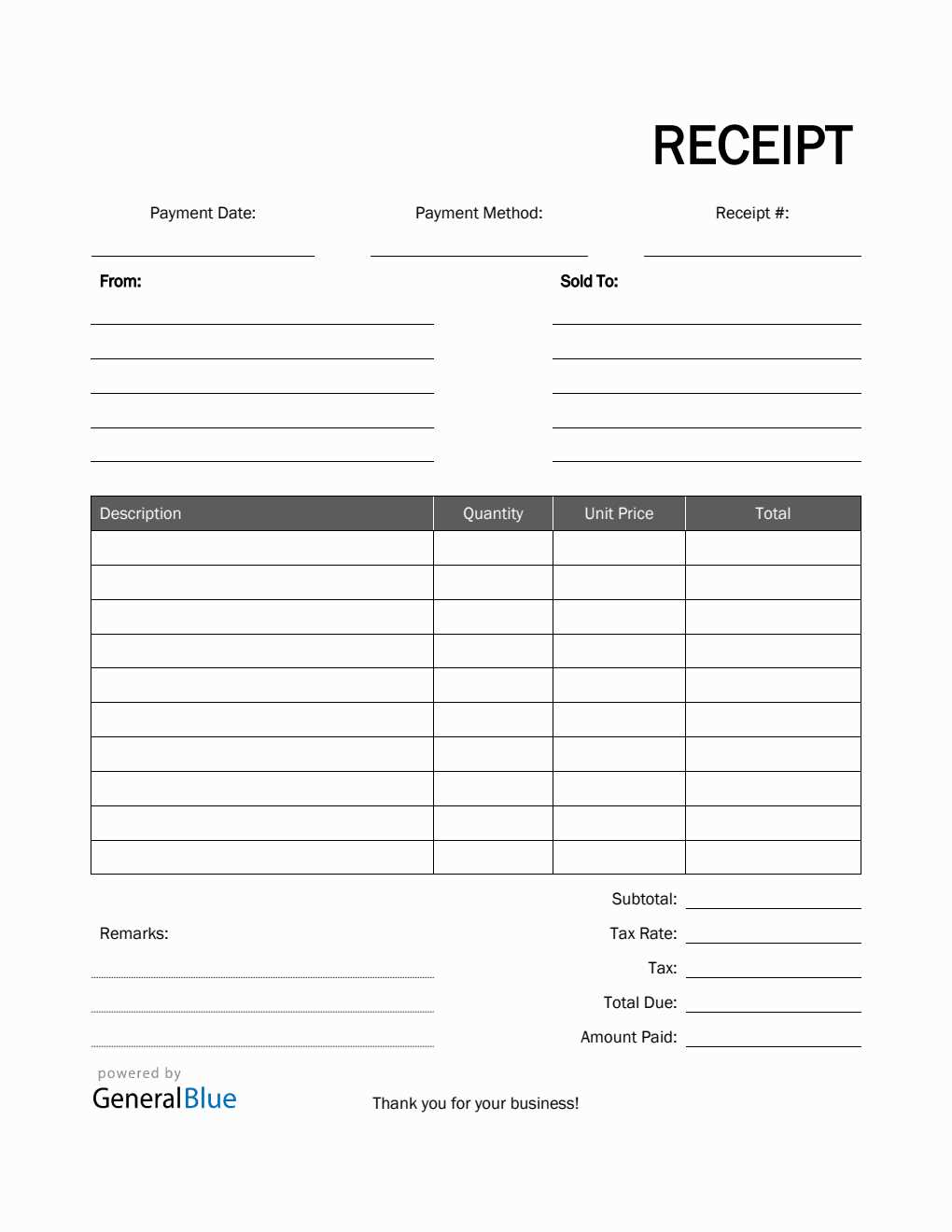

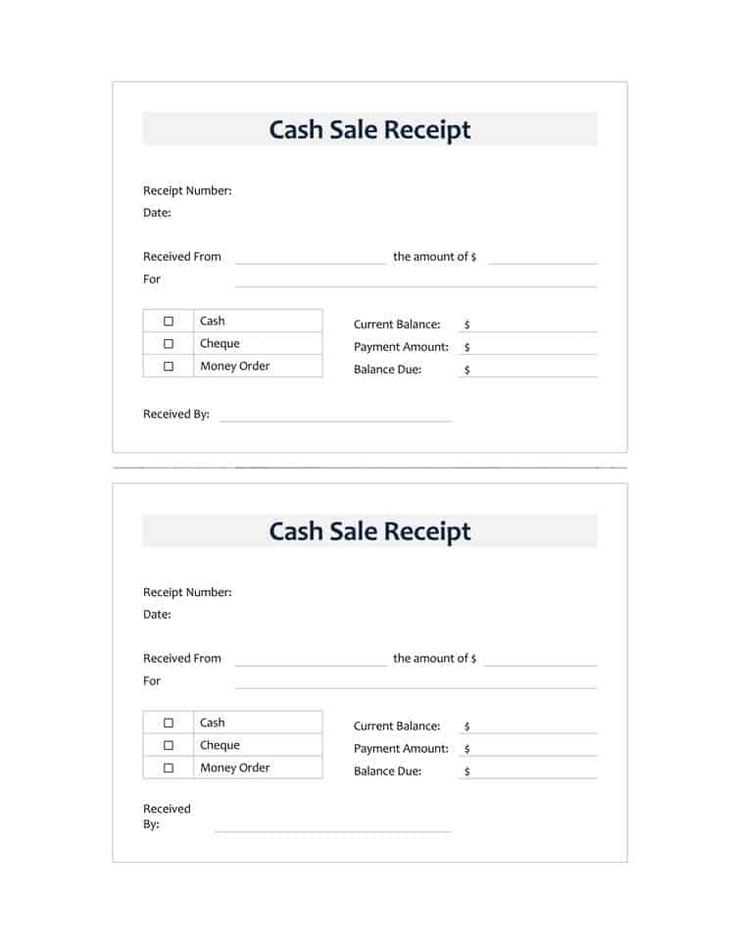

Choose a template that includes all the necessary details: buyer information, product description, prices, taxes, and payment method. This ensures clarity for both you and your customer. If your business requires frequent transactions, look for a customizable template that allows you to adapt it to various products and services quickly.

Once you’ve selected or created your template, you can integrate it with your invoicing or accounting software to automate the process further. Many templates can be saved as PDF files for easy sharing with customers via email, adding another layer of convenience.

Using a template reduces human error and keeps your receipts uniform, making it easier to stay organized and compliant with any tax reporting requirements. A well-designed template is a small but impactful tool in managing your online business smoothly.

Here’s the corrected version:

To create a clear and professional online sales receipt, follow these steps to ensure all necessary details are included:

Basic Information

Start by displaying the business name, contact details, and a unique receipt number. These elements help customers identify the transaction and allow for easy reference later.

Transaction Details

Include the date of purchase and a breakdown of the items or services purchased. Specify quantities, item prices, and any applicable taxes or discounts. Ensure totals are easy to spot for quick verification.

Finally, add a payment method section to clarify how the transaction was completed, whether by card, PayPal, or other methods. Make sure the receipt is concise but informative for a smooth customer experience.

Online Sales Receipt Template

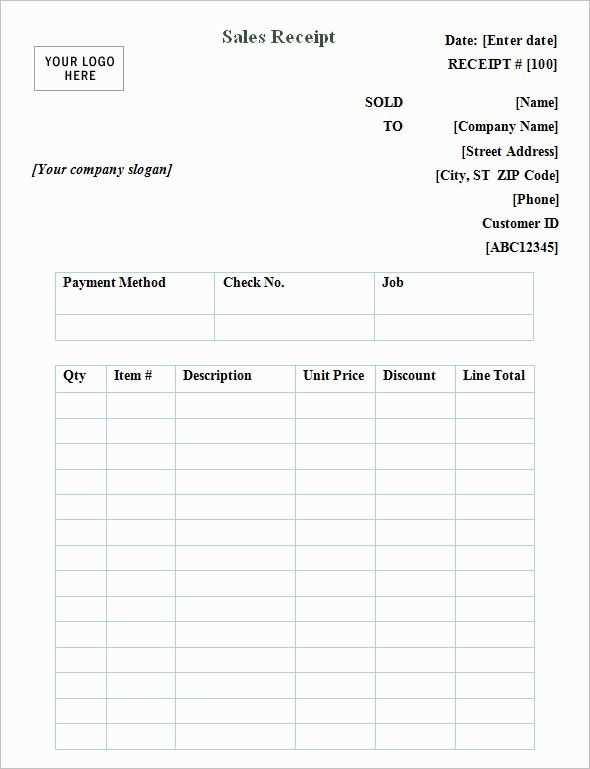

Creating a detailed and clear sales receipt is key for building trust with your customers. A sales receipt template should include all necessary transaction information, such as the product or service purchased, the total cost, payment method, and date of purchase.

Basic Structure

Your template should begin with the name of your business and contact information, followed by the transaction details. Include:

- Receipt title (e.g., “Sales Receipt”)

- Date of transaction

- Customer name and contact info (optional)

- Itemized list of products or services purchased

- Price for each item or service

- Subtotal, taxes, and total cost

- Payment method used (cash, credit card, etc.)

- Receipt number for record-keeping

Design Tips

Keep your layout simple and easy to read. Make sure the font is legible, and the sections are clearly separated for quick reference. You can also add your company logo for branding. Templates should be available in both printable and digital formats, giving flexibility to your customers.

By offering a receipt that includes all the necessary details, you provide transparency and professionalism, ensuring a smooth transaction process for both parties.

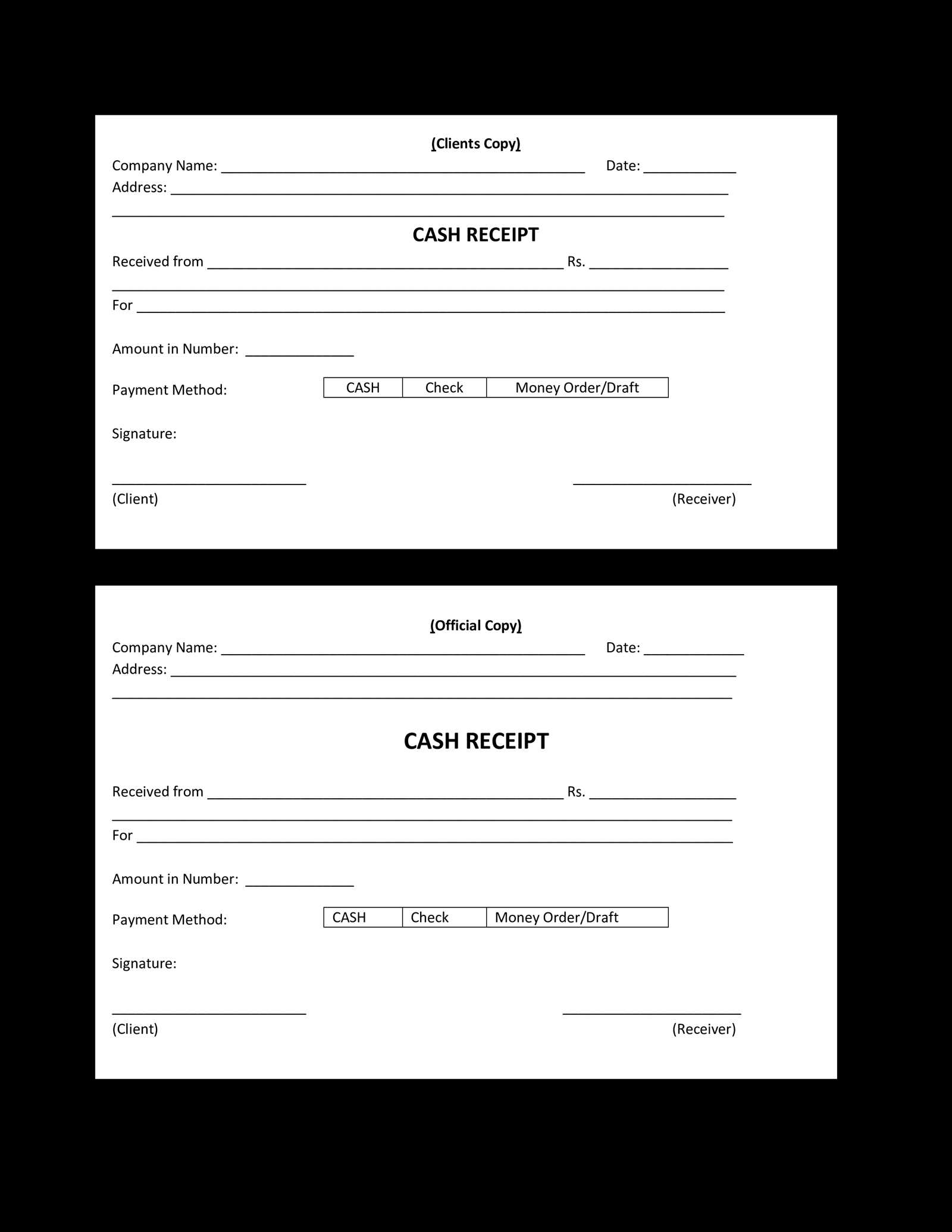

To create a simple sales receipt template online, use a straightforward approach that includes key elements like business name, transaction details, and payment method. Start by choosing an online platform or tool that offers easy-to-use templates. Many websites allow you to customize pre-made formats for quick use.

First, input your business information, such as the company name, address, phone number, and email. This helps customers identify your brand easily. Follow this by including a receipt number for tracking purposes, along with the date of the transaction.

Next, list the items sold with brief descriptions, quantities, individual prices, and totals. Grouping the information in a clear, readable format will enhance the receipt’s clarity. If applicable, add any discounts or taxes, making sure to show itemized amounts for transparency.

Lastly, specify the payment method–whether it’s cash, credit card, or another form–and include the total amount paid. You may also want to add a thank you note to create a positive experience for your customer. Once finished, save your template in a downloadable format (e.g., PDF) or send it directly via email.

Include the transaction date and time. This provides a clear reference for both you and your customer.

List the items sold. Include detailed descriptions of each product or service with quantities and prices. Be specific, as this avoids confusion later.

State the total amount paid. Break down the cost, showing the price of individual items, taxes, and any discounts applied. This keeps everything transparent.

Include the payment method. Specify if the transaction was made by credit card, cash, or any other form of payment.

Provide the seller’s contact information. Include your business name, address, and phone number to make it easy for customers to reach out if needed.

Offer a receipt number. This helps track the transaction in case there are any issues or requests for a refund or exchange.

Don’t forget to mention your return and refund policy. Clearly state your terms to avoid any misunderstandings later.

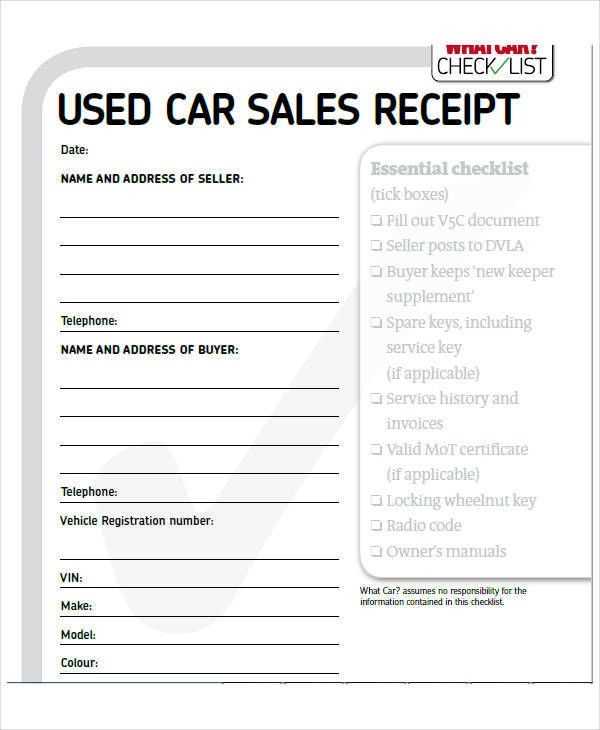

Adjust your sales receipt template to fit the specific needs of the industry you’re serving. For retail businesses, include item descriptions, quantities, and the corresponding prices to give customers a detailed view of their purchase. Highlight taxes and discounts clearly, as these are key components for shoppers who want transparency.

For service-based industries like consulting or freelancing, focus on clear descriptions of the services provided, hourly rates, or project fees. Adding a section for payment terms helps clients understand when payment is due and any potential late fees. Make sure to leave room for client-specific notes or adjustments for customized services.

In the food and hospitality sector, include details like order numbers, table numbers, or server names for easier tracking. Clearly itemize food and beverage orders, including taxes and tips. For delivery services, include delivery fees, time slots, or additional notes that ensure a smooth transaction process.

For subscription-based businesses, a section for subscription terms, renewal dates, and total charges will help customers keep track of their recurring payments. Clarify any free trial periods and billing cycles to avoid confusion. Make sure to keep the design simple but informative.

Finally, for e-commerce stores, include the method of payment, delivery address, and tracking number, so customers can easily track their orders. An itemized list with pictures or links to the products purchased can enhance customer experience and serve as a useful reference.

Include specific details like transaction date, item names, and amounts for each purchase. This keeps things clear for customers and reduces confusion later.

Key Elements to Include

- Transaction Date: Always note the exact date of purchase for accurate records.

- Item Description: List each item with a brief description, including quantity and price per unit.

- Total Amount: Provide a clear breakdown of the total amount paid, including taxes, shipping, and any discounts.

- Payment Method: Indicate how the customer paid, whether through credit card, PayPal, or other methods.

- Customer Information: Include the customer’s name, address, and contact details for easier follow-up.

Formatting Tips

- Easy-to-Read Layout: Use bullet points or tables to organize the information clearly. Avoid clutter.

- Use Clear Fonts: Choose a simple, readable font to ensure all details are legible, even on small screens.

- Mobile-Friendly: Optimize for mobile devices to enhance the user experience when viewed on phones or tablets.