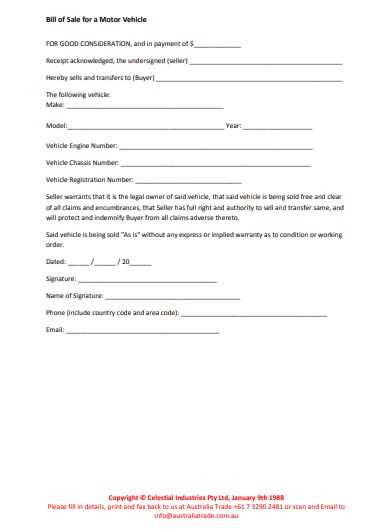

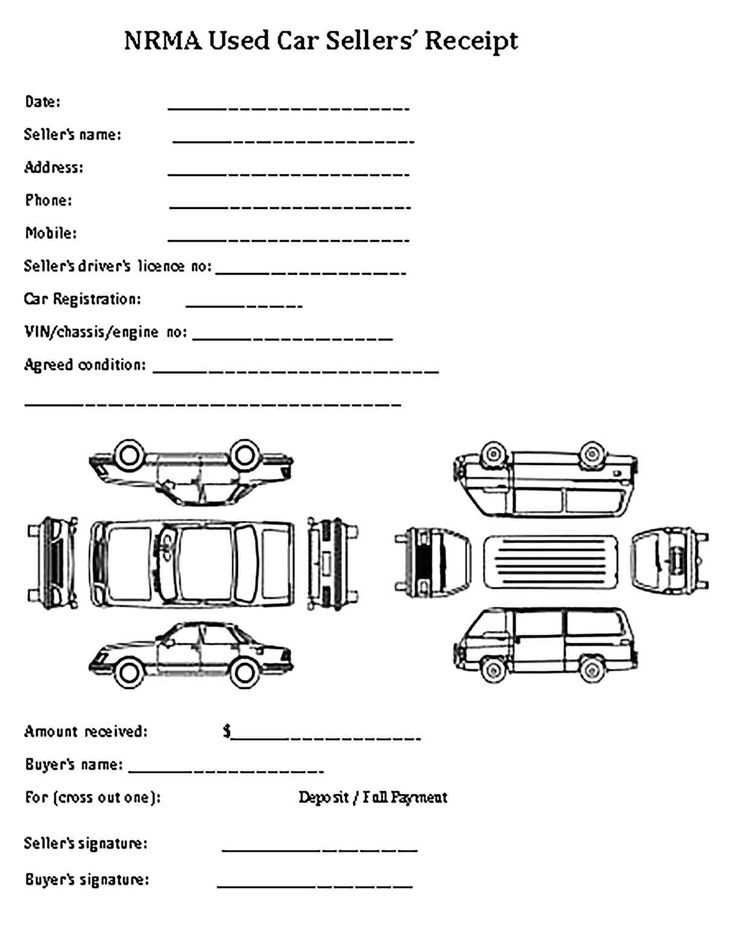

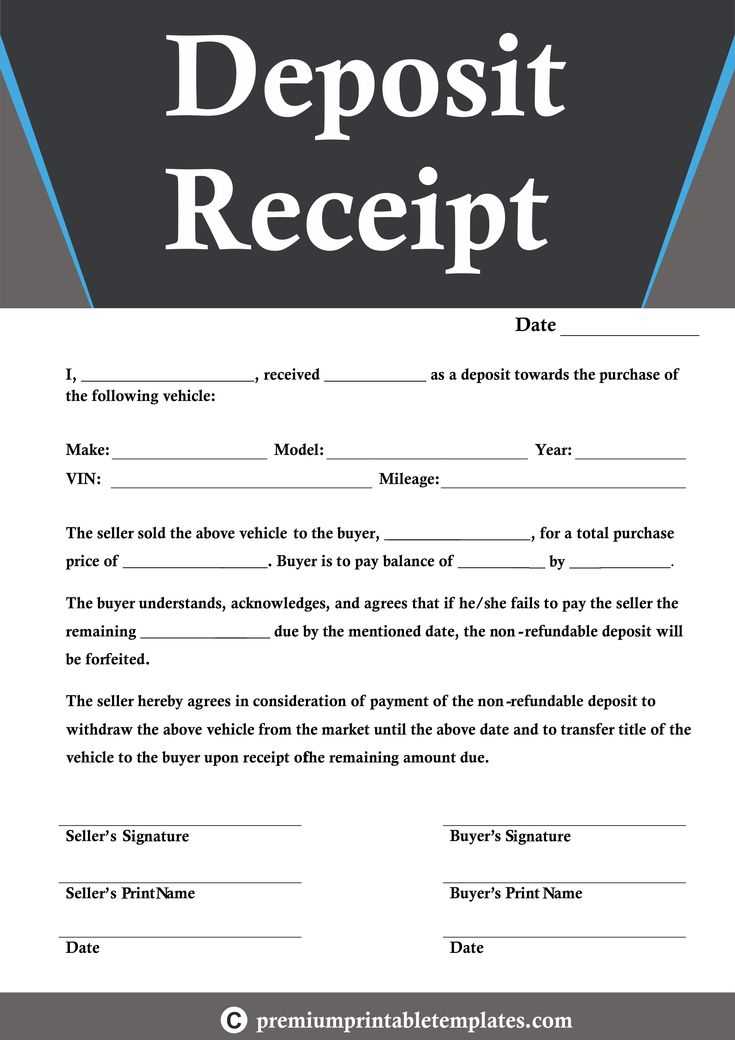

To create a deposit receipt for a private car sale, clearly outline the key details that both parties need for future reference. This document serves as proof of payment, and should include the buyer’s and seller’s names, the amount paid, and the date of payment. Specify that the deposit is non-refundable unless the sale terms change, and include the agreed-upon total sale price for the car.

Be sure to include a section that describes the vehicle, including make, model, year, and VIN (Vehicle Identification Number). This ensures the car is properly identified in the transaction. Also, state any agreed-upon conditions or agreements between the buyer and seller, such as delivery arrangements or further payments required before finalizing the sale.

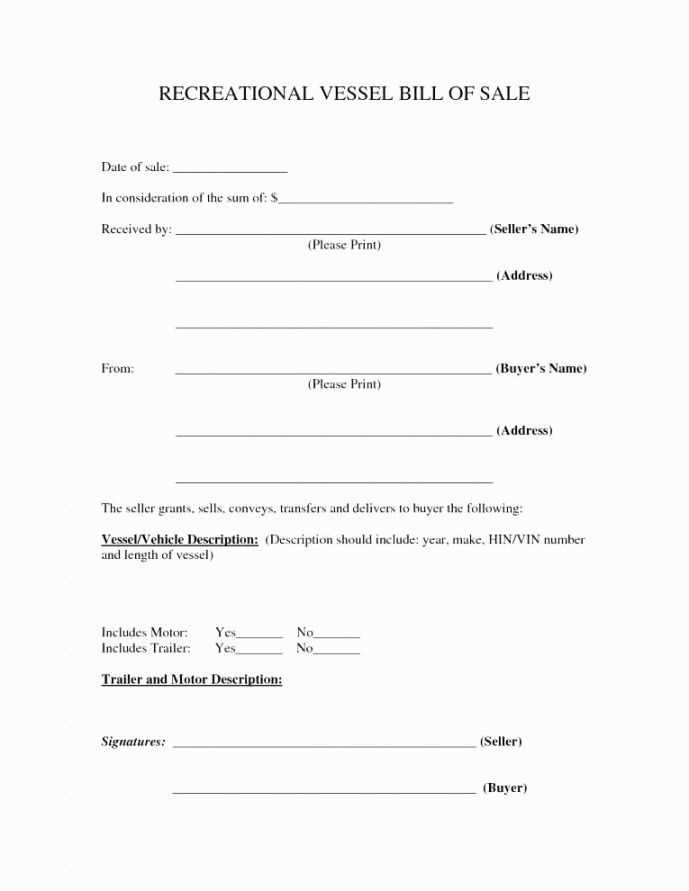

The receipt should be signed by both parties, providing a record that they acknowledge the terms and conditions of the deposit. Keep a copy for yourself and give one to the other party for their records.

Private Car Sale Deposit Receipt Template

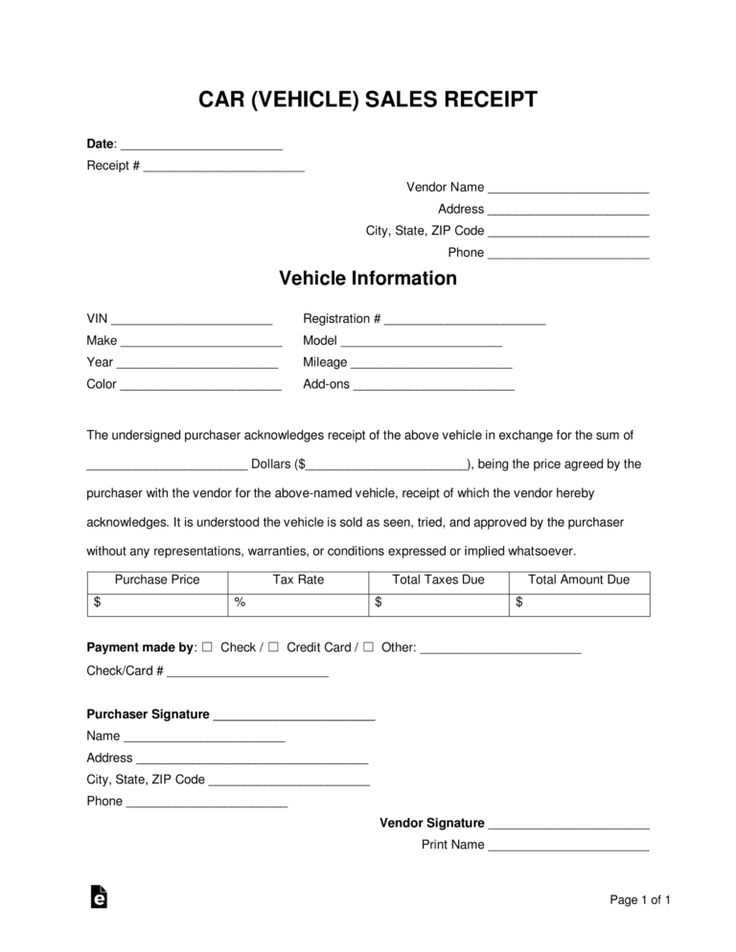

When selling a car privately, a clear and straightforward deposit receipt is crucial for both parties. This document outlines the agreement regarding the deposit amount, payment terms, and any conditions attached to the sale. Include the buyer’s and seller’s full names, contact details, and the car’s details (make, model, year, and VIN) at the top of the receipt.

Specify the deposit amount in the body of the receipt. It should be a fixed sum, agreed upon by both parties, and clearly marked as a deposit toward the total sale price. Include the total sale price of the vehicle, noting any agreed-upon balance due upon final transaction completion.

Include the payment method used for the deposit–whether it’s cash, bank transfer, or another form of payment. This ensures there’s no ambiguity regarding how the deposit was made. Also, outline the terms regarding the deposit, such as whether it is refundable or non-refundable, and the circumstances under which it may be returned or retained by the seller.

Lastly, both the buyer and seller should sign the receipt. This solidifies the agreement and provides evidence of both parties’ consent to the transaction. Keep a copy of the signed receipt for personal records.

Creating a Clear Agreement for the Deposit

Clearly outline the deposit amount in the agreement, specifying both the dollar value and the percentage of the total sale price. This removes any ambiguity for both parties involved.

Define the deposit’s purpose. State whether it serves as a commitment to purchase the vehicle or if it can be refunded under certain conditions. This prevents future misunderstandings about the deposit’s role in the transaction.

Set a timeline for the remaining payment. Specify when the full amount is due, whether it’s within a set number of days or upon transfer of the car title. This helps manage expectations and ensures both parties know what to expect next.

Clarify any conditions under which the deposit may be forfeited. Whether it’s due to the buyer backing out or failing to meet payment deadlines, listing these terms ensures the buyer is aware of the potential consequences.

Include a section for signatures. Both the buyer and the seller should sign to confirm agreement with the terms, making the document legally binding.

State the method of payment. Specify whether the deposit is to be paid in cash, via bank transfer, or another method. This avoids confusion during the transaction process.

Key Elements to Include in the Template

Include the names and contact details of both the buyer and the seller. Ensure full names, addresses, phone numbers, and email addresses are clearly listed to avoid confusion. This serves as a primary point of reference in case of any issues.

Transaction Details

Clearly state the agreed deposit amount, the total sale price of the vehicle, and the payment method. Specify whether the deposit is refundable and outline any conditions under which it could be returned. This clarifies expectations for both parties.

Vehicle Information

Include the vehicle’s make, model, year, VIN (Vehicle Identification Number), and current mileage. It’s also helpful to add any relevant details about the car’s condition or recent maintenance, as this provides transparency and helps avoid disputes.

Clearly outline the date and time when the deposit was paid, and specify the next steps in the transaction process, including when the full payment is due. This creates a clear timeline and agreement for both parties to follow.

Legal Aspects and Buyer-Seller Protection

Both buyers and sellers should understand their rights and obligations to avoid legal disputes during a private car sale. A well-written deposit receipt provides clarity and legal security for both parties. Here are key aspects to consider:

Clear Terms of Agreement

Both parties must define clear terms in the receipt, including the agreed deposit amount, payment conditions, and the vehicle’s sale price. This document should explicitly outline the deposit’s refundable nature, conditions for refund, and the timeline for the remaining payment. Without this clarity, misunderstandings can arise if either party wishes to back out of the agreement.

Buyer Protection Against Fraud

Buyers should be cautious about potential fraud. The deposit receipt should list the seller’s full name, address, and vehicle registration details. This ensures that the buyer has full documentation to trace the seller if any disputes arise. Always keep a copy of the receipt and any related correspondence for future reference.

- Ensure the receipt includes the seller’s legal identity and contact details.

- Verify the vehicle identification number (VIN) to prevent purchasing stolen vehicles.

- Document any verbal agreements about repairs or modifications that may influence the vehicle’s value.

Sellers’ Rights and Responsibilities

Sellers must clearly state whether the deposit is refundable or non-refundable. If non-refundable, the seller must specify the consequences of a buyer’s failure to complete the transaction. Sellers should also ensure the car is free of any outstanding legal issues, such as unpaid fines or unresolved ownership disputes, before finalizing the sale.

- Clarify if the deposit will be refunded if the sale is canceled by the seller.

- Provide full disclosure of any known issues with the car.

Both parties should keep copies of the signed receipt, which serves as proof of the agreement. This documentation can help resolve any disputes in court, should the need arise.